Last updated: August 20, 2025

Introduction

KLOR-CON M20, a branded formulation of potassium chloride, is a widely prescribed medication used to treat hypokalemia and electrolyte imbalances. Its significance in healthcare emerges from its critical role in managing potassium deficiency, which can lead to cardiac arrhythmias and neuromuscular disturbances. Understanding the market dynamics and financial trajectory of KLOR-CON M20 is essential for stakeholders, including pharmaceutical companies, investors, healthcare providers, and regulatory bodies aiming to anticipate growth trends, competitive movements, and regulatory landscapes influencing its market positioning.

Market Overview

Product Profile and Therapeutic Significance

KLOR-CON M20 contains potassium chloride, with 20 mmol per tablet (or per specified unit), facilitating rapid correction of potassium deficits. Its standardized dosage, safety profile, and ease of administration have established it as a preferred treatment option. Given the global prevalence of conditions leading to hypokalemia, such as diuretic therapy, gastrointestinal losses, and certain chronic illnesses, the demand for potassium chloride formulations remains consistently robust (WHO reports suggest electrolyte imbalances are among the top causes of hospital admissions worldwide).

Global Market Size and Segmentation

The global potassium chloride market was valued at approximately USD 4.1 billion in 2022, with an expected compound annual growth rate (CAGR) of around 4.2% through 2030, driven by increasing prevalence of electrolyte disorders and expanding indications for potassium supplementation.[1] Segment-wise, formulations such as immediate-release tablets (like KLOR-CON M20) constitute a significant share owing to their widespread use in outpatient and inpatient settings.

Key Market Drivers

-

Rising Prevalence of Hypokalemia:

The aging global population, increasing chronic disease burden, and widespread use of diuretics bolster the need for potassium supplementation. For instance, in cardiovascular disease management, loop and thiazide diuretics induce potassium loss, necessitating regular replacement therapy (American Heart Association data).

-

Expanding Indications and Off-label Use:

Beyond hypokalemia, KLOR-CON M20 finds applications in conditions like alkalosis and certain metabolic disorders, expanding its utilization scope.

-

Healthcare Infrastructure Development:

Emerging economies investing in healthcare infrastructure enhance access and prescription rates for electrolyte management drugs.

-

Pattern of Combination Therapy:

Products combining potassium chloride with other electrolytes or vitamins offer convenience, influencing market growth.

Competitive Landscape

Key Players and Market Share

Major pharmaceutical players include Pfizer, Novartis, and other regional manufacturers producing generic equivalents. Original branded formulations like KLOR-CON M20 often benefit from established brand recognition and trust.

-

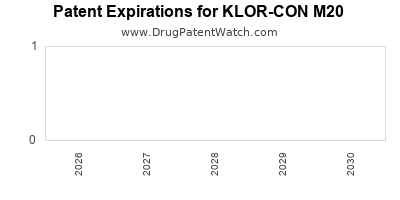

Patent Status:

As a generic formulation, KLOR-CON M20 faces commoditization risk; however, patent expirations on other formulations open indoor markets for core potassium chloride products.

-

Generics and Biosimilars:

The robust presence of generics dilutes pricing power but sustains volume sales.

Pricing and Reimbursement Dynamics

Pricing strategies are influenced by market competition, regulatory reimbursements, and healthcare policies. In developed countries, reimbursement schemes bolster consistent sales, whereas price pressures are more prominent in emerging markets.[2]

Regulatory Landscape

Regulatory bodies like the FDA, EMA, and equivalents in emerging markets enforce safety, quality, and efficacy standards. The approval of formulations like KLOR-CON M20 depends on compliance with pharmacopeial standards, labeling, and manufacturing practices.

-

Post-market Surveillance:

Monitoring adverse events (e.g., gastrointestinal irritation, hyperkalemia) influences market dynamics and product labeling.

-

Innovations and Line Extensions:

While the core molecule remains unchanged, newer delivery forms and combination therapies influence the competitive environment.

