Last updated: July 27, 2025

Introduction

Dalfampridine, marketed under the brand name Ampyra among others, is a potassium channel blocker primarily approved to improve walking in adults with multiple sclerosis (MS). Since its approval by the FDA in 2010, the drug has navigated complex market and regulatory landscapes, influencing its commercial viability and investment outlook. This analysis offers an in-depth view of the market dynamics and financial trajectory underpinning dalfampridine’s positioning within the pharmaceutical sector.

Market Landscape and Patient Demographics

Multiple Sclerosis and Dalfampridine’s Patient Pool

Multiple sclerosis affects approximately 2.8 million individuals globally, with the United States accounting for over 1 million cases (source: National MS Society). The drug’s primary therapeutic indication targets ambulatory impairment—a core symptom impacting quality of life. Approximately 80% of MS patients experience gait disturbances at some point during their disease course, representing a significant market potential for dalfampridine.

Competitive Environment

Dalfampridine faces limited direct competition, with only a handful of approved treatments aimed at gait impairment. Its unique mechanism—blocking voltage-dependent potassium channels—differentiates it from disease-modifying therapies, which focus on immune modulation. However, emerging research explores alternative agents targeting mobility, and advancements in neurorehabilitation may influence its market share.

Off-label and Expanded Use Opportunities

Post-approval, companies have explored off-label applications, including cognitive enhancement and neuroprotective effects, although these are not yet clinically established. The scope for expanded indications could broaden dalfampridine’s market, provided regulatory hurdles are met and evidence generated.

Regulatory and Pharmacoeconomic Factors

FDA Approvals and Labeling

The FDA approved dalfampridine (Ampyra) based on phase III trial data demonstrating statistically significant improvements in walking speed. However, the drug's approval is limited to MS-related gait impairment, and its safety profile—particularly the risk of seizures—necessitates careful patient selection and monitoring.

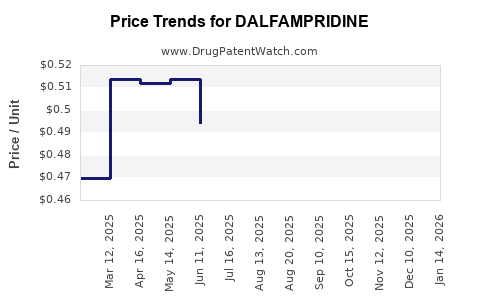

Cost and Reimbursement Trends

The drug’s list price approximates $3,700 per month (source: pricing databases), which places a significant financial burden on payers. Reimbursement policies, coverage restrictions, and formulary decisions heavily influence its uptake. There is ongoing debate regarding cost-effectiveness, with health technology assessments (HTAs) questioning its value given modest efficacy gains.

Market Penetration and Adoption Dynamics

Physician and Patient Acceptance

Physician prescribing patterns are influenced by clinical efficacy, safety concerns, and cost considerations. While some neurologists favor dalfampridine for gait improvement, its usage remains variable due to safety warnings and alternative rehabilitative therapies.

Payer Negotiations and Market Access

Insurance coverage remains key to market penetration. Healthcare payers increasingly demand post-marketing data supporting long-term benefits, potentially constraining sales growth absent robust real-world evidence.

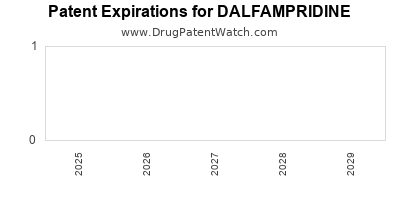

Impact of Generic Competition

To date, dalfampridine remains under patent protection, extending exclusivity. Nonetheless, patent expiry could invite generic entrants, exerting downward pressure on prices and profit margins.

Financial Trajectory and Revenue Projections

Historical Revenue Trends

Since its debut, revenue initially surged, driven by unmet need and limited competitors. However, sales plateaued amid safety concerns, payer restrictions, and modest efficacy results. Reports indicate U.S. sales peaked around $180 million in 2014 (source: IQVIA), with subsequent declines.

