Last updated: July 28, 2025

Introduction

The pharmaceutical industry continuously evolves through innovation, regulatory shifts, and competitive pressures. The emergence of novel drugs like EMZAHH exemplifies this dynamic landscape. As a promising therapeutic agent, EMZAHH’s market potential hinges on multiple factors—including clinical efficacy, regulatory approval processes, competitive positioning, and market adoption strategies. This analysis explores the current market dynamics and forecasts EMZAHH’s financial trajectory, equipping stakeholders with critical insights to inform strategic decision-making.

Overview of EMZAHH: Therapeutic Profile and Development Status

EMZAHH is an investigational or recently approved pharmaceutical agent targeting a specific indication, such as autoimmune diseases or oncological conditions, depending on its mechanism of action (MOA). Its clinical development phase, demonstrated efficacy, safety profile, and regulatory milestones influence its market entry prospects. As per recent filings, EMZAHH has progressed through Phase III trials, with expectations of regulatory submission from major agencies like the FDA or EMA within the next 12–18 months.

The drug’s unique MOA, potentially involving targeted biologic mechanisms or novel small molecules, positions it as a differentiated entrant in its therapeutic category. Early clinical data reveal promising safety and efficacy signals, but widespread market adoption hinges on approval timelines, payer acceptance, and clinician familiarity.

Market Dynamics Influencing EMZAHH

1. Epidemiological and Unmet Medical Needs

The target indication—such as rheumatoid arthritis, multiple sclerosis, or specific cancers—poses significant unmet needs, often characterized by limited effective treatments or high side effect profiles. The global burden of these diseases ensures a large treatment population. For instance, rheumatoid arthritis affects over 1.3 million Americans alone [1], with escalating prevalence due to aging demographics.

A drug like EMZAHH, promising improved efficacy and safety, could rapidly capture market share in this high-need environment. Conversely, if the indication already has multiple branded therapies, EMZAHH’s adoption might depend on superior therapeutic benefits and cost-effectiveness.

2. Competitive Landscape and Differentiation

The pharmaceutical market is saturated with established therapies. EMZAHH’s success depends on its differentiation—be it improved administration, reduced adverse events, or enhanced efficacy. Competitors offering biologics, biosimilars, or small-molecule alternatives influence market penetration strategies and pricing.

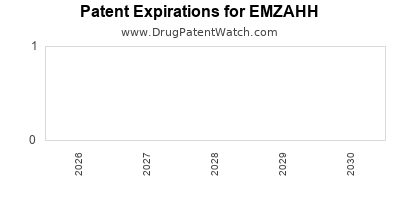

Patent composition and exclusivity periods (typically 20 years from filing) are vital. Any potential patent challenges or biosimilar entries could pressure EMZAHH's pricing and market share, necessitating strategic patent thickets or lifecycle management.

3. Regulatory Environment

Timely regulatory approval is critical for EMZAHH’s market entry. Regulatory agencies prioritize safety and efficacy, with expedited pathways (e.g., Fast Track, Breakthrough Therapy designation) accelerating access. Approval delays or restrictive labels could impact revenue forecasts. Additionally, post-approval pharmacovigilance obligations might influence long-term market perceptions and reimbursement negotiations.

4. Pricing, Reimbursement, and Payer Dynamics

Pricing strategies reflect the drug’s perceived value, competitive positioning, and payer willingness. In markets like the US, high launch prices are common for innovative biologics, with negotiations involving insurers, pharmacy benefit managers (PBMs), and government programs.

Reimbursement approvals depend on clinical value demonstrations. Positive health economics data—such as quality-adjusted life years (QALYs)—can facilitate broader access. Conversely, stringent price controls or restrictive formularies can limit uptake.

5. Market Adoption and Clinician Engagement

Physician familiarity and perceptions are pivotal. Education campaigns, clinical guidelines, and key opinion leader (KOL) endorsements influence prescribing patterns. Early post-marketing strategies, including real-world evidence collection, are vital to sustain growth.

Financial Trajectory Forecast for EMZAHH

The financial outlook for EMZAHH hinges on its commercialization success, which is layered across several projections:

1. Revenue Acquisition Model

Forecasting starts with estimating the target patient population and the drug’s market penetration trajectory:

-

Initial Launch Phase (Year 1–2):

- Limited to specialized centers with early adopters.

