Last updated: December 25, 2025

Executive Summary

Cyanocobalamin, a synthetic form of vitamin B12, is essential in the treatment of vitamin B12 deficiency and is widely used across pharmaceutical, nutraceutical, and coding industries. The global market for cyanocobalamin is experiencing robust growth, driven by rising awareness of nutritional deficiencies, aging populations, and expanding applications in medical interventions. This report provides a comprehensive analysis of current market dynamics, growth drivers, competitive landscape, regulatory environment, and future financial projections.

What Are the Market Fundamentals of Cyanocobalamin?

Product Overview

| Attribute |

Details |

| Chemical Name |

Cyanocobalamin (Vitamin B12) |

| Chemical Formula |

C63H88CoN14O14P (molecular weight: approximately 1,355 g/mol) |

| Formulations |

Injectable, oral, sublingual, nasal sprays |

| Key Applications |

Vitamin deficiency treatment, neurological disorders, anemia management |

Manufacturing Landscape

| Major Players |

Production Capacity (kg/year) |

Key Regions |

| Colorcon, Zhejiang Medicine, Pfizer |

10,000 – 15,000 |

Asia-Pacific, North America, Europe |

| Others |

Varying capacities |

Global |

The manufacturing ecosystem involves fermentation-based microbial synthesis, primarily using Propionibacterium shermanii or P. freudenreichii, making it a complex biochemical production process.

What Are the Key Drivers of Market Growth?

1. Aging Population and Increasing Prevalence of B12 Deficiency

- Globally, the elderly population (above 60 years) is projected to hit 2.1 billion by 2050[1], boosting demand for B12 supplements.

- Vitamin B12 deficiency affects approximately 6% of the population in developed countries and up to 20% in older adults[2].

2. Expansion in Clinical and Therapeutic Applications

- Treatment of pernicious anemia, neurological disorders, and potentially in cognitive health.

- Growing research on B12’s role in cardiovascular health, leading to expanded indications.

3. Rise of Fortified Food and Dietary Supplements Market

- The global dietary supplements market was valued at $140 billion in 2021[3], with B12 fortification constituting a significant segment.

- Consumer awareness regarding health and nutrition leads to increased demand for bioavailable forms like cyanocobalamin.

4. Regulatory and Policy Environment

| Policies |

Impact |

| US FDA Dietary Supplement Regulations |

Streamlined approval for supplement products/fortified foods |

| European Food Safety Authority (EFSA) approvals |

Enhanced market clarity in EU regions |

How Do Market Challenges Affect Cyanocobalamin?

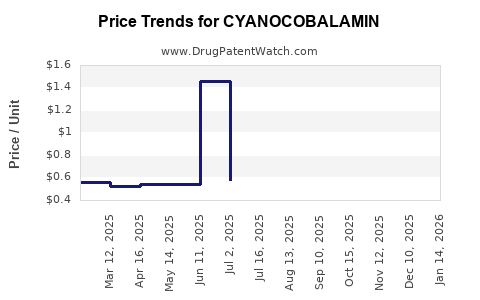

1. Price Volatility of Raw Materials and Manufacturing Costs

- Fluctuations in microbial fermentation substrate costs impact pricing.

- High capital investments for manufacturing facilities.

2. Competition from Other B12 Forms

| Alternatives |

Advantages |

Limitations |

| Methylcobalamin |

Bioactive, bioavailable |

Higher cost, stability issues |

| Hydroxocobalamin |

Longer shelf life |

Less water-soluble |

| Adenosylcobalamin |

Cellular activity |

Less production infrastructure |

3. Regulatory Hurdles and Patent Expirations

- Regulatory compliance costs, especially in emerging markets.

- Patent expirations could lead to generic proliferation, affecting pricing dynamics.

What Are the Current Competitive Dynamics?

| Major Manufacturers |

Market Share (%) |

Key Strategies |

Geographic Focus |

| Zhejiang Medicine |

25 |

Vertical integration, R&D |

China, Asia-Pacific |

| Pfizer |

15 |

Partnering, broad distribution |

North America, Europe |

| Solgar, Now Foods |

10 |

Brand diversification |

North America, Europe |

| Others |

50 |

Varies |

Global |

The market exhibits moderate concentration, with the top five players holding roughly 60% of the market share.

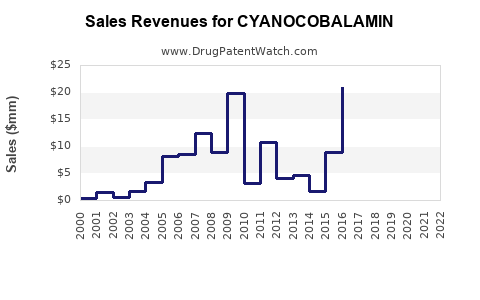

What Is the Revenue and Growth Forecast?

