IBRANCE Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Ibrance, and what generic alternatives are available?

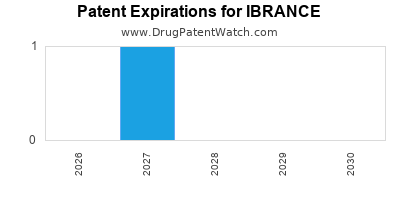

Ibrance is a drug marketed by Pfizer and is included in two NDAs. There are three patents protecting this drug and two Paragraph IV challenges.

This drug has one hundred and sixty-nine patent family members in fifty-six countries.

The generic ingredient in IBRANCE is palbociclib. There are thirteen drug master file entries for this compound. Two suppliers are listed for this compound. Additional details are available on the palbociclib profile page.

DrugPatentWatch® Generic Entry Outlook for Ibrance

Ibrance was eligible for patent challenges on February 3, 2019.

There have been thirty-eight patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

There are six tentative approvals for the generic drug (palbociclib), which indicates the potential for near-term generic launch.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for IBRANCE?

- What are the global sales for IBRANCE?

- What is Average Wholesale Price for IBRANCE?

Summary for IBRANCE

| International Patents: | 169 |

| US Patents: | 3 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 2 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 128 |

| Patent Applications: | 4,925 |

| Drug Prices: | Drug price information for IBRANCE |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for IBRANCE |

| What excipients (inactive ingredients) are in IBRANCE? | IBRANCE excipients list |

| DailyMed Link: | IBRANCE at DailyMed |

Recent Clinical Trials for IBRANCE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| University Medical Center Groningen | Phase 4 |

| Megalabs | PHASE4 |

| AstraZeneca | Phase 1/Phase 2 |

Pharmacology for IBRANCE

| Drug Class | Kinase Inhibitor |

| Mechanism of Action | Cytochrome P450 3A Inhibitors Kinase Inhibitors |

Paragraph IV (Patent) Challenges for IBRANCE

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| IBRANCE | Tablets | palbociclib | 75 mg, 100 mg and 125 mg | 212436 | 1 | 2020-11-24 |

| IBRANCE | Capsules | palbociclib | 75 mg, 100 mg and 125 mg | 207103 | 12 | 2019-02-04 |

US Patents and Regulatory Information for IBRANCE

IBRANCE is protected by three US patents and two FDA Regulatory Exclusivities.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pfizer | IBRANCE | palbociclib | CAPSULE;ORAL | 207103-001 | Feb 3, 2015 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Pfizer | IBRANCE | palbociclib | TABLET;ORAL | 212436-002 | Nov 1, 2019 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Pfizer | IBRANCE | palbociclib | TABLET;ORAL | 212436-003 | Nov 1, 2019 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Pfizer | IBRANCE | palbociclib | CAPSULE;ORAL | 207103-002 | Feb 3, 2015 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Pfizer | IBRANCE | palbociclib | CAPSULE;ORAL | 207103-001 | Feb 3, 2015 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Pfizer | IBRANCE | palbociclib | CAPSULE;ORAL | 207103-003 | Feb 3, 2015 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Pfizer | IBRANCE | palbociclib | TABLET;ORAL | 212436-002 | Nov 1, 2019 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for IBRANCE

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Pfizer | IBRANCE | palbociclib | CAPSULE;ORAL | 207103-001 | Feb 3, 2015 | ⤷ Get Started Free | ⤷ Get Started Free |

| Pfizer | IBRANCE | palbociclib | CAPSULE;ORAL | 207103-003 | Feb 3, 2015 | ⤷ Get Started Free | ⤷ Get Started Free |

| Pfizer | IBRANCE | palbociclib | CAPSULE;ORAL | 207103-002 | Feb 3, 2015 | ⤷ Get Started Free | ⤷ Get Started Free |

| Pfizer | IBRANCE | palbociclib | TABLET;ORAL | 212436-003 | Nov 1, 2019 | ⤷ Get Started Free | ⤷ Get Started Free |

| Pfizer | IBRANCE | palbociclib | CAPSULE;ORAL | 207103-003 | Feb 3, 2015 | ⤷ Get Started Free | ⤷ Get Started Free |

| Pfizer | IBRANCE | palbociclib | TABLET;ORAL | 212436-001 | Nov 1, 2019 | ⤷ Get Started Free | ⤷ Get Started Free |

| Pfizer | IBRANCE | palbociclib | TABLET;ORAL | 212436-001 | Nov 1, 2019 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for IBRANCE

