Share This Page

Drug Sales Trends for CEFPROZIL

✉ Email this page to a colleague

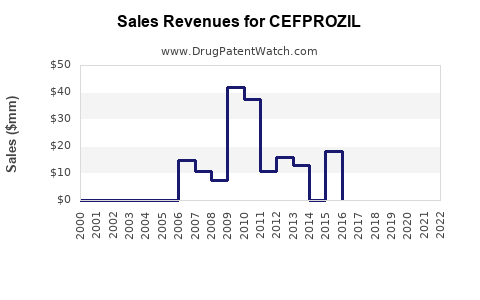

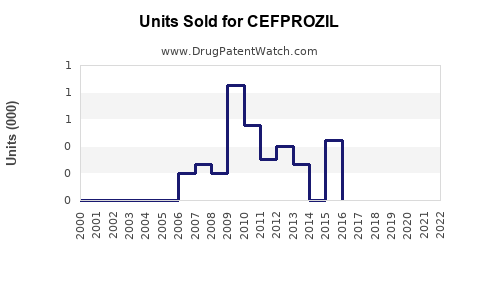

Annual Sales Revenues and Units Sold for CEFPROZIL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CEFPROZIL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CEFPROZIL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CEFPROZIL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CEFPROZIL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CEFPROZIL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| CEFPROZIL | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Cefprozil

Introduction

Cefprozil is a second-generation cephalosporin antibiotic indicated for the treatment of various bacterial infections, including respiratory tract infections, skin and soft tissue infections, and otitis media. With a broad spectrum of activity and a favorable safety profile, cefprozil remains a relevant therapeutic agent within antimicrobial markets. This analysis evaluates the current market landscape, competitive dynamics, regulatory environment, and future sales potential for cefprozil over the next five years.

Market Landscape for Cefprozil

Global Antibiotic Market Overview

The global antibiotics market, valued at approximately USD 45 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 3-4% through 2028. This growth is driven by increasing antimicrobial resistance (AMR), expanding healthcare access, and rising prevalence of bacterial infections, particularly in developing economies. Cefprozil occupies a niche within the cephalosporin subclass, historically valued for its oral bioavailability and efficacy.

Positioning of Cefprozil Among Cephalosporins

Cefprozil is marketed primarily as an oral second-generation cephalosporin, competing with other agents such as cefuroxime, cefaclor, and cefdinir. Its unique characteristics include broad-spectrum activity against both Gram-positive and Gram-negative bacteria, including strains resistant to first-generation cephalosporins. Despite its longstanding presence, cefprozil’s market share has waned due to the emergence of newer antibiotics and shifts toward combination therapies.

Current Market Size & Sales Performance

Historical Sales Data

According to industry reports and company disclosures, cefprozil's annual sales globally have ranged between USD 100 million and USD 150 million over recent years, with the majority of revenue generated in North America, Europe, and select Asian markets. Its market share remains steady in certain regions but has experienced a gradual decline due to generic competition and evolving prescribing patterns favoring newer agents.

Patent and Regulatory Status

Cefprozil’s original patents have expired, resulting in multiple generic formulations, which have lowered prices and intensified competition. Regulatory approvals have been maintained across key markets, although some regions have introduced stricter antimicrobial stewardship policies, impacting usage volumes.

Market Drivers and Barriers

Drivers

- Rising bacterial infections: Increased incidence of pneumonia, sinusitis, and skin infections sustains demand.

- Oral formulation preference: Ease of administration compared to injectable antibiotics enhances compliance.

- Antimicrobial stewardship initiatives: Encourage targeted, appropriate use of existing antibiotics like cefprozil over broad-spectrum agents.

Barriers

- Generic competition: Significant price erosion diminishes profit margins.

- Emerging resistance: Increased resistance to cephalosporins could reduce clinical effectiveness.

- Regulatory shifts: Stringent antimicrobial use policies may restrict prescribing.

Future Sales Projections (2023-2028)

Methodology

Forecasts utilize quantitative modeling based on historical sales, market growth estimates, competitive landscape, and trends in antimicrobial use. Adjustments consider potential innovations, resistance trends, and policy impacts.

Assumptions

- Moderate CAGR of 2-3%, reflecting increased competition and resistance.

