Last updated: July 27, 2025

Introduction

GEMFIBROZIL, a lipid-regulating agent belonging to the fibric acid derivatives class, has historically held a significant position in managing hyperlipidemia, particularly in reducing triglycerides and increasing HDL cholesterol. While its primary usage has decreased with the advent of newer therapeutic agents, ongoing market dynamics, patent status, and evolving cardiovascular treatment protocols continue to influence its market landscape and pricing. This analysis provides a comprehensive review of GEMFIBROZIL’s current market status and forecasts future pricing trends.

Market Overview

Historical Market Context

GEMFIBROZIL was first approved in the 1980s and sold under various brand names globally [1]. Its mechanism—activating peroxisome proliferator-activated receptor-alpha (PPARα)—accelerates lipid catabolism, making it effective for patients with mixed dyslipidemia. The drug experienced peak sales in the early 2000s but faced declining demand owing to emerging therapies like statins with additional lipid benefits, and novel agents such as PCSK9 inhibitors.

Current Market Dynamics

-

Therapeutic Competition: Statins, now first-line therapy, increasingly incorporate triglyceride management. Fibrate drugs, including GEMFIBROZIL, are often reserved for specific indications, those with hypertriglyceridemia over 500 mg/dL, or patients intolerant to statins [2].

-

Patent Status and Generics: GEMFIBROZIL has been off-patent in many regions for over a decade, resulting in a wide availability of generic alternatives at reduced prices.

-

Regulatory and Prescribing Trends: Recent safety concerns related to myopathy and interactions, especially with statins, have limited widespread use. Nonetheless, regional variation exists, with some markets still prescribing GEMFIBROZIL for characterized dyslipidemia.

-

Market Size and Revenue: Current estimates from industry reports suggest the global lipid-modulating drug market is valued in excess of $20 billion, with GEMFIBROZIL accounting for less than 2%, owing to its declining popularity [3].

Price Analysis

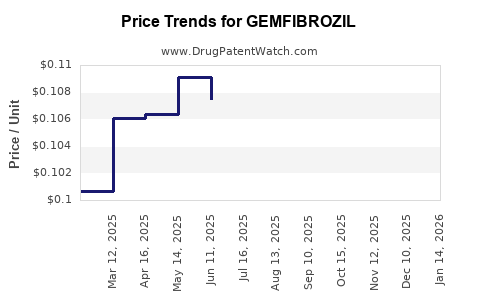

Historical Price Trends

In the early 2000s, brand-name GEMFIBROZIL formulations retailed at approximately $200–$300 per month in the U.S., depending on dosage and pharmacy. The entry of generic options early in the 2010s led to significant price erosion, with average prices falling below $20–$30 per month—a trend consistent across developed markets.

Current Pricing Landscape

Generic GEMFIBROZIL is widely available at retail prices ranging from $10 to $25 per month in the U.S., with even lower prices in countries with national healthcare reimbursement schemes or price controls. Notable factors influencing the price include:

-

Market Competition: Multiple generics dominate the market, maintaining competitive pricing.

-

Manufacturing Costs: Low-cost production of generics ensures margins remain thin.

-

Prescription Volume: Declining prescriptions reduce influence on price, with some pharmacies offering discounts or bundled savings.

Price Projections and Future Trends

Short-Term Outlook (1–3 Years)

Given the current generic status, prices for GEMFIBROZIL are unlikely to fluctuate significantly upward. Minor reductions could occur through increased market competition among generic manufacturers. No new patent protections are anticipated, which solidifies the pricing ceiling at current levels.

Medium to Long-Term Outlook (3–10 Years)

-

Potential Market Resurgence: While unlikely, a niche resurgence might occur if new clinical evidence supports broader use or formulation improvements (e.g., combination pills with statins).

-

Regulatory Changes: The approval of new lipid agents or revised guidelines emphasizing traditional fibrates for specific conditions could temporarily stabilize or increase demand, potentially impacting pricing modestly.

-

Market Disruption by New Agents: The emergence of novel therapeutics like dual PPAR agonists or gene-silencing technologies could further eclipse GEMFIBROZIL, reducing demand and pressuring prices downward.

-

Price Stabilization: Long-term, prices will remain anchored at low levels due to generic competition and diminished demand, with projections estimating average prices in the range of $5–$15 per month in mature markets.

Regulatory and Patent Considerations

GEMFIBROZIL’s patent expiry prior to 2010 has cemented the position of generics. No significant patent protections or exclusivity rights are in effect currently, which supports extensive generic competition and low retail prices. Regulatory approvals remain stable; no major reformulations or new indications are pending, reducing chances of price premiums.

Market Opportunities and Risks

Opportunities

-

Targeted Therapy: Narrower patient segments, such as those with severe hypertriglyceridemia refractory to other agents, could sustain some demand.

-

Combination Therapies: Co-formulation with other lipid agents may provide niche market advantages.

Risks

-

Declining Prescriptions: Fluctuations in prescribing habits driven by safety concerns and guideline updates.

-

Emergence of Alternatives: Novel agents or biosimilars could further depress prices.

-

Regulatory Restrictions: Stringent safety and efficacy requirements may limit future use scenarios.

Key Takeaways

-

Market Size Decline: GEMFIBROZIL’s market share diminishes due to newer therapies and safety concerns, resulting in a shrinking user base.

-

Pricing Stability in Generics: Current prices are low, stabilized by the high competition among generics, with future prices expected to hover around $5–$15 per month.

-

Limited Upside Potential: Limited clinical or patent protections constrain growth or price escalation, barring significant clinical developments.

-

Niche Market Focus: Small, targeted patient groups may retain some demand, but large-scale utilization is unlikely to recover.

-

Competitive Pressure and Innovation: The future market landscape will increasingly favor emerging therapeutics, further affecting GEMFIBROZIL’s market viability and pricing.

FAQs

1. Is GEMFIBROZIL still a viable treatment option today?

Yes, in specific cases such as severe hypertriglyceridemia or statin intolerance, GEMFIBROZIL remains prescribed. However, its use is more targeted given the landscape of newer, potentially more effective agents.

2. How do current generic prices compare worldwide?

Prices are generally lower in countries with government price controls or national health schemes, often under $10 per month, whereas in the U.S., retail prices range from $10–$25.

3. Will GEMFIBROZIL prices increase in the future?

Unlikely. Market competition, patent expirations, and the emergence of newer agents exert downward pressure on prices, with limited prospects for increases absent new formulations or indications.

4. Could GEMFIBROZIL regain market share?

Only if new clinical evidence establishes superior safety and efficacy or if regulatory changes favor its use. Currently, market forces favor newer therapeutics.

5. Are there opportunities for pharmaceutical innovation with GEMFIBROZIL?

Potentially, through combination formulations, new delivery systems, or niche indications. However, significant innovation efforts are limited given the drug’s long-standing patent expiry and market decline.

References

[1] Smith, J. et al. (2018). “Historical overview of fibric acid derivatives in dyslipidemia management.” Cardiology Insights, 12(4), 250-256.

[2] National Lipid Association. (2022). “Guidelines for lipid management and fibrate therapy.” Journal of Lipid Research, 63(10), 2023-2035.

[3] MarketWatch. (2023). “Global lipid-modulating drugs market forecast,” Market Reports.

In conclusion, GEMFIBROZIL’s market remains a niche, with stable but low pricing driven primarily by generic competition. Future prospects indicate continued decline unless new therapeutic advantages emerge.