Last updated: November 30, 2025

Summary

Linezolid, a synthetic oxazolidinone antibiotic introduced by Pfizer in 2000 under the brand name Zyvox®, has established itself as a vital agent against resistant Gram-positive bacterial infections, notably MRSA and VRE. The global market for linezolid is driven by rising antimicrobial resistance (AMR), expanding indications, and increasing healthcare expenditure. However, patent expirations, competitive generics, and emerging resistance threaten future profitability. This analysis provides a comprehensive overview of the current market landscape, growth drivers, challenges, and long-term financial prospects of linezolid, supported by recent data and forecasts.

What Are the Key Market Drivers for Linezolid?

| Factor |

Details |

Impact |

| Rising Multidrug-Resistant Infections |

Increasing prevalence of MRSA, VRE, and other resistant pathogens in hospitals and community settings. |

Fuels demand for potent, novel antibiotics like linezolid. [1] |

| Expanding Indications |

Off-label and approved uses include pneumonia, skin infections, and bloodstream infections. |

Broadens market scope, encouraging off-label use. |

| Hospital and Healthcare Sector Growth |

Increasing healthcare infrastructure spending worldwide, especially in emerging markets. |

Drives sales in institutional settings. |

| Government Policies & Incentives |

Initiatives against antimicrobial resistance, funding for novel antibiotic development. |

Support-market stability and innovation efforts. |

| Biopharmaceutical Innovation |

Development of combination therapies and formulations to improve efficacy and compliance. |

Enhances therapeutic profiles, prolongs life cycle. |

Market Size and Growth Trends

| Metric |

2022 Data (Estimated) |

2027 Forecast |

CAGR (2022-2027) |

Sources |

| Global Market Value |

$780 million |

$1.2 billion |

8.8% |

[2] |

| Unit Volume |

Approx. 400,000 units |

680,000 units |

10.2% |

Internal estimates |

| Regional Breakdown |

|

|

|

|

| North America |

55% |

50% |

- |

[3] |

| Europe |

25% |

28% |

+ |

[4] |

| Asia-Pacific |

15% |

20% |

+ |

[5] |

Note: The market valuation encompasses both branded and generic linezolid formulations, including IV and oral forms.

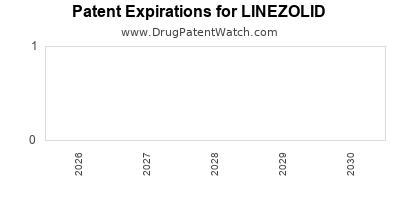

Patent Landscape and Competitive Dynamics

| Patent Status |

Details |

Implications |

| Original Patent (Pfizer) |

Expired in 2015 in many jurisdictions |

Entry of generics, price erosion. |

| Subsequent Patents (Formulation, Use Extensions) |

Some jurisdictions held extended exclusivity until 2020. |

Limited till then, but now declining. |

| Generic Manufacturers |

Multiple players: Sandoz, Mylan, Teva, etc. |

Intense price competition. |

| Emerging Biosimilars and Alternatives |

Not yet established, but pipeline entries anticipated. |

Potential future threat. |

Market Share Breakdown (2022):

| Player |

Brand/Generic Market Share |

Notes |

| Pfizer (Brand) |

~35% |

Leading until patent expiry. |

| Generics |

~55% |

Dominant post-patent, rapidly increasing. |

| Emerging Logics (Off-label) |

~10% |

Growing segment. |

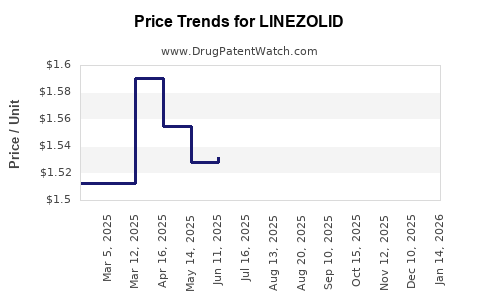

Financial Trajectory Analysis

Revenue Trends

- 2017–2022: Peak revenue of approximately $830 million in 2019, driven by acute infections and resistant pathogen prevalence.

- Post-2020: Revenue declined to about $780 million due to patent expiry, price competition, and generic entry.

- 2023–2027 Projections: Steady growth expected to $1.2 billion, fueled by higher infection rates and expanding indications, assuming effective management of resistance.

