Last updated: July 29, 2025

Introduction

KLOR-CON, a potassium chloride supplement, is a widely prescribed medication primarily used to treat and prevent hypokalemia—an electrolyte imbalance characterized by low potassium levels. As potassium plays a critical role in cardiac, muscular, and nerve functions, the demand for KLOR-CON remains consistent across diverse healthcare settings. Analyzing the market dynamics and financial trajectory of KLOR-CON involves evaluating regulatory environment, patent status, competitive landscape, epidemiological trends, and changing healthcare practices.

Regulatory Landscape and Market Entry

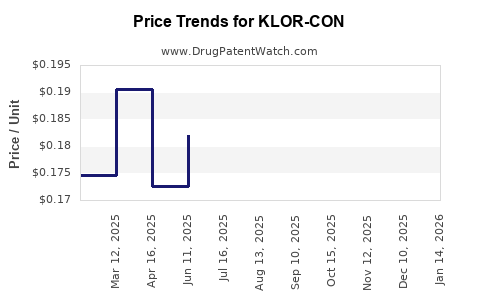

KLOR-CON benefits from an established regulatory framework, with approvals granted by agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). Its status as an over-the-counter (OTC) and prescription medication varies across markets, influencing sales channels and marketing strategies. Patent expirations and regulatory approvals for generics significantly affect pricing strategies and market share. Notably, the widespread availability of generic formulations post-patent expiry has led to substantial price competition, reducing average selling prices (ASPs) and augmenting access.

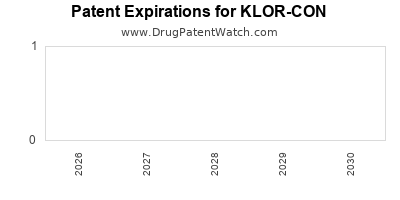

Patent and Intellectual Property Status

The original patents for KLOR-CON formulations have expired in key regions, fostering a proliferative generics market. This shift fosters increased competitive pressure, leading to lower prices and expanded accessibility. Innovative formulations, such as sustained-release versions, may possess supplementary patent protections—potentially offering extended market exclusivity. The impact of patent expirations on revenue is significant; for instance, generic entry has historically reduced prices by up to 80%, affecting profit margins but broadening market penetration.

Competitive Landscape

The landscape for potassium chloride supplements is highly competitive. Major pharmaceutical companies, including generic manufacturers like Teva, Sandoz, and Mylan, dominate distribution channels. They often engage in price wars, further compressing profit margins but simultaneously expanding consumer access. Additionally, non-traditional competitors such as nutraceutical companies and compounding pharmacies increasingly offer compounded potassium chloride products, diversifying the competitive environment.

Pharmacovigilance concerns, especially about gastrointestinal irritation and hyperkalemia risks, influence prescribing behaviors. Innovations in delivery systems—such as coated tablets and controlled-release formulations—aim to mitigate adverse effects and differentiate products within a commoditized market.

Epidemiological and Demographic Drivers

The demand for KLOR-CON correlates strongly with population health trends. The increasing prevalence of chronic conditions—heart failure, hypertension, chronic kidney disease—escalates the need for electrolyte management. According to CDC data, over 6 million adults in the United States suffer from chronic kidney disease, many of whom require potassium supplementation or regulation.

Aging populations further amplify the demand, as older adults are more susceptible to electrolyte disturbances. Moreover, the rise in hospitalizations involving electrolyte imbalances during acute illnesses or post-surgical procedures sustains the necessity for potassium salts.

Healthcare Practice Trends and Prescribing Behavior

Practices favoring outpatient management of electrolyte abnormalities favor oral supplements like KLOR-CON over intravenous routes, which are reserved for severe cases. The trend toward outpatient care and home health services augments the demand for convenient, orally administered potassium supplements.

Guidelines from organizations such as the American Heart Association recommend vigilant monitoring and correction of potassium levels, bolstering continued prescription rates. Telemedicine and digital health innovations facilitate patient adherence and monitoring, potentially increasing utilization.

