Last updated: July 28, 2025

Introduction

INSPRA (mometasone furoate) represents a significant entry in the pharmaceutical landscape, primarily targeting inflammatory and allergic conditions. As a topical corticosteroid, its market potential hinges on a combination of therapeutic efficacy, regulatory pathways, competitive positioning, and broader healthcare trends. This analysis examines the key market dynamics and the financial trajectory forecast for INSPRA, providing insights into its commercial prospects amid evolving industry forces.

Pharmacological Profile and Therapeutic Indications

INSPRA’s active ingredient, mometasone furoate, is a highly potent corticosteroid renowned for its anti-inflammatory, antipruritic, and vasoconstrictive properties. It is primarily indicated in dermatology for conditions such as atopic dermatitis, psoriasis, and allergic dermatitis, among others. Its favorable safety profile and once-daily application enhance compliance, which are pivotal for widespread adoption.

The drug's therapeutic positioning aligns with the high unmet needs in chronic inflammatory skin disorders, bolstering its market appeal. Moreover, increased recognition of corticosteroids' role in managing allergic and dermatological conditions sustains demand growth.

Market Dynamics

1. Competitive Landscape

The dermatological corticosteroid segment is crowded, with established products like clobetasol, betamethasone, and hydrocortisone dominating the arena. INSPRA’s success relies on differentiating factors such as signaling superior safety, lower potency-related side effects, or better formulation technology. Its positioning as a mid- to high-potency corticosteroid offers a strategic advantage, yet pricing pressures from generics and biosimilars influence market dynamics.

2. Regulatory Environment

Regulatory agencies, including the FDA and EMA, scrutinize corticosteroids extensively for safety, particularly regarding long-term use and skin atrophy. INSPRA’s approval pathways depend on demonstrating comparable efficacy with favorable safety profiles, which can accelerate market entry but may be impeded by stringent post-marketing surveillance requirements.

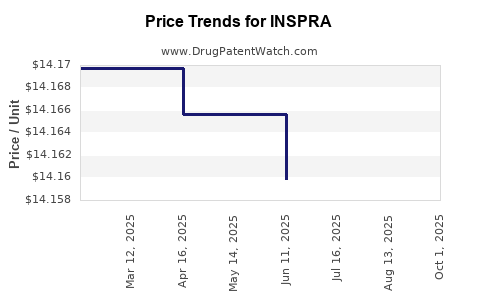

3. Pricing and Reimbursement Strategies

Pricing strategies play a pivotal role. If INSPRA is brought to market as a branded product, initial pricing can be premium, especially targeting specialist dermatologists. Subsequently, reimbursement policies and formulary inclusions will shape accessibility and volume. In markets with significant generic penetration, competitive pricing will be critical to maintain market share.

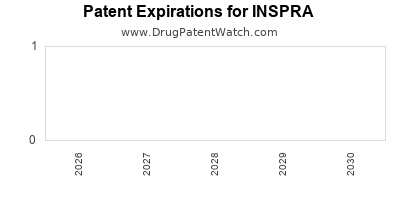

4. Patent and Exclusivity Considerations

Patent protections provide exclusivity periods that directly impact revenue trajectories. Securing formulation patents or innovative delivery mechanisms could extend market exclusivity, delaying generic competition and bolstering revenue streams.

5. Prescriber and Patient Adoption

Physician preference for formulations with proven safety and efficacy, compounded with patient adherence factors, influences sales. Educational campaigns and clinical evidence are essential to drive adoption, especially as new formulations or combination therapies emerge.

Market Size and Forecast

Global Dermatology Market Outlook

The global dermatology market is projected to reach approximately USD 28 billion by 2028, with corticosteroids comprising a significant segment. The increasing prevalence of dermatological conditions—driven by environmental factors, urbanization, and rising awareness—fuels demand. North America and Europe currently dominate due to high healthcare expenditures and established outpatient dermatology services, but growth in Asia-Pacific signals substantial future opportunities.

Market Penetration Potential for INSPRA

Assuming INSPRA captures a modest share within its targeted indications, initial revenues could range between USD 200 million and USD 500 million within five years post-launch. This projection accounts for market penetration rates, pricing strategies, and competitive responses.