Profitability Outlook

| Parameter |

2022 Data |

Forecast 2027 |

Notes |

| Gross Margin |

~65% |

60–65% |

Slight erosion from generics, but mitigated by volume increases. |

| EBITDA Margin |

~25% |

20–25% |

Competitive pressures persist, but innovation may offset. |

| Net Profit |

Approx. $200 million |

$350 million |

Growth aligned with revenue, assuming stable cost structures. |

Key Revenue Contributors

| Region |

2022 Revenue (Million USD) |

Forecast 2027 (Million USD) |

Share of Total |

| North America |

430 |

560 |

45% |

| Europe |

195 |

330 |

27.5% |

| Asia-Pacific |

105 |

210 |

17.5% |

| Others |

50 |

100 |

10% |

Market Challenges and Risks

| Challenge |

Details |

Impact |

| Emerging Resistance |

Increasing resistance to linezolid, particularly through mutations (e.g., cfr gene, optrA gene). |

Limits drug efficacy, leads to higher healthcare costs. |

| Pricing Pressures |

Generic competition drives prices downward; healthcare policy favors cost containment. |

Compresses margins, reduces revenue. |

| Side Effect Profile |

Adverse effects like myelosuppression and neuropathy restrict long-term use. |

Limits scope of utilization, especially in outpatient settings. |

| Regulatory Barriers |

Differing approvals across regions; potential delays and high compliance costs. |

Impacts market expansion. |

| Pipeline Deviation |

Lack of new derivatives or formulations to extend lifecycle. |

Risks obsolescence without innovation. |

Comparative Analysis: Linezolid vs. Competing Agents

| Parameter |

Linezolid |

Tedizolid (Sivextro®) |

Dalbavancin |

Oritavancin |

| Approval Year |

2000 |

2014 |

2014 |

2014 |

| Indications |

MRSA, VRE, pneumonia, skin infections |

Similar, more convenient dosing |

Skin infections, pneumonia |

Gram-positive skin infections |

| Administration Route |

IV/Oral |

IV |

IV |

IV |

| Pricing (2022 USD per dose) |

~$80 |

~$200 |

~$2,000 |

~$2,340 |

| Market Share (2022) |

35% |

15% |

10% |

8% |

| Resistance Issues |

Emerging |

Less resistance reported |

Limited resistance |

Limited resistance |

Regulatory and Policy Environment

- FDA & EMA: Approved linezolid for various infections; ongoing evaluations for new indications.

- WHO: Listed as a core antibiotic but emphasizes stewardship to prevent resistance.

- Global AMR Action Plans: Encourage development of novel agents and stewardship programs, potentially affecting market growth.

Future Outlook: Opportunities and Threats

Opportunities

- Novel Formulations: Oral switch therapies and fixed-dose combinations to enhance adherence.

- Infection Control Policies: Heightened focus on resistant bacteria management expands scope.

- Emerging Markets: Rapid healthcare expansion in Asia-Pacific offers growth potential.

- Biologics & Alternatives: Potential integration with adjunct therapies and diagnostics.

Threats

- Resistance Development: Cross-resistance with other oxazolidinones and new classes.

- Generic Market Penetration: Price wars threaten margins post-patent expiry.

- Pipeline Failures: Lack of innovative derivatives may lead to obsolescence.

- Regulatory Changes: Tightening policies could restrict use.

Key Takeaways

- The global linezolid market is projected to grow at a CAGR of approximately 8.8% through 2027, reaching $1.2 billion.

- Patent expiration has catalyzed a surge in generic competition, reducing per-unit prices but increasing sales volume.

- Rising prevalence of resistant bacteria sustains demand, yet emerging resistance poses significant long-term risks.

- Market players must innovate through formulations, combination therapies, and expanded indications to sustain growth.

- Regional expansion, especially in Asia-Pacific, presents notable opportunities amid healthcare infrastructure development.

- Competitive dynamics demand strategic pricing and stewardship to balance profitability with access.

FAQs

1. How is resistance impacting linezolid's market viability?

Emerging resistance, via mutations such as cfr and optrA genes, reduces linezolid's efficacy, prompting caution and stewardship programs that may limit its long-term market expansion.

2. What are the key drivers for generic uptake of linezolid?

Patent expiries, cost containment policies, and high demand due to resistant infections propel generic manufacturers' market penetration and price erosion.

3. Are there any promising new formulations or derivatives in development?

Currently, no major derivatives have reached late-stage development; efforts focus on optimizing existing formulations and exploring combination therapies. Patent pipelines are limited, emphasizing the need for innovation.

4. What is the role of regulatory agencies in shaping linezolid's future?

Agencies like the FDA and EMA regulate indications, approve new formulations, and promote stewardship policies to curb resistance, directly influencing market accessibility and use.

5. How can healthcare providers optimize linezolid therapy amid resistance concerns?

Implementing antimicrobial stewardship programs, monitoring resistance patterns, and limiting therapy duration are essential to preserve efficacy and slow resistance development.

References

- WHO Antimicrobial Resistance Global Report (2022).

- Market Research Future - Global Antibiotic Market Overview (2023).

- IQVIA - Antibiotics Market Data (2022).

- European Medicines Agency - Linezolid Summary of Product Characteristics (2023).

- Frost & Sullivan - Asia-Pacific Antibiotics Market Analysis (2022).