Last updated: July 31, 2025

Introduction

ERTUGLIFLOZIN, a sodium-glucose cotransporter-2 (SGLT2) inhibitor, has gained prominence within the pharmacological landscape primarily for managing type 2 diabetes mellitus (T2DM). Developed by Merck & Co., this drug reflects a strategic expansion of SGLT2 inhibitors, a class that has redefined diabetes treatment paradigms due to added cardiovascular and renal benefits. As the market for antidiabetic therapies evolves, understanding ERTUGLIFLOZIN’s market dynamics and financial trajectory becomes critical for stakeholders, including pharmaceutical companies, investors, healthcare providers, and policymakers.

Market Landscape and Competitive Positioning

Global Diabetes burden drives the sustained demand for effective therapies. According to the International Diabetes Federation (IDF), approximately 537 million adults worldwide were living with T2DM in 2021, with projections exceeding 700 million by 2045 [1]. The increasing prevalence underscores the robust need for novel, efficacious, and safe medications such as ERTUGLIFLOZIN.

Market Competition and Differentiators:

ERTUGLIFLOZIN enters a competitive class that includes established drugs like Pfizer’s Empagliflozin and AstraZeneca’s Dapagliflozin. These drugs have already demonstrated cardiovascular and renal benefits, supported by large-scale trials (e.g., EMPA-REG OUTCOME, DAPA-CKD). ERTUGLIFLOZIN distinguishes itself through specific clinical trial data, safety profile, and regulatory approvals. The VERTIS clinical program provided substantial evidence of efficacy in glycemic control and cardiovascular safety, bolstering its competitive positioning [2].

Regulatory Milestones and Approvals:

ERTUGLIFLOZIN received FDA approval in 2017 for T2DM adjunct therapy and later expanded approvals for diabetic kidney disease (DKD) and cardiovascular indications in multiple regions. The drug’s approval for DKD, supported by the VERTIS CV trial, enhances its market scope beyond glycemic management to renal protection [3].

Market Penetration and Adoption Challenges:

Despite its benefits, ERTUGLIFLOZIN faces barriers such as existing entrenched competitors, physician familiarity, and formulary preferences. Insurance coverage, especially in the U.S., significantly influences prescribing trends, affecting sales volume.

Market Dynamics Influencing Revenue and Growth

1. Epidemiological Drivers

The consistent growth in T2DM prevalence directly correlates with increased demand for SGLT2 inhibitors. The rising impact of obesity, sedentary lifestyles, and aging populations bolsters the diabetic patient pool. Moreover, expanding indications, especially renal and cardiovascular benefits, extend the market to non-traditional patient segments.

2. Clinical Evidence and Guideline Endorsements

Guidelines from authoritative bodies like the American Diabetes Association (ADA) and European Association for the Study of Diabetes (EASD) increasingly favor SGLT2 inhibitors for patients with cardiovascular and renal comorbidities. Such endorsements elevate ERTUGLIFLOZIN’s prominence, encouraging prescriber confidence and uptake.

3. Pricing Strategies and Market Access

Price positioning remains pivotal. Merck’s strategy balances competitive pricing with value-based pricing, aligning reimbursement with clinical benefits. The drug’s cost-effectiveness, demonstrated through health economic models, influences formulary acceptance, especially when considering long-term renal and cardiovascular event reductions.

4. Research and Development Pipeline

Ongoing clinical trials assessing ERTUGLIFLOZIN’s efficacy in non-diabetic populations and combination therapies with other antidiabetics can augment market size. Positive trial outcomes could open new revenue streams, while failed studies risk obsolescence.

5. Geographic Expansion

While North America stands as a primary revenue hub, expansion into European countries, Asia-Pacific, and emerging markets offers significant growth potential. Regulatory approvals and local healthcare infrastructure development affect time-to-market and sales.

Financial Trajectory and Revenue Forecasts

Historical Performance

Since its FDA approval in 2017, ERTUGLIFLOZIN's sales have demonstrated steady growth bolstered by clinical validation and expanded indications. In 2021, Merck reported ERTUGLIFLOZIN's revenues reaching approximately $1.2 billion, accounting for a significant portion of its diabetes franchise [4].

