Last updated: July 29, 2025

Introduction

DAYPRO, a nonsteroidal anti-inflammatory drug (NSAID), is primarily indicated for pain relief and inflammation reduction associated with conditions such as osteoarthritis, rheumatoid arthritis, and acute musculoskeletal disorders. Known for its active ingredient, oxaprozin, DAYPRO has maintained a niche within the NSAID market due to its distinctive pharmacokinetic profile and safety considerations. This report analyzes the current market dynamics and projects the financial trajectory of DAYPRO, providing insights vital for stakeholders including pharmaceutical manufacturers, investors, and healthcare providers.

Market Position and Competitive Landscape

Historical Market Performance

DAYPRO entered the market over two decades ago, leveraging its unique once-daily dosing regimen, which enhances patient compliance compared to other NSAIDs requiring multiple doses daily. Its market performance historically benefited from favorable prescribing patterns linked to its safety profile in specific patient populations. However, over the past decade, the NSAID market has grown increasingly competitive with the integration of new formulations, such as selective COX-2 inhibitors, and emerging biologic therapies for rheumatoid conditions.

Competitive Forces and Product Differentiation

DAYPRO's primary competition includes traditional NSAIDs like ibuprofen, naproxen, and diclofenac, alongside Cox-2 inhibitors such as celecoxib and etoricoxib. The advent of biologics has also altered treatment paradigms for rheumatoid arthritis, potentially reducing reliance on NSAIDs. Nonetheless, DAYPRO’s once-daily oral formulation gives it a competitive edge in chronic disease management, especially in patients intolerant to selective Cox-2 inhibitors due to cardiovascular risks.

Regulatory Environment

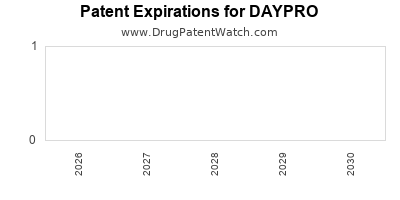

Regulatory oversight has tightened globally, notably post-2010 with increased attention on NSAID-associated cardiovascular and gastrointestinal adverse effects. While DAYPRO conforms to established safety guidelines, patent expiration, and generic entry are expected to erode market share and profit margins over time unless differentiation strategies are implemented.

Market Dynamics

Demand Drivers

- Chronic Disease Prevalence: Rising incidence of osteoarthritis and rheumatoid arthritis, particularly in aging populations, sustains demand for NSAIDs like DAYPRO.

- Patient Preference for Convenience: Once-daily dosing enhances patient adherence, key in chronic therapy frameworks.

- Physician Prescribing Patterns: Physicians favor medications with established safety and efficacy profiles, which supports continued prescription of DAYPRO in suitable cases.

Market Restraints

- Safety Concerns: Increased awareness of NSAID-related cardiovascular and gastrointestinal risks limits broad usage.

- Generic Competition: Patent expirations lead to the introduction of generics, compressing prices and margins.

- Emerging Therapies: Biologic agents and selective drugs offering better safety profiles are gradually encroaching on NSAID indications.

Market Opportunities

- Niche Segment Focus: Targeting patients intolerant or contraindicated to COX-2 inhibitors or biologics.

- Formulation Innovation: Developing new formulations with improved safety profiles could rejuvenate demand.

- Geographic Expansion: Emerging markets exhibit rising prevalence of arthritis-related conditions, providing growth opportunities.

Financial Trajectory

Revenue Trends and Projections

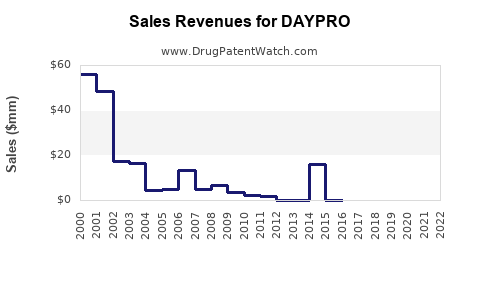

Historically, DAYPRO recorded moderate but steady revenue owing to its differentiated dosing and established market presence. However, impending patent expirations forecast a decline in profit margins as generic competition intensifies.

