Share This Page

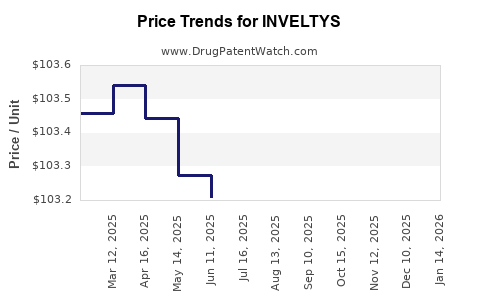

Drug Price Trends for INVELTYS

✉ Email this page to a colleague

Average Pharmacy Cost for INVELTYS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INVELTYS 1% EYE DROP | 71571-0121-28 | 103.29981 | ML | 2025-12-17 |

| INVELTYS 1% EYE DROP | 71571-0121-28 | 102.99235 | ML | 2025-11-19 |

| INVELTYS 1% EYE DROP | 71571-0121-28 | 103.01867 | ML | 2025-10-22 |

| INVELTYS 1% EYE DROP | 71571-0121-28 | 103.09800 | ML | 2025-09-17 |

| INVELTYS 1% EYE DROP | 71571-0121-28 | 103.04500 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for INVELTYS (Tafluprost 0.0015%)

Introduction

INVELTYS (Tafluprost 0.0015%) is a corticosteroid-free, preservative-free ophthalmic suspension indicated for the treatment of ocular inflammation and pain following ophthalmic surgery. Developed by Kala Pharmaceuticals, INVELTYS addresses a significant unmet need in postoperative ocular care due to its innovative preservative-free formulation, which enhances safety profiles and patient comfort. As the global market for postoperative ocular anti-inflammatory agents expands, understanding INVELTYS’s market positioning and future pricing landscape becomes critical for stakeholders.

This report presents a comprehensive market analysis and forecasts the drug’s pricing trajectory, considering competitive dynamics, regulatory factors, and market demand drivers.

Market Overview

Global Ophthalmic Postoperative Inflammatory Market

The global ophthalmic anti-inflammatory market, particularly products used post-surgery, is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 4–6% over the next five years, reaching an estimated USD 3–4 billion by 2028 [1]. This growth stems from increasing cataract surgeries, expanding indications for ocular surgeries, and patient preference for preservative-free formulations.

Key Drivers

- Rising Prevalence of Ocular Surgeries: The number of cataract procedures globally surpassed 20 million annually, with projections increasing due to aging populations and expanded surgical indications [2].

- Shift Toward Preservative-Free Therapies: Patients and clinicians favor preservative-free options because of reduced ocular surface toxicity, increased comfort, and improved adherence.

- Regulatory Approvals and Reimbursement Policies: Enhanced reimbursement for advanced ophthalmic therapies enhances market penetration.

Unmet Needs Addressed by INVELTYS

- Preservative-Free Delivery: Reduces ocular surface toxicity associated with traditional corticosteroid eye drops.

- Postoperative Inflammation Management: Offers a targeted, sustained anti-inflammatory effect with reduced steroid-related side effects.

- Patient Comfort: The suspension formulation enhances compliance post-surgery.

Competitive Landscape

Major competitors include:

- Prednisolone Acetate 1% (e.g., Pred Forte, Omnipred): Widely used but associated with preservative-related eye surface toxicity.

- Durezol (Difluprednate 0.05%): A potent corticosteroid offering high anti-inflammatory efficacy but with a higher propensity for intraocular pressure elevation.

- Loteprednol Etabonate (e.g., Lotemax): A soft steroid with a favorable safety profile.

- NSAID agents (e.g., Bromfenac, Nepafenac): Often used adjunctively or as alternatives, with different mechanisms and efficacy profiles.

INVELTYS’s differentiators include:

- Preservative-Free Suspension: Minimizes surface toxicity.

- Formulation Stability and Bioavailability: Optimized for postoperative use with sustained absorption.

- Safety Profile: Reduced intraocular pressure spikes compared to other corticosteroids.

Market Penetration and Adoption

Current Position

Since its U.S. launch in 2020, INVELTYS has gained traction among ophthalmologists seeking advanced, preservative-free anti-inflammatory options. The initial uptake is driven by the rising demand for postoperative therapies aligning with safety and tolerability.

Factors Influencing Market Share

- Physician Preferences: Preference for preservative-free and steroid-sparing agents.

- Reimbursement and Pricing Strategies: Competitive pricing enhances adoption, especially in cost-sensitive markets.

