Last updated: July 27, 2025

Introduction

Bromfenac sodium is a non-steroidal anti-inflammatory drug (NSAID) primarily utilized in ophthalmology to manage postoperative inflammation and pain associated with ocular surgeries such as cataract extraction. Its unique pharmacological profile has positioned it as a key player within the ocular anti-inflammatory market. This analysis evaluates the current market landscape, growth drivers, competitive environment, regulatory influences, and future financial outlook for bromfenac sodium.

Pharmacological Profile and Clinical Application

Bromfenac sodium, marketed under brands like Xibrom and BromSite, functions as a potent cyclooxygenase (COX) inhibitor, reducing inflammation and pain by suppressing prostaglandin synthesis. Its high lipophilicity facilitates ocular penetration, enabling effective treatment of intraocular and periocular inflammation. The drug’s favorable ocular bioavailability and once-daily dosing schedule enhance patient compliance, bolstering its clinical adoption.

Market Drivers

Rising Incidence of Cataract Surgeries

The global increase in cataract surgeries is a principal growth driver. According to the World Health Organization (WHO), cataracts are responsible for approximately 51% of global blindness, with surgical interventions increasing annually [1]. The expanding aging population and improved surgical techniques contribute to this surge, necessitating effective anti-inflammatory agents like bromfenac sodium.

Advancements in Ophthalmic Therapeutics

Innovations in ophthalmic drug delivery systems and formulation enhancements, including preservative-free options, have improved drug efficacy and safety profiles. These advances attract ophthalmologists toward bromfenac sodium-based therapies for postoperative care.

Regulatory Approvals and Expanded Indications

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have approved bromfenac formulations for various ocular inflammatory conditions, widening its market scope. Ongoing clinical trials examining off-label and extended-use applications may further expand its indications.

Market Penetration of Branded and Generic Formulations

While branded products hold significant market share, the introduction of generic bromfenac sodium formulations offers cost advantages, improving access in Tier 2 and Tier 3 markets. This price competitiveness is vital for capturing emerging economies’ markets.

Competitive Landscape

The bromfenac sodium market features key players such as Alcon (BromSite), Sun Pharma (rIVA), and Novartis (Bromfenac ophthalmic solutions). The competitive environment emphasizes product differentiation through formulation improvements, preservative-free options, and combination therapies.

Alcon’s BromSite, combining bromfenac with dexamethasone, exemplifies a strategic move toward multi-mechanistic approaches for pain and inflammation management, expanding their market dominance. Meanwhile, Sun Pharma has gained significant market traction through cost-effective generic formulations.

Emerging competitors are focusing on novel delivery devices and biosimilar development to gain comparative advantages, thereby intensifying competitive pressures.

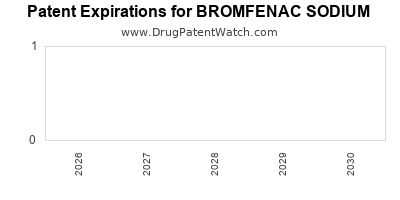

Regulatory and Patent Landscape

Patent expirations have facilitated the proliferation of generics, impacting pricing and market share dynamics. For instance, Alcon’s patents for BromSite faced challenges in key jurisdictions, paving the way for generic entrants.

Regulatory pathways for new formulations, such as preservative-free drops and sustained-release implants, are under development, aiming to improve patient outcomes and compliance.

Market Challenges

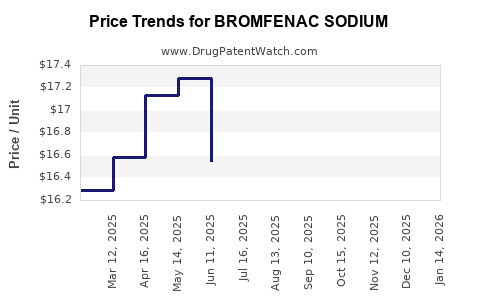

Pricing Pressures and Reimbursement Policies

Price sensitivity, especially in developing countries, constrains revenue growth. Reimbursement algorithms favor cost-effective generic options, reducing profit margins for branded products.

Safety and Tolerability Concerns

Although generally well tolerated, NSAID-associated risks such as corneal melts and delayed wound healing remain concerns. Enhanced safety profiles and clinician awareness impact prescribing patterns.

