Last updated: July 27, 2025

Introduction

EDEX, commercially known as Edex, is a pharmaceutical injection formulation of Alprostadil—used primarily in the treatment of erectile dysfunction (ED) and certain circulatory conditions. As a pivotal player within the urological and cardiovascular therapeutic domains, EDEX’s market trajectory is influenced by a confluence of regulatory, clinical, economic, and competitive factors. This analysis dissects EDEX’s current market landscape, emerging trends, and forecasted financial performance, providing insights vital for industry stakeholders.

Regulatory Landscape & Market Approvals

EDEX has historically secured approval from major regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), underpinning its clinical credibility and market access. However, evolving regulatory requirements and the emergence of biosimilar and alternative therapies influence its market boundaries. The ongoing approval processes in emerging markets—such as Asia-Pacific and Latin America—present growth opportunities, contingent upon local health policy and reimbursement frameworks. Notably, the positive clinical outcomes supporting EDEX’s efficacy and safety profiles reinforce its regulatory stance and market sustainability.

Market Drivers

Clinical Demand and Therapeutic Necessity

EDEX remains a critical treatment modality for erectile dysfunction, particularly in cases involving penile vascular insufficiency, post-surgical ED, or cavernous nerve injury—scenarios where oral phosphodiesterase type 5 inhibitors (e.g., sildenafil) are ineffective. Its direct injection mechanism allows localized delivery, providing rapid and reliable responses, crucial in both inpatient and outpatient settings.

Aging Population and Prevalence of ED

The global demographic shift towards an aging population augments the demand for ED therapies. According to the International Society for Sexual Medicine, ED prevalence among men aged 40-70 approaches 52%, underscoring significant market potential. This trend is especially pronounced in developed markets with higher healthcare access, boosting demand for injectable treatments like EDEX.

Physician and Patient Acceptance

Despite the advent of oral medications, EDEX retains clinical relevance due to its efficacy in complex ED cases. Physician familiarity and patient preference for rapid-onset, localized treatments bolster continued utilization. Moreover, an increasing focus on personalized medicine enhances the utility of injectable therapies.

Reimbursement Policies

Insurance coverage and reimbursement policies play a pivotal role. Countries with comprehensive health coverage facilitate broader access, supporting steady revenue streams. Conversely, high out-of-pocket costs or restrictive coverage can impede adoption, especially for a relatively invasive treatment like EDEX.

Market Challenges

Competition from Oral and Alternative Therapies

The widespread adoption of oral phosphodiesterase inhibitors (sildenafil, tadalafil, vardenafil) remains a formidable market barrier for injectable therapies. These orally administered drugs offer ease of use, improving patient adherence; thus, EDEX is often reserved for refractory cases or contraindications to oral agents.

Emergence of Gene and Stem Cell Therapies

Innovative regenerative approaches targeting underlying ED pathology threaten to disrupt current pharmacotherapy paradigms. Advances in gene therapy, nanotechnology, and stem cell treatments could diminish the market share of traditional drugs like EDEX in the coming decade.

Manufacturing and Supply Chain Considerations

Injectable formulations require stringent manufacturing standards, cold chain management, and training for proper administration. Disruptions or costs associated with these logistics can impact profitability and market stability.

Financial Trajectory and Market Forecasts

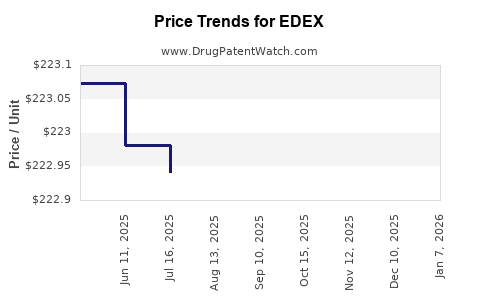

Historical Financial Performance

EDEX’s revenue performance has historically been stable within niche markets owing to its unique clinical niche and established user base. However, revenue growth has plateaued in mature markets due to saturation and competitive pressures.