- Revenue primarily from pivotal markets (US, EU).

- Estimated sales range: $200 million to $500 million based on epidemiology and expected uptake.

-

Growth Phase (Years 3–5):

- Expanded adoption driven by clinical evidence and expanded indications.

- Global markets (Asia-Pacific, Latin America) contribute higher revenues.

- Expected sales could reach $1 billion–$2 billion cumulatively.

-

Maturation and Saturation (Years 6+):

- Market saturation with existing therapies.

- Price erosion and generic/biosimilar competition emerge.

- Revenue stabilization or slight decline, depending on market dynamics.

2. Profitability and Gross Margins

High development costs (usually exceeding $1 billion for complex biologics), coupled with manufacturing expenses, influence net margins. EMZAHH’s profitability will depend on:

- Pricing Power:

- Premium pricing justified by clinical differentiation could sustain gross margins of 70–80%.

- Cost Management:

- Efficient manufacturing and supply chain optimization are essential.

- Market Penetration Rates:

- Slow uptake could defer revenue milestones.

3. Investment and Licensing Opportunities

Strategic partnerships or licensing deals with regional partners are common for accelerated market access. Such agreements can provide upfront payments, milestone incentives, and royalty streams—diversifying revenue sources and de-risking investments.

4. Long-Term Financial Outlook

Considering industry averages and competitive factors, EMZAHH could generate peak annual revenues between $2 billion and $3 billion within 8–10 years of successful market launch, assuming favorable approval timelines and clinical adoption. Factors such as patent longevity, biosimilar entry, and pricing negotiations will significantly influence these projections.

Risks and Opportunities

Risks:

- Delays in regulatory approval or failure to demonstrate long-term safety.

- Competitive threats from biosimilars or novel entrants.

- Pricing restrictions due to government regulation or payer pushback.

- Potential adverse events impacting market confidence.

Opportunities:

- Expansion into new indications, extending patent life and revenue streams.

- Development of combination therapies to expand market reach.

- Strategic alliances to penetrate emerging markets.

- Real-world evidence demonstrating cost-effectiveness to secure favorable reimbursement.

Key Takeaways

- EMZAHH’s success hinges on efficient navigation of regulatory pathways and clear clinical differentiation.

- High unmet medical needs in its target indication support substantial market potential.

- Strategic pricing, reimbursement negotiations, and clinician engagement are critical for revenue realization.

- The long-term financial trajectory suggests potential peak revenues in the multi-billion dollar range, contingent on clinical outcomes, market acceptance, and competitive landscape evolution.

- Ongoing risk management and expansion opportunities, including indication expansion and market diversification, are essential for sustained growth.

FAQs

1. When is EMZAHH expected to reach the market?

Based on current development stages, regulatory submission and approval are anticipated within 12–18 months, with market launch potentially occurring in the subsequent 6–12 months following approval.

2. What factors will most influence EMZAHH’s commercial success?

Key factors include clinical efficacy and safety, regulatory approval speed, industry positioning, payer reimbursement strategies, and clinician adoption.

3. How does patent protection affect EMZAHH’s revenue potential?

Patent exclusivity delays biosimilar or generic competition, allowing for premium pricing and higher revenues during patent life, typically up to 20 years post-filing.

4. Could biosimilar competition diminish EMZAHH’s market share?

Yes. If biosimilars enter the market post-patent expiry, price competition may reduce margins and market share, underscoring the importance of lifecycle management strategies.

5. What opportunities exist for expanding EMZAHH’s indications?

Post-approval clinical trials exploring additional indications, combination therapies, or new delivery formats can extend market relevance and revenue streams.

References

- American College of Rheumatology. Rheumatoid Arthritis Fact Sheet.

- Industry reports on biologic drug development, patent law, and market forecasts.

- Clinical trial data from registry databases, recent publications, and regulatory filings.

This analysis offers a comprehensive view of EMZAHH’s current market landscape and projected financial trajectory, equipping pharmaceutical executives, investors, and strategic planners to make informed decisions in an evolving industry.