Forecasted Growth

Industry analysts project a compound annual growth rate (CAGR) of 8-12% for ERTUGLIFLOZIN through 2028, driven by escalating global diabetes prevalence, extended indications, and competitive positioning. The renal and cardiovascular benefits are expected to be primary catalysts, with sales potentially surpassing $3 billion within this period.

Key Revenue Drivers

- Increased patient adoption due to clinical evidence support.

- Expansion into new markets and indications.

- Price adjustments and reimbursement policies favoring long-term cost savings.

- Combination therapies, which may command premium pricing.

Risks and Challenges

Despite optimistic forecasts, several risks persist: generic erosion after patent expiry, regulatory hurdles for new indications, competition, and potential safety concerns impacting market share. Additionally, the COVID-19 pandemic has indirectly affected healthcare resource allocation, delaying diagnosis and treatment initiation.

Strategic Market Opportunities & Challenges

Opportunities:

- Development of fixed-dose combination (FDC) formulations enhances patient adherence.

- Utilization of real-world evidence (RWE) to demonstrate cost savings and clinical efficacy supports value-based negotiations.

- Expansion into special populations such as patients with heart failure or non-diabetic CKD.

Challenges:

- Competitive pressure from newer drugs with superior efficacy profiles.

- Price sensitivity in emerging markets.

- Non-adherence due to side effect profiles, such as genitourinary infections.

Conclusion

ERTUGLIFLOZIN’s market dynamics reflect a confluence of clinical validation, expanding indications, and a growing global diabetic population. While facing formidable competition, strategic positioning—especially emphasizing its renal and cardiovascular benefits—is likely to sustain its revenue trajectory. Careful navigation of regulatory landscapes, reimbursement negotiations, and ongoing clinical research will be essential for maximizing its market potential.

Key Takeaways

- The global increase in T2DM prevalence underpins sustained demand for ERTUGLIFLOZIN.

- Its expanded indications for kidney and cardiovascular protection amplify revenue opportunities.

- Market share gains hinge on clinical endorsement, reimbursement policies, and competitive pricing.

- Projected revenues could more than double by 2028, contingent on successful market expansion and clinical outcomes.

- Navigating competitive challenges and maintaining innovation are critical for long-term financial success.

FAQs

1. How does ERTUGLIFLOZIN differentiate itself from other SGLT2 inhibitors?

ERTUGLIFLOZIN distinguishes itself through specific clinical trial data demonstrating efficacy and safety in diabetic kidney disease and cardiovascular protection, alongside its regulatory endorsements, positioning it as a dual-role therapy beyond glucose control.

2. What are the main regulatory hurdles facing ERTUGLIFLOZIN?

Regulatory challenges include securing approvals for new indications, demonstrating long-term safety, and navigating regional approval processes—particularly as emerging markets develop their regulatory frameworks.

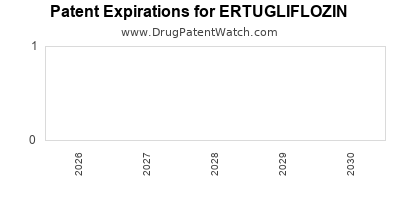

3. How might patent expirations impact ERTUGLIFLOZIN’s financial trajectory?

Patent expirations could lead to generic or biosimilar competition, potentially eroding margins and market share. Strategic timing of patent protections and pipeline expansion are vital to mitigate this risk.

4. What role does health economics play in ERTUGLIFLOZIN’s market expansion?

Health economic evaluations support reimbursement and formulary acceptance by demonstrating cost savings associated with renal and cardiovascular event reductions, thus influencing payer decisions.

5. What future clinical trials could influence ERTUGLIFLOZIN’s market outlook?

Ongoing studies assessing efficacy in non-diabetic populations, combination therapies, and long-term safety will further shape its positioning, with positive results likely to expand its market applicability.

References

- IDF Diabetes Atlas (2021). International Diabetes Federation.

- VERTIS CV Trial Data (2019). Merck & Co.

- FDA Approvals & Labeling (2017-2022). U.S. Food and Drug Administration.

- Merck Annual Report 2021. Merck & Co.