Projections suggest that:

- Short-term (1–3 years): Revenues may stabilize owing to existing prescription base and ongoing physician familiarity, with slight reductions due to biosimilar entry.

- Medium-term (3–5 years): Significant revenue erosion is anticipated in line with generic market infiltration unless the formulation gains new indications or formulations.

- Long-term (5+ years): Revenues are likely to decline substantially unless strategic pivoting—such as combination formulations or new therapeutic uses—is pursued.

Profitability Outlook

Profit margins are expected to shrink as manufacturing costs for branded DAYPRO are spread over a shrinking sales volume. Strategic investments in marketing and innovation could mitigate declines temporarily, but sustainability depends on diversification and differentiation.

Impact of Patent Dynamics and Regulatory Changes

Patent expiry historically correlates with revenue decline. The absence of new, potent patent protections or meaningful reformulation efforts heightens vulnerability to generic price erosion. Conversely, obtaining new regulatory approvals for expanded indications could sustain revenue streams.

Strategic Recommendations

- Innovation in Formulation: Develop safer, more effective formulations to re-establish competitive advantage.

- Market Diversification: Focus on emerging markets with expanding healthcare infrastructure and increasing arthritis prevalence.

- Lifecycle Management: Engage in patent extension strategies or develop combination therapies.

- Collaborate with Biotech: Partner with biologic firms to explore complementary or combination therapies.

Key Market Trends Impacting Future Trajectory

- Growing Preference for Biologics: While currently less relevant for DAYPRO’s indication spectrum, the shift towards biologics for rheumatoid conditions influences NSAID usage patterns.

- Digital Health Integration: Use of digital tools for adherence monitoring and patient engagement enhances long-term therapy success.

- Regulatory Tighter Scrutiny: Ongoing safety concerns necessitate advanced pharmacovigilance and could influence market acceptance.

Conclusion

DAYPRO’s market dynamics reflect a complex interplay of demand for effective pain management, safety concerns, competitive pressure from biosimilars, and patent timelines. The financial outlook indicates a gradual decline unless innovation or strategic expansion occurs. Stakeholders must weigh short-term stability against long-term sustainability, emphasizing the importance of formulation innovation, market diversification, and strategic collaborations to optimize financial trajectories.

Key Takeaways

- Market positioning is increasingly challenged; innovation and differentiation are critical for sustained relevance.

- Patent expiry and generic competition significantly threaten future revenue streams.

- Emerging markets and niche patient segments offer growth opportunities.

- Biologics and advanced therapies are reshaping the treatment landscape, reducing NSAID reliance.

- Proactive lifecycle management and formulation development are key strategies for maintaining profitability.

FAQs

1. How does DAYPRO compare to other NSAIDs in terms of safety and efficacy?

DAYPRO's once-daily dosing enhances compliance, and its safety profile is comparable to other NSAIDs when used appropriately. Nonetheless, like others, it carries risks of gastrointestinal and cardiovascular adverse effects, necessitating careful patient selection.

2. What is the patent status of DAYPRO, and how does it affect the market?

DAYPRO’s original patents have expired, leading to widespread availability of generics, which significantly impacts pricing and market share.

3. Are there ongoing efforts to reformulate or reposition DAYPRO within the NSAID market?

Currently, no major reformulation initiatives are publicly disclosed. Strategic repositioning may involve combination therapies, alternative dosing strategies, or new indications.

4. What are the main barriers to DAYPRO’s growth in emerging markets?

Regulatory hurdles, limited awareness, reimbursement challenges, and competition from local generics are primary barriers to market expansion.

5. How might future regulatory changes impact DAYPRO’s market viability?

Stricter safety regulations could lead to product reformulation requirements or restrictions on NSAID use, potentially reducing market size or necessitating compliance investments.

Sources

[1] Pharma Market Analysis Reports

[2] Global NSAID Market Trends 2022

[3] Regulatory Updates on NSAID Safety Measures

[4] Patent and Generic Drug Data (FDA, EMA)

[5] Consumer and Physician Prescribing Patterns Studies