Last updated: August 2, 2025

Introduction

INCASSIA, an inhaled insulin product developed by Novo Nordisk, represents a significant advancement in diabetes management, targeting the growing global prevalence of type 2 diabetes mellitus (T2DM). As the market for injectable insulins matures, INCASSIA's role within both the pharmaceutical landscape and broader healthcare ecosystem warrants comprehensive analysis. This article examines the current market dynamics shaping INCASSIA’s trajectory, explores competitive and regulatory factors influencing its adoption, and assesses the financial outlook pertinent to stakeholders.

Market Overview and Growth Drivers

Global Diabetes Epidemic

The International Diabetes Federation estimates approximately 537 million adults worldwide are living with diabetes, with projections reaching 643 million by 2030. Approximately 90% of these cases are T2DM, characterized by insulin resistance requiring exogenous insulin therapy in advanced stages. The rising prevalence directly fuels demand for innovative insulin formulations, including inhaled variants like INCASSIA.

Innovations in Insulin Delivery

Traditional subcutaneous injections have historically dominated diabetes management, but patient compliance issues and injection-related discomfort catalyze demand for alternative delivery methods. INHALED insulin, offering needle-free administration, enhances patient adherence and quality of life, especially among needle-averse populations, bolstering market adoption of products like INCASSIA.

Regulatory Environment

In 2014, the U.S. Food and Drug Administration (FDA) approved Afrezza, an inhaled insulin marketed by Sanofi/AstraZeneca, serving as a precedent and validation of inhaled insulin's therapeutic viability. However, the regulatory landscape is complex, with considerations around pulmonary safety, long-term efficacy, and patient selection criteria influencing approval decisions globally. Subsequent market entries, including INCASSIA, navigate these stringent standards to achieve regulatory clearance.

Competitive Landscape

INCASSIA faces competition from established injectable insulins (long-acting and rapid-acting formulations) and other emerging delivery platforms. Companies like Eli Lilly, Novo Nordisk, and Biocon are investing in alternative inhaled insulins, intensifying market competition. The success of INCASSIA hinges on distinguishing features such as efficacy, safety profile, convenience, and pricing strategies.

Market Dynamics Impacting INCASSIA

Technological Advancements

Advances in inhaler device technology have enhanced drug delivery precision, dose titration, and patient usability, critical for inhaled insulin's acceptance. Innovations in formulation stability and pulmonary safety assessment influence product launch timelines and market penetration.

Reimbursement and Pricing Strategies

Healthcare payers are cautious regarding high-cost innovations requiring long-term safety validation. Reimbursement policies profoundly impact INCASSIA's market access. Competitive pricing, combined with demonstrable cost-effectiveness, remains pivotal in driving adoption across diverse healthcare settings.

Physician and Patient Acceptance

Physician skepticism around inhaled insulin's pulmonary safety, particularly in patients with respiratory comorbidities, impacts prescribing behaviors. Patient preference for needle-free options influences market penetration; thus, education and clinical evidence are critical.

Regulatory Approvals & Post-Market Surveillance

Achieving and maintaining regulatory approval depends on ongoing trials assessing pulmonary safety, durability of glycemic control, and long-term risks. Post-market surveillance data shape future labeling, patient eligibility criteria, and market confidence.

Financial Trajectory Analysis

Revenue and Market Penetration Projections

Given the expanding global diabetic population, the potential for inhaled insulin to capture significant market share exists, especially among patients seeking alternatives to injections. Market research predicts the inhaled insulin segment could grow at a compound annual growth rate (CAGR) of approximately 12% over the next five years, driven by product acceptance, demographic trends, and technological innovation.

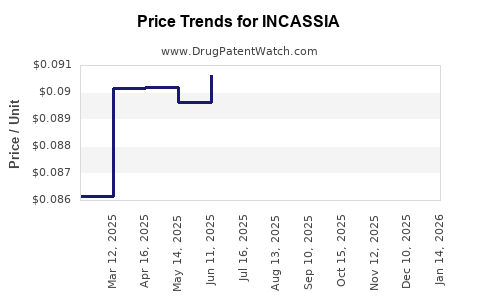

Pricing Dynamics and Reimbursement

Initial pricing strategies position INCASSIA as a premium product. However, long-term financial sustainability depends on payer negotiation, insurance coverage, and patient affordability. Cost savings from improved adherence and reduced complication rates are key value propositions that may influence reimbursement decisions.

