BRILINTA Drug Patent Profile

✉ Email this page to a colleague

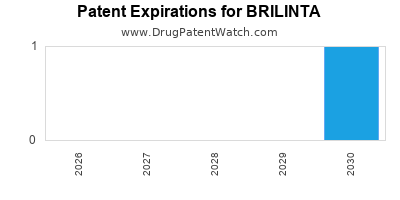

When do Brilinta patents expire, and what generic alternatives are available?

Brilinta is a drug marketed by Astrazeneca and is included in one NDA. There are three patents protecting this drug and two Paragraph IV challenges.

This drug has one hundred and forty-seven patent family members in forty-four countries.

The generic ingredient in BRILINTA is ticagrelor. There are twenty-one drug master file entries for this compound. Twenty-five suppliers are listed for this compound. Additional details are available on the ticagrelor profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Brilinta

A generic version of BRILINTA was approved as ticagrelor by WATSON LABS INC on September 4th, 2018.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for BRILINTA?

- What are the global sales for BRILINTA?

- What is Average Wholesale Price for BRILINTA?

Summary for BRILINTA

| International Patents: | 147 |

| US Patents: | 3 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 3 |

| Raw Ingredient (Bulk) Api Vendors: | 81 |

| Clinical Trials: | 89 |

| Patent Applications: | 1,606 |

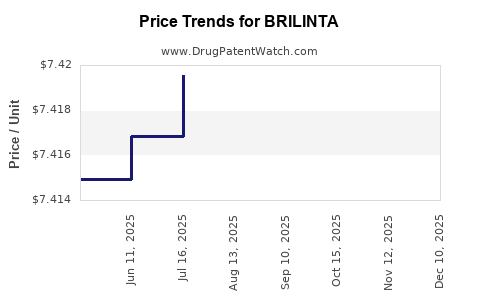

| Drug Prices: | Drug price information for BRILINTA |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for BRILINTA |

| What excipients (inactive ingredients) are in BRILINTA? | BRILINTA excipients list |

| DailyMed Link: | BRILINTA at DailyMed |

Recent Clinical Trials for BRILINTA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Yonsei University | Phase 4 |

| Medical University of South Carolina | Phase 2/Phase 3 |

| University of Cincinnati | Phase 2/Phase 3 |

Pharmacology for BRILINTA

| Drug Class | P2Y12 Platelet Inhibitor |

| Mechanism of Action | Cytochrome P450 3A4 Inhibitors P-Glycoprotein Inhibitors P2Y12 Receptor Antagonists |

| Physiological Effect | Decreased Platelet Aggregation |

Paragraph IV (Patent) Challenges for BRILINTA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| BRILINTA | Tablets | ticagrelor | 60 mg | 022433 | 3 | 2015-09-30 |

| BRILINTA | Tablets | ticagrelor | 90 mg | 022433 | 16 | 2015-07-20 |

US Patents and Regulatory Information for BRILINTA

BRILINTA is protected by three US patents and two FDA Regulatory Exclusivities.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Astrazeneca | BRILINTA | ticagrelor | TABLET;ORAL | 022433-002 | Sep 3, 2015 | AB | RX | Yes | No | 8,425,934*PED | ⤷ Get Started Free | Y | ⤷ Get Started Free | ||

| Astrazeneca | BRILINTA | ticagrelor | TABLET;ORAL | 022433-001 | Jul 20, 2011 | AB | RX | Yes | Yes | RE46276*PED | ⤷ Get Started Free | Y | ⤷ Get Started Free | ||

| Astrazeneca | BRILINTA | ticagrelor | TABLET;ORAL | 022433-002 | Sep 3, 2015 | AB | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for BRILINTA

