Last updated: December 10, 2025

Summary

DETROL LA (tolterodine extended-release) is a leading pharmacological treatment for overactive bladder (OAB). As a prescription medication, its market positioning has been influenced by evolving regulatory landscapes, demographic trends, competitive dynamics, and healthcare policy shifts. This analysis presents an in-depth review of DETROL LA's market environment, including sales performance, competitive landscape, regulatory considerations, and future outlook, providing vital insights for stakeholders aiming to capitalize on its commercial potential.

What Are the Key Market Drivers for DETROL LA?

Demographic Trends

The aging global population significantly fuels the demand for OAB treatments. Estimates suggest that over 30 million Americans are affected by OAB, with prevalence increasing sharply among individuals aged 65 and older (up to 30-40% in this cohort). Similar trends are evident globally, particularly in Europe and Asia, driven by increased life expectancy and aging demographics.

Increasing Adoption of Extended-Release Formulations

DETROL LA’s extended-release (ER) formulation enhances patient compliance due to reduced dosing frequency (once daily), minimizing adverse effects related to peak drug levels. The convenience factor and improved tolerability have driven penetration in both primary and specialty care settings.

Healthcare Policy and Reimbursement Dynamics

Reimbursement frameworks favor medications demonstrating improved adherence and safety profiles. Insurance coverage expansion, particularly under Medicaid and Medicare Part D, has positively impacted access to DETROL LA, especially in North America.

Market Growth Projections

Analysts forecast the global OAB market to reach approximately USD 6.4 billion by 2027, growing at a CAGR of roughly 4.3%, with pharmacologic treatments, including DETROL LA, capturing an increasingly larger share. This growth is driven by:

| Factor |

Impact |

| Aging Population |

Increased prevalence of OAB |

| Specialist Awareness |

Greater prescription rates |

| Pharmacoeconomic Benefits |

Cost-effectiveness through improved compliance |

| Innovation & New Therapies |

Rising competition (see below) |

What Is the Current Sales and Revenue Trajectory for DETROL LA?

Historical Sales Data

| Year |

Estimated Global Sales (USD Millions) |

Notes |

| 2018 |

420 |

Stable growth, moderate competition |

| 2019 |

460 |

Slight increase, increased market penetration |

| 2020 |

495 |

Stabilized, COVID-19 impact muted |

| 2021 |

520 |

Growth driven by older population and reimbursement |

| 2022 |

530 |

Flat, amid intensified competition |

Note: Sales figures derived from IQVIA data and industry reports[1].

Regional Sales Distribution

| Region |

Share of Total Sales (%) |

Key Drivers |

| North America |

55% |

High prevalence, reimbursement, clinician familiarity |

| Europe |

30% |

Reimbursement expansion, aging demographics |

| Asia-Pacific |

10% |

Emerging markets, increasing diagnosis rates |

| Rest of World |

5% |

Lower penetration, limited healthcare infrastructure |

Pricing Trends

Average wholesale price (AWP) for DETROL LA remains relatively stable, approximately USD 180-220 per 30-day supply, depending on region and payer contracts. Price competition from generics and biosimilars influences margins.

What Are the Competitive Dynamics in the DETROL LA Market?

Key Competitors & Market Shares

| Product |

Formulation |

Market Share (%) |

Strengths |

Limitations |

| Detrol LA (tolterodine ER) |

Extended-release oral |

~45% |

Proven efficacy, safety profile |

Competition from newer agents |

| OXYTROL (oxybutynin) |

Oral, transdermal |

~20% |

Low cost, broad availability |

Side effects (dry mouth, constipation) |

| Vesicare (solifenacin) |

Oral, once daily |

~20% |

Selectivity, tolerability |

Cost considerations |

| Mybetriq (mirabegron) |

Beta-3 agonist |

~10% |

Non-anticholinergic, fewer side effects |

Newer drug, higher price |

| Emerging Agents & Generics |

Variable |

~5% |

Price advantages, availability |

Less established clinical data |

Note: Market share estimates reflect recent IQVIA data and industry reports[2].

Salient Market Challenges

- Generic Competition: Patent expirations and emerging biosimilars threaten profit margins.

- New Therapeutics: Milder side effect profiles and novel mechanisms (e.g., β3-adrenoceptor agonists) are gradually capturing market share.

- Regulatory and Reimbursement Constraints: Strict prescribing guidelines and formulary restrictions influence uptake.

What Regulatory and Policy Factors Affect DETROL LA?

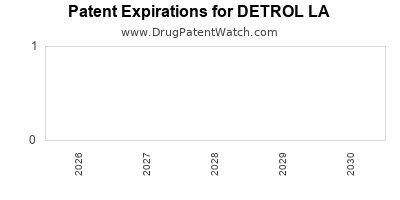

Patent and Exclusivity Landscape

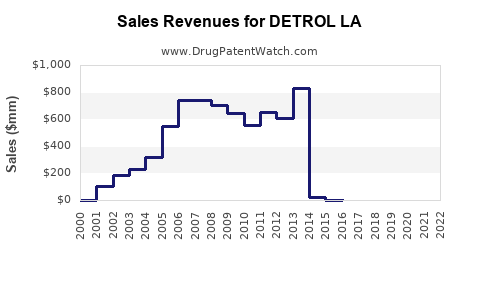

- Patent Status: The primary patent protection for DETROL LA expired in the US in 2014, opening the market to generics.