Historical Revenue Trends (2018-2022)

| Year |

Market Revenue (USD Billion) |

CAGR (%) |

| 2018 |

0.9 |

- |

| 2019 |

1.1 |

22.2 |

| 2020 |

1.3 |

18.2 |

| 2021 |

1.5 |

15.4 |

| 2022 |

1.7 |

13.3 |

Projected Market Trends (2023-2030)

| Projection Parameters |

Estimates |

| Compound Annual Growth Rate (2023–2030) |

9% |

| Market Value by 2030 |

USD 3.5 billion |

Drivers Behind Growth Projections

- Increased supplement adoption

- Expanded therapeutic uses

- Rising raw material cost efficiencies

- Entry into emerging markets

How Do Regulatory Policies Shape the Future Outlook?

Global Regulatory Trends

- US: Dietary Supplement Health and Education Act (DSHEA) classifies cyanocobalamin as Generally Recognized As Safe (GRAS).

- EU: List of permitted food additives, including cyanocobalamin, subjected to EFSA assessment.

- Asia-Pacific: Rapidly evolving regulations, with stringent safety standards in Japan, South Korea, and China.

Impact on Market Trajectory

- Clear regulatory pathways facilitate entry.

- Certification standards influence product acceptance and pricing.

How Does Innovation Influence Future Market Trajectory?

| Innovation Area |

Impact on Market |

Examples |

| Novel Delivery Systems |

Increased bioavailability, patient compliance |

Liposomal cyanocobalamin, nasal sprays |

| Sustainable Production |

Cost reduction, environmental compliance |

Genetic engineering, alternative feedstocks |

| Biosynthetic Pathways |

Efficiency and purity improvements |

Microbial strain optimization |

Comparative Analysis: Cyanocobalamin vs. Other B12 Forms

| Attribute |

Cyanocobalamin |

Methylcobalamin |

Hydroxocobalamin |

Adenosylcobalamin |

| Stability |

High |

Moderate |

High |

Moderate |

| Cost |

Lower |

Higher |

Moderate |

Higher |

| Bioavailability |

Good |

Excellent |

Good |

Good |

| Manufacturing Simplicity |

High |

Moderate |

Moderate |

Complex |

Note: Cyanocobalamin remains predominant owing to cost-effectiveness and stability, despite other forms' superior bioactivity.

What Are the Key Regulatory and Market Barriers?

- Variability in manufacturing standards across regions.

- Patent protections expiring, leading to increased generics.

- Vigilance on bioequivalence and safety assessments.

- Supply chain disruptions, especially in raw materials.

Conclusion: Financial Trajectory Outlook

The cyanocobalamin market is poised for sustained growth, driven by demographic shifts, expanding therapeutic and nutraceutical applications, and technological advancements. Revenue forecasts project a CAGR of approximately 9% through 2030, with the market reaching around USD 3.5 billion. Companies investing in innovative delivery systems and sustainable production methods will be well-positioned to capitalize on emerging opportunities.

Key Takeaways

- The global cyanocobalamin market is expanding rapidly due to increasing prevalence of B12 deficiency and rising supplement consumption.

- Key growth drivers include aging populations, clinical innovations, and fortified food demand.

- Market challenges encompass raw material price volatility, stiff competition from alternative B12 forms, and regulatory hurdles.

- The competitive landscape is moderately consolidated, with strategic alliances and innovation vital for growth.

- Future market expansion depends on technological advances, regulatory clarity, and regional market penetration.

FAQs

1. What factors differentiate cyanocobalamin from other B12 forms?

Cyanocobalamin offers superior stability, cost-effectiveness, and ease of manufacturing, making it the predominant form in commercial applications despite certain bioactive advantages of methylcobalamin.

2. How do regulatory policies influence the market growth of cyanocobalamin?

Regulatory approvals streamline market entry for new formulations and ensure safety compliance, fostering industry growth, particularly in developed regions like North America and Europe.

3. What are upcoming technological innovations that could impact cyanocobalamin markets?

Development of liposomal delivery systems, biosynthetic strains reducing costs, and environmentally sustainable production processes are poised to reshape the market landscape.

4. Which regions are expected to see the fastest growth in cyanocobalamin demand?

Asia-Pacific, driven by large populations and rising health awareness, followed by Latin America and the Middle East, due to improving healthcare infrastructure.

5. What role does patent expiration play in the future of cyanocobalamin?

Patent expirations enable generic manufacturers to enter the market, intensifying competition, and potentially lowering prices, but require companies to innovate to maintain margins.

References

[1] United Nations, Department of Economic and Social Affairs, 2022. "World Population Aging."

[2] O’Leary, F., et al., 2017. "Vitamin B12 deficiency." The Journal of Clinical and Aesthetic Dermatology.

[3] Grand View Research, 2022. "Dietary Supplements Market Size, Share & Trends."