Share This Page

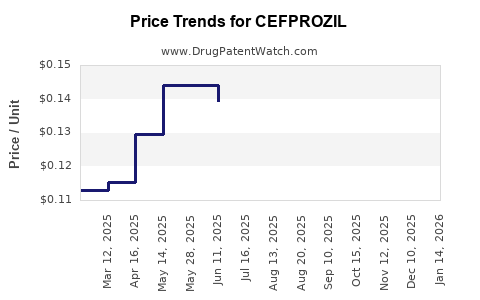

Drug Price Trends for CEFPROZIL

✉ Email this page to a colleague

Average Pharmacy Cost for CEFPROZIL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CEFPROZIL 125 MG/5 ML SUSP | 57237-0034-50 | 0.16867 | ML | 2025-11-19 |

| CEFPROZIL 125 MG/5 ML SUSP | 57237-0034-75 | 0.09395 | ML | 2025-11-19 |

| CEFPROZIL 125 MG/5 ML SUSP | 57237-0034-01 | 0.11217 | ML | 2025-11-19 |

| CEFPROZIL 125 MG/5 ML SUSP | 68180-0401-03 | 0.11217 | ML | 2025-11-19 |

| CEFPROZIL 125 MG/5 ML SUSP | 16714-0396-02 | 0.09395 | ML | 2025-11-19 |

| CEFPROZIL 500 MG TABLET | 68180-0404-01 | 1.06420 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Cefprozil

Introduction

Cefprozil, a second-generation oral cephalosporin antibiotic, is primarily prescribed for bacterial infections such as pharyngitis, tonsillitis, bronchitis, and sinusitis. Approved by regulatory agencies like the FDA, it offers a broad spectrum of activity against both gram-positive and gram-negative bacteria. Its market landscape, influenced by patent status, regional approvals, competition, and emerging resistance trends, warrants a comprehensive analysis to inform strategic decisions. This report examines the current market standing of Cefprozil, evaluates factors impacting its pricing, and provides future price projections, offering valuable insights for pharmaceutical firms, investors, and healthcare stakeholders.

Market Overview

Regulatory Status and Market Approvals

Cefprozil was first introduced globally in the late 1990s, with key approvals in the United States, Europe, and Asia. While the drug remains FDA-approved in the US, its market presence varies across regions. Notably, in numerous jurisdictions, Cefprozil has lost market exclusivity due to patent expiration or statutory patent cliffs, leading to the entry of generic alternatives. This affects pricing and overall market share dynamics significantly.

Competitive Landscape

The antibiotics market is highly competitive, characterized by numerous generic cephalosporins and alternative classes such as macrolides and fluoroquinolones. Older drugs like Cefprozil face intense price competition from generics, which drastically reduces margins post-patent expiry. Moreover, newer antibiotics with broader spectrums or improved safety profiles, such as cefdinir and cefuroxime, continuously threaten Cefprozil’s market share.

Market Segments and Geographic Variations

Regionally, North America, Europe, and parts of Asia constitute the primary markets for Cefprozil. North America remains a mature and highly commoditized market, with generics dominating post-patent expiry. In contrast, emerging markets in Asia-Pacific experience growth owing to increasing healthcare access and antibiotic consumption. However, regulatory frameworks, prescription guidelines, and antibiotic stewardship programs influence utilization rates and pricing across these regions.

Usage Trends and Prescribing Patterns

The trend toward prudent antibiotic use and rising antimicrobial resistance (AMR) concerns have impacted Cefprozil’s prescribing frequency. Healthcare providers increasingly favor narrower-spectrum or newer agents based on resistance patterns, reducing Cefprozil’s share. Nonetheless, in settings where cost-effectiveness is prioritized, Cefprozil remains a preferred option due to its established efficacy and affordability, especially in developing countries.

Price Dynamics and Influencing Factors

Patent Expiry and Generic Competition

Cefprozil's patent expiration in major markets like the US and Europe, which occurred roughly around the early to mid-2010s, catalyzed a sharp decline in list prices. Generic manufacturers introduced multiple formulations, intensifying price competition, often reducing prices by over 70%. Generic entry is the primary driver of price erosion in the antibiotics segment.

Manufacturing Costs and Supply Chain

Manufacturing costs for Cefprozil are relatively low given its well-established synthesis pathways. However, supply chain complexities, raw material availability, and regulatory compliance costs influence final pricing. Price fluctuations in beta-lactam raw materials can translate into marginal price shifts in the generic landscape.

