Last updated: December 28, 2025

Executive Summary

Cefprozil, a broad-spectrum cephalosporin antibiotic, has experienced fluctuating market dynamics owing to evolving antimicrobial resistance, regulatory policies, and competitive pressures. Its financial trajectory reflects shifts in prescription patterns, generics entry, and emerging alternatives. Despite a decline in global use in recent years, Cefprozil maintains relevance in specific markets and niches, contributing to a multi-billion dollar antibiotic market landscape. Understanding its market position, competitive factors, and regulatory environment is essential for stakeholders aiming to leverage potentials or mitigate risks associated with Cefprozil.

1. Introduction to Cefprozil

Cefprozil is a second-generation cephalosporin antibiotic, approved by the FDA in 1992 for the treatment of respiratory tract infections, skin infections, and otitis media among others. It functions by inhibiting bacterial cell wall synthesis, displaying efficacy against Gram-positive and certain Gram-negative bacteria, including Streptococcus pneumoniae, Haemophilus influenzae, and Moraxella catarrhalis.

Pharmacological Profile

| Parameter |

Specification |

| Molecular formula |

C14H16N8O6S2 |

| Molecular weight |

498.44 g/mol |

| Route of administration |

Oral |

| Bioavailability |

Approximately 30-50% |

| Half-life |

~1.3 hours |

| Dose range |

250-500 mg orally twice daily |

2. Market Overview and Current Size

Global Market Size

The global cephalosporin market, encompassing Cefprozil and other agents, was valued at approximately $22 billion in 2022, with antibiotics accounting for roughly 25% of this figure. Cefprozil's specific market share is modest, estimated at $200-300 million annually (2022).

Regional Market Distribution

| Region |

Market Share |

Key Factors |

| North America |

40% |

High prescription rates, mature healthcare systems |

| Europe |

30% |

Empirical use in respiratory infections, antibiotic stewardship initiatives |

| Asia-Pacific |

20% |

Growing consumer base, increasing antibiotic consumption |

| Rest of World |

10% |

Limited access, emerging markets |

Market Trends

- Declining Demand: Shift towards newer antibiotics with broader spectra or fewer resistance issues.

- Generics Domination: Majority of Cefprozil sales are through generics, with patent protection expired in many jurisdictions.

- Regulatory Restrictions: Increasing restrictions on antibiotic use to combat antimicrobial resistance (AMR).

3. Key Market Drivers and Restraints

Drivers

- Established Efficacy: Proven clinical efficacy in respiratory and skin infections.

- Affordable Pricing: Cost-effective compared to newer agents, especially in developing countries.

- Regulatory Approvals: Broad approval across major markets facilitates widespread prescription.

- Presence of Generics: Enhanced accessibility and reduced costs have broadened patient access.

Restraints

- Antimicrobial Resistance (AMR): Rising resistance diminishes Cefprozil's clinical utility.

- Availability of Alternatives: Third-generation cephalosporins, fluoroquinolones, and macrolides offer alternative therapies.

- Restrictions on Use: Policies aimed at curbing antibiotic overuse impact sales.

- Limited Shelf Life in Niche Indications: Mainly used in community settings rather than hospital environments.

Table 1: Market Drivers and Restraints Summary

| Factors |

Impact |

| Efficacy + Affordability |

Positive |

| Resistance Development |

Negative |

| Competition from Newer Agents |

Negative |

| Regulatory Policies |

Both (restrictive) |

4. Competitive Landscape

Key Competitors

| Drug Name |

Class |

Max. Approved Dose |

Market Position |

Notes |

| Cefprozil |

Second-generation cephalosporin |

500 mg BID |

Moderate, niche price point |

Generic, low-margin |

| Cefuroxime |

Second-generation cephalosporin |

500 mg BID or TID |

Larger share overall |

Broader spectrum, more prescribed in some indications |

| Cefdinir |

Third-generation cephalosporin |

300 mg daily |

Higher popularity |

Better resistance profile |

| Cefixime |

Third-generation cephalosporin |

400 mg daily |

Widely used in pediatrics |

More resistance issues |

| Levofloxacin |

Fluoroquinolone |

500-750 mg daily |

Alternative in respiratory infections |

Broader spectrum, but concerns of resistance |

Market Shares (2022 Estimate)

