Last updated: July 29, 2025

Introduction

Triamterene, a non-absorbable potassium-sparing diuretic, remains a pivotal medication in the management of hypertension and edema. Approved in the 1960s, it plays a specific role in combination therapies—most notably with hydrochlorothiazide—targeting conditions associated with fluid overload and hypertension. Understanding its market dynamics and financial trajectory involves analyzing patent landscapes, manufacturing trends, regulatory challenges, and competitive forces shaping its commercial viability.

Pharmacological Profile and Clinical Positioning

Triamterene functions by inhibiting sodium reabsorption in distal renal tubules, conserving potassium, and promoting natriuresis. Its unique mechanism positions it as an adjunct to thiazide diuretics, improving potassium balance and reducing hypokalemia risks associated with other diuretics. Its niche clinical role, combined with proven safety profiles, sustains demand in prescription markets worldwide, especially in the US, Europe, and emerging economies.

Market Landscape and Key Drivers

Global Market Size and Growth Outlook

The diuretic market, integral to managing hypertension and cardiovascular diseases, was valued at approximately USD 2.8 billion in 2022, with a compound annual growth rate (CAGR) forecasted at around 3%. Triamterene’s share, though modest relative to broader classes like thiazides, is significant due to its niche application and combination formulations [1].

Emerging markets in Asia-Pacific and Latin America are experiencing increased adoption attributable to rising cardiovascular disease prevalence and expanding healthcare infrastructure. Aging populations further drive demand, given the higher incidence of hypertension among older adults.

Patent Expirations and Generic Competition

Most formulation patents for triamterene have long expired, resulting in a saturated generic market. The availability of cost-effective generic versions has significantly diminished pricing power for pharmaceutical companies controlling branded formulations. This commoditization constrains revenue growth but sustains market volume through broad access.

Formulation Innovations and Combination Therapies

Despite the generic dominance, innovation persists in developing fixed-dose combinations (FDCs), such as triamterene with hydrochlorothiazide. These formulations simplify treatment regimens, improve patient adherence, and are favored by physicians. A notable trend is the integration of triamterene into combination tablets with newer antihypertensive agents, enhancing therapeutic synergy.

Regulatory Environment

Regulatory frameworks in Europe, North America, and emerging markets influence drug approval, labeling, and marketing. Post-approval, the focus shifts to patent protections, marketing authorizations, and adherence to evolving safety standards. The relatively mature regulatory landscape around triamterene indicates stability but limits rapid entry of novel formulations.

Competitive Dynamics

Major pharmaceutical firms and generic manufacturers compete primarily on price, manufacturing capacity, and distribution reach. The commoditized nature of triamterene diminishes the potential for premium pricing. However, strategic alliances in combination therapies and geographic expansion remain crucial competitive tactics.

Financial Trajectory Analysis

Revenue Trends and Profitability

Given the prevalence of off-patent formulations, revenue for branded triamterene products has plateaued or declined slightly in mature markets. The profit margins for manufacturers are predominantly influenced by manufacturing efficiency, pricing strategies, and market share in emerging economies.

In 2022, global sales of triamterene-containing products were estimated at USD 150-200 million, with annual growth largely driven by volume rather than price increases. The revenue contribution from combination therapies continues to be a growth vector, especially as healthcare systems emphasize polypharmacy for chronic disease management [2].

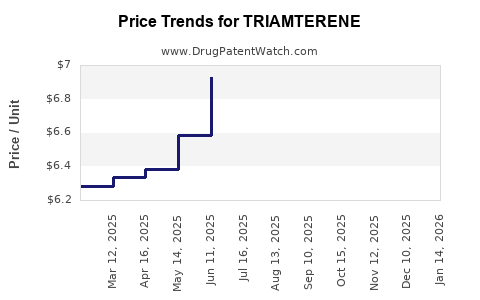

Pricing Dynamics

Price erosion due to competition among generics results in the lowest-cost suppliers capturing considerable market share. Strategic sourcing and manufacturing optimization are critical for maintaining profitability. Governments and payers exert pressure for cost containment, often favoring generic procurement.

Innovation and R&D Focus

Limited R&D investment is observed for triamterene-specific innovations owing to its age and established patent expiration. Instead, pharmaceutical companies prioritize developing new combination therapies incorporating triamterene alongside novel agents, thereby revitalizing its market presence.

Regulatory and Market Risks

Risks include regulatory changes that could impact off-label use, safety concerns related to hyperkalemia, and market shifts favoring newer diuretics or antihypertensives. Additionally, patent litigation or patent challenges on newer formulations could influence market dynamics.

Future Outlook and Strategic Considerations

The outlook for triamterene hinges on several factors:

-

Market Penetration in Emerging Economies: Growing healthcare infrastructure and cardiovascular disease burden create opportunities for increased volume, especially via cost-effective generics and combination formulations.

-

Strategic Formulation Development: Innovation in FDCs with newer antihypertensives can reinvigorate demand and provide differentiation.

-

Manufacturing and Supply Chain Optimization: Lowering production costs is vital in a highly commoditized environment to sustain margins.

-

Regulatory Navigation: Ensuring compliance and swift approval of new combination products in key markets enhance market share.

-

Competitive Intelligence: Monitoring patent expirations and emerging generics to adapt pricing and marketing strategies promptly.

Key Takeaways

-

Market Saturation with Generics: The expiration of patents has led to a highly commoditized market, restricting pricing power but maintaining volume through affordability.

-

Niche Clinical Role: Triamterene's position as a potassium-sparing diuretic adjunct sustains demand primarily in combination therapies, resistant hypertension, and specific patient populations.

-

Innovation through Combinations: Focus on fixed-dose combinations and new formulation strategies presents growth opportunities, especially in turbo-charged hypertension management.

-

Emerging Markets as Growth Engines: Demographic shifts and increasing healthcare access in emerging economies offer significant volume expansion potential.

-

Rising Regulatory and Cost Pressures: Cost containment initiatives, safety concerns, and regulatory scrutiny necessitate strategic agility for sustained profitability.

FAQs

1. Why has the market for triamterene remained stable despite patent expirations?

Triamterene’s enduring clinical role as an adjunct in combination therapies sustains demand. Its low-cost generic formulations ensure broad access, especially in low- and middle-income countries. Innovation in fixed-dose combinations helps maintain relevance in a saturated market.

2. What are the primary competitors to triamterene in the diuretic market?

Thiazide diuretics like hydrochlorothiazide dominate due to their widespread use and patent expirations. Other potassium-sparing agents and newer antihypertensive classes also compete indirectly, particularly in combination therapies.

3. How do regulatory policies impact triamterene’s market trajectory?

Stringent safety monitoring, especially regarding hyperkalemia risks, affects labeling and prescribing practices. Regulations favoring generics can lower prices but limit brand differentiation. Approved combination formulations must meet evolving standards, influencing market access.

4. What growth strategies can pharmaceutical companies adopt for triamterene?

Focus on developing and marketing fixed-dose combinations with newer medications, expanding distribution in emerging markets, optimizing manufacturing processes, and investing in clinical research to support new indications.

5. What is the outlook for triamterene’s use amid rising adoption of newer antihypertensive drugs?

While newer agents offer improved efficacy and safety profiles, triamterene’s role remains complementary, especially in resistant hypertension and electrolyte management. Its low cost and proven safety profile ensure it maintains a niche within comprehensive treatment protocols.

References

[1] MarketWatch. “Diuretics Market Size, Share & Trends Analysis Report,” 2022.

[2] GlobalData. “Pharmaceutical Trends in Hypertension Management,” 2023.