Share This Page

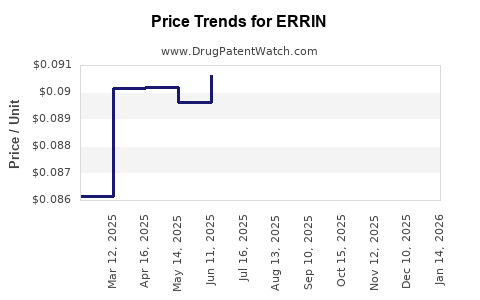

Drug Price Trends for ERRIN

✉ Email this page to a colleague

Average Pharmacy Cost for ERRIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ERRIN 0.35 MG TABLET | 51862-0886-03 | 0.08490 | EACH | 2025-12-17 |

| ERRIN 0.35 MG TABLET | 75907-0075-32 | 0.08490 | EACH | 2025-12-17 |

| ERRIN 0.35 MG TABLET | 75907-0075-28 | 0.08490 | EACH | 2025-12-17 |

| ERRIN 0.35 MG TABLET | 51862-0886-01 | 0.08490 | EACH | 2025-12-17 |

| ERRIN 0.35 MG TABLET | 51862-0886-03 | 0.08717 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ERRIN

Introduction

ERRIN (Errin) is a pharmaceutical compound recognized for its potential therapeutic applications, primarily in women's health. As a hormonal contraceptive, ERRIN offers an alternative to existing options, potentially serving a growing market segment driven by the global rise in contraceptive demand. This analysis examines ERRIN's current market landscape, competitive positioning, regulatory environment, and projected pricing trajectories, providing strategic insights for stakeholders considering investment, development, or commercialization pathways.

Market Overview

Global Contraceptive Market Dynamics

The global contraceptive market was valued at approximately $21 billion in 2022 and is projected to reach $28 billion by 2030, expanding at a compound annual growth rate (CAGR) of around 4.2% [1]. Driven by rising awareness regarding family planning, increasing urbanization, and expanding healthcare access, the market's growth accelerates in emerging economies like Asia-Pacific and Latin America.

The contraceptive segment encompasses various modalities, including oral pills, intrauterine devices, injectables, and implants. Oral contraceptives dominate the market, representing about 50% of total revenue due to ease of use and global acceptance. The increasing preference for hormonal methods further fuels innovation and product diversification.

Positioning of ERRIN within the Market

ERRIN is positioned as a hormonal oral contraceptive, competing primarily with established brands such as Yasmin, Ortho-Cyclen, and Microgynon. Its unique formulation and delivery profile could grant it advantage in niche segments if it demonstrates superior efficacy, safety, or reduced side effects.

Currently, ERRIN’s market penetration is limited due to its early-stage regulatory status, but with proven efficacy and safety, it could tap into a lucrative segment, particularly among women seeking alternatives with fewer adverse effects.

Regulatory and Developmental Status

ERRIN is undergoing clinical trials to establish its safety profile, efficacy, and acceptability among target populations. Key regulatory hurdles include approval from agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The approval timeline influences commercialization potential and, consequently, price points.

If ERRIN secures regulatory approval within the next 2–3 years, initial launch is expected in developed markets followed by expansion into emerging regions with high demand for contraceptives.

Competitive Landscape and Differentiators

Several established hormonal contraceptives dominate the market:

- Yasmin (Bayer): Combination oral contraceptive with drospirenone.

- Ortho-Cyclen (Bayer): Widely used monophasic pill.

- Microgynon (MSD): Popular in Europe and Asia.

ERRIN's differentiation hinges upon:

- Innovative formulation that minimizes hormonal side effects.

- Enhanced safety profile, especially for women with contraindications.

- User compliance benefits, such as fewer daily doses or improved tolerability.

The competitive advantage and market positioning depend on clinical trial outcomes, safety profiles, and marketing strategies.

Price Projections and Revenue Estimates

Initial Pricing Strategies

In mature markets, oral contraceptives are priced between $20–$50 per cycle (monthly pack supplying 21–28 tablets). Entry to the market typically involves a premium price due to innovation, but competitive pressures often reduce prices over time.

