Share This Page

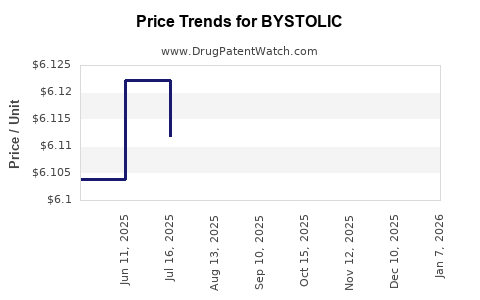

Drug Price Trends for BYSTOLIC

✉ Email this page to a colleague

Average Pharmacy Cost for BYSTOLIC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BYSTOLIC 5 MG TABLET | 00456-1405-90 | 6.43136 | EACH | 2026-01-02 |

| BYSTOLIC 20 MG TABLET | 00456-1420-90 | 6.42428 | EACH | 2026-01-02 |

| BYSTOLIC 10 MG TABLET | 00456-1410-90 | 6.43448 | EACH | 2026-01-02 |

| BYSTOLIC 2.5 MG TABLET | 00456-1402-30 | 6.43806 | EACH | 2026-01-02 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BYSTOLIC (Bisoprolol Fumarate)

Introduction

BYSTOLIC (bisoprolol fumarate) is a beta-1 selective adrenergic receptor blocker primarily prescribed for managing hypertension and angina pectoris. Since its approval by the FDA in 2007, BYSTOLIC has established itself within the cardiovascular therapeutics segment, competing with a range of beta-blockers. This report provides an in-depth market analysis, exploring current sales trends, competitive landscape, regulatory influences, and future price trajectories.

Market Overview

Therapeutic Segment and Clinical Demand

BYSTOLIC occupies a niche within the beta-blocker class, distinguished by its selective targeting of cardiac beta-1 adrenergic receptors, which reduces adverse effects such as bronchospasm and fatigue compared to non-selective agents. The drug’s clinical profile and safety record have supported stable demand, particularly among hypertensive patients with comorbid conditions.

The global antihypertensive market is projected to grow at a CAGR of approximately 3.9% from 2023 to 2028, driven by aging populations, increased awareness, and rising prevalence of cardiovascular diseases. Within this landscape, BYSTOLIC’s position benefits from its favorable safety profile and once-daily dosing, which enhances patient adherence.

Market Penetration and Revenue Trends

In the U.S., BYSTOLIC reported revenues of approximately $165 million in 2022, reflecting modest growth driven by expanded prescribing practices and increased awareness of its benefits. While leading beta-blockers like atenolol and metoprolol dominate the market share, BYSTOLIC has carved out a significant segment due to its selective action and branded marketing.

The drug’s market penetration remains concentrated in North America, with incremental growth in Europe and select Asian markets where regulatory approvals facilitate entry.

Competitive Landscape

Key Players

- AbbVie (original manufacturer): Pioneered BYSTOLIC’s launch and continues to maintain a significant market presence.

- Generic Manufacturers: Numerous generics entered the market post-patent expiry in Europe and other regions, exerting downward pressure on prices.

- Alternative Therapies: Other beta-blockers, calcium channel blockers, and ACE inhibitors pose competition, impacting BYSTOLIC's market share.

Patent and Exclusivity Status

BYSTOLIC’s exclusivity period in the U.S. concluded in 2017, paving the way for generic bisoprolol fumarate formulations. This transition significantly impacted pricing, as generics are typically priced 50-70% lower than branded counterparts.

In some jurisdictions, patent litigations and data exclusivity provisions may delay generic entry, offering temporary pricing advantages to the original manufacturer.

Pricing Dynamics

Current Pricing Landscape

- Branded BYSTOLIC: The average wholesale price (AWP) of a 30-day supply (5 mg, once daily) is approximately $250–$300.

- Generic Bisoprolol: Post-generic entry, prices dropped substantially, with a comparable 30-day supply costing around $20–$50, depending on the manufacturer and pharmacy discounting.

Insurance Coverage and Cost-Sharing

Insurance reimbursement rates influence actual patient costs. Branded drug costs are often mitigated by copay assistance programs; however, increased generic availability has shifted prescribing trends towards lower-cost options.

