Last updated: July 27, 2025

Introduction

Doxazosin mesylate, a selective alpha-1 adrenergic receptor blocker, is primarily prescribed for the treatment of hypertension and benign prostatic hyperplasia (BPH). Since its initial approval by the U.S. Food and Drug Administration (FDA) in the late 1980s, the drug has sustained a vital presence in the cardiovascular therapeutics market. Understanding its current market dynamics and financial trajectory involves analyzing factors such as patent landscapes, competition, regulatory environment, and emerging therapeutic innovations.

Market Overview and Growth Drivers

The global cardiovascular drugs market, including antihypertensives such as doxazosin mesylate, remains robust, driven by increasing prevalence of hypertension and BPH, aging populations, and lifestyle-related risk factors. According to MarketsandMarkets, the global antihypertensive drugs market valuation was projected at USD 32.5 billion in 2022, with an expected compound annual growth rate (CAGR) of approximately 3.2% through 2027 [1]. Doxazosin mesylate benefits from this overarching growth, especially given its dual indication in hypertension and BPH.

Key Growth Drivers

-

Rising Prevalence of Hypertension and BPH: According to the World Health Organization, over 1.2 billion people worldwide suffer from hypertension, a primary indication for doxazosin mesylate [2]. Concurrently, BPH affects roughly 50% of men aged 51-60 and up to 90% of men over 80 years, emphasizing substantial patient populations.

-

Older Population Dynamics: The global demographic shift towards an aging population bolsters demand for medications like doxazosin mesylate, which are effective in managing age-related disorders.

-

Cost-Effectiveness and Generic Availability: Doxazosin mesylate’s widespread availability as a generic medication has increased affordability and accessibility, especially in emerging markets, expanding its market share.

Market Challenges and Competitive Landscape

Despite its established utility, doxazosin mesylate faces challenges in sustaining growth, including:

-

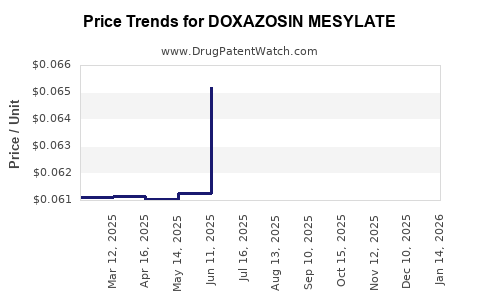

Generic Competition: Since patent expiration in the late 1990s, several generics flooded the market, exerting intense price competition. This commoditization limits revenue growth for branded manufacturers.

-

Shift Toward Targeted and Combination Therapies: Newer antihypertensives like angiotensin receptor blockers (ARBs), calcium channel blockers, and combination therapies have reduced reliance on traditional alpha-1 blockers.

-

Adverse Side Effects and Safety Profile: The potential for hypotension, dizziness, and syncope requires clinicians to carefully select therapy, given newer, more tolerable alternatives.

Competitive Market Players

Major pharmaceutical companies such as Pfizer, Teva, Mylan, and Aurobindo produce generic doxazosin mesylate, dominating the market segment. Brand-name formulations, previously led by Pfizer's Cardura, now face significant generic erosion.

Regulatory and Patent Trajectory

The original patent protection for doxazosin mesylate lapsed in the late 1990s, leading to widespread generic manufacturing. Ongoing regulatory considerations focus on biosimilar and formulation innovations:

-

Patent Litigation and Market Exclusivity: Limited patent protection prolongs exclusivity for formulations with new delivery mechanisms but provides little protection for the active ingredient alone.

-

Regulatory Approvals and Labeling: Markets such as the European Union and the U.S. maintain stringent approval pathways for new formulations or combination therapies based on doxazosin mesylate.

Emerging Therapeutic Developments

Innovations in hypertension and BPH management influence the drug's market trajectory:

-

Combination Therapy Potential: Fixed-dose combinations with other antihypertensives aim to improve patient adherence and clinical outcomes, potentially revitalizing interest in doxazosin-based regimens.

