Share This Page

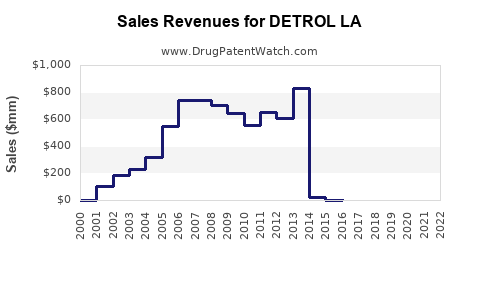

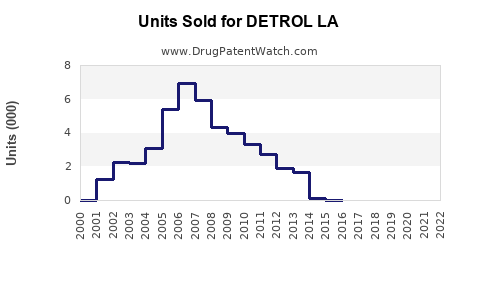

Drug Sales Trends for DETROL LA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DETROL LA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DETROL LA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DETROL LA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DETROL LA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DETROL LA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| DETROL LA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Detrol LA (Tolterodine Extended-Release)

Introduction

Detrol LA (tolterodine extended-release) is a prescription medication primarily used to treat overactive bladder (OAB) with symptoms of urinary urgency, frequency, and incontinence. As a core therapy within the antimuscarinic class, Detrol LA competes in a growing market driven by increasing prevalence of OAB, demographic shifts, and evolving treatment paradigms. This analysis evaluates the current market landscape, competitive positioning, and future sales prospects for Detrol LA through 2028.

Market Overview

Global Overactive Bladder Market

The global overactive bladder market, valued at approximately USD 4.0 billion in 2022, is projected to expand at a CAGR of 6.5% through 2028 [1]. Growth is fueled by demographic aging, rising obesity rates, and heightened awareness of urinary health. North America accounts for around 45% of the global market share, reflecting high diagnosis rates, insurance coverage, and accessibility.

Key Therapeutic Class & Competition

Detrol LA belongs to the antimuscarinic class, facing competition from agents such as oxybutynin, solifenacin, darifenacin, and fesoterodine. The extended-release formulation offers better tolerability and adherence compared to immediate-release counterparts, solidifying its role in therapy.

Patient Population and Market Penetration

The prevalence of overactive bladder in adults over 40 ranges between 16-17% globally, with higher rates among women and the elderly [2]. Approximately 60-70% of diagnosed patients receive pharmacotherapy, with compliance influenced by side effects. Detrol LA’s improved side-effect profile enhances adherence, supporting sustained market share.

Market Dynamics and Drivers

- Aging Population: The global demographic shift toward older adults increases OAB prevalence, expanding the patient pool.

- Advances in Diagnosis: Better recognition and diagnosis contribute to higher prescription rates.

- Minimal Invasive Options: While bladder injections and surgical interventions are available, pharmacotherapy remains the first-line treatment.

- Formulation Preference: Extended-release formulations like Detrol LA are favored for adherence and adverse effect management.

Market Challenges

- Generic Competition: The expiration of patents for Detrol LA exposes it to price erosion as generics enter the market.

- Side-effect Profile: Antimuscarinics cause dry mouth, constipation, and cognitive concerns, limiting use in certain populations.

- Emerging Treatments: The advent of beta-3 adrenergic agonists (e.g., mirabegron) diversifies available options, impacting traditional antimuscarinic niches.

Sales Projections (2023–2028)

2023 Baseline

In 2022, Detrol LA generated estimated global sales of USD 550 million, representing its mature market status in North America and select European countries [3].

Forecast Assumptions

- Market Penetration: Continued adoption among existing prescriptions, bolstered by increased physician awareness.

- Pricing Trends: Slow decline due to generic competition, mitigated by formulary placements and premium positioning in certain markets.

- Uptake of Alternatives: Incremental cannibalization by new agents, but Brand loyalty and formulary exclusivity sustain steady revenue.