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Pfizer Europe MA EEIG | Ibrance | palbociclib | EMEA/H/C/003853Ibrance is indicated for the treatment of hormone receptor (HR) positive, human epidermal growth factor receptor 2 (HER2) negative locally advanced or metastatic breast cancer:in combination with an aromatase inhibitor;in combination with fulvestrant in women who have received prior endocrine therapy.In pre- or perimenopausal women, the endocrine therapy should be combined with a luteinizing hormone releasing hormone (LHRH) agonist. | Authorised | no | no | no | 2016-11-09 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for IBRANCE

When does loss-of-exclusivity occur for IBRANCE?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 4842

Estimated Expiration: ⤷ Get Started Free

Patent: 4909

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 14220354

Estimated Expiration: ⤷ Get Started Free

Patent: 16272881

Estimated Expiration: ⤷ Get Started Free

Patent: 19204689

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2015019508

Estimated Expiration: ⤷ Get Started Free

Patent: 2017025398

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 00322

Estimated Expiration: ⤷ Get Started Free

Patent: 31892

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 17003089

Estimated Expiration: ⤷ Get Started Free

China

Patent: 5008357

Estimated Expiration: ⤷ Get Started Free

Patent: 7666914

Estimated Expiration: ⤷ Get Started Free

Patent: 7759594

Estimated Expiration: ⤷ Get Started Free

Patent: 1253394

Estimated Expiration: ⤷ Get Started Free

Patent: 3616606

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 17012362

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 170540

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0192065

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 20734

Estimated Expiration: ⤷ Get Started Free

Patent: 22454

Estimated Expiration: ⤷ Get Started Free

Patent: 24068

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 58916

Estimated Expiration: ⤷ Get Started Free

Patent: 02565

Estimated Expiration: ⤷ Get Started Free

Patent: 31475

Estimated Expiration: ⤷ Get Started Free

Dominican Republic

Patent: 017000280

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 17085737

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 58916

Estimated Expiration: ⤷ Get Started Free

Patent: 02565

Estimated Expiration: ⤷ Get Started Free

Patent: 31475

Estimated Expiration: ⤷ Get Started Free

Patent: 36283

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 11032

Estimated Expiration: ⤷ Get Started Free

Patent: 48217

Estimated Expiration: ⤷ Get Started Free

Patent: 50570

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 40434

Estimated Expiration: ⤷ Get Started Free

Patent: 47477

Estimated Expiration: ⤷ Get Started Free

Patent: 54212

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 0277

Estimated Expiration: ⤷ Get Started Free

Patent: 5632

Estimated Expiration: ⤷ Get Started Free

Patent: 7437

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 81016

Estimated Expiration: ⤷ Get Started Free

Patent: 24152

Estimated Expiration: ⤷ Get Started Free

Patent: 27302

Estimated Expiration: ⤷ Get Started Free

Patent: 14162794

Estimated Expiration: ⤷ Get Started Free

Patent: 17002034

Estimated Expiration: ⤷ Get Started Free

Patent: 17186376

Estimated Expiration: ⤷ Get Started Free

Patent: 19116512

Estimated Expiration: ⤷ Get Started Free

Patent: 21167343

Estimated Expiration: ⤷ Get Started Free

Patent: 23112149

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 02565

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 3715

Estimated Expiration: ⤷ Get Started Free

Patent: 6083

Estimated Expiration: ⤷ Get Started Free

Patent: 6473

Estimated Expiration: ⤷ Get Started Free

Patent: 15010858

Estimated Expiration: ⤷ Get Started Free

Patent: 17015579

Estimated Expiration: ⤷ Get Started Free

Patent: 19003605

Estimated Expiration: ⤷ Get Started Free

Patent: 20003825

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 0138

Estimated Expiration: ⤷ Get Started Free

Patent: 7391

