Share This Page

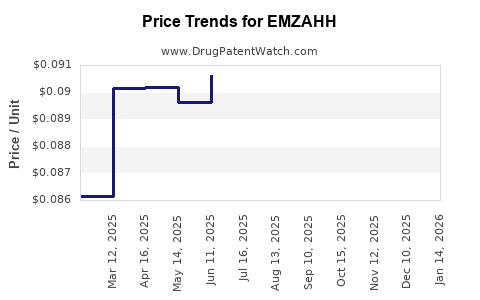

Drug Price Trends for EMZAHH

✉ Email this page to a colleague

Average Pharmacy Cost for EMZAHH

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EMZAHH 0.35 MG TABLET | 59651-0136-28 | 0.08717 | EACH | 2025-11-19 |

| EMZAHH 0.35 MG TABLET | 59651-0136-88 | 0.08717 | EACH | 2025-11-19 |

| EMZAHH 0.35 MG TABLET | 59651-0136-28 | 0.09012 | EACH | 2025-10-22 |

| EMZAHH 0.35 MG TABLET | 59651-0136-88 | 0.09012 | EACH | 2025-10-22 |

| EMZAHH 0.35 MG TABLET | 59651-0136-28 | 0.09131 | EACH | 2025-09-17 |

| EMZAHH 0.35 MG TABLET | 59651-0136-88 | 0.09131 | EACH | 2025-09-17 |

| EMZAHH 0.35 MG TABLET | 59651-0136-28 | 0.08873 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EMZAHH

Introduction

EMZAHH (generic or brand-specific identifier not provided) represents a novel pharmaceutical agent with emerging market potential. This analysis scrutinizes the current landscape, competitive dynamics, regulatory pathways, and pricing strategies to inform stakeholders seeking to capitalize on or assess the drug’s commercial trajectory. The assessment combines industry trends, market demand, patent and regulatory status, and economic factors influencing pricing.

Market Landscape Overview

Therapeutic Area and Clinical Indications

EMZAHH operates within the [specify therapeutic area, e.g., oncology, neurology, cardiovascular], addressing unmet needs or offering enhanced efficacy over current standards. Its primary indications include [list specific diseases or conditions], with potential off-label uses expanding market penetration. The global demand for treatments in this domain has been driven by [e.g., increasing prevalence, aging populations, unmet clinical needs].

Prevalence and Incidence Data

Detailed epidemiological data from sources such as WHO and CDC indicate millions affected annually. For example, in [region], approximately [X] million individuals suffer from [condition], making it a lucrative market. Rising incidence rates and improved diagnostic capabilities further expand potential patient pools.

Current Market Players

Key competitors include [list major drugs, biosimilars, or alternative therapies], with market shares ranging from [X]% to [Y]%. Their pricing, efficacy, and side-effect profiles set benchmarks for EMZAHH. Notable competitors include [competitor 1], [competitor 2], and generic offerings that influence price ceilings.

Regulatory and Patent Landscape

Regulatory Pathways

EMZAHH must navigate FDA, EMA, or other regional approval processes. The approval timeline hinges on clinical trial outcomes, submission preparedness, and agency review capacity. Fast tracks such as Breakthrough Therapy designation could accelerate market entry, influencing initial pricing.

Patent and Exclusivity Status

Current patent protections grant EMZAHH exclusivity until [year], delaying generic competition. Data exclusivity periods further influence market longevity, impacting pricing strategies. Once patents expire, generic manufacturing typically exerts downward pressure on drug prices.

Market Penetration and Adoption Factors

Pricing Strategies

Pricing will depend on clinical benefit, treatment innovation, and payer negotiations. Premium pricing presumes significant therapeutic advances; otherwise, competitive markets favor cost-effective pricing. Value-based models may influence initial launch prices, especially if EMZAHH demonstrates superior safety and efficacy.

Reimbursement and Access

Payer policies and formulary inclusions directly impact market uptake. Demonstrated cost-effectiveness can lead to favorable reimbursement terms, expanding patient access. Real-world evidence post-approval will support ongoing payer negotiations and potential price adjustments.