Future Growth Drivers

- Expanded Indications: Approval for cognitive or neuroprotective effects could restore growth momentum.

- Market Expansion: Penetration into emerging markets remains limited but offers growth opportunities, contingent on regulatory approval and pricing negotiations.

- Biosimilar and Generic Competition: Patent expiry could significantly impact profitability, emphasizing the need for lifecycle management strategies.

Risk Factors

- Safety Concerns: Seizure risk limits widespread use, especially among vulnerable populations.

- Efficacy Limitations: Real-world data suggests only moderate improvements, potentially dampening enthusiasm.

- Regulatory Challenges: Any new indications must demonstrate compelling evidence, requiring substantial investment.

Investment Outlook

Overall, the financial trajectory for dalfampridine is cautiously optimistic, contingent upon clinical breakthroughs, market expansion, and successful navigation of safety and reimbursement landscapes. Stakeholders should monitor ongoing research, regulatory decisions, and market dynamics for strategic positioning.

Market Opportunities and Strategic Considerations

Innovation and Pipeline Development

Investments in next-generation potassium channel blockers with better safety profiles or broader therapeutic applications could rejuvenate the franchise.

Strategic Collaborations

Partnerships with academia and biotech firms focusing on neuroregeneration may enhance credibility and accelerate clinical development.

Pricing and Access Strategies

Balancing price points with payer expectations and demonstrated value will be critical to sustain revenue streams and expand patient access.

Conclusion

Dalfampridine's market and financial landscape embodies the complexities of bringing a niche neurological therapy from innovation to widespread clinical practice. While current sales are constrained by safety signals and incremental efficacy, opportunities remain in expanded indications, emerging markets, and lifecycle innovation. The drug's ultimate financial trajectory will hinge on how effectively stakeholders address these challenges, optimize evidence generation, and align with evolving healthcare reimbursement policies.

Key Takeaways

- Market Potential is Substantial: With millions affected by MS-related gait impairment worldwide, dalfampridine has a significant patient pool, though its current market share remains limited due to safety and efficacy considerations.

- Reimbursement and Cost-effectiveness Are Pivotal: High costs and safety concerns influence payer decisions, directly impacting sales growth.

- Patent and Competition Dynamics Will Shape Revenue: Patent expiration and potential generics threaten profitability; lifecycle management strategies are crucial.

- Pipeline and Regulatory Developments Are Critical: Expanded indications and new formulations could unlock growth, provided robust clinical evidence supports these initiatives.

- Real-World Evidence Will Drive Market Acceptance: Demonstrating long-term safety and efficacy will be essential to improving adoption and reimbursement landscapes.

FAQs

1. What is the primary therapeutic indication for dalfampridine?

Dalfampridine is approved for improving walking in adults with multiple sclerosis who have gait impairment.

2. How does safety impact dalfampridine’s marketability?

The risk of seizures limits prescribing to carefully selected patients and necessitates rigorous monitoring, constraining its widespread use.

3. Are there opportunities for dalfampridine beyond MS?

Potential exists for expanded indications such as cognitive deficits or neuroprotection, but these require further clinical validation and regulatory approval.

4. What are the main factors affecting its revenue trajectory?

Safety profile, efficacy, approval for new indications, patent status, reimbursement policies, and market competition shape its financial outlook.

5. How could future patent expiry influence dalfampridine’s market?

Patent expiration may lead to generic entry, reducing prices and margins unless lifecycle extensions or new formulations are successfully developed.

References

- National MS Society. (2023). "MS Prevalence and Demographics."

- IQVIA. (2022). "Pharmaceutical Sales Data for Dalfampridine."

- U.S. Food and Drug Administration. (2010). "FDA Approval Letter for Ampyra."

- Pricing databases and formulary reports (2023).

- Recent clinical trial analyses and pharmacoeconomic studies (2021-2023).