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 180395

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 58916

Estimated Expiration: ⤷ Get Started Free

Patent: 02565

Estimated Expiration: ⤷ Get Started Free

Patent: 31475

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 58916

Estimated Expiration: ⤷ Get Started Free

Patent: 02565

Estimated Expiration: ⤷ Get Started Free

Patent: 31475

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 19944

Estimated Expiration: ⤷ Get Started Free

Patent: 86840

Estimated Expiration: ⤷ Get Started Free

Patent: 15132371

Estimated Expiration: ⤷ Get Started Free

Saudi Arabia

Patent: 7390473

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 672

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 201505680R

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 58916

Estimated Expiration: ⤷ Get Started Free

Patent: 02565

Estimated Expiration: ⤷ Get Started Free

Patent: 31475

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1707780

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1858913

Estimated Expiration: ⤷ Get Started Free

Patent: 2068423

Estimated Expiration: ⤷ Get Started Free

Patent: 2369405

Estimated Expiration: ⤷ Get Started Free

Patent: 150107872

Estimated Expiration: ⤷ Get Started Free

Patent: 170094012

Estimated Expiration: ⤷ Get Started Free

Patent: 180015232

Estimated Expiration: ⤷ Get Started Free

Patent: 200006633

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 94787

Estimated Expiration: ⤷ Get Started Free

Patent: 64459

Estimated Expiration: ⤷ Get Started Free

Patent: 69277

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 33103

Estimated Expiration: ⤷ Get Started Free

Patent: 35863

Estimated Expiration: ⤷ Get Started Free

Patent: 70269

Estimated Expiration: ⤷ Get Started Free

Patent: 63881

Estimated Expiration: ⤷ Get Started Free

Patent: 1444834

Estimated Expiration: ⤷ Get Started Free

Patent: 1711687

Estimated Expiration: ⤷ Get Started Free

Patent: 1803872

Estimated Expiration: ⤷ Get Started Free

Patent: 1906611

Estimated Expiration: ⤷ Get Started Free

Turkey

Patent: 1816077

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering IBRANCE around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| European Patent Office | 3636283 | ⤷ Get Started Free | |

| South Korea | 20150107872 | ⤷ Get Started Free | |

| Poland | 391191 | ⤷ Get Started Free | |

| Canada | 2931892 | ⤷ Get Started Free | |

| Singapore | 11201505680R | ⤷ Get Started Free | |

| China | 102295643 | ⤷ Get Started Free | |

| Denmark | 1470124 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for IBRANCE

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1470124 | C20170012 00212 | Estonia | ⤷ Get Started Free | PRODUCT NAME: PALBOTSIKLIIB;REG NO/DATE: EU/1/16/1147 11.11.2016 |

| 1470124 | 122017000014 | Germany | ⤷ Get Started Free | PRODUCT NAME: PALBOCICLIB, OPTIONAL IN FORM EINES PHARMAZEUTISCH ANNEHMBAREN SALZES, ESTERS, AMIDES ODER EINES PRODRUGS HIERVON; REGISTRATION NO/DATE: EU/1/16/1147 20161109 |

| 1470124 | 12/2017 | Austria | ⤷ Get Started Free | PRODUCT NAME: PALBOCICLIB, GEGEBENENFALLS IN FORM EINES PHARMAZEUTISCH ANNEHMBAREN SALZES, ESTERS, AMIDS ODER PRODRUGS DAVON; REGISTRATION NO/DATE: EU/1/16/1147/001-006 (MITTEILUNG) 20161111 |

| 1470124 | LUC00009 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: PALBOCICLIB, EVENTUELLEMENT SOUS LA FORME D'UN SEL , D'UN ESTER, D'UN AMIDE OU D'UN PROMEDICAMENT PHARMACEUTIQUEMENT ACCEPTABLE DE CELUI-CI; AUTHORISATION NUMBER AND DATE: EU/1/16/1147 20161111 |

| 1470124 | C01470124/01 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: PALBOCICLIB; REGISTRATION NO/DATE: SWISSMEDIC-ZULASSUNG 66138 31.01.2017 |

| 1470124 | SPC/GB17/026 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: PALBOCICLIB, OPTIONALLY IN THE FORM OF A PHARMACEUTICALLY ACCEPTABLE SALT, ESTER, AMIDE OR PRODRUG THEREOF; REGISTERED: UK EU/1/16/1147 20161109; UK FURTHER MAS ON IPSUM 20161109 |

| 1470124 | 614 | Finland | ⤷ Get Started Free | |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for IBRANCE (Palbociclib)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.