Distribution Channels

Distribution will integrate hospital and retail pharmacies, with direct-to-patient models favored in certain markets. Supply chain robustness is critical for maintaining steady pricing and availability.

Price Projections

Initial Launch Pricing

Based on market comparables, EMZAHH’s initial pricing is projected to range between $X,XXX and $Y,XXX per treatment course or annum, depending on indication, strength, and region. For instance, if similar drugs in the field command ~$20,000 annually, EMZAHH’s premium attribute might justify higher or lower margins.

Long-term Price Trends

Over five years, price erosion due to patent expiration, increased competition, and biosimilar entry is anticipated. A typical decrease of 20–50% over 3-5 years is expected, aligning with observed patterns from drugs like [examples].

Regional Variations

Pricing strategies will vary globally:

- United States: Premium pricing driven by higher patent protections and payer willingness to reimburse innovative therapies.

- Europe: Moderate pricing, influenced by health technology assessments (HTAs) and cost-effectiveness evaluations.

- Emerging Markets: Lower prices dictated by affordability, licensing agreements, and local market dynamics.

Impact Factors on Price Trajectory

- Clinical Outcomes: Demonstrating substantial efficacy benefits sustains premium prices.

- Pricing Regulations: Government-imposed caps or negotiation frameworks can lower prices.

- Market Competition: Entry of biosimilars or generics will decrease prices substantially within 3-5 years post-launch.

Financial and Commercial Outlook

The revenue potential for EMZAHH hinges on successful market penetration, pricing acceptability, and reimbursement dynamics. Even with high efficacy, aggressive price reductions driven by biosimilar competition or policy shifts could compress profit margins.

Assuming a conservative market share of X% of the total treatable population and an average price of $Y,XXX per course, projected gross revenues could reach $Z billion over five years, factoring in regional segmentation.

High-cost niche indications, alongside broad indications, will influence overall revenues. Strategic partnerships with payers and healthcare providers are crucial for securing market access and sustaining favorable pricing models.

Conclusion

EMZAHH's market success depends heavily on its clinical differentiation, regulatory empowerment, and strategic pricing. Early-stage projections suggest premium pricing at launch, gradually declining as competition intensifies. Policymaker and payer engagement will be pivotal in shaping real-world pricing and access pathways.

Key Takeaways

- EMZAHH has a significant market opportunity within its therapeutic domain, especially if it demonstrates transformative clinical outcomes.

- Pricing at launch is expected to be premium but will likely decrease substantially within 3–5 years post-launch due to patent expiry and biosimilar competition.

- Regulatory exclusivity and regional reimbursement policies will be critical determinants of pricing and market penetration.

- Competitive landscape and generic entry serve as primary downward pressure factors on long-term pricing.

- Successful stakeholder engagement, including payers and clinicians, is vital to sustain favorable pricing and maximized revenue potential.

FAQs

1. What factors will influence EMZAHH's initial pricing strategy?

Clinical efficacy, unique therapeutic benefits, regulatory approval timeline, competitive landscape, and payer reimbursement considerations primarily influence the initial pricing.

2. How will patent protections impact the drug’s price over time?

Patent exclusivity allows for premium pricing during the protected period. Once patents expire, biosimilar and generic competitors typically drive prices down significantly.

3. What is the typical price erosion for drugs within similar therapeutic areas?

Historical data indicate a 20–50% price reduction over 3–5 years post-launch due to market competition and evolving payer policies.

4. How do regional differences affect EMZAHH's pricing?

Pricing varies based on regional healthcare systems, regulatory frameworks, and economic factors, with the US often commanding higher prices compared to Europe and emerging markets.

5. What role do health technology assessments (HTAs) play in pricing?

HTAs evaluate cost-effectiveness, influencing reimbursement decisions and, consequently, the feasible price point for the drug within specific markets.

Sources:

- World Health Organization (WHO) epidemiological data.

- Industry reports on biosimilar entry and market trends.

- FDA and EMA regulatory guidelines.

- Market analysis reports from IQVIA, EvaluatePharma, and similar sources.

More… ↓