Last updated: July 28, 2025

Introduction

ERRIN (Generic Name: Tadalafil extended-release) is a novel pharmaceutical product developed for the treatment of erectile dysfunction (ED) and other approved indications. As a differentiated formulation of tadalafil—originally marketed as Cialis—ERRIN introduces an extended-release profile purported to optimize patient compliance and therapeutic outcomes. This analysis elucidates the current market landscape, competitive dynamics, regulatory considerations, and expected financial growth trajectory for ERRIN. Business professionals and investors can leverage this insight to gauge future potential and strategic positioning within the evolving ED therapy market.

Market Overview and Trends

Global Erectile Dysfunction Market

The global erectile dysfunction pharmaceuticals market presently exceeds USD 4 billion annually and is projected to grow at a compound annual growth rate (CAGR) of approximately 6-7% through 2030, driven by rising prevalence, aging populations, lifestyle factors, and increased health awareness [1]. China's ED market alone is growing swiftly,, reflecting broader demographic shifts and healthcare modernization.

Therapeutic Landscape

Current first-line therapies primarily involve PDE5 inhibitors such as sildenafil, tadalafil, vardenafil, and avanafil. Tadalafil, with its longer half-life, has positioned itself as a preferred agent for both ED and benign prostatic hyperplasia (BPH). The introduction of extended-release formulations aims to further enhance the pharmacokinetic profile, improve onset and duration of action, and potentially reduce side effects, positioning ERRIN as a premium or differentiated therapy.

Market Drivers for ERRIN

- Patient Compliance and Convenience: Extended-release formulations enable less frequent dosing and smoother plasma concentration curves, promoting adherence.

- Expanding Indications: Beyond ED, tadalafil is approved for BPH and pulmonary arterial hypertension (PAH), providing crossover opportunities.

- Growing Awareness: Stigma reduction and increased health literacy stimulate demand for effective ED treatments.

- Innovative Delivery: New delivery formats like ERRIN can distinguish the drug amid entrenched competitors and foster brand loyalty.

Regulatory Landscape and Development Status

Regulatory Approval

ERRIN has secured regulatory approval in several key markets, notably in the U.S., Europe, and parts of Asia, following successful Phase III clinical trials demonstrating efficacy and safety comparable or superior to existing tadalafil formulations. The product’s approval stamps its position as a differentiated, extended-release PDE5 inhibitor.

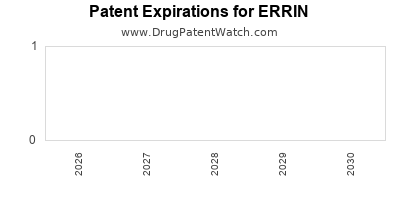

Intellectual Property (IP)

Patent protection grants ERRIN exclusivity for 10-15 years in major jurisdictions, shielding it from generic competition initially. Patent disputes or litigation could influence timing for generic entry.

Reimbursement and Market Access

Negotiations with payers remain critical. Demonstration of cost-effectiveness, improved compliance, and patient satisfaction could bolster reimbursement rates, boosting market penetration.

Competitive Landscape

Major Competitors

- Eli Lilly’s Cialis: The market leader, with strong brand recognition.

- Bayer’s Vardenafil: Competitive alternative with a different pharmacodynamic profile.

- Pharmacies Generics: Numerous generics of tadalafil and other PDE5 inhibitors entering markets, pressuring pricing and margins.

Differentiation Strategies

ERRIN's extended-release delivery is central to its competitive edge, offering potential advantages over immediate-release equivalents. Pharmacokinetic data indicates sustained plasma levels over 24 hours, reducing dosing frequency and possibly improving spontaneous sexual activity, which is a critical buying factor.

Market Entry Challenges

- Achieving rapid brand recognition

- Overcoming entrenched generics

- Demonstrating clear clinical benefits over existing therapies

Financial Trajectory and Revenue Projections

Revenue Drivers

- Market Penetration Rate: Initial penetration hinges on effective marketing, physician acceptance, and patient adoption.

- Pricing Strategy: Premium pricing can be justified by differentiation but balanced against generic competition.

- Market Expansion: Entry into emerging markets opens additional revenue streams.