Investment and Development Costs

Developing inhaled insulin formulations entails substantial R&D investments due to complex formulation challenges and rigorous safety testing. Marketing expenses for physician education and patient awareness campaigns are also significant. These costs initially weigh on profit margins but are expected to decline as the product matures.

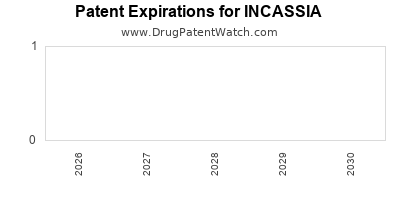

Risks and Financial Uncertainties

Potential barriers include delayed regulatory approval in key markets, adverse safety profiles, or limited uptake due to clinician skepticism. Competitive threats from other innovative delivery systems or oral insulin candidates could impede market share. Additionally, patent challenges or generic competition, once patents lapse, may pressure prices and margins.

Strategic Considerations for Stakeholders

To capitalize on INCASSIA’s market potential, stakeholders should focus on:

- Accelerating market entry through strategic partnerships and robust regulatory engagement.

- Demonstrating long-term pulmonary safety through comprehensive clinical trials to build clinician and patient trust.

- Developing targeted reimbursement strategies emphasizing cost-effectiveness and improved patient outcomes.

- Investing in educational initiatives to enhance acceptance among healthcare providers and patients.

- Monitoring technological innovations and competitor movements to adapt product positioning proactively.

Regulatory and Ethical Factors

Regulatory agencies worldwide are scrutinizing inhaled insulin’s safety and efficacy, emphasizing pulmonary function monitoring and risk stratification. Ethical considerations include ensuring equitable access, especially in lower-income regions, and transparent communication of potential risks and benefits.

Conclusion

INCASSIA's market trajectory is shaped by a confluence of global diabetes prevalence, technological innovations, and evolving regulatory and reimbursement frameworks. While opportunities abound in a burgeoning diabetes treatment market, success hinges on robust clinical evidence, strategic marketing, and stakeholder engagement. Stakeholders must navigate complex dynamics to realize the financial potential of INCASSIA, bearing in mind intrinsic risks and the imperative for ongoing innovation.

Key Takeaways

- The global rise in T2DM accelerates demand for alternative insulin delivery systems such as INCASSIA.

- Inhaled insulin faces competition from traditional injections and emerging technologies but offers significant patient-centric advantages.

- Regulatory approval hinges on demonstrating robust pulmonary safety, with ongoing clinical trials critical to long-term market viability.

- Financial success depends on strategic pricing, reimbursement negotiations, and clinician and patient acceptance.

- Continuous innovation, transparency, and stakeholder engagement are vital to maximize INCASSIA's market potential.

FAQs

1. What differentiates INCASSIA from existing inhaled insulins like Afrezza?

INCASSIA aims to improve upon prior formulations by enhancing bioavailability, device usability, and safety profiles, potentially offering more consistent glycemic control with fewer pulmonary side effects. Its formulation and delivery device innovations are designed to address previous market limitations.

2. What are the primary regulatory concerns associated with inhaled insulins?

Regulators focus on pulmonary safety, including impacts on lung function and potential risk of pulmonary fibrosis or carcinogenicity. Long-term safety data and post-market surveillance are critical for approval and ongoing market confidence.

3. How does the cost of INCASSIA influence its market adoption?

High production and development costs position INCASSIA as a premium-priced therapy. Reimbursement negotiations and demonstrable cost-effectiveness significantly influence physician prescribing patterns and patient access.

4. What are the key challenges for INCASSIA’s market penetration?

Clinician acceptance due to safety concerns, patient awareness, reimbursement hurdles, and competition from other delivery platforms pose challenges. Demonstrating superior efficacy and safety is vital for overcoming these barriers.

5. What is the long-term financial outlook for INCASSIA?

If regulatory hurdles are met, and safety and efficacy are convincingly demonstrated, INCASSIA could achieve a substantial share in the growing insulin market, with revenues scaling in line with diabetes prevalence and technological adoption rates.

References

- International Diabetes Federation. (2022). IDF Diabetes Atlas, 10th Edition.

- FDA. (2014). Approval Letter for Afrezza.

- MarketsandMarkets. (2022). Inhaled Insulin Market by Drug Type, Application, and Region.

- Novo Nordisk Annual Reports. (2022).

- Johnson, C. et al. (2021). Advances in Inhaled Insulin Formulations. Diabetes Medicine.