Competition from Alternative Therapies

Emerging anti-inflammatory agents, including corticosteroids and novel biologics, challenge bromfenac sodium’s market position, requiring continuous innovation and positioning strategies.

Financial Trajectory and Revenue Forecasts

Historical Market Performance

The global ophthalmic anti-inflammatory drugs market was valued at approximately USD 1.2 billion in 2020, with bromfenac sodium constituting a significant share due to its efficacy and ease of use. The market has shown compound annual growth rates (CAGR) of approximately 5-7% over the past five years [2].

Projected Growth and Revenue Streams

Forecasts suggest the bromfenac sodium market will expand at a CAGR of 6-8% through 2030, driven by increasing cataract surgeries, product innovation, and expanding geographical reach. North America currently dominates with an estimated 45% market share; however, Asia-Pacific is poised for the highest growth rates (~9-10%) due to burgeoning healthcare infrastructure and disease prevalence.

Impact of Patent Expirations and Generics

Patent expirations over the next five years will catalyze an influx of generic formulations, likely reducing branded drug revenues by 20-25%. Nevertheless, premium formulations and combination drugs will sustain profitability for key innovators.

Emerging Opportunities

Development of sustained-release implants and preservative-free drops represent new revenue avenues, potentially increasing overall market size by 10-15%. Clinical trials targeting new indications could further propel financial growth.

Strategic Outlook

To capitalize on emerging trends, pharmaceutical companies should prioritize:

- Investment in novel delivery technologies to enhance patient compliance and treatment efficacy.

- Strategic collaborations and licensing to expand geographical presence.

- R&D focused on safety enhancements and extended indications.

- Market segmentation targeting aging populations and regions with expanding ocular disease burdens.

Regulatory and Policy Influences

Evolving regulatory frameworks emphasizing drug safety and affordability will influence market dynamics. Governments promoting biosimilars and generics will accelerate price competition, necessitating agile strategic responses from market incumbents.

Conclusion

Bromfenac sodium retains a robust position in the ophthalmic anti-inflammatory space, buoyed by the rising volume of ocular surgeries and ongoing innovation. While patent expirations and competitive pressures pose challenges, strategic investments in formulation and delivery advancements, coupled with expanding global access, promise sustained growth. Companies that adapt swiftly to regulatory changes and consumer preferences, while maintaining cost-effective offerings, will dominate the evolving market landscape.

Key Takeaways

- The increasing global burden of cataracts and ocular surgeries drives demand for bromfenac sodium-based therapies.

- Innovation in formulations—especially preservative-free options—and combination therapies support market expansion.

- Patent expiries facilitate the entry of generics, exerting downward pressure on prices but creating opportunities for cost-effective alternatives.

- Strategic investments in delivery technologies and geographic expansion are critical for sustained growth.

- Regulatory shifts toward safety and affordability influence product development and market positioning.

FAQs

1. What are the primary clinical uses of bromfenac sodium?

Bromfenac sodium is primarily indicated for reducing postoperative inflammation and pain following ocular surgeries such as cataract extraction and intraocular lens implantation.

2. How does patent expiration affect the bromfenac sodium market?

Patent expirations lead to increased generic competition, reducing prices and margins for branded formulations while expanding access through more affordable options, especially in emerging markets.

3. What innovations are shaping the future of bromfenac sodium formulations?

Developments include preservative-free eye drops, sustained-release implants, and combination therapies designed to improve patient comfort, compliance, and therapeutic efficacy.

4. Which regions are expected to drive most of the growth for bromfenac sodium?

While North America currently dominates, rapid growth is anticipated in Asia-Pacific nations due to increasing surgical procedures and expanding healthcare infrastructure.

5. What are the main challenges facing bromfenac sodium market growth?

Price competition, safety concerns related to NSAID use, regulatory hurdles, and competition from alternative anti-inflammatory therapies represent significant challenges.

Sources

[1] World Health Organization (WHO). "Global Data on Visual Impairment." 2020.

[2] MarketWatch. "Ophthalmic Anti-Inflammatory Drugs Market Size, Share & Trends Analysis Report." 2022.