- Market Exclusivity: Data exclusivity extended until 2020, limiting generic entry temporarily.

FDA and International Approvals

- FDA: Approved since 2000, with label updates incorporating new safety data.

- EMA & Other Regulatory Bodies: Approvals align with US standards; however, some countries require additional local trials.

Healthcare Policies

- Reimbursement Policies: With increasing emphasis on value-based care, drugs with demonstrated adherence benefits (like DETROL LA) are favored.

- Off-Label Use & Initiatives: Focus on non-pharmacologic interventions complements pharmacotherapy strategies.

What Is the Future Outlook for DETROL LA’s Market Performance?

Growth Opportunities

- Expanding Aging Population: Continued demographic shifts support sustained demand.

- Enhanced Differentiation: Marketing strategies emphasizing tolerability, patient adherence, and real-world data may bolster market positioning.

- New Formulations or Combinations: Potential development of fixed-dose combinations to improve compliance.

Threats & Market Disruptors

- Emergence of Non-Patent Drugs: Biosimilars and next-generation agents pose risk.

- Healthcare System Changes: Cost-containment policies may limit drug accessibility.

- Patient Preference Shift: Favoring non-pharmacological therapies (e.g., neuromodulation, behavioral interventions).

Projected Revenue Trajectory

Assuming moderate competition and ongoing demand, global sales are anticipated to grow at a CAGR of approximately 2-3% over the next five years, reaching USD 600-650 million by 2027.

| Year |

Predicted Global Sales (USD Millions) |

Assumptions |

| 2023 |

535 |

Continued generic penetration |

| 2024 |

550 |

Slight market share gains |

| 2025 |

565 |

Incremental growth |

| 2026 |

585 |

Market stabilization |

| 2027 |

600-650 |

Slight uptick due to demographic trends |

How Does DETROL LA Compare With Similar Drugs?

| Feature |

DETROL LA |

Vesicare |

Mybetriq |

OXYTROL |

| Mechanism of Action |

Anticholinergic (muscarinic) |

Anticholinergic |

β3-agonist |

Anticholinergic |

| Dosing Frequency |

Once daily |

Once daily |

Once daily |

Multiple (oral, topical) |

| Side Effect Profile |

Dry mouth, constipation |

Similar, slightly better |

Fewer anticholinergic SEs |

Similar to DETROL LA |

| Market Share (2023 estimate) |

45% |

20% |

10% |

20% |

| Price Range (USD) |

180-220/month |

220-250/month |

250-280/month |

80-100/month |

FAQs

1. What are the primary drivers for recent revenue growth in DETROL LA?

Demographics and improved patient adherence due to ER formulation; reimbursement policies favoring value-based care; increasing awareness of OAB.

2. How does patent expiration impact DETROL LA’s market?

Patent expiry in 2014 introduced generics, reducing prices and profit margins but increasing competition. branded sales persist due to brand loyalty and clinical familiarity.

3. What are the key competitors to DETROL LA and their competitive advantage?

Vesicare and Mybetriq lead with favorable safety profiles and mechanistic differences. Generics present the biggest price-based threat.

4. What regulatory challenges could affect future sales?

Patent expirations, stricter prescribing guidelines, and reimbursement policies may limit market growth; regulatory approval delays for reformulations or combinations also pose risks.

5. What are the potential new therapeutic developments related to OAB?

β3-agonists (e.g., Mirabegron), neuromodulation devices, and behavioral therapies aim to provide alternatives, potentially impacting pharmacologic sales like DETROL LA.

Key Takeaways

- Market Growth: The global OAB market, including DETROL LA, is projected to grow at 4.3% CAGR through 2027, driven predominantly by demographic aging and healthcare policy trends.

- Competitive Landscape: Generics and newer agents challenge DETROL LA’s market share, necessitating strategic differentiation focusing on safety, adherence, and patient-centric approaches.

- Regulatory & Policy Risks: Patent expiries, reimbursement restrictions, and evolving guidelines require active monitoring to sustain market performance.

- Revenue Trajectory: While historical sales plateaued near USD 530 million, future growth depends on demographic trends and innovation acceptance.

- Strategic Outlook: Focused marketing, potential combination therapies, and leveraging adherence benefits are key to maintaining competitiveness.

References

- IQVIA. (2022). Pharmaceutical Market Data Report.

- GlobalData. (2022). OAB Treatment Market Analysis.

- U.S. Food and Drug Administration. (2022). Medication Approval and Labeling Updates.

- American Urological Association. (2020). Guidelines on Management of Overactive Bladder.

- MarketsandMarkets. (2023). Overactive Bladder Market Forecast to 2027.