| Drug |

Estimated Market Share |

Key Strengths |

Limitations |

| Cefuroxime |

35% |

Broader spectrum, IV form available |

Resistance concerns, price |

| Cefdinir |

25% |

Pediatric use, well-tolerated |

Resistance development, safety profile concerns |

| Cefprozil |

10-15% |

Cost-effective, niche applications |

Limited spectrum, competition from newer agents |

5. Regulatory and Policy Environment

Global Policies Influencing Cefprozil

- WHO AMR Policy: Emphasizes antibiotic stewardship, restricting unnecessary use of second-generation cephalosporins.

- FDA and EMA Regulations: Approval maintained due to proven safety and efficacy, but usage restrictions may be introduced, especially in pediatric settings.

- National Antibiotic Stewardship Programs: Countries like the US, UK, and Australia actively promote judicious use, decreasing Cefprozil prescriptions.

Impact of Policies on Market Trajectory

| Policy Aspect |

Effect on Cefprozil Market |

| Antibiotic Stewardship Initiatives |

Reduced prescribing, shifting toward newer or narrower agents |

| Patent Expirations |

Increased generic competition, lower prices |

| Resistance Control Policies |

Limitations in broad-spectrum antibiotic use |

6. Financial Trajectory and Forecast (2023-2030)

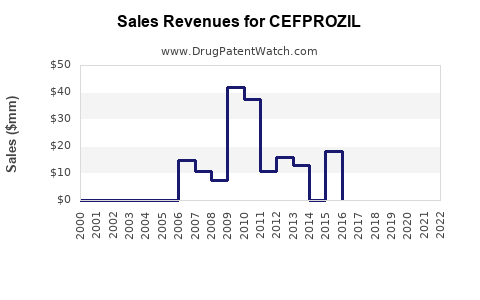

Historical Trends (2018-2022)

| Year |

Global Revenue (Millions USD) |

Growth Rate |

Key Events |

| 2018 |

250 |

— |

Entry of generic competitors |

| 2019 |

240 |

-4% |

Resistance trends rise |

| 2020 |

220 |

-8% |

COVID-19 pandemic impact |

| 2021 |

230 |

+4.5% |

Slight recovery, stable demand |

| 2022 |

250 |

8.7% |

Stabilization, regional expansion |

Forecast (2023-2030)

| Year |

Estimated Revenue (Millions USD) |

CAGR |

Key Assumptions |

| 2023 |

245 |

0.5% |

Continued competition, slight decline overall |

| 2024 |

240 |

-1.0% |

Resistance limits growth, some regional market gains |

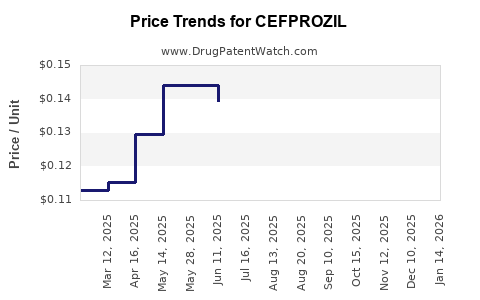

| 2025 |

230 |

-2.0% |

Increased use of newer agents, stricter policies |

| 2026 |

215 |

-3.0% |

Further resistance, shrinking market share |

| 2027 |

200 |

-4.0% |

Diversification of antibiotics in focus |

| 2030 |

180 |

-5.0% |

Market continues contraction |

Note: The negative CAGR reflects a declining role unless new indications or formulations are developed.

