Share This Page

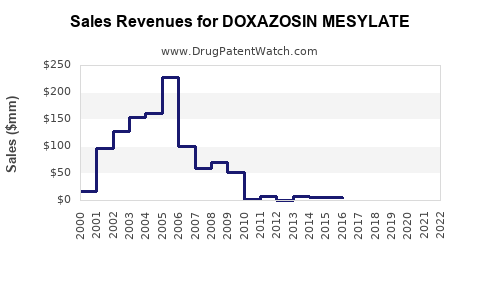

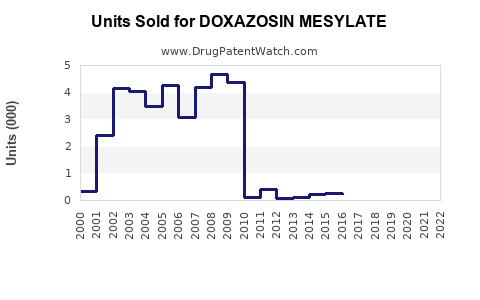

Drug Sales Trends for DOXAZOSIN MESYLATE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DOXAZOSIN MESYLATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DOXAZOSIN MESYLATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DOXAZOSIN MESYLATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DOXAZOSIN MESYLATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DOXAZOSIN MESYLATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| DOXAZOSIN MESYLATE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Doxazosin Mesylate

Introduction

Doxazosin mesylate is an alpha-1 adrenergic receptor antagonist predominantly prescribed for hypertension and benign prostatic hyperplasia (BPH). Approved by the FDA in 1986, the drug has maintained its relevance in monotherapy and combination therapy settings. Its unique pharmacological profile and evolving clinical applications position it as a noteworthy candidate for market expansion. This analysis delineates the current market landscape, assesses growth drivers, evaluates competitive dynamics, and projects future sales trajectories for doxazosin mesylate.

Market Landscape Overview

Global Market Size and Segmentation

As of 2022, the global antihypertensive drugs market was valued approximately at USD 34 billion, with alpha-blockers constituting roughly 10%—equating to USD 3.4 billion (source: MarketWatch). Doxazosin mesylate, while not the market leader, maintains a significant share within the alpha-blocker segment, primarily due to its proven efficacy and established safety profile.

Within the BPH treatment domain, alpha-blockers account for a substantial proportion of sales, with doxazosin mesylate competing alongside tamsulosin, terazosin, and alfuzosin. Its contribution to the total BPH drug market is estimated at USD 500 million globally, with North America and Europe representing the majority of revenue streams owing to higher treatment adoption rates.

Key Markets

- North America: Accounts for approximately 45-50% of sales, driven by high hypertension prevalence and comprehensive healthcare infrastructure.

- Europe: Constitutes around 30%, with widespread prescription practices aligned with clinical guidelines.

- Asia-Pacific: Rapid adoption due to increasing healthcare awareness and urbanization, though current market share remains comparatively modest but growing.

- Rest of World: Developing regions exhibit emerging opportunities, facilitated by expanding healthcare access.

Market Drivers

Increasing Prevalence of Hypertension and BPH

Hypertension affects over 1.3 billion people globally, with prevalence rising due to lifestyle changes, aging populations, and urbanization. BPH prevalence escalates with age; approximately 50% of men aged over 60 and up to 80% over 70 are affected. The aging demographic complexities amplify the demand for effective alpha-blockers like doxazosin mesylate.

Efficacy and Safety Profile

Doxazosin’s favorable tolerability profile and once-daily dosing enhance patient adherence. Its dual efficacy for hypertension and BPH offers clinicians a versatile therapeutic option, fostering increased prescription volumes.

Regulatory Approvals and Clinical Guidelines

Clinical guidelines increasingly endorse alpha-blockers as first-line therapy for BPH and as adjuncts in hypertension management. Regulatory approvals in emerging markets further catalyze sales expansion.

Generic Entry and Price Accessibility

The patent expiration of branded doxazosin products around 2005 led to a proliferation of generic versions, significantly reducing costs (~USD 1-3 per tablet) and expanding access, especially in cost-sensitive markets.

Competitive Landscape

Major Players

- Pfizer (Cardura): Historically dominant; brand recognition bolstered by extensive clinical data.

- Teva Pharmaceuticals, Mylan, and Sandoz: Major generic manufacturers contributing to price competition.

