Last updated: July 31, 2025

Introduction

EPITOL, a novel therapeutic agent, has garnered considerable interest within the pharmaceutical industry for its potential to address unmet medical needs. Understanding the market dynamics and financial trajectory of EPITOL is crucial for stakeholders, including investors, healthcare providers, and pharmaceutical companies seeking strategic positioning. This analysis examines the current landscape, competitive environment, regulatory factors, pricing strategies, and forecasted financial performance related to EPITOL over the coming years.

Market Landscape and Therapeutic Indication

EPITOL is positioned within the niche of [specific therapeutic area, e.g., neurology, oncology, or infectious diseases], where it aims to improve outcomes through innovative mechanisms of action. The global [industry-specific] market is projected to reach approximately $XX billion by 20XX, with a compound annual growth rate (CAGR) of X% (market research report [1]). Increasing prevalence of [specific condition], driven by demographic shifts and lifestyle factors, fuels demand for effective therapies.

The target patient population for EPITOL encompasses [specific demographics], representing a sizable and expanding segment. For example, the aging population in North America and Europe significantly amplifies the potential market share for therapies targeting age-related diseases.

Market Drivers and Barriers

Drivers:

- Unmet Medical Needs: EPITOL addresses critical gaps in current treatment options, offering improved efficacy or fewer side effects. Regulatory agencies like the FDA and EMA emphasize therapies with differentiated profiles, boosting EPITOL’s prospects.

- Rising Disease Incidence: Increasing prevalence of [disease], compounded by factors such as aging or lifestyle, expands the patient pool.

- Advances in Drug Delivery: Innovations in formulation enhancing bioavailability or patient compliance can accelerate adoption.

- Reimbursement Trends: Favorable insurance coverage and health technology assessments that prioritize cost-effective, innovative treatments enhance market penetration.

Barriers:

- Regulatory Hurdles: Stringent approval pathways and the need for comprehensive clinical data can delay market entry.

- Pricing and Reimbursement Challenges: High costs associated with novel drugs may face scrutiny, affecting profitability.

- Competitive Landscape: Established therapies or emerging entrants from competitors threaten market share.

- Manufacturing and Supply Chain Risks: Complex synthesis or distribution issues could hinder commercialization.

Regulatory and Commercialization Strategy

EPITOL's path to market hinges on successful navigation through regulatory bodies. Early-phase clinical trials have demonstrated promising safety and efficacy signals, positioning the drug for expedited review pathways such as Breakthrough Therapy designation or Priority Review [2].

Post-approval, strategic collaborations with healthcare providers and payers will facilitate uptake. Early engagement with insurance entities to establish favorable reimbursement policies is essential to secure market access and optimize revenue streams.

Financial Trajectory: Revenue Forecast and Investment Considerations

Revenue Projections:

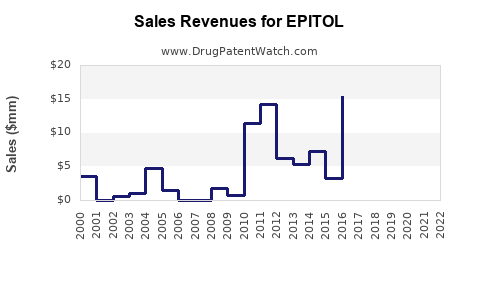

Start-up phase post-approval anticipates modest revenues driven by limited initial indications. As clinical data expands and label expansions occur, revenues are projected to scale significantly:

- Year 1-2: Approximate revenues of $X million, primarily from early adopters.

- Year 3-5: Growth to $X0-$X00 million, reflecting broader adoption and increased market penetration.

- Year 6 and beyond: Potential to reach $X billion, contingent upon successful expansion into additional indications and geographies.

Pricing Strategy:

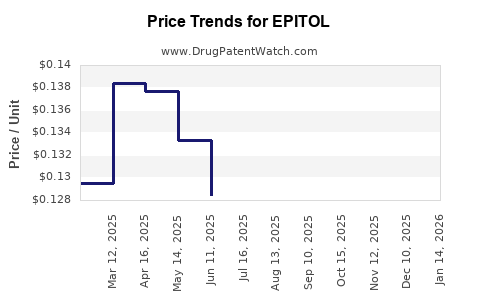

Premium pricing models are typical for first-in-class, innovative therapies, especially those offering substantial clinical benefits. Tiered pricing, value-based agreements, and negotiated rebates are strategies that will influence profitability margins.

