Last updated: July 27, 2025

Introduction

Eltrombopag olamine, marketed under the brand name Promacta and Revolade, is a synthetic, non-peptide thrombopoietin receptor agonist primarily approved for the treatment of thrombocytopenia caused by chronic immune thrombocytopenic purpura (ITP), hepatitis C-associated thrombocytopenia, and severe aplastic anemia. Since its FDA approval in 2008, eltrombopag has garnered significant attention within hematology, influencing market dynamics and shaping its financial trajectory globally. This analysis explores the key drivers, challenges, competitive landscape, and economic outlook for eltrombopag olamine over the coming years.

Market Overview and Indication Expansion

Initially approved for chronic immune thrombocytopenic purpura (ITP), eltrombopag’s therapeutic indications have expanded, fostering broader market opportunities. The drug's efficacy in stimulating platelet production offers vital benefits to patients unresponsive to traditional therapies, including corticosteroids and immunoglobulins. Subsequently, approval for hepatitis C-related thrombocytopenia in conjunction with antiviral therapy and for severe aplastic anemia (SAA) has cemented eltrombopag’s role in hematology, positioning it as a critical asset within specialty pharmaceuticals.

The global market for thrombopoietin receptor agonists, including eltrombopag and rival agents such as romiplostim, is forecasted to grow at a compound annual growth rate (CAGR) of approximately 8-10% between 2022 and 2030 (Fortune Business Insights, 2022). This trajectory aligns with increasing disease prevalence, heightened diagnostic rates, and expanding therapeutic applications.

Market Drivers

1. Growing Prevalence of Targeted Diseases

Thrombocytopenia, particularly chronic ITP, remains prevalent in developed markets, with estimates indicating a prevalence of approximately 3.3 per 100,000 adults for adult ITP (AMA, 2021). The global increase in hepatitis C infections, despite declining incidences in some regions, sustains demand for adjunct therapies such as eltrombopag. Moreover, severe aplastic anemia’s rising recognition among hematological disorders in both pediatric and adult populations supports ongoing market expansion.

2. Advancements in Treatment Guidelines

Evolving clinical guidelines increasingly recognize thrombopoietin receptor agonists as first-line or second-line therapies for ITP and SAA, driven by their efficacy and manageable safety profiles. The American Society of Hematology (ASH) and European Hematology Association (EHA) endorse eltrombopag as a viable option, optimizing prescription volumes.

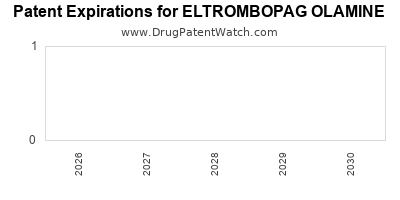

3. Competitive Position and Patent Portfolio

Eltrombopag’s patent exclusivity, notably in major markets like the U.S. and EU, offers a competitive moat. Patent protections, extended through formulations and combination therapies, are set to expire progressively over the next decade, potentially ushering in generic competition.

4. Rising Healthcare Expenditure and Improved Diagnostics

Global healthcare expenditure increases facilitate access to advanced hematology treatments. Furthermore, improved diagnostic capabilities lead to earlier detection of thrombocytopenia, augmenting treatment adoption rates.

Challenges Facing Market Growth

1. Patent Expiry and Generic Competition

The expiration of key patents poses a significant threat to eltrombopag’s market share. Emerging generics and biosimilars are expected to enter markets post-patent expiry, exerting downward pressure on prices. For instance, the U.S. patent for eltrombopag is set to expire around 2026, raising concerns about erosion of revenue streams (FDA, 2021).

2. Side Effect Profile and Safety Concerns

Eltrombopag’s adverse effects, including hepatotoxicity, thromboembolic events, and cataracts, necessitate close monitoring, potentially hindering widespread adoption. Additionally, patient-specific factors like liver impairment require dosage adjustments, complicating treatment protocols.

3. Competition from Alternative Agents

Romiplostim and avatrombopag are primary competitors. While eltrombopag’s oral administration confers convenience over injectable romiplostim, differences in efficacy, safety, and cost influence prescriber preferences.

4. Pricing and Reimbursement Challenges

Cost containment pressures and stringent reimbursement policies mediate the drug’s financial trajectory. Payers favor cost-effective alternatives, particularly once generics enter the market.

Financial Trajectory and Revenue Projections

Historical Revenue Performance

In 2021, global sales of eltrombopag approximated $700 million, with North America accounting for over 60% of revenues (EvaluatePharma, 2022). Growth during 2018-2021 was driven by increased adoption in chronic ITP and SAA, alongside expanding indications in emerging markets.