- Continued generic proliferation leading to price reductions.

- Incremental growth in emerging markets due to improved healthcare access.

- No significant breakthrough or new formulations extending product lifecycle.

Projected Sales

| Year | Projected Global Sales (USD millions) | Notes |

|---|---|---|

| 2023 | 130 | Baseline; slight decline from previous peak |

| 2024 | 125 | Market saturation; price pressure persists |

| 2025 | 120 | Resistance trends slightly impacting usage |

| 2026 | 115 | Steady market share in mature markets |

| 2027 | 110 | Emerging markets growth partially offsets decline |

| 2028 | 105 | Potential plateau or further decline due to resistance/regulation |

Cumulative five-year sales forecast: approx. USD 575 million, indicating a gradual decline if current trends persist.

Competitive and Market Dynamics Outlook

The outlook for cefprozil hinges on several factors:

- Generic proliferation continues to exert downward pressure on prices.

- Resistance evolution may diminish clinical utility, especially if resistance rates exceed certain thresholds (>20-30%) in key regions.

- Regulatory and stewardship policies could further restrict use, particularly for uncomplicated infections.

- Potential for niche markets exists in pediatric populations and regions with limited access to newer antibiotics.

To sustain or enhance sales, manufacturers may explore differentiation strategies, including combination therapies, reformulations, or targeted marketing campaigns emphasizing safety and efficacy.

Strategic Opportunities and Risks

-

Opportunities:

- Expansion into emerging markets with improved infrastructure.

- Developing fixed-dose combination products to broaden therapeutic utility.

- Leveraging stewardship programs to promote appropriate cefprozil use.

-

Risks:

- Accelerated resistance leading to obsolescence.

- Enactment of antimicrobial restrictions.

- Competition from advanced cephalosporins and novel antibiotics.

Regulatory and Patent Landscape

The expiration of patents has opened markets to generics, which dominate sales. Future retention of market share depends on brand recognition, formulary inclusion, and physician prescribing habits. Regulatory agencies increasingly require stewardship-compatible labeling, potentially limiting indications.

Conclusion

Cefprozil’s market trajectory is characterized by gradual decline over the next five years, primarily driven by generic competition, resistance development, and evolving prescribing practices. Despite these headwinds, niche applications and expanding markets in developing economies offer avenues for sustained sales. Strategic marketing, innovation, and stewardship alignment will be critical to maximizing remaining commercial potential.

Key Takeaways

- Cefprozil remains a modest yet crucial player in the second-generation cephalosporin segment, with stable but declining global sales.

- Market growth prospects are limited; revenues are expected to trend downward at a CAGR of approximately 2-3% through 2028.

- Generic competition, resistance, and stewardship policies are principal challenges impacting future sales.

- Opportunities revolve around expanding access in emerging markets and developing combination therapies or formulations.

- Manufacturers should prioritize strategic differentiation and stewardship alignment to prolong product viability.

FAQs

-

What are the primary clinical indications for cefprozil?

Cefprozil is indicated for respiratory tract infections, skin and soft tissue infections, and otitis media caused by susceptible bacteria. -

How does cefprozil compare to other second-generation cephalosporins?

Cefprozil offers broad-spectrum activity and oral bioavailability, comparable to cefuroxime and cefaclor, but it faces competitive pressure from newer antibiotics and generic versions. -

What factors could influence cefprozil sales in the coming years?

Resistance patterns, prescribing practices, regulatory restrictions, and market penetration in emerging economies are key factors. -

Are there any recent innovations related to cefprozil?

Currently, no significant formulations or combination products have been introduced, but ongoing research explores enhancements to existing antibiotics, including cefprozil. -

What strategic options exist for pharmaceutical companies to extend cefprozil’s market life?

Developing fixed-dose combinations, targeting unmet or niche indications, expanding geographies, and aligning with stewardship programs are potential strategies.

References

- Grand View Research. Antibiotics Market Size, Share & Trends Analysis Report. 2022.

- IQVIA. The Global Use of Medicine Report. 2022.

- U.S. Food & Drug Administration. Approved Drugs Database.

- Pharmaceutical Market Reports. Cephalosporin Antibiotics Analysis. 2022.

- World Health Organization. Antimicrobial Resistance Surveillance Report. 2021.

More… ↓