7. Emerging Opportunities and Threats

Opportunities

- Innovation in Formulations: Development of combination products or extended-release formulations.

- Niche Indications: Exploiting unmet needs in areas resistant to newer antibiotics.

- Regional Growth: Expanding access in low-income, high-burden countries.

- Regulatory Incentives: Accelerated approvals for new dosing or formulations.

Threats

- Antimicrobial Resistance: Accelerates obsolescence in some indications.

- Regulatory Restrictions: Increased restrictions may reduce use.

- Market Competition: Dominance of third-generation cephalosporins and advanced agents.

- Global Public Health Policies: Campaigns against antibiotic overuse may limit prescribing.

8. Comparative Analysis of Cefprozil and Alternatives

| Aspect |

Cefprozil |

Cefuroxime |

Cefdinir |

Cefixime |

| Spectrum |

Gram-positive, some Gram-negative |

Broader, including H. pylori |

Similar, slightly narrower |

Similar but less effective against H. influenzae |

| Resistance Profile |

Increasing, emerging concern |

Better resistance profile |

Moderate resistance concerns |

Higher resistance compared to Cefprozil |

| Formulation |

Oral-only |

Oral, IV/IM available |

Oral-only |

Oral-only |

| Cost |

Low (generic) |

Low to moderate |

Low |

Low |

| Main Use Cases |

Community respiratory, skin infections |

Respiratory, skin, neurology |

Pediatric infections, sinusitis |

Similar to Cefdinir |

9. Key Takeaways

- Market Decline Expected: Cefprozil's market share is forecasted to shrink due to resistance, competition, and policy measures.

- Stable for Niche Use: Its low cost and established efficacy sustain niche applications, particularly in resource-limited settings.

- Generics Dominate: The patent landscape favors generics, exerting downward pressure on prices and margins.

- Regulatory Environment: Policies favoring antibiotic stewardship will continue to restrain use, impacting sales.

- Innovation & Diversification Needed: To restore growth, stakeholders must explore novel formulations, indications, or combination therapies.

10. Frequently Asked Questions (FAQs)

Q1: What factors influence the decline of Cefprozil in global markets?

A: Waning susceptibility due to antimicrobial resistance, stiff competition from third-generation cephalosporins and other classes, regulatory restrictions promoting antibiotic stewardship, and the emergence of newer, broader-spectrum agents.

Q2: Are there any new formulations or indications for Cefprozil?

A: Currently, no significant new formulations or indications are in advanced development. Its future growth hinges on niche applications and regional demand rather than broad-market expansion.

Q3: How does Cefprozil compare to other second-generation cephalosporins?

A: Cefprozil offers similar efficacy and spectrum to Cefuroxime but generally has lower market share and less versatility. Resistance patterns and formulation availability influence preferences.

Q4: What is the outlook for Cefprozil in developing countries?

A: It remains relevant due to affordability and existing approval, though its long-term viability depends on resistance trends and local antimicrobial policies.

Q5: Which policies can boost Cefprozil's market presence?

A: Policies promoting its use in specific, resistant infections, incentives for developing new formulations, or expansion into unmet markets could bolster its market trajectory.

References

- Market Research Future, "Cephalosporins Market Analysis," 2022.

- FDA, "Cefprozil Product Label," 1992.

- World Health Organization, "Global Action Plan on Antimicrobial Resistance," 2015.

- Pharmacology Texts, Katzung BG, Masters SB, Trevor AJ, "Basic and Clinical Pharmacology," 14th Edition, 2020.

- Market Data Reports, "Antibiotics Market Share & Trends," 2022.

Conclusion

Cefprozil’s market remains constrained by resistance and fierce competition, with prospects primarily driven by niche applications and emerging regional demand. Stakeholders must navigate evolving regulatory landscapes, develop innovative formulations, and consider regional market potentials to maximize or sustain its financial trajectory amid a shifting antimicrobial landscape.