Growth Drivers

- Rising prevalence of skin conditions, notably atopic dermatitis and psoriasis.

- Advancements in formulation technology, enhancing delivery and safety (e.g., lower systemic absorption).

- Expanding insurance and reimbursement coverage, facilitating access.

- Growing preference for corticosteroids with improved safety profiles.

Challenges Restraining Growth

- Intense competition from existing corticosteroids.

- Cost containment policies, especially in managed care settings.

- Generic entries post-patent expiry, exerting downward pressure on prices.

Financial Trajectory

Revenue Streams

Post-launch, revenues hinge on volume sales augmented by pricing strategies. An initial phase focused on specialist prescribing is expected to be followed by broader adoption in primary care settings.

Profitability Outlook

High initial R&D and marketing expenditures typically depress margins in the early years. However, as sales mature and market share stabilizes, economies of scale and optimized supply chains should improve profitability margins.

Investment and Funding

Commercialization efforts may require significant investments in marketing and clinical education, with funding sourced through partnerships, venture capital, or licensing deals. The potential for licensing out rights or co-marketing arrangements could diversify revenue streams.

Long-term Financial Outlook

If INSPRA secures a strong foothold, revenues are forecasted to grow at a compound annual growth rate (CAGR) of approximately 8-12% over five years, driven by increasing demand and expanded indications. Market saturation and patent expiries will be key inflection points affecting long-term growth.

Regulatory and Market Risks

- Regulatory delays or unfavorable rulings could impact launch timelines and revenues.

- Emergence of biosimilars or generics may erode market share.

- Pricing pressures amid healthcare cost containment may limit profit margins.

- Unanticipated safety issues could hinder prescriber confidence.

Key Strategic Considerations

To optimize financial trajectory, stakeholders should prioritize:

- Robust clinical trial data to demonstrate safety and efficacy.

- Early payer engagement to secure favorable reimbursement.

- Differentiation through formulation innovations.

- Monitoring competitive activities and adapting marketing strategies accordingly.

- Expanding indications in respiratory or other inflammatory conditions targeting mometasone’s versatility.

Key Takeaways

- INSPRA’s success depends on strategic positioning amidst a competitive corticosteroid market, leveraging safety and formulation advantages.

- Market expansion hinges on increasing awareness, forging strong reimbursement pathways, and broadening indications.

- Early patent protections and formulation innovations are vital for maximizing revenues before generic competition.

- The global dermatology market’s growth trajectory offers substantial upside, with tiered revenue patterns aligned with penetration and competition.

- Continuous monitoring of regulatory and competitive developments is essential for sustained financial performance.

FAQs

1. What differentiates INSPRA from other corticosteroids?

INSPRA’s formulation aims for superior safety and compliance profiles, with once-daily application and a potent anti-inflammatory effect, offering advantages over traditional corticosteroids.

2. How will patent expiry impact INSPRA’s revenues?

Patent expiration typically introduces generics, which exert price competition and reduce branded product revenues. Securing formulation patents or exclusivity rights can prolong market dominance.

3. What are the primary growth markets for INSPRA?

North America and Europe currently dominate, but rapid growth is anticipated in Asia-Pacific due to rising skin disease prevalence and expanding healthcare infrastructure.

4. How does competitive pricing influence INSPRA's market share?

Competitive pricing, aligned with quality and safety advantages, enhances adoption. Excessively high prices may limit accessibility, while aggressive pricing could compress margins but improve volume.

5. What regulatory challenges could impact INSPRA’s market introduction?

Regulatory agencies require extensive safety data, especially regarding long-term corticosteroid use, which could delay approval or necessitate additional studies, affecting time-to-market and revenue timelines.

References

- MarketWatch. "Global Dermatology Drugs Market Outlook," 2022.

- IQVIA. "Pharmaceutical Market Reports," 2022.

- FDA. "Guidance for Industry: Topical Corticosteroids," 2021.

- Grand View Research. "Dermatology Market Size & Trends," 2023.

- EvaluatePharma. "Top Pharmaceutical Revenue Drivers," 2022.