CAPECITABINE Drug Patent Profile

✉ Email this page to a colleague

When do Capecitabine patents expire, and what generic alternatives are available?

Capecitabine is a drug marketed by Accord Hlthcare, Alkem Labs Ltd, Amneal Pharms, Dr Reddys, Eugia Pharma, Hetero Labs Ltd V, Hikma, MSN, Reliance Life, Rising, Shilpa, Sun Pharm, Teva Pharms Usa, and Teyro Labs. and is included in fourteen NDAs.

The generic ingredient in CAPECITABINE is capecitabine. There are twenty-eight drug master file entries for this compound. Twenty-one suppliers are listed for this compound. Additional details are available on the capecitabine profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Capecitabine

A generic version of CAPECITABINE was approved as capecitabine by TEVA PHARMS USA on September 16th, 2013.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for CAPECITABINE?

- What are the global sales for CAPECITABINE?

- What is Average Wholesale Price for CAPECITABINE?

Summary for CAPECITABINE

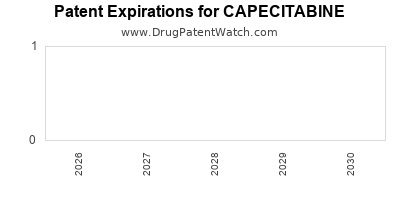

| US Patents: | 0 |

| Applicants: | 14 |

| NDAs: | 14 |

| Finished Product Suppliers / Packagers: | 20 |

| Raw Ingredient (Bulk) Api Vendors: | 85 |

| Clinical Trials: | 2,031 |

| Patent Applications: | 6,741 |

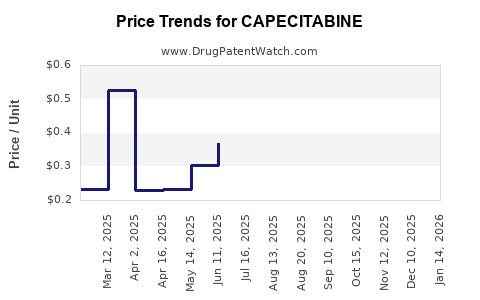

| Drug Prices: | Drug price information for CAPECITABINE |

| DailyMed Link: | CAPECITABINE at DailyMed |

Recent Clinical Trials for CAPECITABINE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Lady Davis Institute | PHASE2 |

| Tao Zhang | PHASE2 |

| Sir Mortimer B. Davis - Jewish General Hospital | PHASE2 |

Pharmacology for CAPECITABINE

| Drug Class | Nucleoside Metabolic Inhibitor |

| Mechanism of Action | Nucleic Acid Synthesis Inhibitors |

Medical Subject Heading (MeSH) Categories for CAPECITABINE

Anatomical Therapeutic Chemical (ATC) Classes for CAPECITABINE

Paragraph IV (Patent) Challenges for CAPECITABINE

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| XELODA | Tablets | capecitabine | 150 mg and 500 mg | 020896 | 1 | 2008-11-10 |

US Patents and Regulatory Information for CAPECITABINE

EU/EMA Drug Approvals for CAPECITABINE

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| medac Gesellschaft für klinische Spezialpräparate mbH | Capecitabine Medac | capecitabine | EMEA/H/C/002568Capecitabine Medac is indicated for the adjuvant treatment of patients following surgery of stage-III (Dukes’ stage-C) colon cancer.Capecitabine Medac is indicated for the treatment of metastatic colorectal cancer.Capecitabine Medac is indicated for first-line treatment of advanced gastric cancer in combination with a platinum-based regimen.Capecitabine Medac in combination with docetaxel is indicated for the treatment of patients with locally advanced or metastatic breast cancer after failure of cytotoxic chemotherapy. Previous therapy should have included an anthracycline.Capecitabine Medac is also indicated as monotherapy for the treatment of patients with locally advanced or metastatic breast cancer after failure of taxanes and an anthracycline-containing chemotherapy regimen or for whom further anthracycline therapy is not indicated. | Authorised | yes | no | no | 2012-11-19 | |

