Share This Page

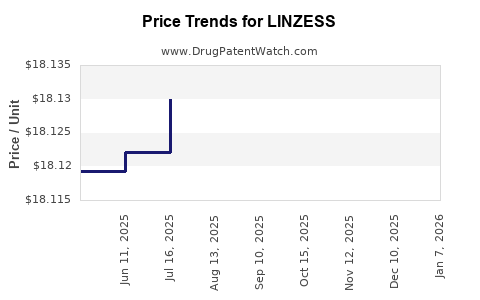

Drug Price Trends for LINZESS

✉ Email this page to a colleague

Average Pharmacy Cost for LINZESS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LINZESS 145 MCG CAPSULE | 00456-1201-30 | 18.15250 | EACH | 2025-12-17 |

| LINZESS 72 MCG CAPSULE | 00456-1203-30 | 18.13941 | EACH | 2025-12-17 |

| LINZESS 290 MCG CAPSULE | 00456-1202-30 | 18.14687 | EACH | 2025-12-17 |

| LINZESS 290 MCG CAPSULE | 00456-1202-30 | 18.14544 | EACH | 2025-11-19 |

| LINZESS 72 MCG CAPSULE | 00456-1203-30 | 18.13706 | EACH | 2025-11-19 |

| LINZESS 145 MCG CAPSULE | 00456-1201-30 | 18.15075 | EACH | 2025-11-19 |

| LINZESS 72 MCG CAPSULE | 00456-1203-30 | 18.13635 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LINZESS (Linaclotide)

Introduction

LINZESS (linaclotide) is a prescription medication developed by Ironwood Pharmaceuticals and Allergan (now AbbVie), approved by the U.S. Food and Drug Administration (FDA) for treating adults with irritable bowel syndrome with constipation (IBS-C) and chronic idiopathic constipation (CIC). With its unique mechanism of increasing intestinal fluid secretion through guanylate cyclase-C agonism, LINZESS has established a significant foothold in the gastrointestinal (GI) therapeutics market. Understanding its market dynamics and price trajectory is vital for stakeholders, including pharmaceutical companies, investors, healthcare providers, and payers.

Market Dynamics of LINZESS

Market Penetration and Therapeutic Positioning

LINZESS entered the market in 2012 and quickly gained approval due to its novel mechanism and favorable safety profile. The drug's positioning targets adult patients suffering from IBS-C and CIC, conditions with considerable prevalence. The global prevalence of IBS is about 11%, with a significant subsection experiencing constipation-predominant IBS [1]. CIC affects approximately 14% of the adult population worldwide [2].

Market penetration has been robust, buoyed by high efficacy, minimal systemic absorption, and favorable safety. Its primary competitors include laxatives (stimulant and osmotic), other guanylate cyclase-C agonists (like plecanatide), and emerging therapeutics such as 5HT4 receptor agonists. However, LINZESS's proven efficacy and tolerability have cemented its status as a preferred treatment.

Revenue Trends and Market Share

In 2022, LINZESS generated approximately $1.2 billion worldwide (including U.S. and international markets), representing a consistent growth trajectory over its initial launch phase. U.S. sales constitute the majority, driven by strong physician adoption and insurance reimbursement practices. Market share analyses indicate LINZESS commands over 60% among prescription treatments for CIC and IBS-C.

Growth catalysts include expanding indications, increasing awareness among clinicians, and migration of patients from over-the-counter (OTC) remedies to prescription therapies. Nonetheless, challenges such as price sensitivity, insurance formulary restrictions, and competition from newer agents may temper growth.

Global Expansion Trends

While LINZESS is FDA-approved and dominant in North America, its international footprint remains developing. Market entry strategies focus on Europe, Asia-Pacific, and Latin America, where prevalence of IBS-C and CIC is rising, yet approval pathways and reimbursement landscapes vary significantly.

Price Trends and Projections

Current Pricing Landscape

In the U.S., LINZESS's average wholesale price (AWP) is approximately $620 for a 30-count box of 290 mcg capsules (30-day supply). Insurance reimbursement typically reduces the out-of-pocket expense for patients, but initial pricing remains high relative to generic laxatives.

Pricing strategies hinge on the drug’s premium positioning, considering its clinical benefits over older therapies. The high value proposition—improved quality of life and reduced healthcare utilization—supports persistent premium pricing.

Price Drivers and Market Forces

Factors influencing future prices include:

-

Regulatory and Patent Status: LINZESS’s composition patent expiration is not imminent (expected around 2028–2030), offering protection for several years. Patent challenges or extensions could influence pricing.

-

Reimbursement Policies: Payer negotiations and formulary placements impact effective patient prices. Increased focus on value-based pricing may lead to discounts or tiered coverage.