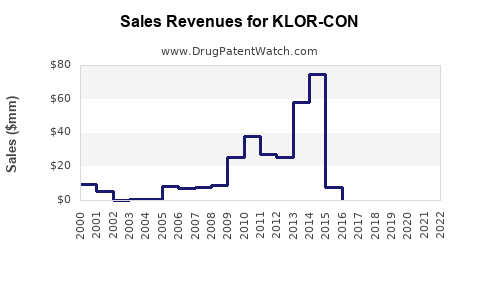

Market Size and Revenue Projections

The global market for potassium chloride supplements, including KLOR-CON, was valued at approximately USD 1.9 billion in 2022, with projections reaching USD 2.6 billion by 2030, growing at a CAGR of approximately 4.2% (2023–2030)[1]. North America consistently holds the largest market share, driven by high disease prevalence, advanced healthcare infrastructure, and robust regulatory environments.

Price erosion due to generic competition has subdued revenue growth margins for branded KLOR-CON products. Nonetheless, volume-driven sales sustain overall revenue growth. The rising adoption of extended-release formulations and combination therapies may generate premium prices, offsetting generic price pressures.

Financial Trajectory and Profitability Factors

Profitability for KLOR-CON manufacturers hinges on several factors:

- Generic Competition: Significantly reduces unit prices, compressing margins.

- Manufacturing Costs: Economies of scale and process efficiencies mitigate cost pressures.

- Regulatory Compliance: Ensures market access; non-compliance risks fines and forced recalls.

- Innovation Investments: Development of novel formulations can command premium pricing.

- Market Penetration Strategies: Expanding into emerging markets presents growth opportunities due to increasing healthcare infrastructure.

Pharmaceutical companies focusing on market share expansion and innovation are likely to sustain or increase revenues despite the commoditized nature of standard potassium chloride supplements.

Emerging Trends and Future Outlook

The future of KLOR-CON hinges on several key trends:

- Formulation Innovation: Sustained-release and combination therapies improve patient adherence and safety.

- Regulatory Developments: Stricter safety monitoring may influence labeling and prescribing practices.

- Digital Health Tools: Integration with remote monitoring enhances patient management.

- Emerging Markets: Growing healthcare infrastructure supports expansion into Asia, Africa, and Latin America.

- Pricing Strategies: Value-based pricing models may become prevalent, emphasizing improved safety and efficacy.

The market is poised for steady growth, moderated by competitive pressures and regulatory considerations. Companies investing in formulation advancements and digital integration are best positioned for future financial success.

Key Takeaways

- Market Dynamics: Rising prevalence of chronic diseases and aging demographics drive steady demand, with competitive pressures leading to price erosion but volume growth.

- Regulatory Environment: Generic patent expirations have expanded access but increased price competition; innovation in formulations remains a strategic focus.

- Financial Trajectory: Revenue growth remains positive, supported by global expansion, with margins impacted by commoditization and regulatory costs.

- Innovation and Digital Integration: Extended-release formulations and remote monitoring solutions offer revenue diversification.

- Emerging Markets: Untapped markets present growth potential, contingent on healthcare infrastructure development and regulatory reforms.

Conclusion

KLOR-CON remains a vital component in electrolyte management amid evolving healthcare landscapes. While generics dominate, innovation, digital health integration, and strategic expansion into emerging markets are critical to sustaining financial performance. Stakeholders embracing these trends are well-positioned to capitalize on the stable but highly competitive potassium chloride supplement market.

FAQs

-

What factors influence the pricing of KLOR-CON in different markets?

Pricing varies based on patent status, the level of generic competition, healthcare reimbursement policies, manufacturing costs, and regional regulatory requirements.

-

How do patent expirations affect KLOR-CON's market share?

Patent expirations enable generic entrants, leading to reduced prices and increased access but intensify competition, diminishing the profitability of branded formulations.

-

What are the primary safety concerns associated with KLOR-CON?

Risks include gastrointestinal irritation, hyperkalemia, and potential cardiac disturbances if improperly dosed or monitored.

-

What innovations are expected to shape KLOR-CON’s future market?

Extended-release formulations, combination therapies, and integration with remote patient monitoring tools are anticipated to enhance safety, adherence, and market differentiation.

-

Which regions are projected to experience the fastest growth in KLOR-CON demand?

Emerging markets in Asia, Africa, and Latin America are expected to see accelerated growth, driven by expanding healthcare infrastructure and rising chronic disease prevalence.

References

[1] Market Research Future, "Global Potassium Chloride Market Forecasts," 2023.