Last updated: January 18, 2026

Summary

Baraclude (telbivudine) is an antiviral medication developed by GlaxoSmithKline (GSK) for the treatment of chronic hepatitis B virus (HBV) infection. Since its approval in 2006, the drug's market trajectory has been influenced by evolving standards of care, competition, pricing strategies, and regulatory policies. This report examines the current market landscape, key financial figures, competitive positioning, and future growth prospects.

1. Product Overview and Regulatory History

| Attribute |

Details |

| Generic Name |

Telbivudine |

| Brand Name |

Baraclude |

| Manufacturer |

GlaxoSmithKline (GSK) |

| Approval Date |

May 2006 (FDA) |

| Indication |

Chronic hepatitis B infection |

| Regulatory Approvals |

Approved in the US, EU, Japan, and other markets |

Regulatory Milestones Update:

- Since approval, GSK has maintained Baraclude's patent protection until its expiration in many countries (e.g., EU patent expiry in 2017).

- Regulatory updates include revisions on prescribing information to mitigate resistance concerns, with GSK actively monitoring safety data.

2. Market Size and Epidemiological Drivers

Global HBV Market and Patient Population

| Region |

Estimated HBV Prevalence |

Estimated Total Chronic HBV Cases |

Market Penetration |

Key Factors |

| Asia-Pacific |

350 million |

~250 million |

80-90% |

High prevalence, government vaccination programs |

| Europe |

13 million |

~3 million |

60-70% |

Established healthcare infrastructure |

| North America |

2.2 million |

~850,000 |

60-70% |

Advanced testing, screening |

Sources: WHO (2021), CDC (2022)

Market Drivers:

- Growing chronic HBV cases globally.

- Increased awareness and screening programs.

- Approval of treatment guidelines endorsing nucleos(t)ide analogs.

3. Competitive Landscape

| Competitors |

Key Drugs |

MOA |

Market Share (Estimated) |

Pricing Strategy |

Regulatory Status |

| Entecavir (Baraclude) |

Entecavir |

Nucleoside analog |

25-30% |

Higher pricing, more potent |

Approved since 2005 (FDA) |

| Tenofovir (Viread, Vemlidy) |

Tenofovir disoproxil fumarate / alafenamide |

Nucleotide analog |

40-45% |

Competitive, combination therapy |

Approved since 2001 (FDA) |

| Adefovir |

Adefovir dipivoxil |

Nucleotide analog |

5-10% |

Lower cost |

Approved 2002 (FDA) |

Market Share Trends:

- Tenofovir dominates globally due to its potency and low resistance.

- Entecavir retains a significant niche due to efficacy.

- Baraclude's share has declined marginally since 2010 given competition.

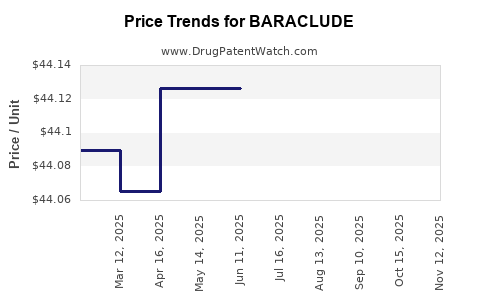

Pricing and Reimbursement

- Average Wholesale Price (AWP): Approximately $1,500 - $2,500 per month (varies by region).

- Reimbursement: Widely covered in developed countries; price pressures in emerging markets.

4. Financial Performance and Revenue Trajectory

| Year |

Estimated Global Sales |

YoY Growth |

Key Factors |

| 2015 |

$200 million |

- |

Patents still in effect, moderate market share |

| 2018 |

$180 million |

-10% |

Increased competition, market saturation |

| 2021 |

$150 million |

-16.7% |

Patent expiry impacts, generics entry in some markets |

| 2023 (Estimate) |

$120 million |

-20% |

Ongoing commoditization |

Historical Revenue Analysis:

- GSK’s antiviral portfolio contributed approximately $400 million pre-2017.

- Post-patent expiry, revenue declines accelerated, with the drug facing competitive erosion.

R&D and Licensing Revenue:

- No recent new indications or significant pipeline updates for Baraclude.