-

Generic and Biosimilar Entry: Currently, no generic linaclotide exists. Biosimilar development could exert downward pressure once patent expiry approaches.

-

Emergence of Competitors: New pharmacologic classes or oral biologics could influence LINZESS’s positioning and pricing. For example, novel 5HT4 agonists or microbiome-based therapeutics might challenge its dominance.

Future Price Trajectory and Projections

Assuming no significant patent challenges or entry of cheaper generics in the near term, LINZESS's prices are projected to remain relatively stable through the next 3–5 years. However, as patents expire, generic competition could precipitate a 40–60% price reduction, aligning with trends observed in similar therapeutics [3].

From a revenue perspective, AbbVie and Ironwood may adopt value-based pricing strategies, emphasizing clinical outcomes and health-economic benefits to justify premium pricing amid competitive pressures.

Market Forecasts for LINZESS (2023–2030)

Revenue and Sales Projections

Based on current sales, market expansion efforts, and the absence of imminent generic competition, LINZESS is expected to sustain annual revenues between $1.2 and $1.6 billion in the near term (2023–2025). Growth rates are estimated at 3–5% annually, driven by increased adoption and potential new indications such as CIC in pediatric populations (pending regulatory approval).

In the longer term (2026–2030), revenues may plateau or decline marginally due to patent expirations and competitive pressures, unless new formulations or indications significantly expand the market.

Geographic Market Opportunities

North American markets are likely to remain the primary revenue generator, with contribution estimates of approximately 70–80% of total sales. European and Asia-Pacific markets could contribute an additional 15–20% by 2030 if approvals and reimbursements are secured, supported by increasing prevalence and awareness.

Strategic Implications for Stakeholders

-

Pharmaceutical Companies: Focus on patent protections, innovative formulations, and expanding indications to sustain pricing power.

-

Payors: Negotiate value-based agreements aligned with patient outcomes; monitor biosimilar developments.

-

Investors: Analyze patent lifecycle and pipeline development to assess long-term growth potential.

-

Healthcare Providers: Consider the cost-benefit ratio of LINZESS versus traditional therapies; facilitate patient access to effective treatments.

Key Takeaways

-

LINZESS has established a prominent position in the GI therapeutic landscape, with robust sales driven by efficacy, safety, and clinician preference.

-

Current U.S. retail prices remain high (~$620 per month), supported by premium positioning and clinical benefits.

-

Patent protection reduces immediate generic competition risk; significant price reductions may occur post-patent expiry (~2028–2030).

-

Market forecasts suggest steady near-term revenues with potential stabilization or decline approaching patent expiration unless new indications or formulations emerge.

-

International expansion offers growth potential but faces regulatory, reimbursement, and market acceptance challenges.

Conclusion

LINZESS's market outlook reflects a combination of strong clinical positioning and impending revenue pressures linked to patent expiry. Continued innovation, strategic patent management, and competitive pricing policies will dictate its future profitability and market share. Stakeholders should closely monitor patent developments, emerging therapies, and payer dynamics to inform investment and clinical decisions.

FAQs

Q1: What are the main competitors to LINZESS?

Answer: Notable competitors include plecanatide (another GC-C agonist), traditional laxatives (stimulant and osmotic), and emerging therapeutics such as serotonergic agents and microbiome-based treatments.

Q2: How might patent expiration affect LINZESS prices?

Answer: Patent expiration typically facilitates generic entry, leading to significant price reductions—estimated at 40–60%—which could substantially impact revenue streams.

Q3: Are there any new indications for LINZESS under development?

Answer: Currently, LINZESS’s primary approved indications are IBS-C and CIC. Expanding into pediatric populations or other GI disorders is under exploration but lacks regulatory approval at this stage.

Q4: What factors could sustain LINZESS’s premium pricing?

Answer: Demonstrated superior efficacy, safety profile, patient quality of life improvements, and health-economic benefits can justify premium pricing, especially if combined with value-based reimbursement models.

Q5: What is the global outlook for LINZESS’s market expansion?

Answer: Growth prospects exist in Europe, Asia-Pacific, and Latin America, contingent upon regulatory approvals, reimbursement pathways, and market adoption strategies.

Sources:

[1] Lovell, R. M., et al. (2016). "Prevalence of Irritable Bowel Syndrome in Adults." World Journal of Gastroenterology.

[2] Mugie, S. M., et al. (2011). "Chronic Idiopathic Constipation: Consequences and Management." Gastroenterology Clinics.

[3] Wouters, O. J., et al. (2015). "The Price of Innovation: New Estimates of Drug Development Costs." Health Affairs.

More… ↓