OLUMIANT Drug Patent Profile

✉ Email this page to a colleague

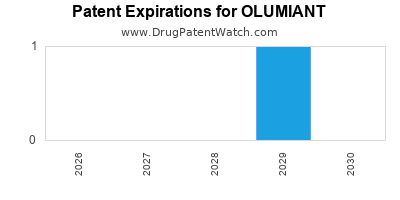

When do Olumiant patents expire, and when can generic versions of Olumiant launch?

Olumiant is a drug marketed by Eli Lilly And Co and MSN and is included in two NDAs. There are six patents protecting this drug and two Paragraph IV challenges.

This drug has one hundred and five patent family members in forty-four countries.

The generic ingredient in OLUMIANT is baricitinib. One supplier is listed for this compound. Additional details are available on the baricitinib profile page.

DrugPatentWatch® Generic Entry Outlook for Olumiant

Olumiant was eligible for patent challenges on May 31, 2022.

There have been three patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for OLUMIANT?

- What are the global sales for OLUMIANT?

- What is Average Wholesale Price for OLUMIANT?

Summary for OLUMIANT

| International Patents: | 105 |

| US Patents: | 6 |

| Applicants: | 2 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 100 |

| Clinical Trials: | 16 |

| Patent Applications: | 3,173 |

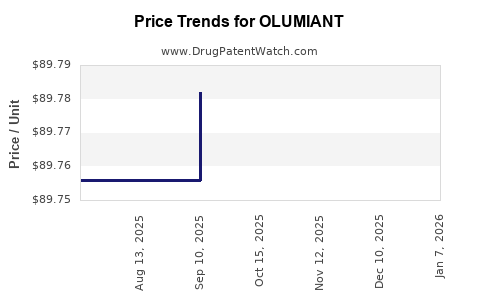

| Drug Prices: | Drug price information for OLUMIANT |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for OLUMIANT |

| What excipients (inactive ingredients) are in OLUMIANT? | OLUMIANT excipients list |

| DailyMed Link: | OLUMIANT at DailyMed |

Recent Clinical Trials for OLUMIANT

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| University of North Carolina, Chapel Hill | Phase 2 |

| Vanderbilt University | Phase 2 |

| Emory University | Phase 2 |

Pharmacology for OLUMIANT

| Drug Class | Janus Kinase Inhibitor |

| Mechanism of Action | Janus Kinase Inhibitors |

Paragraph IV (Patent) Challenges for OLUMIANT

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| OLUMIANT | Tablets | baricitinib | 4 mg | 207924 | 1 | 2023-10-03 |

| OLUMIANT | Tablets | baricitinib | 1 mg and 2 mg | 207924 | 2 | 2022-05-31 |

US Patents and Regulatory Information for OLUMIANT

OLUMIANT is protected by six US patents and two FDA Regulatory Exclusivities.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Eli Lilly And Co | OLUMIANT | baricitinib | TABLET;ORAL | 207924-002 | Oct 8, 2019 | AB | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Eli Lilly And Co | OLUMIANT | baricitinib | TABLET;ORAL | 207924-003 | May 10, 2022 | AB | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Msn | OLUMIANT | baricitinib | TABLET;ORAL | 217585-001 | Aug 8, 2025 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Eli Lilly And Co | OLUMIANT | baricitinib | TABLET;ORAL | 207924-002 | Oct 8, 2019 | AB | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for OLUMIANT

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Eli Lilly Nederland B.V. | Olumiant | baricitinib | EMEA/H/C/004085Rheumatoid arthritisBaricitinib is indicated for the treatment of moderate to severe active rheumatoid arthritis in adult patients who have responded inadequately to, or who are intolerant to one or more disease modifying anti rheumatic drugs (DMARDs). Olumiant may be used as monotherapy or in combination with methotrexate.Atopic DermatitisOlumiant is indicated for the treatment of moderate to severe atopic dermatitis in adult and paediatric patients 2 years of age and older who are candidates for systemic therapy.Alopecia areataBaricitinib is indicated for the treatment of severe alopecia areata in adult patients (see section 5.1).Juvenile idiopathic arthritisBaricitinib is indicated for the treatment of active juvenile idiopathic arthritis in patients 2 years of age and older who have had an inadequate response or intolerance to one or more prior conventional synthetic or biologic DMARDs:- Polyarticular juvenile idiopathic arthritis (polyarticular rheumatoid factor positive [RF+] or negative [RF-], extended oligoarticular),- Enthesitis related arthritis, and- Juvenile psoriatic arthritis.Baricitinib may be used as monotherapy or in combination with methotrexate. | Authorised | no | no | no | 2017-02-13 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for OLUMIANT

When does loss-of-exclusivity occur for OLUMIANT?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 12345732

Estimated Expiration: ⤷ Get Started Free

Patent: 16244212

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2014013224

Patent: inibidores de jak antivirais úteis no tratamento ou prevenção de infecções retrovirais e outras infecções virais

