Last updated: July 28, 2025

Introduction

Baricitinib, a Janus kinase (JAK) inhibitor developed by Eli Lilly and licensed for treatment of several autoimmune diseases, has emerged as a significant pharmaceutical asset amid expanding indications and competitive landscape shifts. Originally approved for rheumatoid arthritis (RA), its repositioning for COVID-19 treatment and potential expansion into other therapeutic domains have substantially influenced its market trajectory. Understanding the intricate market dynamics and financial prospects of baricitinib requires analyzing its current regulatory status, competitive environment, clinical pipeline, and broader healthcare trends.

Regulatory Landscape and Acceptance

Baricitinib received initial approval from the U.S. Food and Drug Administration (FDA) in 2018 for moderate to severe rheumatoid arthritis, positioning it as a key competitor within the JAK inhibitor class alongside tofacitinib and upadacitinib. The FDA later granted Emergency Use Authorization (EUA) for baricitinib in combination with remdesivir for COVID-19 patients requiring supplemental oxygen or ventilation, significantly elevating its visibility and sales during the pandemic (FDA, 2020 [1]).

European Medicines Agency (EMA) approved baricitinib for RA and later expanded indications, reinforcing its global footprint. However, the drug's acceptance faces regulatory hurdles in certain markets over safety concerns—particularly relating to thrombosis and infections, which have implications for its market access and pricing strategies (EMA, 2021 [2]).

Market Demand and Therapeutic Expansion

Autoimmune Diseases

The primary revenue source remains treatment of rheumatoid arthritis, where baricitinib competes with established biologics and other oral DMARDs. The global RA market is projected to reach USD 31 billion by 2025, with a CAGR of approximately 4% (Grand View Research, 2022 [3]). Baricitinib's ability to offer oral convenience and targeted immunosuppression positions it favorably, especially among patients seeking alternatives to injectable biologics.

COVID-19 Indications

The COVID-19 pandemic catalyzed immediate demand, with baricitinib positioned as a proposed therapy to mitigate cytokine storm effects. While pandemic-related sales spiked, the sustainability of COVID-19-specific revenues remains uncertain, contingent on evolving treatment protocols and viral epidemiology. As the pandemic wanes, the focus shifts toward integrating baricitinib into treatment algorithms for other inflammatory or infectious diseases (FDA, 2020 [1]).

Emerging and Investigational Uses

Ongoing clinical trials are exploring baricitinib's potential in dermatology (atopic dermatitis), hematology (cytoproliferative disorders), and oncology. Positive trial outcomes could diversify revenue streams, especially if label expansions are approved. However, this also heightens competition and regulatory risk.

Market Dynamics and Competitive Environment

Competitive Positioning

Baricitinib faces competition from other JAK inhibitors such as tofacitinib (Xeljanz) and upadacitinib (Rinvoq). Tofacitinib, approved since 2012, commands a sizable market share, but concerns over safety profile and administration route favor newer agents. Upadacitinib's higher selectivity and promising efficacy positions it as a direct rival with a comparable target demographic.

Pricing and Reimbursement

Pricing strategies for baricitinib align with high-cost biologics and targeted synthetic DMARDs, with list prices exceeding USD 50,000 per year in developed markets. Payer negotiations and formulary placements influence actual reimbursement and accessible patient populations. During the pandemic, supplemental funding and expedited approvals temporarily alleviated some barriers but long-term pricing remains under scrutiny amid rising healthcare costs and biosimilar threats.

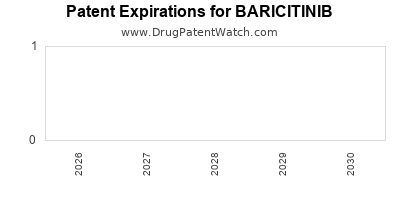

Biosimilars and Patent Expiry

Patent expirations threaten to erode market share, particularly in key markets like the EU and the US. Eli Lilly has taken strategic measures, such as patent extensions and litigation, to prolong exclusivity. Nonetheless, biosimilars of structurally similar molecules could introduce pricing pressures within the next 5-7 years, impacting revenue forecasts.

Financial Trajectory and Revenue Outlook

Historical Sales Performance

Eli Lilly reported global sales of baricitinib at approximately USD 726 million in 2021, reflecting rapid growth driven largely by COVID-19 indications and RA sales (Eli Lilly Annual Report, 2022 [4]). The pandemic's peak significantly bolstered revenue figures, but post-pandemic scenarios highlight the need for diversification and sustained demand.