- Novel formulations: Extended-release formulations and combination therapies are emerging, potentially impacting market shares.

Competitive Strategies

- Cost leadership through generics to boost volume.

- Product differentiation via improved formulations or combination drugs.

- Marketing and education targeted at primary care providers and urologists.

Sales Projections (2023-2028)

Assumptions

- Continued growth in hypertension and BPH prevalence.

- Sustained approval and utilization across key markets.

- Moderate penetration into emerging markets following regulatory approvals.

- No significant patent barriers or regulatory setbacks.

- Competitive pressure from other alpha-blockers persists but remains manageable due to established clinician familiarity.

Projection Methodology

Using compound annual growth rate (CAGR) estimations and considering market expansion factors, the global sales of doxazosin mesylate are forecasted to grow at a CAGR of approximately 4-6% over five years.

| Year | Estimated Global Sales (USD Millions) | Notes |

|---|---|---|

| 2023 | 600 | Baseline estimate |

| 2024 | 630 - 636 | Growth driven by increased prevalence |

| 2025 | 660 - 680 | Entry into new markets |

| 2026 | 690 - 720 | Expanded formulary inclusion |

| 2027 | 720 - 760 | Product optimization and education |

| 2028 | 750 - 810 | Market saturation approaches |

Note: Variances depend on regional growth rates, pricing strategies, and evolving clinical guidelines.

Market Challenges and Opportunities

Challenges

- Intense Price Competition: Generics suppress margins.

- Brand Loyalty: Prescribers' familiarity with existing medications.

- Regulatory Dynamics: Stringent approval processes in emerging markets.

- Adverse Event Profiles: Occasional reports of orthostatic hypotension may impact acceptance.

Opportunities

- Combination therapy formulations: Doxazosin combined with other antihypertensives or BPH medications.

- Personalized medicine: Pharmacogenomics enabling targeted therapy.

- Expanding indications: Potential use in adjunctive therapy for heart failure.

- Digital health integration: Monitoring adherence and therapeutic outcomes.

Conclusion

The market for doxazosin mesylate remains robust, driven by persistent hypertension and BPH burdens, especially in aging populations. The transition to generics has democratized access but compressed profit margins, emphasizing the necessity for strategic differentiation through formulations, new indications, or combination therapies. Sales are projected to grow steadily, with a compound annual increase of approximately 4-6%, contingent upon global health trends, regulatory pathways, and competitive strategies.

Key Takeaways

- Stable Segment: Doxazosin mesylate continues to be a staple in alpha-blocker therapy, with steadied demand backed by clinical efficacy.

- Market Expansion: Emerging markets and new formulations represent significant growth avenues.

- Pricing Dynamics: Generics have lowered entry barriers, necessitating cost-competitiveness for sustained market share.

- Strategic Positioning: Emphasize combination therapies and novel formulations to differentiate products.

- Regulatory Landscape: Active engagement with regulatory agencies will be pivotal for timely market access in new regions.

FAQs

1. What are the primary indications for doxazosin mesylate?

Doxazosin mesylate is primarily prescribed for hypertension and benign prostatic hyperplasia (BPH). It can also be used adjunctively in other cardiovascular conditions.

2. How does the expiration of patent protections affect the market?

Patent expirations around the early 2000s facilitated widespread generic manufacturing, drastically reducing prices and expanding patient access, but intensifying price competition.

3. Are there emerging markets for doxazosin mesylate?

Yes. Asia-Pacific and Latin America present growing opportunities due to increasing hypertension prevalence, expanding healthcare infrastructure, and regulatory approvals.

4. What are the key challenges faced by doxazosin mesylate manufacturers?

Pricing pressures from generic competition, prescriber loyalty to established brands, regulatory hurdles, and potential side-effect concerns remain primary challenges.

5. Can doxazosin mesylate be combined with other therapies?

Yes. It is often combined with other antihypertensive agents for synergistic effects, with ongoing research into fixed-dose combination formulations to improve adherence and efficacy.

References

[1] MarketWatch. “Antihypertensive Drugs Market Size & Share Analysis.” 2022.

[2] EvaluatePharma. “Global Pharmacy & Healthcare Market Data,” 2023.

[3] U.S. Food & Drug Administration. “Doxazosin Mesylate Drug Label,” 1986.

More… ↓