Last updated: July 28, 2025

Introduction

Desloratadine, a selective peripheral inverse agonist of peripheral H₁ receptors, is a second-generation antihistamine predominantly prescribed for allergic rhinitis and chronic idiopathic urticaria. Since its initial approval in the early 2000s, desloratadine has established itself as a leading antihistaminic agent globally, owing to its favorable safety profile and minimal sedative effects. This article examines the evolving market dynamics and financial outlook for desloratadine, analyzing key drivers, challenges, and emerging opportunities influencing its trajectory.

Global Market Overview

The global antihistamine market, valued at approximately USD 3.4 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 4.2% through 2030, driven primarily by increasing prevalence of allergic disorders and expanding healthcare access in emerging markets [1]. Desloratadine's dominant position within the second-generation antihistamines has contributed significantly to this growth.

Regional markets display divergent dynamics. North America, with its high awareness and access to healthcare, accounts for roughly 45% of the global desloratadine market. Europe follows, supported by an aging population and rising allergy incidence. Asia-Pacific has shown accelerated growth—at a CAGR of approximately 5.8%—due to increased urbanization, pollution-related allergies, and expanding healthcare infrastructure [2].

Key Market Drivers

1. Rising Prevalence of Allergic Disorders

The global allergy burden continues to expand, with reports indicating that approximately 20-30% of the population suffers from allergic rhinitis and urticaria [3]. Increased diagnosis rates and broader awareness bolster demand for effective antihistamines like desloratadine.

2. Efficacy and Safety Profile

Desloratadine’s minimal sedative effects, once-daily dosing, and safety in pediatric and elderly populations underpin its sustained popularity. Its over-the-counter (OTC) availability in several markets further amplifies consumer access.

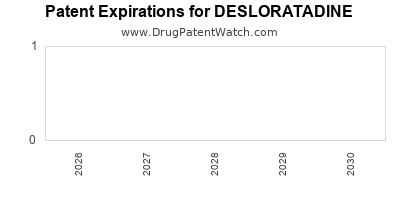

3. Patent Expiry and Market Entry

Generic pharmaceutical companies have introduced cost-effective desloratadine formulations, boosting accessibility and volume sales. The expiration of patents in key markets (e.g., the US in 2019) facilitated proliferation of generics, intensifying competitive dynamics.

4. Strategic Alliances and Market Expansion

Pharmaceutical firms pursue licensing agreements and regional expansion to capitalize on emerging markets. For instance, local formulations tailored to regional preferences have contributed to increased sales volumes.

Challengers and Market Constraints

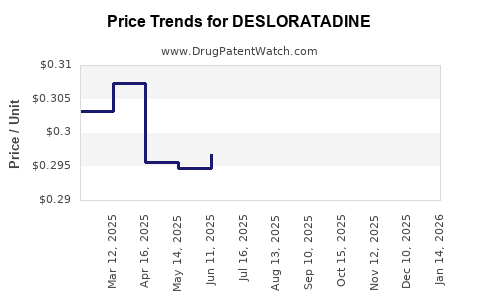

1. Pricing Pressures

Generic proliferation exerts downward pressure on prices, impacting profit margins. The commoditization of desloratadine constrains revenue growth unless offset by volume increases.

2. Regulatory and Patent Challenges

While patent expiries foster generic competition, ongoing patent disputes and regulatory hurdles can delay new product introductions, affecting revenue timelines.

3. Market Saturation in Developed Regions

High penetration rates in North America and Europe create limited room for growth, prompting companies to target emerging markets or diversify product portfolios.

4. Emerging Competitors

Newer antihistamines or combination therapies, with improved efficacy or expanded indications, threaten to displace desloratadine in certain patient segments.

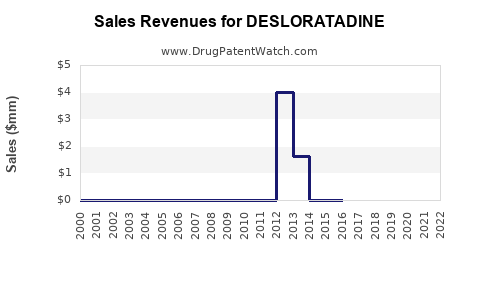

Financial Trajectory and Future Outlook

The financial prospects of desloratadine hinge on multiple factors:

-

Market Penetration and Growth:

In developed markets, desloratadine’s sales are stabilizing due to saturation. However, robust growth persists in Asia-Pacific and Latin America, where healthcare penetration is still increasing and allergy prevalence is rising [4].