Forecasted Revenue Growth

Market analysts project that, with the upcoming expansion into additional indications and geographic markets, baricitinib's revenue could potentially surpass USD 1.2 billion annually by 2025 with a compound annual growth rate (CAGR) of nearly 15%. This estimate assumes approvals in major Asian markets and successful expansion into dermatological indications, alongside steady RA sales (GlobalData, 2022 [5]).

Risks and Opportunities

Key risks include regulatory delays, safety concerns impacting market acceptance, competitive pressures from newer agents, and patent challenges. Conversely, opportunities reside in clinical trial success, label expansions, and strategic partnerships for molecular innovation.

Market Trends Influencing the Trajectory

Shift Toward Oral Small Molecules

The pharmaceutical industry’s broader move toward oral small molecules over biologics supports baricitinib's positioning, as convenience-driven patient preference enhances adherence and market penetration.

Personalized Medicine and Precision Therapies

Advances in biomarker development could facilitate more targeted use of JAK inhibitors, enabling differentiated treatment strategies and specific market segments.

Pricing Pressures and Healthcare Policies

Global healthcare expenses and cost-containment policies influence pricing strategies. Industry players must optimize value-based pricing models to sustain margins.

Digital Health and Patient Engagement

Emerging digital health tools and remote monitoring could improve patient adherence and satisfaction, indirectly elevating the commercial viability of drugs like baricitinib.

Key Takeaways

-

Market Position: Baricitinib maintains a strong position in RA therapy, bolstered temporarily by COVID-19 treatment indications, with significant growth prospects in expanding into dermatology and other inflammatory disorders.

-

Revenue Outlook: With strategic label expansions and geographic penetration, revenues could exceed USD 1.2 billion annually by 2025, driven by increased adoption and competitive differentiation.

-

Competitive Challenges: Facing fierce competition from established and emerging JAK inhibitors, alongside patent expirations, companies must navigate pricing pressures and safety concerns meticulously.

-

Regulatory and Safety Risks: Safety profiles influence market acceptance; proactive risk management and robust post-market surveillance are essential to sustain revenue streams.

-

Market Trends: The shift toward oral, targeted therapies, alongside personalized medicine, aligns with baricitinib's profile but necessitates continuous innovation and pipeline development.

Conclusion

Baricitinib's market dynamics reflect a complex interplay of regulatory approvals, competitive forces, and clinical advancements. Its financial trajectory hinges on successful pipeline expansion, strategic market positioning, and adaptation to healthcare policy shifts. While near-term growth remains promising, especially with ongoing clinical developments, long-term success depends on effectively mitigating safety concerns, patent challenges, and market competition.

FAQs

1. What are the primary therapeutic indications for baricitinib?

Baricitinib is primarily approved for rheumatoid arthritis and has received emergency authorization for COVID-19 treatment in combination with remdesivir. Ongoing trials are exploring its use in dermatology, hematology, and oncology.

2. How does the competitive landscape affect baricitinib's market share?

The presence of other JAK inhibitors like tofacitinib and upadacitinib intensifies competition, potentially impacting market share and pricing. Strategic differentiation and broadening indications are vital for sustained growth.

3. What factors could threaten the financial stability of baricitinib?

Patent expirations, safety concerns, regulatory delays, and biosimilar competition pose significant risks, potentially reducing revenues and market exclusivity.

4. How might COVID-19 impact future sales of baricitinib?

While initial pandemic-driven demand boosted sales, the decline in COVID-19 cases and treatment reliance may diminish revenues unless the drug secures solid positioning in other therapeutic areas.

5. What role does geographic expansion play in baricitinib's financial outlook?

Expanding into emerging markets, especially Asia, can significantly enhance revenues, provided regulatory hurdles and price negotiations are successfully managed.

References

[1] FDA. (2020). Emergency Use Authorization for Baricitinib.

[2] EMA. (2021). Market authorization for Baricitinib.

[3] Grand View Research. (2022). Rheumatoid Arthritis Market Size & Trends.

[4] Eli Lilly. (2022). Annual Report.

[5] GlobalData. (2022). Pharmaceutical Market Outlook.