Last updated: August 4, 2025

Introduction

FOSAMAX (alendronate sodium) is a bisphosphonate primarily used in the treatment and prevention of osteoporosis, Paget’s disease of bone, and to mitigate fracture risk in postmenopausal women. Since its launch in the late 1990s, FOSAMAX has cemented its position as a leading anti-osteoporotic drug, driven by an aging global population and increasing awareness of osteoporosis management. This analysis explores the current market landscape, key drivers, competitive dynamics, regulatory influences, and forecasts FOSAMAX pricing over the upcoming five years.

Market Overview: Size and Dynamics

Global Osteoporosis Drug Market

The osteoporosis therapeutics segment has seen considerable growth, projected to reach USD 10.7 billion by 2027, with a compounded annual growth rate (CAGR) of approximately 3.9% from 2020 through 2027 [1]. FOSAMAX commands a significant share within this market, especially in North America and Europe.

Market Penetration and Adoption

FOSAMAX's widespread acceptance owes to its proven efficacy, longstanding clinical history, and high patient awareness. Prevalent among postmenopausal women and elderly populations, the drug's market share remains high despite the emergence of newer therapeutic classes such as denosumab, abaloparatide, and romosozumab.

Key Geographies:

- North America: The largest market, driven by high osteoporosis prevalence, healthcare infrastructure, and reimbursement support.

- Europe: Significant penetration with robust healthcare systems supporting osteoporosis treatment.

- Asia-Pacific: Emerging market with improving healthcare infrastructure, expected to witness the fastest growth due to increasing aging populations and awareness.

Competitive Landscape

Major Players:

- Novartis Pharma (original marketer of FOSAMAX; now marketed by other entities globally).

- Teva Pharmaceuticals: Generic formulations since patent expiry.

- Mylan/Pfizer: Generic versions offer price competition.

- Ongoing Development of Alternatives: Biologics like denosumab (Prolia) and anabolic agents are gaining market share, posing competitive threats to FOSAMAX's dominance.

Patent and Regulatory Status:

FOSAMAX faced patent expiry in most markets around 2011, leading to an influx of generics, which significantly reduced pricing and expanded access. Nonetheless, branded formulations retain higher pricing power in certain markets due to brand recognition and formulary preferences.

Pricing Trends and Influences

Historical Price Trends:

In North America, originator brand prices historically ranged from USD 200–300 per month [2], whereas generic versions reduced prices by over 50% post-patent expiry. Similar trends are evident internationally, albeit with regional variations.

Factors Affecting Pricing Dynamics:

- Generic Competition: Major driver for price reductions; increased availability leads to more options and lower prices.

- Regulatory Environment: Reimbursement policies, price controls, and subsidies influence final consumer costs.

- Healthcare Provider Preferences: Prescribing patterns shifting towards newer agents with distinct advantages, impacting FOSAMAX's market share and price stability.

- Manufacturing Costs: Stable for generics, facilitating low pricing strategies.

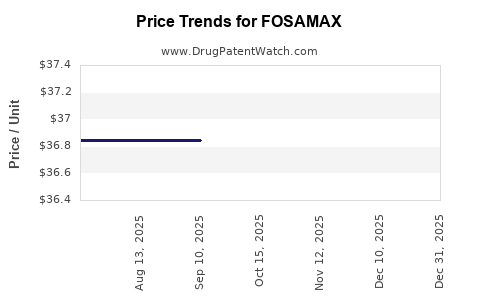

Future Price Projections (2023-2028)

Assumptions and Methodology:

Forecasts consider patent expiration timelines, generic market penetration, healthcare policy evolutions, and the competitive landscape's maturation. Analyst estimates suggest the following:

| Year |

Average Monthly Price (USD) |

Notes |

| 2023 |

USD 50–80 (generics) |

Continued generic dominance; stable prices. |

| 2024 |

USD 45–75 |

Slight decrease due to increased generic supplies. |

| 2025 |

USD 40–70 |

Integration of biosimilar and newer agents' impact. |

| 2026 |

USD 35–65 |

Further price erosion expected. |

| 2027 |

USD 30–60 |

Market saturation with generics; minimal rebounding. |

| 2028 |

USD 30–55 |

Marginal decline, stabilized by supply chain dynamics. |

Premium Pricing for Branded Formulations:

In specialized markets or regions with restrictive reimbursement policies, branded FOSAMAX formulations may retain prices closer to USD 100–150 per month, albeit with decreasing market share.

Regulatory and Market Access Considerations

Emerging regulatory trends focus on drug pricing transparency, cost-effectiveness analyses, and more aggressive promotion of biosimilars and generics. These measures are expected to influence FOSAMAX’s pricing trajectory:

-

Biosimilar Entry and Competition:

Although biosimilars are not applicable to small-molecule drugs like alendronate, similar effects from multiple generics will continue pressuring prices.

-

Reimbursement Policies:

Countries prioritizing cost containment, such as the UK with NHS protocols and similar models in other regions, will likely maintain low-price environments for osteoporosis drugs.

Implications for Stakeholders

Pharmaceutical Companies:

Producers of FOSAMAX and its generics should anticipate continued price erosion but can explore niche markets, differentiated formulations, or combination therapies to sustain margins.

Healthcare Payers:

Reduced prices will improve medication adherence and overall osteoporosis management, creating opportunities for formulary negotiations and cost savings.

Investors and Business Professionals:

Understanding FOSAMAX’s price trajectory offers insights into investment prospects, patent expiration impacts, and competitive positioning of alternative therapies.

Key Takeaways

- The FOSAMAX market has matured significantly, with generics dominating and exerting downward pressure on prices.

- Pricing is expected to decline steadily over the next five years, stabilizing around USD 30–55 per month in mature markets.

- Despite competition, FOSAMAX maintains a segment due to brand familiarity and clinical utility, particularly where branded formulations command premium prices.

- A shift toward newer therapies and biosimilars will further influence pricing and market share dynamics, necessitating strategic positioning for stakeholders.

- Cost-effectiveness considerations and evolving healthcare policies will continue to shape FOSAMAX’s economic landscape.

FAQs

1. How has patent expiry affected FOSAMAX’s pricing globally?

Patent expiry around 2011 led to a surge of generic versions, significantly reducing FOSAMAX prices—by over 50% in many markets—due to increased competition.

2. Are newer osteoporosis treatments replacing FOSAMAX?

Yes. Agents like denosumab and romosozumab have gained market share owing to their convenience and clinical advantages. However, FOSAMAX remains a cost-effective first-line therapy in many settings.

3. What factors could influence FOSAMAX’s price stability in the future?

Market saturation with generic competitors, regulatory price controls, and the emergence of biosimilars and alternative therapies will primarily drive price trends.

4. Will branded FOSAMAX formulations regain pricing power?

Unlikely without significant clinical differentiation or policy shifts. Branded versions are expected to maintain premium prices mainly in niche or restricted access markets.

5. How should pharmaceutical companies plan for FOSAMAX’s future market?

Focus on value-added formulations, patient adherence programs, and strategic transitions to newer therapies while optimizing cost structures and market access strategies.

References

[1] Allied Market Research. (2022). “Osteoporosis Drugs Market Outlook.”

[2] RxPriceReports. (2021). “Pricing Trends for FOSAMAX Post-Patent Expiry.”