- Distribution and Education: Effective physician education and sample programs expedite adoption.

Price Analysis and Forecast

Current Pricing Landscape

In the U.S., the wholesale acquisition cost (WAC) for INVELTYS approximates USD 400–450 per 10 mL bottle, aligning with premium corticosteroid formulations. Comparable products like Pred Forte are priced around USD 100–150 per bottle, but with known preservative-related issues affecting broader acceptance.

Pricing Strategy Insights

- Premium Positioning: INVELTYS’s preservative-free attribute supports a premium pricing strategy.

- Value-Based Premiums: The combination of safety, tolerability, and convenience justifies higher price points among physicians and chronic users.

Future Price Projections (2023–2028)

Given market dynamics and increasing competition, the following projections are plausible:

| Year | Estimated Price Range (USD) | Rationale |

|---|---|---|

| 2023 | USD 420–470 | Initial stabilization post-launch, with inflation-adjusted premiums maintained. |

| 2024–2025 | USD 440–490 | Slight price adjustments for inflation, enhanced formulary inclusion, and expanded utilization. |

| 2026–2028 | USD 460–510 | Possible price stabilization or incremental increases aligned with market growth, but constrained by payer pressures and competitive responses. |

Note: These projections assume stable market demand, no significant regulatory delays, and continued favorable reimbursement policies.

Regulatory and Market Expansion Factors

International Market Potential

While initially launched in the U.S., expanding into EU, Asia-Pacific, and Latin America offers significant growth opportunities. Regulatory approvals and local pricing negotiations will influence international price points and market access strategies.

Regulatory Pathways

Approvals by the European Medicines Agency (EMA) and other agencies could facilitate international pricing strategies, though local market conditions will vary.

Implications for Stakeholders

- Pharmaceutical Companies: Maintaining premium pricing relies on demonstrating superior safety and tolerability profiles. Investment in physician education and patient awareness enhances market share.

- Payers: As evidence of cost-savings (via reduced adverse event management) accumulates, formulary placements could justify premium reimbursement levels.

- Investors: The stabilization of prices within the projected range indicates sustained revenue streams, especially with increasing adoption.

Key Market Risks

- Pricing Pressure from Generics or Biosimilars: Entry of generic corticosteroid formulations could cap price increments.

- Market Penetration Limitations: Slow adoption due to physician inertia or reimbursement constraints.

- Competitive Innovations: New markets entrants or alternative technologies could alter demand and price dynamics.

Key Takeaways

- INVELTYS occupies a unique position as a preservative-free, post-surgical ocular anti-inflammatory with growing demand.

- The drug’s premium price point (~USD 420–510 per bottle within five years) reflects its safety profile and clinical advantages.

- Market expansion and international regulatory approvals are pivotal for sustained growth and pricing power.

- Competitive pressures and payer strategies will influence pricing trajectories, emphasizing the importance of value demonstration.

- Strategic investments in physician education and formulary access remain critical for maximizing market share and revenue.

FAQs

-

What differentiates INVELTYS from other corticosteroids?

Its preservative-free suspension formulation reduces ocular surface toxicity and improves patient comfort, setting it apart from preserved corticosteroid drops. -

What is the expected market growth for INVELTYS?

The global postoperative ocular anti-inflammatory market is projected to grow at 4–6% CAGR, with INVELTYS benefiting from this trend as a premium, preservative-free option. -

How will pricing evolve as competition intensifies?

While initial premiums are expected to remain stable, increased competition and generic entries could pressure prices downward over time. -

What are the main barriers to INVELTYS’s market expansion?

Physician familiarity, reimbursement policies, and competition from existing therapies pose barriers, along with regulatory approvals in international markets. -

How does payer reimbursement impact INVELTYS’s price projection?

Favorable reimbursement policies support sustained premium pricing; however, payer demands for value-based pricing may influence future price adjustments.

References

- Market Research Future Report, "Global Ophthalmic Anti-inflammatory Market," 2022.

- American Academy of Ophthalmology, "100 Years of Cataract Surgery," 2019.

- Kala Pharmaceuticals, Company Fact Sheet, 2022.

- IQVIA Market Intelligence, "Global Ophthalmology Market," 2022.

- FDA Drug Approval Database, 2020.

By maintaining a clear understanding of market dynamics, competitive positioning, and regulatory pathways, stakeholders can optimize strategic decisions regarding INVELTYS’s pricing and market expansion plans.

More… ↓