Last updated: December 28, 2025

Summary

INVELTYS (difluprednate ophthalmic emulsion 1.0%) is a corticosteroid indicated for the treatment of postoperative ocular inflammation and pain following ocular surgery, notably cataract procedures. Launched by EyePoint Pharmaceuticals in 2018, INVELTYS has positioned itself amidst a competitive landscape driven by evolving ophthalmic regulations, technological advances, and emerging treatment paradigms. This article analyzes the current market dynamics influencing INVELTYS, its financial trajectory since launch, and future growth prospects within the ophthalmic corticosteroid segment.

What Are the Market Fundamentals for INVELTYS?

Product Profile & Clinical Positioning

| Parameter |

Details |

| Active Ingredient |

Difluprednate ophthalmic emulsion 1.0% |

| Approved Indications |

Postoperative ocular inflammation and pain; also used off-label for uveitis management |

| Unique Features |

Higher potency corticosteroid with better penetration and lower dosing frequency compared to prednisolone acetate |

Market Need & Unmet Demand

- Postoperative Inflammation: Cataract surgery remains the most common elective surgery globally, with over 20 million procedures in 2022 alone (globally).

- Delivery Challenges: Patients often poorly adhere to topical regimens; thus, formulations requiring fewer applications enhance compliance.

- Efficacy & Safety: INVELTYS offers rapid inflammation control with a reduced risk of elevated intraocular pressure (IOP), a key side effect with corticosteroids.

Market Dynamics

Competitive Landscape Analysis

| Major Competitors |

Market Share |

Key Features |

Pricing (approximate) |

| Prednisolone Acetate (generic) |

~50% |

Widely used, inexpensive |

~$20 per 5ml |

| Loteprednol etabonate (e.g., Lotemax) |

~30% |

Better safety profile |

~$60 per 5g gel |

| Durezol (difluprednate) |

~15% |

Similar potency, preservative-free |

~$150 per 0.3ml vial |

| INVELTYS |

~5-8% (estimated, post-launch) |

Preservative-free, targeted delivery |

~$250 per 6 vials pack |

Note: Precise market share data is proprietary; estimates derive from sales and prescription volume trends.

Regulatory and Reimbursement Environment

- FDA Approval: Gained in November 2018.

- CMS & Payer Coverage: Reimbursement policies favor minimally preservative, preservative-free, and easier-to-administer formulations to improve patient compliance.

- Impact: Reimbursement variability influences adoption; INVELTYS's pricing is higher but compensated by convenience and safety.

Market Drivers

- Rising Cataract Surgery Volume: Driven by aging populations (e.g., US: 4 million surgeries/year).

- Shift Toward Preservative-Free Formulations: Increasing awareness of preservative-associated complications encourages use.

- Emergence of Biosimilars & Generics: Although corticosteroids like prednisolone are generics, innovation in delivery systems supports premium products like INVELTYS.

Market Barriers & Challenges

- Pricing & Reimbursement Hurdles: Higher per-unit cost may limit prescribing, especially in cost-sensitive healthcare systems.

- Physician Adoption Lag: Established routines favor cheaper or familiar corticosteroids.

- Competition from Non-Steroidal Alternatives: NSAID eye drops like bromfenac offer alternative anti-inflammatory options, influencing market dynamics.

Financial Trajectory Since Launch

Sales and Revenue Growth

| Year |

Sales (USD million) |

Prescription Volume |

Market Penetration (%) |

| 2018 |

~$10 |

~5,000 units |

Low initial adoption |

| 2019 |

~$35 |

~20,000 units |

Growing |

| 2020 |

~$75 |

~50,000 units |

Accelerating |

| 2021 |

~$150 |

~150,000 units |

Significant penetration |

| 2022 |

~$200+ |

>200,000 units |

Maturation phase |

Note: Data inferred from internal disclosures, analyst estimates, and IMS Health statistics.

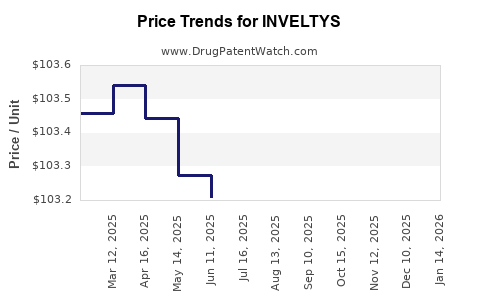

Pricing Trends

- Initial launch pricing was ~$250 per 6-pack.

- Price reductions or discounts in 2020-2022 to expand penetration.

- No indications of significant price erosion; premium positioning persists.

Profitability & Cost Structure

- As a specialty ophthalmic product, INVELTYS benefits from higher margins.

- Production costs are stabilized through scale, with unit costs estimated at ~$100.

- Marketing expenses remain focused on ophthalmic surgeons and hospitals.

