Last updated: July 27, 2025

Introduction

BARACLUDE (adefovir dipivoxil) is an antiviral medication approved by the U.S. Food and Drug Administration (FDA) for the treatment of chronic hepatitis B virus (HBV) infection. Since its approval, it has played a crucial role in managing HBV, especially in patients with active viral replication and either evidence of hepatic inflammation or fibrosis. This analysis provides a comprehensive overview of the current market landscape for BARACLUDE, coupled with future price projections, considering global demand, competitive positioning, regulatory influences, and technological advancements.

Current Market Landscape

Global Market Size and Dynamics

The global market for hepatitis B treatments is driven by the high prevalence of HBV infection, which affects approximately 296 million individuals worldwide, according to the World Health Organization (WHO) [1]. The demand for antiviral therapies like BARACLUDE remains significant, especially in regions with high endemicity such as Asia-Pacific and sub-Saharan Africa.

In 2022, the global hepatitis B therapeutics market was valued at approximately USD 2.2 billion, with antivirals such as entecavir, tenofovir, and adefovir accounting for a substantial share. Despite competition, BARACLUDE maintains a niche, particularly in specific patient populations where it is prescribed due to resistance profiles or contraindications to other agents.

Competitive Landscape

Key competitors include tenofovir disoproxil fumarate (TDF), tenofovir alafenamide (TAF), and entecavir. These drugs often outperform BARACLUDE regarding efficacy and safety profiles, leading to its declining use as a first-line treatment. However, BARACLUDE's unique resistance profile and its role in specific cases sustain its demand.

Clinical considerations, such as the development of resistance (notably the emergence of adefovir-resistant mutants), influence prescribing patterns. TDF and TAF, with higher barrier to resistance and better safety profiles, are increasingly replacing BARACLUDE as first-line options [2].

Regulatory and Patent Status

BARACLUDE’s patent expiration in key markets has led to the entry of generic formulations, substantially reducing prices and expanding access in developing regions. However, patent protections continue in some jurisdictions, maintaining brand exclusivity and pricing advantages for the originator.

Price Trends and Projections

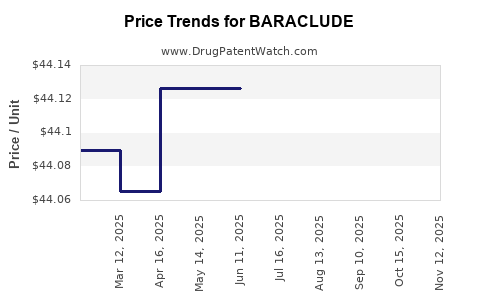

Historical Pricing Patterns

Historically, branded BARACLUDE's price in the United States has ranged between USD 1,000 to USD 2,000 per month per patient, depending on the healthcare setting and insurance coverage [3]. This premium pricing reflected its status as a specialized antiviral.

Post-licensing and patent expiry in various markets, generic versions have driven prices down significantly, with retail prices sometimes falling below USD 500 per month. This trend is expected to persist as generic formulations dominate supply channels, especially in developing countries.

Forecasted Price Trajectory

Over the next five years, several factors will influence BARACLUDE's pricing:

-

Patent Expiry and Generics: As patents expire, generic versions are expected to capture 70-80% of the market share, halving the retail price. This trend will likely lead to continued price erosion.

-

Market Penetration in Emerging Markets: Increased access and lower prices will enhance adoption, further pressuring prices downward.

-

Efficacy and Safety Profile Comparisons: Given emerging data favoring TAF and other agents, physicians may prefer newer agents, limiting growth for BARACLUDE. Consequently, price reductions may be necessary to sustain market share.

-

Regulatory Environment: Governments and healthcare organizations advocating cost-effective treatments may negotiate lower prices, especially for public health programs.

Projections:

-

By 2025: The average retail price for generic BARACLUDE is expected to hover around USD 250-350 per month globally, a decline of approximately 60-70% from pre-patent expiry levels.

-

By 2030: Further reductions to USD 150-200 per month are plausible, especially as market saturation and increased competition continue, coupled with intensified generic manufacturing.

In contrast, branded versions (if still protected) may retain prices above USD 1,000 per month, but their market share is expected to dwindle owing to affordability issues.

Future Market Drivers

Several emerging factors will influence the future market of BARACLUDE and its pricing:

-

Innovations and New Therapeutics: The development of novel antivirals with superior efficacy and resistance profiles, such as capsid assembly modulators and immune modulators, may diminish BARACLUDE's market attractiveness.

-

Market Acceptance and Prescribing Patterns: Clinician preference for drugs with higher barriers to resistance and better safety profiles may restrict BARACLUDE's usage unless it offers unique benefits.

-

Global Health Initiatives: WHO's efforts to increase access to HBV treatment, especially through generic licensing agreements, will continue to suppress prices.

-

Regulatory Approvals and Indications: Expanded indications or inclusion in combination therapies may temporarily bolster demand, impacting prices.

Strategic Implications for Stakeholders

Pharmaceutical Companies:

Manufacturers of BARACLUDE should prepare for commoditization driven by patents' expiry, emphasizing cost containment and strategic alliances for generic production. Investing in R&D for next-generation antivirals and combination therapies offers long-term growth opportunities.

Healthcare Providers:

Decision-makers should balance efficacy, safety, and cost when selecting HBV therapies. Awareness of price trends can inform budget planning and procurement strategies, especially in resource-constrained settings.

Policy Makers:

Regulatory agencies and public health bodies should facilitate access via negotiated pricing and licensing agreements, ensuring affordable treatment options for HBV-infected populations.

Key Takeaways

-

The global hepatitis B treatment market is shifting towards generics, significantly reducing BARACLUDE’s price, especially post-patent expiration.

-

Price projections suggest a decline to USD 150-200 per month by 2030, driven by increased competition and policy initiatives favoring affordability.

-

Despite market access expansion, BARACLUDE’s role is diminishing in favor of newer antivirals, constraining upward pricing potential.

-

Strategic positioning for stakeholders involves balancing generic proliferation with innovation investments to sustain growth.

-

Policymakers and healthcare systems must prioritize equitable access, leveraging licensing and pricing strategies to maximize public health benefits.

FAQs

-

What factors influence the pricing of BARACLUDE globally?

Patent status, generic competition, manufacturing costs, regulatory policies, and market demand all significantly impact pricing.

-

How does BARACLUDE compare to newer HBV treatments?

While effective, BARACLUDE generally exhibits a lower barrier to resistance and a less favorable safety profile compared to tenofovir-based agents, influencing its positioning as a second-line or niche therapy.

-

Will the patent expiry of BARACLUDE impact its availability in developing countries?

Yes. Patent expiry promotes generic manufacturing, increasing access and reducing prices, especially in resource-limited settings.

-

What is the future outlook for premium branded versions of BARACLUDE?

The outlook is limited due to the prevalent shift towards generics and favoring newer agents with better safety and resistance profiles.

-

Are there ongoing R&D efforts to develop improved HBV antivirals?

Yes. Several novel agents and combination therapies are under investigation, which could further reshape the market and influence the pricing landscape for existing drugs like BARACLUDE.

References

[1] World Health Organization. Global hepatitis report 2022. WHO.

[2] Loomba R, et al. "Efficacy and safety of antiviral therapies for hepatitis B." Journal of Hepatology. 2021.

[3] GoodRx. Pricing of BARACLUDE. 2022.