-

Margins and Pricing Strategy:

The commoditization driven by generics has compressed profit margins. Yet, economies of scale, optimized supply chains, and regional tailored formulations can sustain favorable margins.

-

Research and Development:

Incremental innovations, such as combination drugs or new delivery routes, may create ancillary revenue streams. However, significant R&D investment risk limits the likelihood of label extensions unless new indications are discovered.

-

Market Entry and Expansion Strategies:

Companies adopting aggressive regional expansion and engaging in strategic licensing are poised for increased revenue, particularly in underserved markets with rising allergy incidence.

-

Impact of COVID-19:

The pandemic influenced allergy and respiratory condition management, temporarily increasing demand for antihistamines like desloratadine. Post-pandemic recovery appears to reinforce sales momentum as healthcare systems normalize.

Projected Revenue Outlook

Analysts project the global desloratadine market to grow at a moderate CAGR of approximately 3.5-4.0% over the next five years, driven by emerging markets and increased OTC sales. The market value may approach USD 4.2 billion by 2028, with North America and Europe contributing over 60% of revenues, albeit with marginal growth rates. Notably, the Asia-Pacific segment is expected to register the fastest CAGR, buoyed by demographic and infrastructural factors.

Competitive Landscape

Key players include Sanofi, Teva Pharmaceuticals, Mylan (now part of Viatris), and Amneal Pharmaceuticals—each leveraging patent expirations to expand generic offerings. Sanofi’s initial development and commercialization of desloratadine as a branded product established early dominance. Currently, the generic segment comprises over 85% of sales volume due to price sensitivity and widespread availability.

Emerging Opportunities

-

Digital Health and Telepharmacy:

Integration into online healthcare platforms facilitates patient access and adherence, especially in remote regions.

-

Combination Therapies:

Developing multi-active formulations combining desloratadine with decongestants or corticosteroids can address broader clinical needs and open new revenue streams.

-

Personalized Medicine:

Genetic profiling to identify responsive subpopulations may refine prescribing practices and improve market segmentation.

-

Regulatory Advances:

Streamlining approval processes for biosimilars or novel formulations could accelerate market penetration.

Conclusion

Desloratadine’s market remains resilient, supported by its efficacy, safety, and widespread adoption. However, increasing generic competition, pricing pressures, and market saturation in developed regions temper growth prospects. The most promising opportunities lie in emerging markets, innovative formulations, and digital health integration. To capitalize on these dynamics, pharmaceutical companies must adopt region-specific strategies, invest in incremental innovation, and monitor regulatory shifts closely.

Key Takeaways

- The global desloratadine market is expected to grow steadily, primarily driven by emerging markets and OTC sales.

- Patent expiries have catalyzed intense generic competition, constraining margins but expanding accessibility.

- Market saturation in developed regions requires strategic diversification and innovation to sustain growth.

- Emerging opportunities include combination therapies, digital health integration, and regional expansion.

- Long-term success will depend on balancing cost optimization with innovative approaches to address evolving consumer and regulatory landscapes.

FAQs

1. What factors most significantly influence desloratadine's market growth?

Prevalence of allergic disorders, patent expirations, generic competition, regulatory policies, and emerging market expansions are primary drivers.

2. How do patent expirations affect desloratadine’s market dynamics?

Patent expiries enable generic manufacturers to introduce cost-effective alternatives, increasing market competition, reducing prices, and impacting brand revenues.

3. Are there opportunities for desloratadine in treating new indications?

Currently, desloratadine’s approvals focus on allergic rhinitis and urticaria. Research into new indications is limited; most growth strategies focus on expanding existing markets rather than novel uses.

4. How has COVID-19 influenced the desloratadine market?

The pandemic temporarily increased demand due to respiratory and allergy-related symptoms, with post-pandemic recovery expected to stabilize and potentially boost sales further.

5. What strategies can pharmaceutical companies adopt to sustain desloratadine revenues?

Strategies include geographic expansion, developing combination therapies, cost optimization of manufacturing, digital health integration, and pursuing incremental innovation.

References

[1] MarketWatch. Antihistamine Drugs Market Size, Share & Industry Analysis, 2023-2030.

[2] Research and Markets. Geographic Insights into the Antihistamines Market.

[3] World Allergy Organization. Global Allergy Report 2022.

[4] IMS Health. Emerging Markets in Pharmaceutical Sales, 2022.