Last updated: July 27, 2025

Introduction

GEMFIBROZIL, a fibric acid derivative primarily used to treat hyperlipidemia, particularly elevated triglycerides and low HDL cholesterol levels, has historically played a pivotal role in cardiovascular risk management. Although its global market share has waned with the advent of newer lipid-lowering agents, recent trends in cardiovascular disease (CVD) management and regulatory shifts are reshaping its market dynamics. This report analyzes the current landscape, future opportunities, competitive positioning, and financial trajectory of GEMFIBROZIL within the pharmaceutical industry.

Market Overview and Current Demand

GEMFIBROZIL's therapeutic niche centers on hyperlipidemia management, especially for patients intolerant to statins or requiring adjunctive therapy. The global hyperlipidemia market is projected to reach USD 13.2 billion by 2025, with fibric acid derivatives accounting for a modest but significant segment, driven by the increasing prevalence of cardiovascular diseases worldwide [1].

However, the consumption of GEMFIBROZIL has declined over the past decade, partly owing to the emergence of PCSK9 inhibitors, statin intensification, and lipid-modifying combination therapies. Nevertheless, in emerging markets—Asia-Pacific, Latin America, and parts of Africa—the affordability of GEMFIBROZIL sustains its demand, often constituting the first-line therapy in lipid management due to cost-effectiveness.

Market Drivers

1. Rising Cardiovascular Disease Burden

The global rise in CVD prevalence fuels the need for lipid management therapies. Hypertriglyceridemia often coexists with other metabolic syndromes; hence, treatments targeting triglycerides remain relevant.

2. Regulatory Environment and Prescribing Trends

Regulatory agencies in various regions are revisiting lipid management guidelines. Recent endorsements for the combined use of fibrates with statins in specific patient populations could enhance GEMFIBROZIL's utilization.

3. Cost-Effectiveness in Emerging Markets

GEMFIBROZIL remains an affordable alternative to newer yet expensive drugs, securing its market share where healthcare budgets are constrained.

4. Advances in Pharmacogenomics

Understanding genetic predispositions influencing lipid metabolism may lead to personalized therapy approaches, potentially sparking renewed interest in GEMFIBROZIL as an adjunct or standalone treatment.

Market Challenges

1. Competition from Novel Agents

Lipid-modifying drugs like PCSK9 inhibitors, ezetimibe, and omega-3 fatty acid formulations present more targeted or effective options, challenging GEMFIBROZIL’s market share.

2. Safety and Efficacy Perceptions

Concerns over side effects such as gallstones and myopathy, along with questions about long-term efficacy, limit prescriber enthusiasm.

3. Patent Status and Generic Competition

Most formulations of GEMFIBROZIL are off-patent, leading to commoditization and price erosion. While this benefits affordability, it constrains profit margins for manufacturers.

4. Regulatory Restrictions

Increased scrutiny on cardiovascular drugs’ safety profiles has led to restrictions or withdrawals in some markets, affecting overall demand.

Financial Trajectory and Investment Outlook

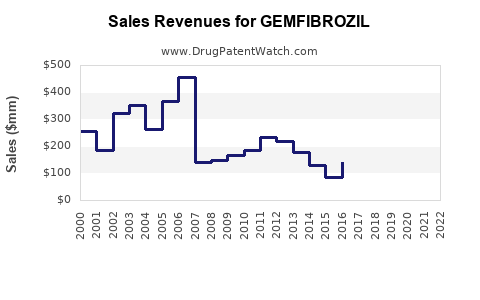

Revenue Trends

The global GEMFIBROZIL market reportedly generated approximately USD 200-300 million in 2022, with a declining trend due to market saturation and competition. Regional analyses indicate higher revenues in emerging economies where affordability sustains prescribing habits.

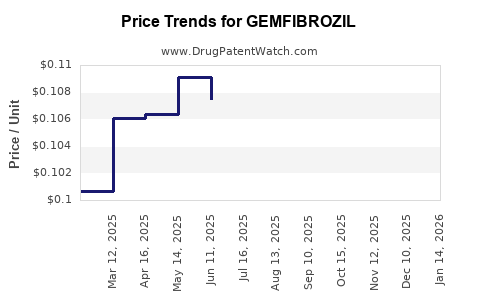

Profitability and Margins

Manufacturers focusing on generic versions benefit from low production costs but face minimal pricing power. Innovative formulations or combination therapies incorporating GEMFIBROZIL may unlock higher margins owing to differentiated offerings.

Research and Development

Limited recent R&D activity targeting GEMFIBROZIL suggests industry repositioning. However, niche development—such as improved formulations or combination products—could extend its lifecycle.

Future Market Growth Potential

Projections indicate a modest CAGR of approximately 1-2% over the next five years, primarily driven by emerging markets and incremental guideline endorsements. Nonetheless, significant growth is unlikely unless new formulations or combination therapies are approved that demonstrate superior efficacy or safety.

Strategic Opportunities

-

Formulation Innovation: Developing fixed-dose combinations or extended-release versions could enhance adherence and clinical efficacy.

-

Regulatory Re-Engagement: Leveraging real-world evidence to support label extensions targeting specific patient populations.

-

Market Expansion: Focused efforts in low-income regions, leveraging cost advantages and generics.

-

Partnerships and Licensing: Collaborations with biotech firms to develop novel derivatives or optimize delivery mechanisms.

Conclusion

GEMFIBROZIL remains relevant in specific segments of the global hyperlipidemia market, especially within low-income and emerging economies. However, its financial trajectory faces considerable headwinds due to stiff competition, safety perceptions, and patent expirations. Strategic innovation, targeted marketing, and regulatory engagement could stabilize or slightly expand its market presence in niche segments.

Key Takeaways

-

The global market for GEMFIBROZIL is gradually declining but remains significant in emerging regions due to cost-effectiveness.

-

The drug’s future depends largely on innovative formulations, combination therapies, and regulatory positioning.

-

Competitive pressure from newer lipid-lowering agents constrains growth, demanding strategic differentiation.

-

Market expansion hinges on affordability, clinician acceptance, and targeted promotional efforts.

-

Companies should consider niche positioning, including developing combination therapies and leveraging regional needs to sustain financial viability.

FAQs

-

What are the primary indications for GEMFIBROZIL?

GEMFIBROZIL is primarily indicated for hypertriglyceridemia and mixed dyslipidemia, particularly in patients who are intolerant to statins or require adjunctive therapy.

-

How does GEMFIBROZIL compare to newer lipid-lowering therapies?

While effective at reducing triglycerides and increasing HDL cholesterol, GEMFIBROZIL is less targeted and has a less favorable safety profile than agents like PCSK9 inhibitors or ezetimibe, limiting its use in some patient populations.

-

What are the main safety concerns associated with GEMFIBROZIL?

Adverse effects include gastrointestinal disturbances, gallstone formation, myopathies, and potential interactions with other medications, especially statins.

-

What opportunities exist for extending the market life of GEMFIBROZIL?

Opportunities include developing fixed-dose combination therapies, demonstrating improved safety profiles through clinical trials, and targeting underserved markets.

-

Is there ongoing research aimed at improving GEMFIBROZIL formulations?

There is limited recent research; however, niche development efforts focusing on extended-release formulations and combination packages could enhance its clinical utility.

Sources:

[1] Global Hyperlipidemia Market Outlook, Market Research Future, 2022.