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 56722

Patent: INHIBITEURS DE JAK ANTIVIRAUX UTILES DANS LE TRAITEMENT OU LA PREVENTION D'INFECTIONS RETROVIRALES ET AUTRES INFECTIONS VIRALES (ANTIVIRAL JAK INHIBITORS USEFUL IN TREATING OR PREVENTING RETROVIRAL AND OTHER VIRAL INFECTIONS)

Estimated Expiration: ⤷ Get Started Free

Patent: 31037

Patent: INHIBITEURS DE JAK ANTIVIRAUX UTILES DANS LE TRAITEMENT OU LA PREVENTION D'INFECTIONS RETROVIRALES ET AUTRES INFECTIONS VIRALES (ANTIVIRAL JAK INHIBITORS USEFUL IN TREATING OR PREVENTING RETROVIRAL AND OTHER VIRAL INFECTIONS)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 4185420

Patent: Antiviral jak inhibitors useful in treating or preventing retroviral and other viral infections

Estimated Expiration: ⤷ Get Started Free

Patent: 7898790

Patent: 用于治疗或预防逆转录病毒和其它病毒感染的抗病毒JAK抑制剂 (Antiviral JAK inhibitors useful in treating or preventing retroviral and other viral infections)

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 85184

Patent: COMPOSITIONS CONTENANT DES INHIBITEURS DE JAK ET DES MÉDICAMENTS HAART DESTINÉES À LA PRÉVENTION OU AU TRAITEMENT DU VIH (COMPOSITIONS COMPRISING JAK INHIBITORS AND HAART DRUGS FOR USE IN THE PREVENTION OR TREATMENT OF HIV)

Estimated Expiration: ⤷ Get Started Free

Patent: 50544

Patent: INHIBITEURS JAK DESTINÉES À LA PRÉVENTION OU AU TRAITEMENT DES INFECTIONS VIRALES (JAK INHIBITORS FOR USE IN THE PREVENTION OR TREATMENT OF VIRAL INFECTION)

Estimated Expiration: ⤷ Get Started Free

Patent: 56010

Patent: INHIBITEURS JAK DESTINÉES À LA PRÉVENTION OU AU TRAITEMENT D'UNE MALADIE CAUSÉ PAR UNE CORONAVIRIDÉE (JAK INHIBITORS FOR USE IN THE PREVENTION OR TREATMENT OF A VIRAL DISEASE CAUSED BY A CORONAVIRIDAE)

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 14006479

Patent: INHIBIDORES ANTIVIRALES DE LA JANUS CINASA UTILES EN EL TRATAMIENTO O PREVENCION DE INFECCIONES RETROVIRALES Y OTRAS INFECCIONES VIRALES. (ANTIVIRAL JAK INHIBITORS USEFUL IN TREATING OR PREVENTING RETROVIRAL AND OTHER VIRAL INFECTIONS.)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 18133

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering OLUMIANT around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Japan | 2013155179 | ⤷ Get Started Free | |

| Japan | 6212107 | ⤷ Get Started Free | |

| Hungary | E045869 | ⤷ Get Started Free | |

| European Patent Office | 2830662 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for OLUMIANT

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2288610 | 300886 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: BARICITINIB, OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT DAARVAN; REGISTRATION NO/DATE: EU/1/16/1170 20170215 |

| 2288610 | SPC/GB17/045 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: BARICITINIB AND PHARMACEUTICALLY ACCEPTABLE SALTS THEREOF; REGISTERED: UK EU/1/16/1170/001(NI) 20170215; UK EU/1/16/1170/002(NI) 20170215; UK EU/1/16/1170/003(NI) 20170215; UK EU/1/16/1170/004(NI) 20170215; UK EU/1/16/1170/005(NI) 20170215; UK EU/1/16/1170/006(NI) 20170215; UK EU/1/16/1170/013(NI) 20170215; UK EU/1/16/1170/014(NI) 20170215; UK EU/1/16/1170/015(NI) 20170215; UK EU/1/16/1170/016(NI) 20170215; UK PLGB 14895/0255 20170215; UK PLGB 14895/0256 20170215; UK EU/1/16/1170/007(NI) 20170215; UK EU/1/16/1170/008(NI) 20170215; UK EU/1/16/1170/009(NI) 20170215; UK EU/1/16/1170/010(NI) 20170215; UK EU/1/16/1170/011(NI) 20170215; UK EU/1/16/1170/012(NI) 20170215 |

| 2288610 | C20170022 00232 | Estonia | ⤷ Get Started Free | PRODUCT NAME: BARITSITINIIB;REG NO/DATE: EU/1/16/1170 15.02.2017 |

| 2288610 | CR 2017 00032 | Denmark | ⤷ Get Started Free | PRODUCT NAME: BARICITINIB AND PHARMACEUTICALLY ACCEPTABLE SALTS THEREOF; REG. NO/DATE: EU/1 /16/1170 20170215 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for Olumiant (Baricitinib): A Comprehensive Analysis

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.