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Astrazeneca | BRILINTA | ticagrelor | TABLET;ORAL | 022433-002 | Sep 3, 2015 | 6,251,910 | ⤷ Get Started Free |

| Astrazeneca | BRILINTA | ticagrelor | TABLET;ORAL | 022433-001 | Jul 20, 2011 | 6,251,910 | ⤷ Get Started Free |

| Astrazeneca | BRILINTA | ticagrelor | TABLET;ORAL | 022433-001 | Jul 20, 2011 | 7,250,419 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for BRILINTA

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| AstraZeneca AB | Brilique | ticagrelor | EMEA/H/C/001241Brilique, co administered with acetylsalicylic acid (ASA), is indicated for the prevention of atherothrombotic events in adult patients withacute coronary syndromes (ACS) ora history of myocardial infarction (MI) and a high risk of developing an atherothrombotic eventBrilique, co-administered with acetyl salicylic acid (ASA), is indicated for the prevention of atherothrombotic events in adult patients with a history of myocardial infarction (MI occurred at least one year ago) and a high risk of developing an atherothrombotic event. | Authorised | no | no | no | 2010-12-03 | |

| AstraZeneca AB | Possia | ticagrelor | EMEA/H/C/002303Possia, co-administered with acetylsalicylic acid (ASA), is indicated for the prevention of atherothrombotic events in adult patients with acute coronary syndromes (unstable angina, non-ST-elevation myocardial infarction [NSTEMI] or ST-elevation myocardial infarction [STEMI]); including patients managed medically, and those who are managed with percutaneous coronary intervention (PCI) or coronary artery by-pass grafting (CABG). | Withdrawn | no | no | no | 2010-12-03 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for BRILINTA

When does loss-of-exclusivity occur for BRILINTA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 2451

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 07288541

Estimated Expiration: ⤷ Get Started Free

Patent: 11205164

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0715712

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 59328

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 07002421

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1505754

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 50163

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0170694

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 19380

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 56832

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 56832

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 31939

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 6700

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 85139

Estimated Expiration: ⤷ Get Started Free

Patent: 10501554

Estimated Expiration: ⤷ Get Started Free

Patent: 14040448

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 56832

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 7966

Estimated Expiration: ⤷ Get Started Free

Patent: 5009

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 0403

Estimated Expiration: ⤷ Get Started Free

Patent: 09001853

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 4514

Estimated Expiration: ⤷ Get Started Free

Patent: 6700

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 1787

Estimated Expiration: ⤷ Get Started Free

Patent: 090425

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 013501627

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 56832

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 56832

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 76223

Estimated Expiration: ⤷ Get Started Free

Patent: 09104330

Estimated Expiration: ⤷ Get Started Free

Patent: 12153069

Estimated Expiration: ⤷ Get Started Free

Saudi Arabia

Patent: 280442

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 884

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 7162

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 56832

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 0900991

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1539467

Estimated Expiration: ⤷ Get Started Free

Patent: 090055561

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 25930

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 82772

Estimated Expiration: ⤷ Get Started Free

Patent: 0817412

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 105

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 551

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering BRILINTA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| China | 112274519 | ⤷ Get Started Free | |

| Norway | 315854 | ⤷ Get Started Free | |

| Hong Kong | 1073101 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for BRILINTA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1135391 | 1190009-9 | Sweden | ⤷ Get Started Free | PRODUCT NAME: TICAGRELOR ELLER ETT FARMACEUTISKT ACCEPTABELT SALT DAERAV; REG. NO/DATE: EU/1/10/655/001-006 20101203 |

| 1135391 | CA 2011 00013 | Denmark | ⤷ Get Started Free | PRODUCT NAME: TICAGRELOR ELLER ET FARMACEUTISK ACCEPTABELT SALT DERAF |

| 1135391 | PA2011004 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: TICAGRELORUM; REGISTRATION NO/DATE: EU/1/10/655/001 2010 12 03 EU/1/10/655/002 2010 12 03 EU/1/10/655/003 2010 12 03 EU/1/10/655/004 2010 12 03 EU/1/10/655/005 2010 12 03 EU/1/10/655/00 20101203 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for BRILINTA (Ticagrelor)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.