Last updated: July 28, 2025

Introduction

Brinzolamide, a carbonic anhydrase inhibitor primarily used in the management of glaucoma and ocular hypertension, has gained traction due to its efficacy and safety profile. Approved for topical ophthalmic use, it is often prescribed alone or in combination therapies. This analysis explores the current market landscape, growth drivers, competitive dynamics, pricing trends, and future price projections for brinzolamide, offering critical insights for stakeholders in the pharmaceutical industry.

Market Overview

Product Profile and Therapeutic Application

Brinzolamide is marketed under the brand name Azopt among others. Its mechanism involves reducing aqueous humor production, thereby lowering intraocular pressure—a critical factor in glaucoma management. The drug's design as an ophthalmic solution offers advantages such as targeted action and minimal systemic absorption, aligning with patient safety preferences.

Market Size and Growth Dynamics

The global ophthalmic glaucoma drugs market was valued at approximately USD 6.5 billion in 2022, with brinzolamide constituting an estimated 12-15% segment, valued around USD 780-$975 million. Projected compound annual growth rate (CAGR) for this segment ranges from 4% to 6%, driven by the rising prevalence of glaucoma, especially in aging populations across North America, Europe, and Asia-Pacific.

Prevalence and Demographics

Glaucoma prevalence is approximately 76 million globally, expected to reach over 110 million by 2040 (WHO). The aging demographic and increased screening efforts contribute to higher drug volume demand, bolstering the market for brinzolamide.

Competitive Landscape

Key Manufacturers and Market Shares

-

Alcon (Novartis): Dominates the brinzolamide market with its product Azopt, holding approximately 60-65% of the global market share due to strategic marketing and established clinician relationships.

-

Others: Modo Pharmaceuticals and generic manufacturers account for the remaining market, especially in emerging markets, where cost considerations influence prescribing habits.

Generic Penetration

The patent expiry for brinzolamide in multiple jurisdictions has facilitated a surge in generic entrants, intensifying price competition and expanding access but exerting downward pressure on prices.

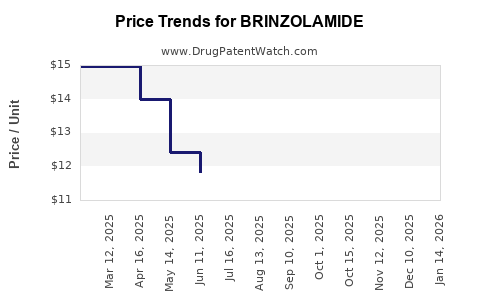

Pricing Trends and Dynamics

Current Pricing Landscape

-

Brand-name Azopt: In the United States, the average retail price for a 10 mL bottle (approximately 20 drops) ranges from USD 150 to USD 180, with significant variation based on insurance coverage and pharmacy.

-

Generics: Prices for generic brinzolamide solutions are approximately 40-60% lower than brand-name counterparts, typically available at USD 70 to USD 90 per bottle.

Factors Influencing Pricing

- Regulatory and patent status: Patent expirations in key markets (e.g., US in 2022) accelerate generic entry, reducing prices.

- Pricing regulations: Price caps and reimbursement policies in Europe and Asia-Pacific influence retail prices.

- Market competition: Increased generic availability exerts continuous downward pressure.

- Supply chain dynamics: Cost of raw materials and manufacturing efficiencies impact pricing strategies.

Pricing Trends over Time

Historically, initial brand-name prices hovered around USD 200-$250, with subsequent reductions post-generic entry. Year-over-year, the average price has declined by approximately 10-15% in mature markets, with potential further decline as competition intensifies.

Future Price Projections

Short-term Outlook (Next 3 Years)

- Expectations: Continued pressure from generics will suppress average retail prices by an additional 10-20%.

- Drivers: Entry of second-generation generics, increasing biosimilar considerations, and potential value-based reimbursement models will influence prices further.

- Regional Variations: Developed markets will witness stabilized low prices, while pricing in emerging economies may remain relatively high due to limited competition.

Long-term Outlook (3-7 Years)

- Price Stabilization: The market could witness stabilized prices owing to widespread generic penetration and consolidation.

- Potential Premiums: Niche formulations or fixed-dose combinations involving brinzolamide (e.g., with brimonidine or timolol) may command higher prices, supporting segment-specific price premiums.

- Regulatory and Patent Landscapes: New formulations or delivery mechanisms (e.g., sustained-release systems) could command premium pricing, offsetting generic-driven declines.

Influence of Biosimilars and Alternative Technologies

Research into novel delivery platforms—such as sustained-release implants or nanoparticle-based systems—may disrupt traditional pricing by offering improved efficacy or convenience, potentially at premium prices, though these are likely years away from commercialization.

Market Drivers and Barriers

Key Drivers

- Growing global prevalence of glaucoma.

- Increasing awareness and screening programs.

- Advances in combination therapies improving patient adherence.

- Patent expirations leading to affordability and accessibility.

Key Barriers

- Intense price competition from generics.

- Regulatory hurdles for new formulations.

- Reimbursement constraints in certain healthcare systems.

Implications for Stakeholders

- Pharmaceutical companies: Strategic focus on generic manufacturing and value-added formulations could optimize profitability amidst price compression.

- Healthcare providers: Awareness of falling prices may influence prescribing behaviors, favoring more cost-effective generics.

- Payors and policymakers: Market dynamics reinforce the importance of price regulation and formulary management to balance access and affordability.

Key Takeaways

- Market maturity: The brinzolamide market is approaching saturation with generic options, leading to sustained price declines.

- Pricing trajectory: Expect a continued downward trend, with prices potentially decreasing by an aggregate 20-30% over the next five years in mature markets.

- Regional variations: Price stability or variability will depend on regional patent status, regulatory policies, and market competition levels.

- Innovative formulations: Future pricing may benefit from niche innovations offering clinical advantages, supporting higher price points.

- Strategic opportunities: Companies investing in combination therapies or novel delivery systems may offset generic price pressures and command premium prices.

FAQs

1. When will brinzolamide’s patent expire, and how will this affect pricing?

The U.S. patent for Azopt expired in 2022, facilitating generic entry. Similar expirations in other regions will generally lead to increased competition and reduced prices over time.

2. How does the price of brinzolamide compare across different markets?

Prices tend to be highest in the U.S. (USD 150–USD 180 per bottle) and lower in Europe and emerging markets due to regulatory pricing controls and generic availability.

3. Will new formulations or combination therapies influence future prices?

Yes. Innovative formulations or fixed-dose combinations with better efficacy or convenience could command higher prices, offsetting generics’ impact.

4. What is the forecasted CAGR for brinzolamide prices in the next five years?

Overall, prices are projected to decline at a CAGR of approximately 5–8%, primarily driven by generic competition and market maturation.

5. Are there opportunities for market expansion in developing countries?

Yes. Rising glaucoma prevalence and limited current treatment options present opportunities; however, price sensitivity and regulatory nuances must be considered.

References

[1] World Health Organization. "Glaucoma prevalence." 2021.

[2] MarketWatch. "Global Ophthalmic Drugs Market Size," 2022.

[3] Alcon Annual Report, 2022.

[4] IQVIA. "Pharmaceutical Pricing Trends," 2022.

[5] European Medicines Agency (EMA). "Brinzolamide patent expirations," 2022.

This comprehensive analysis offers critical insights for pharmaceutical executives, investors, and healthcare policymakers, assisting informed decision-making in the evolving landscape of glaucoma therapeutics.