-

Novel Drug Delivery Systems: Once-weekly formulations or sustained-release mechanisms could extend product lifecycle and generate premium pricing opportunities.

-

Biomarker-Driven Precision Medicine: Advances in hypertension phenotyping may shift prescribing practices towards more targeted therapies, reducing reliance on traditional alpha-1 blockade.

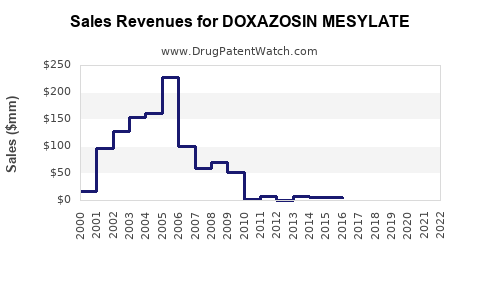

Financial Trajectory Analysis

Given the landscape, doxazosin mesylate’s revenue prospects are characterized by:

-

Stagnation in Developed Markets: Due to saturation and competitive pressures, sales growth is modest in mature regions. Pfizer’s branded Cardura, for example, experienced significant decline post-generic entry.

-

Growth in Emerging Markets: Increased access and rising disease prevalence support robust demand for affordable generics, fostering incremental revenue streams.

-

Pipeline and Lifecycle Management: Companies exploring new formulations or combining doxazosin with other agents could sustain revenues amidst generic erosion.

Forecasting Revenues

Stocks and market share analyses indicate a declining trend in branded revenues but a stable or slowly growing segment in generic sales. The net effect suggests a flattening or slight decline in overall global sales, estimated at approximately USD 500 million annually for doxazosin mesylate globally, with regional variances.

Future Outlook and Strategic Considerations

While the core market faces stagnation, strategic moves such as repositioning doxazosin mesylate in combination therapies or integrating novel delivery systems could stimulate revenue. Moreover, market expansion into low- and middle-income countries remains a viable avenue given the drug’s affordability profile.

Additionally, pharmaceutical companies may leverage lifecycle management, including new formulations or patenting delivery innovations, to extend the product’s commercial viability. However, the overarching trend continues to favor newer, targeted therapies with superior safety profiles and efficacy.

Key Takeaways

- Market saturation and generic competition limit growth prospects for doxazosin mesylate in developed markets.

- Demographic trends and disease prevalence sustain demand in emerging regions, bolstering the global revenue base.

- Innovation in formulation and combination therapies offers pathways to renewal but require significant investment and regulatory clearance.

- The drug’s financial trajectory is characterized by stagnation in revenues, with potential for incremental gains through strategic repositioning.

- Pharmaceutical stakeholders must adapt by focusing on lifecycle management and regional market expansion to maximize profitability.

FAQs

1. What factors most significantly influence the market for doxazosin mesylate?

Market growth hinges on demographic trends, disease prevalence, generic pricing pressure, and the evolution of competing therapies.

2. How does patent expiration impact doxazosin mesylate’s market profitability?

Patent expiry leads to widespread generic competition, dramatically reducing branded revenues and fostering price competition in the global market.

3. Are there upcoming innovations that could revive doxazosin mesylate’s market position?

Yes, formulations such as sustained-release versions, fixed-dose combinations, and novel delivery systems could extend lifecycle and improve patient adherence.

4. What regions present the most promising growth opportunities for doxazosin mesylate?

Emerging economies with increasing healthcare access and large hypertensive/BPH populations, notably in Asia and Latin America, offer growth potential through generic sales.

5. How are regulatory policies affecting the future of doxazosin mesylate?

Strict regulatory frameworks for new formulations and biosimilars could affect market entry and lifecycle management strategies, emphasizing innovation within regulatory bounds.

Sources

[1] MarketsandMarkets, “Antihypertensive Drugs Market,” 2022.

[2] World Health Organization, “Hypertension Fact Sheet,” 2021.