Last updated: July 29, 2025

Introduction

BETADINE, a well-established antiseptic brand, primarily formulated with povidone-iodine, remains a cornerstone in infection prevention and wound care. Its extensive portfolio spans topical antiseptics, gargles, and preoperative skin preparations, making it integral to both clinical and consumer settings. This analysis explores the evolving market landscape, competitive forces, regulatory influences, and financial prospects that shape BETADINE’s trajectory.

Market Overview and Key Drivers

Global Antiseptic Market Growth

The global antiseptic market has exhibited steady expansion, driven by increasing awareness of hygiene, rising surgical procedures, and the surge in infectious diseases. The World Health Organization (WHO) highlights a relentless demand for effective infection control tools, especially amid the COVID-19 pandemic, which amplified the emphasis on antiseptics [1].

Market Penetration and Consumer Trends

BETADINE’s longevity stems from its broad-spectrum antimicrobial efficacy, safety profile, and versatile applications. In emerging markets, especially India and Southeast Asia, BETADINE enjoys high brand loyalty, bolstered by the demand for affordable and trusted antiseptic solutions. Urban consumers and healthcare facilities increasingly favor antiseptics with proven efficacy, further consolidating BETADINE’s market position.

Regional Segmentation

- Asia-Pacific: The dominant region, accounting for a significant share of antiseptic consumption due to population size, healthcare infrastructure development, and improving hygiene standards.

- North America and Europe: Mature markets characterized by stringent regulations, high competition, but also greater adoption of innovative formulations and compliance standards.

Market Challenges and Competitive Dynamics

Saturated Market with Intense Competition

While BETADINE holds a significant share, it faces competition from alternatives like chlorhexidine-based antiseptics, alcohol wipes, and newer formulations touting faster action or broader antimicrobial coverage [2]. Notable competitors include brands like Savlon, Dettol, and proprietary generic products.

Regulatory Environment and Quality Standards

Stringent regulatory scrutiny influences product formulations and marketing strategies. Companies must adapt to evolving standards from agencies such as the FDA and EMA. Betadine’s ability to maintain regulatory compliance without compromising efficacy will influence its market access.

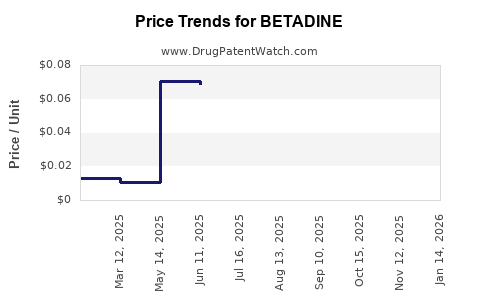

Pricing Strategies and Healthcare Policies

In price-sensitive markets, especially in low-to-middle-income countries, cost competitiveness dictates market share. Moreover, healthcare policies favoring generic competition can impact Betadine’s premium positioning and profit margins.

Technological and Formulation Innovations

Innovations such as sustained-release antiseptic formulations, combination products with analgesics, and alcohol-iodine hybrids are emerging. These developments aim to enhance efficacy, application convenience, and safety, providing avenues for BETADINE's product line expansion.

Financial Trajectory and Revenue Forecasts

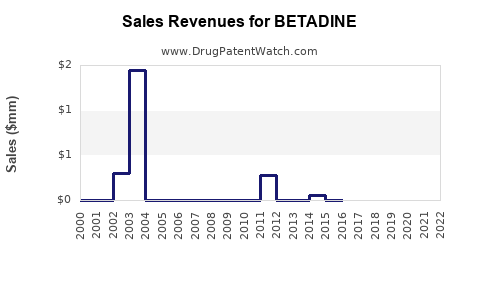

Historical Performance and Revenue Streams

As a dominant antiseptic, BETADINE’s revenues historically derive from both over-the-counter (OTC) sales and institutional procurement. Mature markets display stable, but modest, growth due to market saturation. Emerging markets show high growth potential, buoyed by increasing healthcare expenditures.

Growth Projections and Market Opportunities

- Emerging Markets: Expected to witness compound annual growth rates (CAGR) of 6-8%, driven by rising health awareness and infrastructure improvements.

- Product Line Diversification: Expanding into wound dressings, hand sanitizers, and healthcare disinfectants bolsters revenue streams, with forecasts indicating a 4-6% CAGR over next five years.

Key Financial Factors

- Pricing Flexibility: Balancing affordability and profitability remains critical amid competitive pressures.

- R&D Investment: Continuous innovation enhances market share and secures regulatory approvals, impacting expenses but supporting long-term growth.

- Supply Chain Dynamics: Stable sourcing and manufacturing capacity optimize margins amid fluctuating raw material costs, notably iodine-related compounds.

Regulatory and Market Influences on Financial Outlook

Regulatory clearances and compliance costs influence profit margins. Moreover, global health initiatives and antimicrobial stewardship programs may alter market dynamics, either through increased demand for effective antiseptics or tighter approval processes for new formulations [3].

Strategic Implications

- Market Expansion: Focused entry into untapped regions such as Africa and Latin America holds promise, particularly where hospital-acquired infections are rising.

- Product Innovation: Developing multi-functional formulations amid evolving clinical needs can differentiate BETADINE.

- Partnerships and Licensing: Collaborations with regional distributors and healthcare providers could accelerate market penetration and revenue growth.

Conclusion

BETADINE's longevity and reputation position it favorably amid a growing global antiseptic market. Its adaptability through innovation, strategic market approach, and regulatory compliance will determine its ongoing financial success. Given the rising global emphasis on infection control, especially in the wake of the COVID-19 pandemic, BETADINE’s prospects are promising, provided it navigates competitive and regulatory challenges effectively.

Key Takeaways

- The global antiseptic market is expanding, driven by infection control needs and pandemic-related health practices.

- BETADINE maintains dominance in emerging markets through brand strength, affordability, and broad application.

- Competition from alternatives and regulatory complexities necessitate continuous innovation and strategic positioning.

- Financial growth hinges on expanding in emerging economies, diversifying product lines, and optimizing supply chains.

- Regulatory compliance and market-specific adaptations remain critical to sustaining revenue and profitability.

FAQs

1. How has COVID-19 influenced the demand for BETADINE?

COVID-19 heightened global awareness of hygiene and disinfection, leading to increased sales of antiseptics like BETADINE for both personal and institutional use, especially in healthcare settings.

2. What are the main competitive advantages of BETADINE?

BETADINE’s broad-spectrum antimicrobial efficacy, trusted safety profile, and versatility across consumer and clinical applications underpin its competitive advantage.

3. Which regions offer the most growth opportunities for BETADINE?

Emerging markets in Asia-Pacific, Africa, and Latin America hold substantial growth potential due to rising healthcare infrastructure and hygiene awareness.

4. How do regulatory changes impact BETADINE’s market trajectory?

Stringent regulatory standards necessitate ongoing product reformulation and compliance efforts. Successful navigation ensures continued market access and profitability.

5. What innovations could shape BETADINE’s future?

Formulations with faster action, sustained-release antiseptics, and combination products with analgesics or moisturizers could enhance efficacy and user experience, fostering market differentiation.

References

[1] WHO. (2021). Global Guidelines for Infection Prevention and Control.

[2] Markets and Markets. (2022). Antiseptic Market by Region, Type, and Application.

[3] U.S. Food and Drug Administration. (2020). Regulations on Antiseptic Products and Efficacy Standards.