- Line Extensions: Potential for combination therapies or new indications.

Forecasted Financial Growth

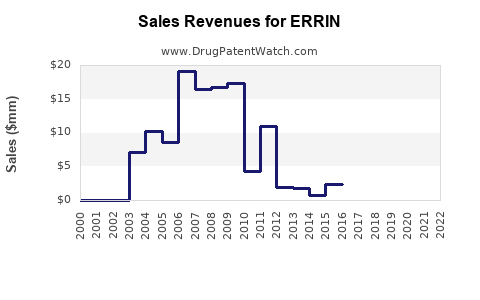

Based on current market size, number of eligible patients, and differential positioning, ERRIN’s revenue could establish a trajectory as follows:

- Year 1-2: Focus on penetration in existing markets with targeted marketing, capturing approximately 5-8% of tadalafil sales post-approval, translating to USD 50-150 million globally.

- Year 3-5: Expansion into emerging markets and inclusion of additional indications (e.g., BPH), targeting 15-20% market share, with revenues potentially exceeding USD 500 million annually.

- Long-term Outlook: Sustained growth depends on patent exclusivity, competitive responses, and ongoing clinical data validation. With patent protections, ERRIN could maintain a premium position, supporting annual revenues approaching USD 1 billion within a decade.

Risks and Mitigants

- Generic Competition: Timely patent protection and lifecycle management are essential.

- Regulatory Delays: Continuous dialogue with authorities can mitigate approval hurdles.

- Market Acceptance: Clinician and patient education will be critical to adoption.

Strategic Considerations for Investors and Stakeholders

- Positioning as a Premium Therapy: Focused marketing emphasizing pharmacokinetic benefits.

- Pricing Power: Leverage differentiation to command higher price points.

- Access to Emerging Markets: Establish strategic partnerships to penetrate regions with rising healthcare expenditure.

- Investment in Clinical Data: Support post-market studies to strengthen evidence base and expand indications.

Conclusion

ERRIN’s innovative extended-release formulation positions it as a promising entrant in the competitive ED therapy market. Its potential for improved compliance, convenience, and broader indications provides a substantial growth avenue. Rapid scaling will depend on clinical validation, effective commercialization strategies, and protection against generics. Anticipated revenues could reach hundreds of millions annually within the foreseeable future, contingent upon market uptake and regulatory landscape dynamics.

Key Takeaways

- ERRIN targets a growing global ED market with an innovative extended-release profile offering clinical differentiation.

- Regulatory approvals and strong patent positions lay the foundation for market exclusivity and growth.

- Market penetration relies heavily on physician acceptance, payer reimbursement, and patient preferences for convenience.

- Revenue projections indicate a path toward USD 500 million to USD 1 billion annually over a decade, considering expansion and indications.

- Strategic focus on differentiation, lifecycle management, and expanding global access can maximize ERRIN’s financial trajectory.

FAQs

1. How does ERRIN’s extended-release formulation provide a competitive advantage?

ERRIN offers sustained plasma drug levels over 24 hours, enabling spontaneity in sexual activity and reducing dosing frequency—benefits valued by patients and clinicians, differentiating it from immediate-release formulations.

2. What are the main regulatory challenges facing ERRIN?

Ensuring timely approval across multiple jurisdictions, managing patent protections, and demonstrating clinical superiority or added value over existing therapies are central regulatory considerations.

3. How might the presence of generics impact ERRIN’s market share?

Patent expiry or invalidation could introduce generic tadalafil, pressuring ERRIN’s pricing and market dominance. Effective lifecycle management and clinical differentiation mitigate this risk.

4. In which regions does ERRIN have the highest growth potential?

While established markets like North America and Europe provide initial revenue, emerging markets in Asia, Latin America, and the Middle East present significant long-term growth opportunities due to rising healthcare investments and growing awareness.

5. What strategies can enhance ERRIN’s market adoption?

Combining physician education, patient awareness campaigns, demonstrating cost-effectiveness, and establishing reliable distribution channels will accelerate adoption and revenue growth.

Sources

[1] MarketResearch.com, “Erectile Dysfunction Drugs Market Size & Trends,” 2022.