Last updated: July 29, 2025

Introduction

Brinzolamide, a member of the carbonic anhydrase inhibitor class, has cemented its role in ophthalmology as a key component in managing glaucoma and ocular hypertension. Developed by Alcon and approved by the FDA in 2006, brinzolamide is primarily marketed as a topical eye drop, often utilized as adjunct therapy when intraocular pressure (IOP) control is inadequate. The compound’s unique pharmacological profile and the evolving landscape of glaucoma management shape its market trajectory. This analysis dissects the current market dynamics, anticipated growth drivers, competitive landscape, and financial outlook for brinzolamide over the coming years.

Market Overview and Size

The global ophthalmic pharmaceuticals market was valued at approximately USD 19.6 billion in 2021 and is projected to surpass USD 30 billion by 2027, growing at a compound annual growth rate (CAGR) of around 6% (1). Within this segment, glaucoma medications account for a significant share, driven by the increasing prevalence of glaucoma—estimated at over 76 million globally—and the aging population. Brinzolamide primarily targets this segment, with a market share that, while relatively modest compared to first-line agents like prostaglandin analogs, remains vital due to its unique mechanism and tolerability profile.

Market Drivers

1. Rising Prevalence of Glaucoma and Ocular Hypertension

The increasing global burden of glaucoma underpins the demand for effective IOP-lowering agents. According to the World Health Organization, glaucoma is the second leading cause of blindness worldwide, emphasizing the persistent need for diverse management options (2). As the population ages—especially in developed countries—incidence rates climb, fostering sustained demand for pharmacological therapies like brinzolamide.

2. Expanding Therapeutic Portfolio and Combination Therapies

While prostaglandin analogs dominate glaucoma treatment, combination therapies incorporating brinzolamide are gaining popularity. Fixed-dose combinations (FDCs), such as brinzolamide/brimonidine or brinzolamide/timolol, enhance patient adherence and optimize IOP reduction. Regulatory approvals and strategic partnerships for FDCs bolster market adoption (3).

3. Growing Awareness and Diagnosis Rates

Enhanced screening programs and increased awareness about eye health contribute to earlier diagnosis and initiation of treatment, further expanding the market for adjunct therapies like brinzolamide.

4. Favorable Pharmacological Profile

Brinzolamide’s favorable tolerability, minimal systemic absorption, and once or twice-daily dosing reinforce its utility in long-term management, supporting sustained market demand.

Market Restraints

1. Dominance of First-Line Agents

Prostaglandin analogs such as latanoprost, bimatoprost, and travoprost command around 80% of the overall glaucoma medication market share, limiting opportunities for monotherapy sales of brinzolamide (4).

2. Competition from Alternative Drug Classes

Prostaglandin analogs, beta-blockers, alpha agonists, and emerging therapies (e.g., rho kinase inhibitors) create a highly saturated market, pressuring pricing and affecting profitability for brinzolamide.

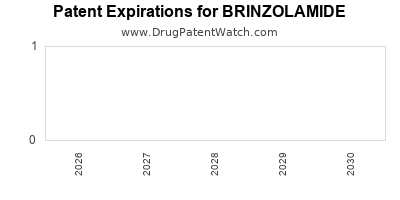

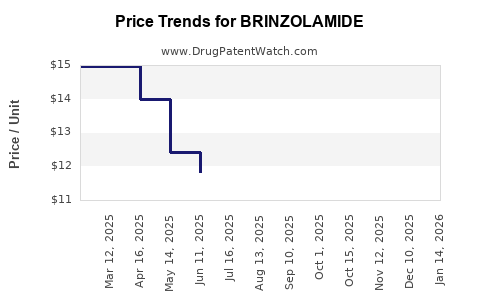

3. Patent Expiry and Generic Competition

Although brinzolamide’s patent protection is still active, upcoming patent expirations threaten price erosion and market share, prompting companies to invest in new formulations and combinations to maintain competitiveness.

4. Side Effect Profiles and Patient Preferences

While well-tolerated, some patients experience adverse effects such as bitter taste, conjunctival hyperemia, or allergic reactions, which can influence treatment choices toward other agents.

Competitive Landscape

Brinzolamide faces competition from:

- Betaxolol and other beta-blockers with established use.

- Prostaglandin analogs as first-line therapies.