Projected Growth Outlook

According to market research forecasts, the global erectile dysfunction therapeutics market, valued at approximately $3.5 billion in 2022, is expected to grow at a CAGR of 7-9% through 2030, driven predominantly by emerging markets and expanding indications [1].

Specifically, EDEX’s segment within this niche could experience modest growth of 3-5% CAGR over the next five years, assuming steady adoption in non-responsive patient populations and expanding clinical indications.

Emerging Markets and Penetration Strategies

The most significant financial growth opportunity is in emerging markets where healthcare infrastructure is improving. Companies investing in localized manufacturing, tailored pricing, and reimbursement negotiations can access these high-growth regions, potentially doubling current revenues within a decade.

Pipeline and Innovation Impact

While EDEX is a mature product, its market outlook benefits from incremental innovations—such as improved formulations, novel delivery devices, and combination therapies—that can extend product lifecycle and expand indications.

Competitive Landscape

EDEX faces competition from:

- Oral PDE5 inhibitors (sildenafil, tadalafil): dominate ED treatment due to convenience.

- Other injectable agents: such as intracavernosal vasoactive drugs like papaverine and phentolamine.

- Emerging regenerative techniques: gene therapy, stem cells, and shockwave therapy.

Market share retention will depend greatly on clinical efficacy, safety profile, physician preference, and patient compliance.

Implications for Stakeholders

- Pharmaceutical Companies: Need to innovate delivery mechanisms and expand indications to sustain growth.

- Healthcare Providers: Adoption hinges on demonstrating long-term efficacy and safety, with consideration for patient preferences.

- Investors: Must monitor regulatory developments, competitors’ innovations, and emerging market opportunities to evaluate EDEX’s financial prospects accurately.

Key Takeaways

- The EDEX market demonstrates stability driven by niche clinical applications and demographic trends but faces stiff competition from oral therapies.

- Growth prospects are strongest in emerging markets, where healthcare access is expanding, and the aging population increases disease prevalence.

- Innovation in device delivery, formulations, and expanding clinical indications will be critical to prolonging EDEX’s market lifespan.

- The infusion of regenerative medicine offers a disruptive potential, necessitating strategic adaptation.

- Strengthening reimbursement pathways and physician education remain crucial to expanding usage and improving financial performance.

FAQs

1. What are the main therapeutic uses of EDEX (Alprostadil Injection)?

EDEX is primarily used to treat erectile dysfunction refractory to oral medications and in certain circulatory conditions, such as peripheral arterial disease and angina pectoris, via vasodilation through direct injection.

2. How does the market competition affect EDEX’s sales?

The dominance of oral PDE5 inhibitors limits the expansion of EDEX’s market share, as ease of use favors oral medications. Injectable therapies like EDEX are reserved for specific cases, constraining sales volume but maintaining a critical niche.

3. What emerging therapies could disrupt EDEX’s market?

Gene therapy, stem cell treatments, low-intensity shockwave therapy, and regenerative approaches pose potential threats by offering more durable or non-invasive solutions for ED, potentially reducing reliance on pharmacologic injections.

4. Which markets offer the highest growth potential for EDEX?

Emerging markets with expanding healthcare infrastructure, increasing aging populations, and growing awareness of ED treatments—such as China, India, Brazil, and Southeast Asian countries—present significant growth opportunities.

5. What strategies can extend EDEX’s market viability?

Innovating delivery systems, expanding indications (e.g., pediatric or circulatory conditions), engaging in strategic partnerships, improving manufacturing efficiencies, and advocating reimbursement facilitation can extend EDEX’s market presence.

References

[1] MarketResearch.com. (2022). Global Erectile Dysfunction Therapeutics Market Forecast.

[2] International Society for Sexual Medicine. (2021). Epidemiology of Erectile Dysfunction.

[3] Pharma Intelligence. (2023). Injectable Therapies in Urology and Cardiovascular Markets.