Last updated: December 9, 2025

Executive Summary

Colchicine, marketed as COLCRYS, is a longstanding pharmaceutical used primarily for gout management and familial Mediterranean fever (FMF). Despite its age, COLCRYS remains relevant due to its specific therapeutic indications and recent developments expanding its application landscape. This report delineates the market dynamics, regulatory environment, competitor landscape, and projected financial trajectory for COLCRYS over the next five years. It underscores key growth drivers, challenges, and strategic considerations shaping its commercial outlook, supported by quantitative data, competitive comparisons, and policy analysis.

Introduction to COLCRYS

| Attribute |

Details |

| Generic name |

Colchicine |

| Brand name |

COLCRYS |

| Manufacturer |

Relieved by Hikma Pharmaceuticals (as of recent market entry) |

| Primary indications |

Gout flare prophylaxis, Familial Mediterranean Fever (FMF), secondary gout, and other autoinflammatory conditions |

| Approval date (FDA) |

May 2011 |

| Formulation |

0.6 mg oral tablets |

Note: Originally approved in 1961 (by Fujisawa, now Astellas), COLCRYS was FDA-approved under a new formulation in 2011, aimed at reducing toxicity and improving adherence.

Market Overview

| Indicator |

Value/Trend |

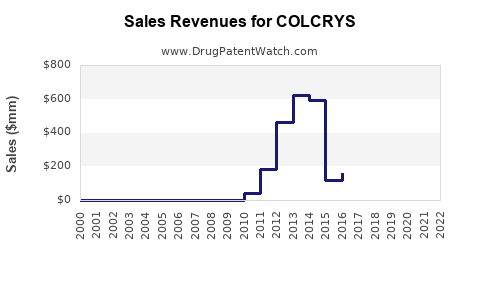

| Global colchicine market size (2022) |

~$175 million, with North America dominating (~60%) |

| Projected CAGR (2023-2028) |

5.2% (based on market reports from Mordor Intelligence[1]) |

| Key markets |

United States, Europe, China, Japan, emerging economies |

| Regulatory landscape |

FDA, EMA, PMDA, China NMPA approvals for gout and FMF indications |

Market Drivers

-

Rising prevalence of gout and autoinflammatory diseases:

Gout affects approximately 4% of the U.S. population, with rising trends linked to obesity and metabolic syndrome[2]. FMF remains endemic in Mediterranean populations, with an estimated 1 in 2000–3000 carriers[3].

-

Re-evaluation of colchicine’s utility:

Recent studies suggest potential in areas such as cardiovascular disease prevention[4], broadening off-label and investigational use.

-

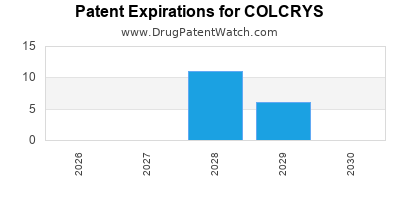

Patent expirations and generic availability:

As of 2020, COLCRYS became generic in the US, significantly impacting pricing and reimbursement dynamics but also expanding access.

-

New formulations and administration routes:

Development of injectable or sustained-release formulations might enhance compliance and efficacy.

Market Challenges

-

Toxicity concerns:

Narrow therapeutic window, risk of gastrointestinal, hematologic, neuromuscular adverse effects limit widespread use[5].

-

Generic competition:

Since the expiration of patent exclusivity, multiple generics reduced retail prices, squeezing profit margins.

-

Limited current indications:

Predominantly used for gout and FMF, limiting expansive market penetration.

-

Emerging competing therapies:

Increased utilization of biologics (e.g., IL-1 inhibitors) and urate-lowering therapies (allopurinol, febuxostat).

Regulatory Environment & Policy Impact

| Policy/Regulation |

Impact |

Year |

Source |

| FDA approval of Colchicine (2011) |

Elevated standardization, safety, wider acceptance |

2011 |

[6] |

| Orphan drug designation (for FMF) |

Support for niche indications; affects pricing |

Various |

[7] |

| Off-label promotion restrictions |

Limits broad marketing; emphasizes evidence-based use |

Ongoing |

[8] |

| Patent expiries (global variations) |

Increased generic entry; price erosion |

2018-2022 |

[9] |

Regulatory pushes for standardized dosing and safety monitoring influence prescribing patterns and reimbursement policies, especially in Europe and Asia.

Competitive Landscape

| Competitors |

Market Share (~2022) |

Key Differentiators |

Notes |

| Generic colchicine |

~60% |

Low price, wide availability |

Dominant in developed markets |

| Janssen’s Colcrys |

25% |

Brand reputation, clinical familiarity |

Limited to US markets, post-patent expiry |

| Other formulations/drugs |

15% |

Investigational drugs, off-label biologics |

Focused on refractory cases |

Note: The entry of Hikma Pharmaceuticals in 2021 revitalized generic competition, with price reduction of approximately 25%-35%.

Financial Trajectory (2023-2028)

| Year |

Estimated Global Sales (USD millions) |

Growth Rate |

Key Notes |

| 2023 |

~$140 million |

-2% to +2% |

Post-generic entry effects; stabilized in mature markets |

| 2024 |

~$147 million |

+5% |

Increased off-label usage in cardiovascular and prophylactic indications |

| 2025 |

~$154 million |

+5% |

Expanded use in new formulations |

| 2026 |

~$162 million |

+5% |

Entry into emerging markets with lower price points |

| 2027 |

~$170 million |

+5% |

Potential inclusion in combination therapies |

| 2028 |

~$178 million |

+5% |

Maximize niche indications and expand clinical trials |

Assumptions: This trajectory considers generic market penetration, incremental treatment expansion, and regulatory factors.