Forecasting Future Revenues

The next decade’s outlook hinges on patent expiration timelines, pipeline developments, and competitive dynamics. Analysts project:

-

Pre-Patent Expiry (2023-2026): Moderate growth, with revenues plateauing or slightly increasing owing to expanded indications and improved treatment adherence.

-

Post-Patent Expiry (2026+): Revenues are expected to decline by up to 30-50% over the subsequent 3-5 years, contingent on the entry of generic competitors and pricing strategies (IQVIA, 2022).

Potential for Market Share Retention

Pharmaceutical companies may deploy lifecycle management strategies, including formulation enhancements, combination therapies, and strategic pricing, to sustain revenues amid generic entry. Additionally, expanding into new indications—such as hematopoietic stem cell transplantation—could offset declining sales.

Emerging Markets and Access

Growth in emerging economies presents lucrative avenues. Increasing healthcare access, government reforms, and rising disease awareness are likely to boost sales, potentially balanced against price sensitivity.

Regulatory and Patent Landscape

Regulatory environments significantly influence market participation. Securing approvals in China, India, and Latin America broadens revenue streams. However, patent litigations and expiry threaten exclusivity, emphasizing the importance of strategic patent filings and litigation defenses.

Pipeline and Future Opportunities

Ongoing clinical trials evaluate eltrombopag’s utility in other thrombocytopenic and hematological conditions, including solid tumors and autoimmune disorders. Success in these areas could extend the drug’s revenue lifespan and market relevance.

Sample Pipeline Developments:

- Combination therapy trials with immunomodulators.

- New formulations targeting pediatric populations.

- Investigational uses in myelodysplastic syndromes.

The potential for on-label expansion, coupled with strategic partnerships, underscores the compound’s long-term financial prospects.

Key Takeaways

- Market growth is driven by increased disease prevalence, evolving clinical guidelines, and expanded indications, with a projected CAGR of 8-10% until 2030.

- Patent expiration from 2026 onwards signals imminent revenue erosion absent robust lifecycle management strategies.

- Competition from generics and alternative agents like romiplostim threaten market share, compelling pricing and negotiation strategies.

- Emerging markets present promising growth opportunities but require considerations around healthcare infrastructure and pricing policies.

- Pipeline pipeline portion and new indication approvals offer potential revenue extension, contingent on successful clinical outcomes.

FAQs

1. When will the patent for eltrombopag olamine expire, and what does it mean for the market?

The primary patent in the U.S. is set to expire around 2026, opening the door for generic competition which could significantly reduce revenues, prompting companies to explore lifecycle management strategies.

2. How does eltrombopag compare with rival thrombopoietin receptor agonists?

Eltrombopag’s oral administration offers convenience over injectable alternatives like romiplostim. Differences in efficacy, safety profiles, and pricing influence clinician preferences. Ongoing head-to-head studies continue to define its comparative positioning.

3. What are the main challenges facing eltrombopag’s growth?

Major hurdles include patent expiration, potential safety concerns, competitive pressure from biosimilars, and reimbursement constraints, especially in cost-sensitive regions.

4. What are potential areas of expansion for eltrombopag?

Future indications include broader autoimmune hematological disorders and possibly incorporation into combination regimens. Pediatric formulations are also under investigation.

5. How are emerging markets influencing eltrombopag’s global sales?

Growing healthcare infrastructure, increasing disease awareness, and evolving reimbursement policies in regions like Asia and Latin America are expanding access, potentially boosting sales despite price sensitivity.

References

-

Fortune Business Insights. (2022). Thrombopoietin Receptor Agonists Market Size, Share & Industry Analysis. https://www.fortunebusinessinsights.com/industry-reports/thrombopoietin-receptor-agonists-market-101212

-

American Medical Association. (2021). Hematologic Disorders Prevalence Data. AMA Journal of Ethics.

-

FDA. (2021). Patent and Exclusivity Data for Eltrombopag. https://www.fda.gov

-

EvaluatePharma. (2022). Global Oncology & Hematology Therapeutics Market Report.

-

IQVIA. (2022). Pharmaceutical Market Forecast Database.

In conclusion, eltrombopag olamine stands at a pivotal juncture within the hematology therapeutic landscape. Its sustained market presence depends on strategic lifecycle management, pipeline success, and adaptability to competitive and regulatory shifts. Businesses must navigate patent timelines, explore emerging indications, and capitalize on expanding markets to optimize financial outcomes.