Last updated: July 29, 2025

Introduction

DEPO-MEDROL, a corticosteroid formulation containing methylprednisolone acetate, has established itself as a critical therapeutic agent in the treatment of inflammatory and allergic conditions. Its market trajectory, shaped by evolving healthcare needs, regulatory landscapes, and competitive dynamics, offers vital insights for industry stakeholders. This analysis provides a comprehensive overview of the current market landscape, key drivers, challenges, and financial prospects associated with DEPO-MEDROL.

Overview of DEPO-MEDROL

Developed by Pfizer (originally by Pharmacia & Upjohn), DEPO-MEDROL is primarily administered via intra-articular, intramuscular, and other localized injection routes. Its anti-inflammatory potency makes it a preferred choice for managing conditions like arthritis, bursitis, and other systemic inflammatory disorders. Despite being a long-standing medication, its role remains significant, especially in acute settings.

Market Size and Growth Trends

Globally, the corticosteroid market was valued at approximately USD 4.5 billion in 2022, with intra-articular corticosteroids constituting a sizable segment [1]. DEPO-MEDROL's share within this segment is notable due to its efficacy and longstanding clinical track record.

The growth prospects for DEPO-MEDROL hinge on several factors:

- Aging Population: The global rise in aged demographics correlates with increased prevalence of arthritis and related inflammatory conditions, expanding demand for intra-articular corticosteroids.

- Chronic Disease Burden: The surge in chronic inflammatory and autoimmune conditions sustains the need for corticosteroid therapies.

- Healthcare Infrastructure Expansion: Growing healthcare access, especially in emerging markets, extends the reach of injectable therapeutics like DEPO-MEDROL.

Projected compound annual growth rate (CAGR) for the corticosteroid segment is expected around 3-4% through 2030, underpinning incremental gains for DEPO-MEDROL.

Market Drivers

-

Clinical Efficacy and Established Use

DEPO-MEDROL’s proven efficacy and familiarity among physicians sustain its market position. Its localized anti-inflammatory effects reduce systemic side effects, favoring its continued use.

-

Brand Recognition and Physician Preference

As a blockbuster drug for decades, DEPO-MEDROL benefits from longstanding physician trust, limiting immediate substitution threats.

-

Regulatory Approvals and Reimbursement

Favorable regulatory status in key markets and reimbursement policies in developed regions support consistent sales.

-

Expansion into Emerging Markets

Increased healthcare investments and rising disease prevalence in Asia-Pacific, Latin America, and Africa open new sales avenues.

Market Challenges

-

Generic Competition

The patent expiration of many corticosteroids has led to proliferation of generic equivalents, exerting downward pressure on prices and margins.

-

Regulatory and Safety Concerns

Reports of adverse effects such as local tissue atrophy and systemic side effects prompt stricter regulatory scrutiny, potentially impacting prescribing patterns.

-

Preference for Alternative Therapies

Growing adoption of biologics and other targeted therapies for autoimmune diseases offers competition for corticosteroids, especially in chronic indications.

-

Cost-Containment Pressures

Healthcare systems' emphasis on cost efficiency incentivizes the shift toward less expensive generics or alternative treatments.

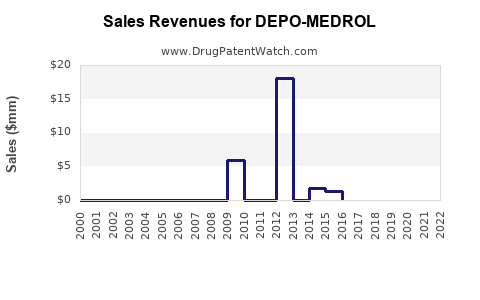

Financial Trajectory

While specific financial data for DEPO-MEDROL is proprietary, general industry trends suggest:

-

Revenue Stability in Developed Markets

Continued demand in orthopedics and rheumatology, supported by aging populations and established clinical protocols, sustains steady revenue streams.