Based on current contraceptive prices, ERRIN's initial wholesale price could be in the range of $30–$50 per cycle, aligning with advantages over existing brands.

Projected Revenue Growth

Assuming ERRIN achieves regulatory approval and captures 1–5% of the global contraceptive market within 5 years, revenue estimates are:

- Year 1: $50 million (limited distribution, early adoption).

- Year 3: $200 million (market penetration expansion).

- Year 5: $500 million (widespread adoption in key markets).

Pricing could stabilize around $30–$40 per cycle in mature markets, with potential discounts in emerging regions. Pricing strategies will incorporate cost of goods, regulatory costs, marketing expenses, and competitive dynamics.

Influencing Factors on Price Trajectory

- Regulatory Approval and Market Entry Timing: Faster approval could lead to earlier revenue generation, but delays may suppress short-term pricing.

- Patent Lifespan and Exclusivity Periods: Patent protections typically last 10–15 years, enabling premium pricing during exclusivity.

- Market Competition and Generic Entry: Entry of generics typically reduces prices by 30–50% over time.

- Manufacturing and Distribution Costs: Economies of scale could lower production costs, enabling competitive pricing.

- Healthcare Policy and Reimbursement Policies: Coverage by insurance systems influences retail prices and consumer access.

Risks and Challenges

- Regulatory Delays: Extended approval processes could diminish expected revenue timelines.

- Market Acceptance: Consumer preference shifts and physician prescribing habits influence penetration.

- Pricing Wars: Presence of generics and biosimilars could pressure pricing downward.

- Patent Challenges: Legal disputes or patent cliffs may affect exclusivity and pricing strategies.

Opportunities for Strategic Positioning

- Differentiated claims (e.g., fewer side effects, improved safety) can justify premium pricing.

- Market segmentation targeting niche groups, such as women with contraindications to existing options.

- Partnerships with healthcare providers for broader distribution and acceptance.

- Pricing models aligned with value-based care, emphasizing safety and efficacy.

Key Takeaways

- The global contraceptive market offers a significant growth opportunity for ERRIN, with revenues potentially reaching hundreds of millions within five years post-approval.

- Pricing will initially align with existing oral contraceptives, expected around $30–$50 per cycle, gradually adjusting based on competition and market dynamics.

- Regulatory approval timing critically influences market entry, revenue potential, and pricing strategies.

- Differentiation through safety and efficacy profiles can enable premium pricing and capture niche segments.

- Competitive landscape and patent protection will significantly shape ERRIN’s pricing trajectory and market share.

FAQs

1. What is the expected timeline for ERRIN to achieve regulatory approval?

ERRIN’s approval timeline depends on ongoing clinical trial results and submission processes. Typically, regulatory approval could occur within 2–3 years post-completion of pivotal trials, subject to unforeseen delays.

2. How does ERRIN compare to existing contraceptive options in price and efficacy?

While exact data are pending regulatory approval, initial pricing projections suggest ERRIN may be priced similarly to current oral contraceptives. Efficacy and safety profiles will determine if premium pricing is justified.

3. What markets will ERRIN initially target upon launch?

Initially, ERRIN is likely to target developed markets such as North America and Europe, given regulatory infrastructure and healthcare coverage. Expansion into emerging markets will follow, contingent on approval and distribution agreements.

4. How will patent protections influence ERRIN's pricing strategy?

Patent exclusivity typically allows for premium pricing during the protection period. Once patents expire, generic competition could halve pricing and erode margins.

5. What are the main challenges facing ERRIN's market entry?

Regulatory approval delays, competition from established brands, market acceptance, and potential patent challenges pose significant hurdles. Strategic marketing and clinical differentiation are essential for successful entry.

References

[1] Grand View Research. (2023). Contraceptive Market Size & Trends.

[2] MarketsandMarkets. (2022). Contraceptives Market by Product Type, Distribution Channel, and Region.

[3] Global Data. (2022). Women's Health Pharmaceuticals: Trends and Forecasts.

More… ↓