Regulatory and Reimbursement Policies

Pricing strategies are heavily affected by regulatory agencies' reimbursement policies and antibiotic stewardship directives. In markets prioritizing cost containment, prices are aggressively negotiated by payers. Conversely, regions with limited reimbursement controls may see higher prices for brand-name Cefprozil, though these are often unsustainable post-generic entry.

Market Demand and Prescriber Preferences

The ongoing decline in Cefprozil utilization leads to downward pressure on prices. However, in certain niche markets or where specific resistance profiles prompt the use of older agents, demand persists and stabilizes certain price levels.

Future Price Projections

Short-term Outlook (1–3 years)

In mature markets, generic Cefprozil prices are expected to remain relatively stable or decline marginally (5–15%) due to ongoing competition. The absence of brand-name Cefprozil in many regions limits opportunities for premium pricing. The consolidation of manufacturing and supply chain efficiencies may further sustain low prices.

Mid- to Long-term Outlook (3–10 years)

As older antibiotics face increasing resistance, niche indications or combination therapy markets might sustain modest price premiums. In emerging markets, where generic supply is less saturated, prices could stabilize or experience slight increases driven by local regulatory shifts or supply shortages. However, overall prices are expected to trend downward, aligning with global antibiotic market patterns.

Impact of New Formulations or Indications

Innovation-driven price premiums may emerge if new formulations (e.g., sustained-release, combination therapies) or novel indications for Cefprozil are approved. Yet, given the generic landscape's dominance, significant premiums are unlikely unless backed by patent protections or unique delivery mechanisms.

Business Strategy Implications

For pharmaceutical companies, understanding the declining trajectory of Cefprozil’s prices necessitates diversification strategies. Investment in next-generation cephalosporins or novel antibiotics with improved resistance profiles offers higher-margin opportunities. For existing producers, optimizing manufacturing efficiencies and entering emerging markets can offset margin erosion.

Investors should monitor patent expiry timelines and regional regulatory changes to anticipate price movements and market entry opportunities for competitors. Healthcare payers and policymakers must balance antibiotic affordability with incentives for innovation, influencing future pricing frameworks.

Conclusion

Cefprozil's market landscape is characterized by widespread generic competition, declining prices, and shifting prescribing habits influenced by antimicrobial resistance trends. Short-term prospects point to continued price declines in mature markets, while emerging markets may sustain relatively higher prices due to lower competition and unmet demand. Innovation and strategic market positioning remain pivotal for stakeholders aiming to optimize returns and ensure sustainable supply.

Key Takeaways

- Patent expiries have led to widespread generic availability, exerting significant downward pressure on Cefprozil prices.

- Competitive landscape favors low-cost generics, limiting profitability for brand manufacturers.

- Aging market with declining demand in developed regions necessitates diversification into newer antibiotics or formulations for growth.

- Emerging markets present opportunities for stabilized or slightly increased prices due to less saturation and growing access.

- Future price trends are expected to remain on a declining trajectory over the next decade, with occasional premiums for niche applications or formulations.

FAQs

1. How have patent expiries affected Cefprozil pricing globally?

Patent expiries have led to the entry of multiple generic manufacturers, significantly reducing Cefprozil’s prices—often by over 70%—particularly in North America and Europe, where generic competition is intense.

2. Are there upcoming regulatory changes that could influence Cefprozil prices?

Regulatory initiatives promoting antimicrobial stewardship and drug repurposing may further limit Cefprozil’s market share. Conversely, approval of new formulations or indications could stabilize or enhance pricing in niche segments.

3. How does antimicrobial resistance impact Cefprozil’s market viability?

Rising resistance reduces Cefprozil’s effectiveness against certain pathogens, leading clinicians to prefer alternative therapies, thereby diminishing demand and pressure on prices.

4. What market segments are most likely to sustain Cefprozil demand in the future?

Developing countries with limited access to newer antibiotics and stable resistance patterns may continue to use Cefprozil, sustaining modest demand and prices.

5. What strategies can manufacturers adopt to maintain profitability amid declining prices?

Innovating with new formulations, exploring niche indications, optimizing manufacturing costs, and expanding into underserved markets are vital strategies.

Sources:

[1] U.S. Food and Drug Administration. Cefprozil Drug Approval Database.

[2] Market Research Future. Antibiotics Market Analysis 2022.

[3] IQVIA. Global Antibiotics Consumption Report 2022.

[4] European Medicines Agency. Summary of Cefprozil’s Regulatory Status.

[5] World Health Organization. Antimicrobial Resistance and Antibiotic Use.

More… ↓