-

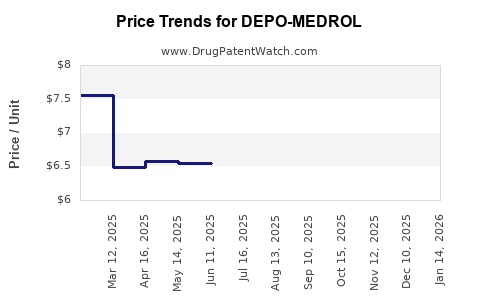

Margin Compression Due to Competition

Price erosion from generics and market saturation are likely to suppress profit margins.

-

Potential Growth from Pediatric and Specialized Applications

Limited but targeted expanding use in pediatric inflammatory conditions and localized dermatological applications offer untapped revenue opportunities.

-

Impact of Regulatory Shifts

Any regulatory actions restricting use or imposing new safety mandates could temporarily dampen financial outlooks, though long-term stability remains probable given the drug’s entrenched position.

Competitive Landscape

DEPO-MEDROL contends with multiple competitors, including:

- Other methylprednisolone formulations

- Triamcinolone acetonide

- Betamethasone preparations

- Emerging biologic therapies

The competitive landscape remains intense, necessitating differentiation via quality, safety, and clinical endorsement.

Future Outlook

-

Incremental Growth Expected: The corticosteroid market’s steady growth, driven by demographics and new indications, sustains DEPO-MEDROL’s relevance.

-

Innovative Delivery Methods: Advancements like sustained-release formulations could enhance patient compliance and expand use cases.

-

Strategic Focus on Emerging Markets: Market expansion strategies will be critical, given rising healthcare access and disease burden.

-

Regulatory Adaptations: Proactive engagement with regulators to address safety concerns will be essential to maintain market access.

Conclusion

DEPO-MEDROL’s market dynamics are characterized by a resilient demand rooted in its clinical efficacy and longstanding presence. However, the financial trajectory faces headwinds from generic competition, safety regulations, and alternative therapies. Its future financial performance will depend on strategic positioning, market expansion, and regulatory compliance. Stakeholders must continuously adapt to the evolving landscape to optimize revenue streams and maintain competitive advantage.

Key Takeaways

- DEPO-MEDROL remains a vital corticosteroid with stable demand driven by aging populations and chronic inflammatory disease prevalence.

- Market growth is modest but steady; opportunities exist in emerging markets and through innovations in delivery methods.

- Price competition from generics and evolving therapeutic preferences pose significant challenges.

- Strategic focus on geographic expansion and regulatory engagement will be vital to sustain profitability.

- Long-term prospects are favorable if the product maintains its safety profile and adapts to market shifts.

FAQs

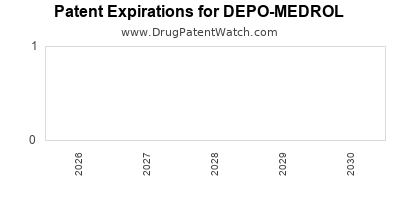

1. How does the patent status of DEPO-MEDROL impact its market?

DEPO-MEDROL’s patent protections have long expired, leading to widespread generic manufacturing. This results in price competition and pressure on margins but also broadens access and maintains volume.

2. What are the primary therapeutic applications of DEPO-MEDROL?

It is mainly used for intra-articular injections in osteoarthritis, bursitis, and tendinitis, as well as for systemic inflammatory conditions via intramuscular administration.

3. How are safety concerns influencing DEPO-MEDROL’s market?

Reports of local tissue atrophy and systemic effects have prompted regulatory agencies to request clearer labeling and usage guidelines, which may influence prescribing behaviors.

4. What is the outlook for DEPO-MEDROL in emerging markets?

Rising healthcare investments and increasing disease prevalence foster growth opportunities, although price sensitivity and regulatory environments pose challenges.

5. Are biologics a threat to corticosteroids like DEPO-MEDROL?

While biologics are transforming autoimmune disease management, corticosteroids remain essential for acute, localized, or cost-sensitive treatments, ensuring continued relevance.

References

[1] Grand View Research. "Corticosteroids Market Analysis & Segment Forecasts," 2022.