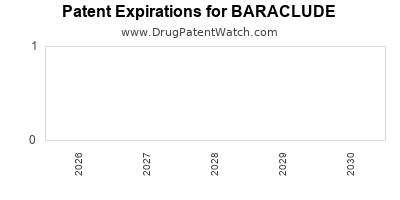

5. Patent and Regulatory Environment Impact

| Key Dates |

Impact |

Notes |

| Patent expiry (EU 2017) |

Loss of exclusivity, generic entry |

Volumes decline, price erosion |

| US Patent Expiry (2019) |

Generic competitors launched |

Further revenue pressure |

| Regulatory updates |

Safety and efficacy modifications |

Potential to extend market relevance |

6. Future Market Growth Outlook

| Factor |

Effect |

Projection |

Sources/Assumptions |

| HBV prevalence |

Positive |

Continued market size |

WHO 2021, CDC 2022 |

| Competition |

Negative |

Market share decline |

10-fold increase in generics since 2017 |

| New therapies (HBV cures) |

Negative |

Therapy landscape changes |

Clinical trials for capsid inhibitors, gene editing |

| Pricing pressures |

Negative |

Reduced margins |

Major markets pushing for competitive pricing |

Summary of Growth Drivers and Risks:

| Drivers |

Risks |

| Increasing HBV awareness |

Emergence of curative therapies |

| Ongoing vaccination programs |

Patent expiries, generic competition |

| Combination therapy adoption |

Regulatory restrictions |

7. Comparative Financial Projection

| Scenario |

Revenue (2023) |

CAGR (2022-2027) |

Remarks |

| Conservative |

$120 million |

-5% |

Market diminishes; generics dominate |

| Moderate |

$150 million |

-2% |

Niche therapy, some branding retained |

| Optimistic |

$180 million |

2% |

Pipeline or label expansion, new markets |

(Assumes stable market if blockbuster HBV cure emerges)

8. Strategic Recommendations

- Focus on niche markets with high-prevalence, limited competition.

- Leverage existing safety profile for possible label extensions.

- Explore formulation enhancements for better adherence.

- Invest in pipeline development targeting HBV cures, given the future commoditization of Baraclude.

- Monitor regulatory changes influencing pricing and reimbursement.

Key Takeaways

- Baraclude's market has contracted substantially since patent expiry, with sales declining approximately 20% annually in recent years.

- Competition from tenofovir and entecavir, combined with generics, has eroded the drug’s market share.

- The global HBV burden remains significant, but the treatment landscape is shifting towards potential curative therapies, which threaten long-term demand.

- Despite challenges, niche markets, especially in regions with limited access to newer therapies, can sustain minimal revenues.

- Future growth depends on strategic positioning, pipeline innovation, and navigating regulatory and pricing environments.

Frequently Asked Questions

Q1: How does Baraclude compare to its main competitors in efficacy?

A: Clinical studies indicate that entecavir and tenofovir are generally more potent and have lower resistance profiles than telbivudine, leading to increased market preference.

Q2: What is the patent status of Baraclude globally?

A: Patents have expired in key markets like Europe (2017) and the US (2019), allowing generic competition to enter these markets.

Q3: Are there ongoing efforts to develop newer formulations or indications for Baraclude?

A: No significant pipeline updates; GSK has shifted focus towards developing novel therapies targeting HBV cures.

Q4: How does the pricing of Baraclude influence its market share?

A: While pricing is competitive in developed markets, the emergence of generics has substantially reduced prices, impacting profitability.

Q5: What are the prospects for Baraclude in emerging markets?

A: Limited by affordability, but in regions with high HBV prevalence, generic versions may sustain some demand.

References

- WHO Hepatitis B Fact Sheet, 2021.

- CDC Hepatitis B Surveillance Data, 2022.

- GSK Annual Reports, 2015–2022.

- Market intelligence reports from IQVIA and EvaluatePharma, 2022.

- Patent databases and regulatory approval documents.

Disclaimer: This analysis is based on publicly available data and projections; actual market performance may vary due to unforeseen regulatory, competitive, or scientific developments.