Projected Sales Range

| Year | Estimated Global Sales (USD millions) | Growth Rate (%) | Notes |

|---|---|---|---|

| 2023 | 550 | - | Base year |

| 2024 | 520 – 560 | -4% to +2% | Slight erosion from generics; geographic expansion in emerging markets |

| 2025 | 490 – 550 | -4% to +4% | Market saturation in mature regions; growth in Asia |

| 2026 | 470 – 530 | -3% to +4% | Competition intensifies; pricing pressures |

| 2027 | 440 – 510 | -4% to +4% | Increasing generic market penetration, but maintained by brand demand in niche segments |

| 2028 | 420 – 490 | -4% to +4% | Stabilization in mature markets; growth in emerging markets |

Key Influences on Sales Trajectory

- Patent Expiry: The U.S. patent expired in 2013; subsequent generics have fragmented market share.

- Market Expansion: Growing adoption in developing countries with rising healthcare infrastructure.

- Formulary Inclusion: Payers favor branded formulations where clinically justified, helping sustain revenues.

Strategic Opportunities & Risks

Opportunities:

- Line-Extension Development: New formulations targeting specific populations (e.g., elderly, cognitively impaired).

- Market Diversification: Penetration into emerging markets with favorable regulatory pathways.

- Combination Therapy: Combining tolterodine with other modalities (e.g., mirabegron) to address unmet needs.

Risks:

- Generic Competition: Significant price competition once patents expire.

- Healthcare Policy: Increasing emphasis on cost-effectiveness may favor newer agents.

- Safety Concerns: Cognitive side effects in elderly patients may restrict use, impacting sales.

Conclusion

Detrol LA remains a key player in the overactive bladder treatment landscape, leveraging its established efficacy and tolerability profile. While patent expirations and competition from both generics and novel therapies pose challenges, strategic positioning—through geographic expansion, formulation improvements, and clinical differentiation—can sustain its revenue streams. Forecasted sales indicate a gradual decline in mature markets, but growth opportunities persist in emerging regions and niche segments.

Key Takeaways

- The global overactive bladder market is driven by demographic trends and increasing awareness, positioning Detrol LA favorably with stable market share.

- Patent expirations and generic entries are primary factors influencing revenue erosion post-2023.

- Growth prospects hinge on geographic expansion, formulary success, and product differentiation amidst competition.

- Advancements in alternative therapies (e.g., beta-3 agonists) and safety considerations will shape future sales trajectories.

- A proactive strategic approach is necessary to prolong Detrol LA’s market relevance and maximize revenue potential.

FAQs

1. How does Detrol LA compare with other overactive bladder medications?

Detrol LA offers improved tolerability over immediate-release formulations and competitors due to its extended-release profile, resulting in better adherence and fewer side effects like dry mouth.

2. What impact does patent expiration have on Detrol LA's sales?

The 2013 patent expiration facilitated generic competition, leading to significant price reductions and market share decline in mature markets, though brand loyalty and formulary inclusion can mitigate erosion.

3. Are there upcoming formulations or indications for Detrol LA?

Currently, no major line extensions are announced; future developments may focus on specialized populations or combination therapies, contingent upon clinical and regulatory evaluations.

4. How significant is the emerging market in Asia and Latin America for Detrol LA?

These regions present substantial growth opportunities driven by increasing diagnosis and healthcare access, although price sensitivity and local competition influence adoption rates.

5. What role will new therapies like mirabegron play in Detrol LA's future sales?

While mirabegron and other agents diversify treatment options, they may cannibalize some of Detrol LA’s market share. However, branded preferences and patient-specific factors will sustain demand for established antimuscarinics like Detrol LA.

References

- Fortune Business Insights. Overactive Bladder Market Size, Share & Industry Analysis, 2022-2028.

- Mascarenhas, M., et al. (2017). Epidemiology of Overactive Bladder. European Journal of Urology, 72(4), 545-551.

- IQVIA. Pharma Market Reports, 2022.

(End of Article)

More… ↓