Financial Trajectory Predictions

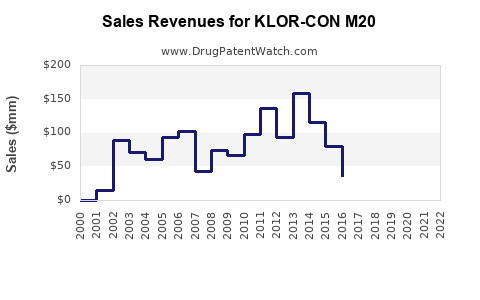

Revenue Trends

Based on current demand and growth drivers, the revenue trajectory for KLOR-CON M20 is projected to follow the overall growth of the potassium chloride market, with regional variances:

-

North America and Europe:

Mature markets benefiting from high healthcare expenditure, aged populations, and insurance reimbursements.

-

Asia-Pacific:

Rapidly expanding markets driven by rising healthcare access and increasing chronic disease prevalence.

Forecasts predict a 5-year CAGR of approximately 4-5% for branded formulations, with generic sales expanding at a similar or higher clip due to price competition.

Profitability Outlook

Profit margins for branded formulations remain moderate, with cost control in manufacturing and marketing impacting margins. The introduction of biosimilars and generics exerts downward pressure on prices, although brand loyalty and patent protections can sustain higher margins temporarily.

Investment and Innovation Trends

Investments in formulation improvements, such as sustained-release tablets, or combination products, can open new revenue streams. However, the commoditization of potassium chloride necessitates continual innovation and strategic positioning.

Market Challenges

-

Safety Concerns:

Overdose risks leading to hyperkalemia can generate regulatory scrutiny and market caution.

-

Pricing Pressures:

Intense generic competition and payer negotiations threaten revenue stability.

-

Regulatory Changes:

Stringent guidelines for electrolyte formulations could impact approval and manufacturing costs.

-

Supply Chain Stability:

Dependence on key raw materials can affect product availability and cost structure.

Strategic Recommendations

-

Product Differentiation:

Develop formulations with improved tolerability, such as effervescent or sustained-release versions.

-

Geographic Diversification:

Target emerging markets where healthcare infrastructure expansion increases demand.

-

Regulatory Engagement:

Maintain proactive compliance to facilitate market access and mitigate risks.

-

Partnerships and Licensing:

Collaborate with regional manufacturers to expand distribution and reduce costs.

Key Takeaways

-

The KLOR-CON M20 market is buoyed by the global rise in electrolyte imbalance management needs, driven by aging populations and prevalent comorbidities.

-

Competitive pressures, patent expirations, and safety concerns necessitate continuous innovation and strategic positioning.

-

North America and Europe constitute mature markets with steady revenue streams, while Asia-Pacific and Latin America offer high-growth opportunities.

-

The financial trajectory indicates stable growth with potential margins compressed by increased generic competition.

-

Stakeholders must focus on product differentiation, regulatory compliance, and geographic expansion to maximize revenue and market share.

FAQs

1. What factors most influence the demand for KLOR-CON M20 globally?

Demand hinges on the prevalence of hypokalemia, healthcare infrastructure development, prescription patterns for related conditions, and the availability of alternative therapies, especially in aging populations with chronic illnesses.

2. How does the regulatory environment impact the market trajectory of potassium chloride formulations?

Regulatory standards for safety, labeling, manufacturing, and post-market surveillance shape product approvals and market perceptions, potentially delaying launches or increasing costs but ensuring product safety and efficacy.

3. What are the main competitive threats facing KLOR-CON M20?

Generic competition, pricing pressures, safety concerns leading to regulatory scrutiny, and the emergence of alternative electrolyte replacement therapies pose ongoing threats.

4. How can pharmaceutical companies capitalize on emerging markets for KLOR-CON M20?

By investing in local manufacturing, forming strategic alliances, adapting products to regional preferences, and engaging with healthcare systems for reimbursement, companies can tap into high-growth regions.

5. What innovations could influence the future financial performance of potassium chloride products?

Development of sustained-release formulations, combination therapies, or enhanced delivery mechanisms can differentiate products, justify premium pricing, and expand market share.

Sources

[1] MarketsandMarkets. "Potassium Chloride Market by Formulation, End User, and Region," 2023.

[2] IQVIA Reports. "Global Generic Pharmaceutical Market Trends," 2022.