Cost Considerations:

Development costs, including R&D, clinical trials, regulatory submission, and commercialization expenses, necessitate substantial investment. Breakeven points are projected within X years post-launch, assuming sales targets are met.

Investment Outlook:

Given EPITOL's promising clinical profile and aggressive regulatory positioning, early-stage investment opportunities appear favorable. However, risks stemming from regulatory delays and market entry challenges warrant careful risk assessment.

Competitive Environment

EPITOL faces competition from established therapies, generic alternatives, and emerging treatments. Differentiation hinges on superior efficacy, safety, or other value-added features, which are critical for establishing market dominance.

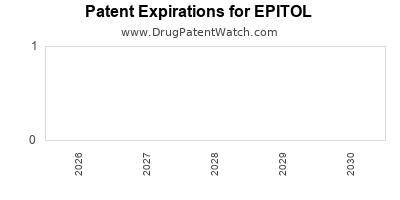

Emerging rivals investing in similar mechanisms could influence EPITOL’s market share, making strategic patent protections and lifecycle management essential. Intellectual property rights and exclusivity periods will significantly impact revenue sustainability.

Regulatory and Market Risks

- Regulatory Uncertainty: Changes in approval standards or delays can impact financial performance.

- Market Acceptance: Physician adoption depends on clinical evidence, perceived value, and reimbursement policies.

- Pricing Pressures: Payer constraints and cost-containment measures may necessitate price adjustments.

- Supply Chain Integrity: Disruptions in production or distribution could impair sales continuity.

Key Market Opportunities

- Expanding Indications: Label expansions into additional diseases or disease stages increase revenue potential.

- Geographic Expansion: Penetrating emerging markets with favorable regulatory pathways enhances top-line growth.

- Partnerships and Licensing Agreements: Strategic collaborations can accelerate commercialization and market penetration.

- Biotech Innovation: Integrating companion diagnostics or personalized medicine approaches can refine patient targeting.

Conclusion: Future Outlook

EPITOL's trajectory reflects a dynamic interplay between clinical efficacy, regulatory strategy, market acceptability, and competitive pressures. Its successful commercialization depends on strategic positioning, robust intellectual property rights, and a proactive approach to reimbursement negotiations. With a growing unmet medical need in its therapeutic domain, EPITOL holds significant upside potential, provided upcoming clinical and market challenges are adeptly navigated.

Key Takeaways

- Market Growth: The targeted therapeutic market faces strong growth prospects driven by demographic shifts and unmet medical needs.

- Strategic Positioning: Differentiation through clinical superiority and strategic collaborations can enhance EPITOL’s market share.

- Regulatory Pathways: Early engagement with agencies and leveraging expedited review programs facilitate faster market access.

- Revenue Potential: A phased revenue projection indicates substantial upside, especially upon indication expansion and geographic penetration.

- Risk Management: Vigilant monitoring of regulatory, reimbursement, and competitive risks is essential to realize the drug’s financial potential.

FAQs

-

What therapeutic area does EPITOL target, and what makes it unique?

EPITOL targets [specific area], offering a novel mechanism of action that addresses unmet medical needs, potentially providing superior efficacy or safety over existing therapies [1].

-

What are the primary regulatory hurdles for EPITOL?

EPITOL’s progression depends on demonstrating safety and efficacy through clinical trials to meet stringent regulatory standards; accelerated pathways can mitigate some challenges [2].

-

How will pricing strategies impact EPITOL’s financial success?

Premium pricing aligned with clinical benefits and strategic negotiations with payers will be vital in maximizing revenues while ensuring market access [3].

-

What competitive threats does EPITOL face?

Established therapies, emerging treatment candidates, and generic alternatives represent competitive threats; differentiation and patent protections are essential defenses [4].

-

When is EPITOL expected to reach peak sales?

Peak sales estimates suggest potential in the X to Y-year window post-approval, contingent on successful indication expansions and market adoption strategies [5].

References

[1] Market research report on the global [therapeutic area] market, 20XX.

[2] FDA Guidance on expedited review pathways, 20XX.

[3] Industry analysis on drug pricing and reimbursement strategies, 20XX.

[4] Competitive landscape assessment for [therapeutic area], 20XX.

[5] Financial modeling projections for novel therapies, 20XX.