| Accord Healthcare S.L.U. | Capecitabine Accord | capecitabine | EMEA/H/C/002386Capecitabine Accord is indicated for the adjuvant treatment of patients following surgery of stage-III (Dukes’ stage-C) colon cancer.Capecitabine Accord is indicated for the treatment of metastatic colorectal cancer.Capecitabine Accord is indicated for first-line treatment of advanced gastric cancer in combination with a platinum-based regimen.Capecitabine Accord in combination with docetaxel is indicated for the treatment of patients with locally advanced or metastatic breast cancer after failure of cytotoxic chemotherapy. Previous therapy should have included an anthracycline.Capecitabine Accord is also indicated as monotherapy for the treatment of patients with locally advanced or metastatic breast cancer after failure of taxanes and an anthracycline containing chemotherapy regimen or for whom further anthracycline therapy is not indicated. | Authorised | yes | no | no | 2012-04-20 | |

| Teva Pharma B.V. | Capecitabine Teva | capecitabine | EMEA/H/C/002362Capecitabine Teva is indicated for the adjuvant treatment of patients following surgery of stage III (Dukes’ stage C) colon cancer.Capecitabine Teva is indicated for the treatment of metastatic colorectal cancer.Capecitabine Teva is indicated for first‑line treatment of advanced gastric cancer in combination with a platinum‑based regimen.Capecitabine Teva in combination with docetaxel is indicated for the treatment of patients with locally advanced or metastatic breast cancer after failure of cytotoxic chemotherapy. Previous therapy should have included an anthracycline. Capecitabine Teva is also indicated as monotherapy for the treatment of patients with locally advanced or metastatic breast cancer after failure of taxanes and an anthracycline containing chemotherapy regimen or for whom further anthracycline therapy is not indicated. | Authorised | yes | no | no | 2012-04-20 | |

| CHEPLAPHARM Arzneimittel GmbH | Xeloda | capecitabine | EMEA/H/C/000316Xeloda is indicated for the adjuvant treatment of patients following surgery of stage III (Dukes' stage C) colon cancer.Xeloda is indicated for the treatment of metastatic colorectal cancer.Xeloda is indicated for first-line treatment of advanced gastric cancer in combination with a platinum-based regimen.Xeloda in combination with docetaxel is indicated for the treatment of patients with locally advanced or metastatic breast cancer after failure of cytotoxic chemotherapy. Previous therapy should have included an anthracycline. Xeloda is also indicated as monotherapy for the treatment of patients with locally advanced or metastatic breast cancer after failure of taxanes and an anthracycline-containing chemotherapy regimen or for whom further anthracycline therapy is not indicated. | Authorised | no | no | no | 2001-02-02 | |

| Krka, d.d., Novo mesto | Ecansya (previously Capecitabine Krka) | capecitabine | EMEA/H/C/002605Ecansya is indicated for the adjuvant treatment of patients following surgery of stage-III (Dukes’ stage-C) colon cancer.Ecansya is indicated for the treatment of metastatic colorectal cancer.Ecansya is indicated for first-line treatment of advanced gastric cancer in combination with a platinum-based regimen.Ecansya in combination with docetaxel is indicated for the treatment of patients with locally advanced or metastatic breast cancer after failure of cytotoxic chemotherapy. Previous therapy should have included an anthracycline. Ecansya is also indicated as monotherapy for the treatment of patients with locally advanced or metastatic breast cancer after failure of taxanes and an anthracycline containing chemotherapy regimen or for whom further anthracycline therapy is not indicated. | Authorised | yes | no | no | 2012-04-20 | |

| Sun Pharmaceutical Industries Europe B.V. | Capecitabine SUN | capecitabine | EMEA/H/C/002050Capecitabine is indicated for the adjuvant treatment of patients following surgery of stage-III (Dukes’ stage-C) colon cancer.Capecitabine is indicated for the treatment of metastatic colorectal cancer.Capecitabine is indicated for first-line treatment of advanced gastric cancer in combination with a platinum-based regimen.Capecitabine in combination with docetaxel is indicated for the treatment of patients with locally advanced or metastatic breast cancer after failure of cytotoxic chemotherapy. Previous therapy should have included an anthracycline. Capecitabine is also indicated as monotherapy for the treatment of patients with locally advanced or metastatic breast cancer after failure of taxanes and an anthracycline-containing chemotherapy regimen or for whom further anthracycline therapy is not indicated. | Withdrawn | yes | no | no | 2013-06-21 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

Market Dynamics and Financial Trajectory for CAPECITABINE

More… ↓