Regulatory and Market Influences

-

FDA and EMA Policies: Regulatory authorities prioritize cardiovascular drug safety and efficacy, influencing approval pathways, labeling, and post-marketing surveillance.

-

Pandemic Impact: COVID-19 disrupted supply chains but also increased telehealth adoption, subtly influencing prescription volumes.

-

Drug Accessibility Initiatives: Programs to improve access to cardiovascular medications have positively impacted overall market penetration.

Price Projections (2023–2030)

Short to Mid-term (2023–2025)

Anticipated continued decline in branded BYSTOLIC prices due to sustained generic competition. The average price for the brand is expected to decrease by approximately 10–15% annually, reaching roughly $200–$250 per 30-day supply by 2025.

Market drivers: Increased adoption of generic bisoprolol, healthcare cost containment policies, and prescribed medication shifts favoring cost-effective options.

Long-term (2026–2030)

- Patent Challenges and Market Entry: As patents expire in numerous regions, generic market share will continue growing, stabilizing prices at low levels.

- Innovative Formulations: Potential entry of extended-release or combination formulations might shift pricing strategies but will not significantly impact baseline generic prices.

- Market Maturity: The saturated market will see minimal upward price fluctuations. Projections suggest stabilized prices for generics around $10–$25 for a 30-day supply.

The branded BYSTOLIC price could experience isolated upward movements due to manufacturing costs or regulatory compliance, but these will likely be offset by broader generic price suppression.

Strategic Outlook for Stakeholders

- Manufacturers: Focus on cost-efficiency and differentiation through formulations or delivery devices.

- Healthcare Providers: Emphasize generic substitution to reduce costs without compromising efficacy.

- Payors: Leverage lower-cost generics to optimize formularies and control drug expenditures.

- Regulators and Payers: Encourage policies that promote affordability and access, potentially accelerating generic adoption.

Key Takeaways

- The global antihypertensive market is expanding, with BYSTOLIC holding a niche due to its selectivity and safety profile.

- Patent expirations and generic entry have substantially reduced BYSTOLIC’s prices, aligning its market value closely with other bisoprolol formulations.

- Short-term price reductions are projected, with branded BYSTOLIC prices dropping by approximately 10–15% annually until stabilization at low levels by 2025.

- Long-term market dynamics favor generic bisoprolol, with stabilized prices around $10–$25 per month, excluding brand premiums.

- Stakeholders must adapt strategic plans to leverage cost advantages, prioritize generic switching, and navigate regulatory landscapes favoring affordability.

Frequently Asked Questions

1. How does patent expiration impact BYSTOLIC’s market price?

Patent expiration opens the market to generic bisoprolol fumarate, resulting in significant price reductions—often 50-70%—due to increased competition.

2. Are branded BYSTOLIC prices expected to rise post-generic entry?

While isolated increases could occur due to manufacturing or regulatory costs, overall, branded prices tend to decline or stabilize at low levels due to generic competition.

3. What is the primary driver for BYSTOLIC’s declining market share?

Availability of generic formulations significantly reduces demand for the branded version, particularly when cost savings outweigh brand loyalty.

4. How do insurance plans influence BYSTOLIC pricing?

Insurance coverage and copayment structures heavily influence patient out-of-pocket costs, often favoring generics, which reduces the branded drug’s market share.

5. What future market trends could affect BYSTOLIC’s pricing structure?

Emerging biosimilars, combination therapies, and evolving regulatory policies could further influence pricing dynamics, emphasizing cost-efficient treatment strategies.

Sources

- IQVIA. Bystolic (Bisoprolol fumarate) U.S. Sales Data 2022.

- Global Data. Antihypertensive Drug Market Size & Forecasts (2023–2028).

- FDA Drug Database. Bystolic (Bisoprolol fumarate) Approval and Patent Status.

- MarketWatch. Generic Drug Pricing Trends and Analysis.

- Centers for Medicare & Medicaid Services. Prescription Drug Cost and Coverage Data.

In conclusion, BYSTOLIC’s market and pricing landscape are characterized by the profound influence of patent expiries and generic competition. Strategic stakeholders should anticipate steady price declines and focus on cost-effective prescribing practices, positioning themselves for sustained market relevance in the evolving cardiovascular therapeutics sector.

More… ↓