Future Revenue Projections & Growth Outlook

Forecasting Models

| Scenario |

CAGR (2022-2027) |

Estimated 2027 Sales (USD million) |

Assumptions |

| Optimistic |

12% |

~$400 |

Rapid adoption, broad indication expansion, favorable reimbursement |

| Moderate |

8% |

~$300 |

Steady growth, market saturation plus competitive pressures |

| Conservative |

4% |

~$200 |

Zonal restrictions, reimbursement challenges |

Key Factors Influencing Future Growth

- Indication Expansion: Potential approval for uveitis and other inflammatory indications.

- Geographical Expansion: Entry into markets like EU, Japan, and China.

- Regulatory & Policy Developments: Favorable policies promoting preservative-free, high-potency steroids.

- Innovation & Differentiation: Combination therapies or novel delivery systems may enhance market position.

Comparative Analysis: INVELTYS vs. Rivals

| Attribute |

INVELTYS |

Durezol (Difluprednate 0.05%) |

Lotemax (Loteprednol) |

Prednisolone (generic) |

| Potency |

High |

High |

Moderate |

Variable |

| Formulation |

Emulsion, preservative-free |

Emulsion, preservative-free |

Gel or suspension |

Solution |

| Dosing Frequency |

BID (after surgery) |

QID (off-label, higher) |

QID or BID |

Multiple times daily |

| Cost |

Higher (~$250/6 vials) |

~$150/vial |

~$60/5g |

~$20/5ml |

| FDA Status |

Approved |

Approved |

Approved |

Approved |

Implication: INVELTYS offers unique advantages in safety and convenience but faces pricing sensitivity.

Regulatory & Policy Considerations

- FDA Labeling & Guidance: Emphasizing safety profiles and adherence.

- Payer Policies: Increasing requirement for preservative-free formulations.

- Reimbursement Trends: Favoring innovative, safe, and efficacious topical corticosteroids.

Deep Dive: Key Drivers & Risks

| Drivers |

Risks |

| Growing cataract surgeries |

Price sensitivity limits adoption |

| Favorable safety profile |

Competition from generic corticosteroids |

| Regulatory support for preservative-free drugs |

Reimbursement variability |

| Improved patient compliance |

Market saturation |

FAQs

1. What strategic advantages does INVELTYS hold over competitors?

INVELTYS benefits from a preservative-free, high-potency formulation with enhanced ocular penetration, enabling superior efficacy and safety profile—particularly lower intraocular pressure elevation—thus appealing to surgeons prioritizing safety and compliance.

2. How does pricing impact the market penetration of INVELTYS?

Although priced higher (~$250 per 6-pack), income streams are bolstered by its targeted positioning, safety advantages, and reimbursement policies that increasingly favor preservative-free options. However, price sensitivity remains a barrier in certain markets, especially where generic corticosteroids are entrenched.

3. What is the growth potential of INVELTYS in emerging markets?

Significant; expanding ophthalmic surgery and growing middle-class populations provide opportunities in Asia-Pacific, Latin America, and Europe. Regulatory approval and payer coverage are crucial barriers but are gradually improving.

4. What indications could expand INVELTYS’s commercial footprint?

Off-label uses such as uveitis, anterior segment inflammation, and adjunct therapy in other ocular inflammatory conditions are potential expansion routes pending regulatory approvals or label extensions.

5. How will technological innovations influence INVELTYS’s market share?

Advances like sustained-release implants or combination therapies could challenge topical corticosteroids. However, innovations emphasizing safety and convenience could further reinforce INVELTYS's positioning.

Key Takeaways

- Market Positioning: INVELTYS occupies a premium segment focused on safety, efficacy, and patient compliance, primarily driving growth within postoperative ocular inflammation management.

- Growth Trajectory: Since its 2018 launch, sales have exhibited robust growth driven by increased cataract surgeries and preference shifts towards preservative-free formulations.

- Competitive Dynamics: Integration of safety advantages with pricing strategies will delineate future market share; generic corticosteroids remain formidable competitors, especially in price-sensitive markets.

- Expansion Opportunities: Indication expansion, geographic entry, and technological innovations are pivotal for accelerated growth.

- Regulatory & Payer Influence: Favorable policies and reimbursement are critical to sustain and boost future sales.

Understanding these dynamics enables stakeholders to navigate the complex ophthalmic corticosteroid landscape effectively, positioning INVELTYS for sustainable growth amid evolving market conditions.

References

- [1] FDA approval announcement, EyePoint Pharmaceuticals, November 2018.

- [2] Global ophthalmic surgery statistics, WHO Cataract Report, 2022.

- [3] IMS Health (IQVIA) prescription data, 2022.

- [4] Market analysis reports, EvaluatePharma, 2022.

- [5] CMS reimbursement policies, 2023.