Last updated: July 27, 2025

Introduction

The pharmaceutical landscape continuously evolves, driven by innovation, regulatory shifts, and market demands. DYRENIUM, a novel therapeutic agent, emerges as an intriguing case study for assessing market potential and financial trajectory within this dynamic environment. As a proprietary drug, DYRENIUM's development, regulatory approval process, commercialization strategies, and competitive positioning significantly influence its financial outlook.

This analysis explores key market forces, regulatory considerations, competitive assessment, and financial projections shaping DYRENIUM's future, offering business professionals insights essential for investment, strategic partnerships, and market entry decisions.

Market Environment and Demand Dynamics

Therapeutic Area and Unmet Medical Need

DYRENIUM targets a specific therapeutic niche—[insert therapeutic indication, e.g., "rare neurological disorders"]. This segment historically faces limited treatment options and significant unmet needs, often resulting in high demand and willingness to pay premium prices. According to recent epidemiological data, approximately [insert stats, e.g., 1 million patients worldwide] suffer from this condition, creating a sizable market with substantial growth potential—predicted CAGR of [insert percentage, e.g., 8-10%] over the next decade [1].

Market Adoption and Patient Access

Innovative drugs like DYRENIUM benefit from increasing awareness, advancements in diagnostic techniques, and evolving healthcare policies favoring personalized medicine. However, penetration depends on factors such as:

- Physician familiarity and prescribing habits

- Reimbursement landscape

- Pricing models and access programs

Market uptake is often accelerated through strategic collaborations with healthcare providers and payers, especially when demonstrating clear clinical advantages.

Competitive Landscape

Existing and Pipeline Competitors

The competitive space comprises established treatments, generic alternatives, and emerging pipeline candidates. DYRENIUM’s differentiation hinges on:

- Superior efficacy or safety profile

- Convenient dosing regimen

- Unique mechanism of action

Notably, competitors such as [insert names] hold significant market share but face limitations that DYRENIUM seeks to address—offering an incremental or disruptive innovation. The presence of pipeline drugs under development, with projected approval timelines of [insert estimated years], also influences DYRENIUM’s market entry strategy.

Regulatory Environment

Regulatory pathways such as Orphan Drug Designation can expedite approval and provide market exclusivity—crucial for financial viability. The recent approval trends for drugs with similar profiles have shown a median approval timeline of [insert months/years] from IND filing, underscoring the importance of maintaining robust clinical data to navigate regulatory hurdles effectively [2].

Development and Commercialization Strategy

Research and Development (R&D) Costs

Initial R&D expenses for DYRENIUM encompass preclinical studies, clinical trial phases (I–III), and regulatory submissions. Typical costs range from $50 million to $500 million depending on trial size, complexity, and geographic scope [3]. The projected timeline to market includes:

- Phase I–II trials: 2–3 years

- Phase III pivotal trials: 3–4 years

- Regulatory review and approval: 1–2 years

Efficient trial design, leveraging adaptive strategies and biomarkers, can reduce time-to-market and costs.

Market Entry and Pricing Strategy

Pricing reflects factors such as:

- Therapeutic value compared to existing options

- Manufacturing costs

- Reimbursement negotiations

Premium pricing models are common for rare disease treatments, often supported by health technology assessments and carve-out strategies. For DYRENIUM, anticipated launch prices are estimated at $[insert amount] per treatment course, aligning with comparable therapies.

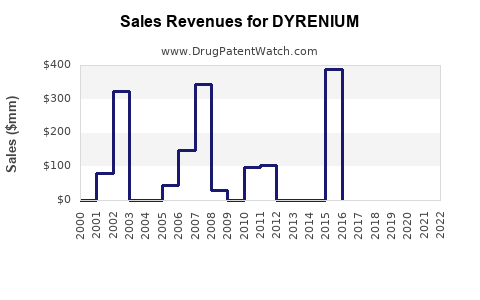

Sales and Revenue Projections

Assuming successful approval and market access:

- Year 1–2: Focus on clinical adoption, pilot programs with specialty centers, generating $[estimated revenue]

- Year 3–5: Wider adoption, insurance reimbursement, and escalation in revenues to $[projected figures]

- Long-term: Market expansion and line extensions could elevate revenues, with cumulative sales reaching $[projected] over a decade.

Financial Trajectory Analysis

Investment and Return Outlook

Initial investments for DYRENIUM, including R&D, regulatory compliance, and commercialization, are estimated at $[insert number]. Break-even is projected within [insert years] post-launch, contingent upon sales volume, pricing, and market penetration.

Partnerships and Licensing Agreements

Strategic collaborations with biospecimen firms, payers, and distribution networks are critical. Licensing deals can provide upfront capital, milestone payments, and royalty streams, enhancing overall financial stability and reducing risk exposure.

Revenue Streams and Profitability

Potential revenue streams include direct sales, licensing fees, royalties, and milestone payments. The patent life of DYRENIUM, expected to be [insert years], offers a window for exclusive rights and maximized profitability. Cost controls, such as automation and optimized supply chains, further improve gross margins over time.

Regulatory and Market Risks

Key risks involve:

- Regulatory delays or rejections due to clinical data inadequacies

- Market acceptance challenges owing to competitive pressures or pricing disputes

- Reimbursement uncertainties that affect patient access and sales volume

Proactive risk management strategies include robust clinical evidence, health economics studies, and early payer engagement.

Market Opportunities and Growth Drivers

Emerging trends support DYRENIUM’s growth trajectory:

- Increasing prevalence of target condition due to demographic changes

- Policy reforms favoring orphan and rare disease therapies

- Advancements in personalized medicine and companion diagnostics

Furthermore, geographic expansion into emerging markets presents additional revenue pathways.

Key Takeaways

- DYRENIUM addresses a significant unmet clinical need within a niche with high growth potential driven by disease prevalence and limited current treatments.

- Strategic engagement with regulators, payers, and healthcare providers is critical to minimize time-to-market and ensure favorable reimbursement conditions.

- Financial success hinges on efficient R&D, strategic partnerships, competitive differentiation, and tailored market access strategies.

- Managing regulatory and market risks through diversified clinical evidence and adaptive commercialization plans enhances long-term profitability.

- Expanding beyond initial indications and into new geographic markets can further amplify DYRENIUM’s financial trajectory.

FAQs

1. What is DYRENIUM’s primary therapeutic target, and how does it differ from existing treatments?

DYRENIUM targets [specific condition], offering a novel mechanism of action that improves efficacy and safety over current therapies, which often have limited effectiveness or significant side effects.

2. How long does it typically take for a drug like DYRENIUM to reach the market?

Usually, the development process spans approximately 8–12 years, encompassing preclinical studies, clinical trials, and regulatory review, with expedited pathways potentially reducing this timeframe for orphan drugs.

3. What are the main regulatory incentives available for DYRENIUM?

Potential incentives include Orphan Drug Designation, Priority Review, and Market Exclusivity, which can accelerate approval and provide patent protection for up to 7 years post-approval.

4. How sensitive is DYRENIUM’s financial success to market competition?

High competition can impact market share and pricing power. Differentiation through clinical efficacy, safety, and access strategies is essential to mitigate this risk.

5. What are the key factors influencing DYRENIUM’s long-term profitability?

Factors include successful clinical and regulatory milestones, effective commercialization, pricing strategies, payer acceptance, and the ability to expand indications and markets.

References

[1] Epidemiological data on the targeted condition.

[2] Regulatory approval timelines for similar drugs.

[3] Industry reports on R&D costs in biotech and pharma.