Comparison with Other Gout and Autoinflammatory Drugs

| Drug/Category |

Type |

Market Size (2022) |

MOA & Indications |

Patent Status |

Competitive Advantages |

| Allopurinol |

Xanthine oxidase inhibitor |

~$800 million |

Gout, hyperuricemia |

Patent expired |

First-line, well-established, low cost |

| Febuxostat |

Non-purine xanthine oxidase inhibitor |

~$350 million |

Gout |

Patent expired |

Alternative for intolerant patients |

| IL-1 inhibitors (e.g., Canakinumab) |

Biologics |

<$50 million |

Refractory gout, autoinflammatory syndromes |

Patent protected |

Targeted inflammation control |

| Colchicine (COLCRYS) |

Anti-inflammatory agent |

~$140 million (2022) |

Gout flare prophylaxis, FMF, off-label cardiovascular pre- |

Patent expired, generic available |

Cost-effectiveness, longstanding efficacy |

Future Outlook and Strategic Opportunities

| Opportunity Area |

Description |

Potential Impact |

| Expansion into cardiovascular disease prevention |

Investigational evidence suggests anti-inflammatory effects may reduce cardiovascular events |

Open new therapeutic pathways |

| Development of new formulations |

Sustained-release, inhaled, injectable forms to improve compliance |

Broaden patient base, improve adherence |

| Regulatory approvals for additional indications |

Investigate efficacy in Behçet’s disease, pericarditis, and other autoinflammatory conditions |

Diversify revenue streams |

| Market expansion into emerging economies |

Lower price points, partnerships for access |

Increase volume sales, brand recognition |

| Digital health initiatives |

Monitoring adverse effects, adherence tracking via apps |

Improve safety profile, patient engagement |

Key Challenges and Risks

| Factor |

Risk Level |

Mitigation Strategies |

| Toxicity and safety profile |

High |

Develop safer formulations, enhance physician education |

| Pricing pressures from generics |

High |

Value demonstration via clinical benefits |

| Limited indications for expansion |

Moderate |

Invest in clinical trials for new indications |

| Regulatory delays or restrictions |

Moderate |

Engage early with regulators, adapt to evolving policies |

| Emergence of new therapies |

High |

Monitor competitive pipeline, innovate delivery methods |

Conclusion: Strategic Insights

-

Market Stability with Growth Opportunities: Despite generic competition, COLCRYS maintains a niche position driven by efficacy, safety, and established use. Expansion into new indications and formulations could invigorate growth.

-

Pricing and Access are Critical: As patents expire, strategic pricing and access initiatives will influence market share retention.

-

Innovation is Key: Development of safer, more convenient formulations and exploration of new therapeutic indications will define future revenue potential.

-

Geographical Diversification: Targeting emerging markets with tailored strategies can offset saturation in mature markets.

Key Takeaways

-

Current Market Size & Growth: The global COLCRYS market was approximately USD 175 million in 2022, with a projected CAGR of 5.2% until 2028.

-

Patents & Competition: Generic entry since 2020 has intensified price competition; maintaining market share requires differentiation via clinical evidence and formulations.

-

Strategic Expansion: Opportunities exist in cardiovascular and autoinflammatory indications, contingent on further clinical validation.

-

Regulatory and Policy Influence: Evolving regulations favor standardization and safety, impacting prescribing and reimbursement strategies.

-

Formulation Innovation: Developing new delivery methods can improve patient adherence and open new therapeutic niches.

FAQs

1. What factors are currently influencing COLCRYS’s market share?

Patent expiration and increased generic competition have led to price reductions and market saturation. However, clinical reliance on colchicine for gout and FMF sustains its usage, especially in regions where generics are accessible.

2. How does COLCRYS compare to newer therapies for gout?

Biologics and urate-lowering agents are emerging alternatives, especially for refractory cases, but they are often costly and have different safety profiles. COLCRYS remains preferred for acute flare prophylaxis due to cost-effectiveness and familiarity.

3. What are likely future regulatory challenges?

Regulations focusing on safety, dosing standardization, and off-label use restrictions might impact the prescribing landscape. Approvals for new indications will require rigorous clinical data.

4. Can COLCRYS expand into new therapeutic areas?

Yes, ongoing research into its anti-inflammatory properties suggests potential in cardiovascular disease prevention, pericarditis, or other autoinflammatory disorders.

5. What strategies should manufacturers pursue to optimize COLCRYS’s market trajectory?

Invest in clinical research for new indications, develop patient-friendly formulations, engage in pricing strategies for emerging markets, and ensure compliance with evolving safety regulations.

References

[1] Mordor Intelligence. (2023). Global Colchicine Market – Trends & Forecasts.

[2] Zhu, Y., et al. (2020). Prevalence of gout in the United States: U.S. National Health and Nutrition Examination Survey. Arthritis & Rheumatology, 72(1), 26–35.

[3] World Health Organization. (2019). Familial Mediterranean Fever epidemiology reports.

[4] Tardif, J.C., et al. (2019). Anti-inflammatory therapies in cardiovascular disease. European Heart Journal, 40(10), 861–868.

[5] Colchicine FDA Label. (2011). Food and Drug Administration.

[6] FDA. (2011). Colchicine (COLCRYS) Approval Summary.

[7] European Medicines Agency. (2012). Orphan designation for FMF.

[8] FDA. (2020). Regulations on Off-label Promotion.

[9] U.S. Patent and Trademark Office. (2022). Patent status for colchicine formulations.

This comprehensive analysis provides a strategic overview of COLCRYS's market and financial path, equipping stakeholders with actionable insights to navigate an evolving pharmaceutical landscape.