- Combination products like Brimonidine/Brinzolamide (Simbrinza), which offer enhanced efficacy but face competition from other combination FDCs.

Key players include:

- Novartis (products like Cosopt, a dorzolamide/timolol FDC).

- Allergan (now AbbVie) with various combination formulations.

- Alcon, holding the primary patent for brinzolamide.

Regulatory and Research Trajectory

Regulatory agencies remain supportive of ongoing research into brinzolamide, including novel formulations (e.g., sustained-release devices) and new indications such as retinal vascular disorders, although these remain experimental. The focus on combination formulations with improved bioavailability and reduced side effects indicates an innovation-driven market evolution.

Financial Trajectory and Forecast

Revenue Projections

Considering the overall growth of the glaucoma therapeutics market and incremental uptake of combination therapies, brinzolamide’s revenues are expected to grow modestly over the next five years. A conservative CAGR of 4-6% is projected, driven by increased diagnosis rates and expanded use in combination products, despite intense competition from first-line agents.

Pricing Dynamics

Patent protections and brand recognition support premium pricing initially; however, imminent generic entry and market saturation are likely to exert downward pressure. Companies may adopt tiered pricing strategies, especially in emerging markets.

Investment in Innovation

To sustain growth, manufacturers are investing in:

- Formulation improvements: sustained-release devices.

- New combinations: targeting fixed-dose, simplified regimens.

- Biomarker-driven personalized medicine approaches to optimize treatment outcomes.

Market Entry and Expansion Strategies

Emerging markets represent high-growth opportunities due to increasing healthcare infrastructure and glaucoma awareness. Strategic licensing, local manufacturing, and tailored pricing will influence financial trajectories in these regions.

Regulatory Outlook

Regulatory pathways remain supportive for fixed-dose combinations and new formulations. Increased approval of biosimilar and generic versions poses both threats and opportunities, compelling incumbents to innovate further. Continuous monitoring of regulatory landscapes across regions like the U.S., EU, and Asia-Pacific is vital for financial forecasts.

Conclusion and Future Outlook

Brinzolamide's market is characterized by steady growth, driven primarily by the expanding prevalence of glaucoma, the adoption of combination therapies, and ongoing innovations in drug delivery systems. While facing stiff competition from prostaglandin analogs and other drug classes, its niche in adjunct therapy and favorable safety profile sustain its relevance. With strategic development and marketing efforts, interests are likely to shift toward combination products, sustained-release formulations, and expanding indications, securing its position in the evolving ophthalmic therapeutics landscape.

Key Takeaways

- The global glaucoma market is poised for steady growth, underpinning brinzolamide's continued relevance.

- Competition from first-line agents constrains standalone sales, emphasizing the importance of combination therapies.

- Patent expirations and generic entries will pressure prices, catalyzing innovation in formulation and delivery.

- Emerging markets offer significant growth prospects, provided tailored strategies are employed.

- Future success depends on R&D investments in sustained-release formulations and new combination therapies to differentiate from existing treatments.

FAQs

1. What are the main indications for brinzolamide?

Brinzolamide is primarily indicated for the reduction of IOP in patients with open-angle glaucoma or ocular hypertension, often as adjunct therapy.

2. How does brinzolamide compare to other glaucoma medications?

It offers a favorable safety profile and reduced systemic absorption compared to oral carbonic anhydrase inhibitors. However, its monotherapy efficacy is typically lower than prostaglandin analogs, making it more suitable as part of combination regimens.

3. What are the key factors influencing brinzolamide's market growth?

Increasing glaucoma prevalence, adoption of combination therapies, innovations in drug delivery, and expansion into emerging markets primarily drive growth.

4. How will patent expirations impact brinzolamide's market?

Patent expirations could lead to generic competition, exerting downward pressure on pricing and market share, incentivizing companies to develop new formulations and combination products.

5. Are there any promising new formulations of brinzolamide in development?

Yes, sustained-release eye drop formulations and novel combination products are under investigation to improve adherence and efficacy, presenting future growth opportunities.

References

[1] Market Research Future, “Global Ophthalmic Drugs Market,” 2022.

[2] World Health Organization, “Prevalence of Glaucoma,” 2020.

[3] Food and Drug Administration, “Regulatory Approvals for Glaucoma Medications,” 2019.

[4] IQVIA, “Global Ophthalmic Market Insights,” 2021.