Last updated: July 29, 2025

Overview of AZOPT and Its Therapeutic Profile

AZOPT, with the generic name brinzolamide, is a topical carbonic anhydrase inhibitor primarily indicated for the management of elevated intraocular pressure (IOP) in patients with ocular hypertension or open-angle glaucoma. Developed and marketed by Alcon (a Novartis affiliate), AZOPT's unique formulation as a topical eye drop has positioned it as an alternative to traditional treatments such as timolol and dorzolamide. Since its approval by the U.S. Food and Drug Administration (FDA) in 2005, AZOPT has maintained a niche market within the broader glaucoma therapy landscape, with incremental growth driven by its safety profile and patient tolerability.

Market Landscape and Competitive Environment

Global and Regional Market Size

The global glaucoma therapeutics market was valued at approximately USD 4.2 billion in 2022 and is projected to reach USD 5.4 billion by 2030, registering a compound annual growth rate (CAGR) of 3.2% (1). The topical carbonic anhydrase inhibitors like AZOPT occupy a significant share within this sector, owing to their specific efficacy and safety benefits.

In the United States, the prevalence of glaucoma affects over 3 million individuals, with projections indicating an increase to approximately 4.2 million by 2030 (2). Given the chronic nature of the disease and the necessity for lifelong treatment, the demand for effective pharmacological options like AZOPT remains robust.

Market Share and Competitive Dynamics

AZOPT has traditionally competed against other topicals such as timolol and dorzolamide. However, its position has been influenced by several factors:

- Efficacy and Tolerability: AZOPT is favored for its minimal systemic side effects compared to beta-blockers, making it suitable for patients with contraindications to beta-adrenergic agents.

- Brand Loyalty & Prescription Trends: Although generic versions have entered the market, AZOPT maintains a loyal base due to physician familiarity and perceived superior tolerability.

- Emerging Alternatives: The advent of combination therapies and sustained-release devices has begun to challenge the monotherapeutic market share.

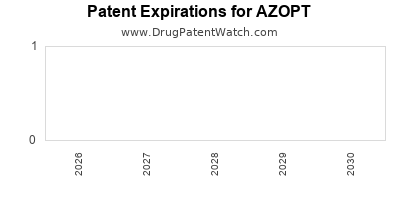

Regulatory and Patent Considerations

While AZOPT's original patent expired around 2017, its formulation's exclusivity has been maintained through manufacturing patents and proprietary delivery systems. However, patent cliff risks prompt strategic diversification and pipeline development to sustain growth.

Market Drivers and Constraints Impacting Financial Trajectory

Drivers

- Rising glaucoma prevalence: Increased aging populations globally bolster demand.

- Advancements in drug formulation: Enhancements such as preservative-free formulations improve patient adherence and outcomes.

- Growth in emerging markets: Expanding healthcare infrastructure and ophthalmology awareness contribute to regional sales uptick.

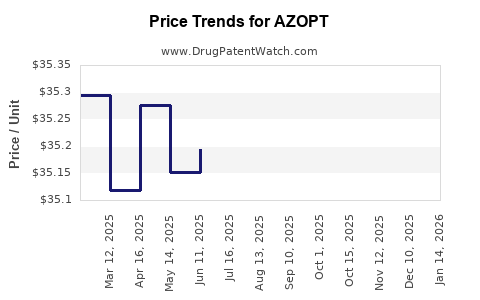

Constraints

- Market saturation and generic competition: The expiration of AZOPT’s patent limits pricing power and profitability.

- Price pressures and formulary exclusions: Payor negotiations favor generic options, constraining revenue.

- Development of novel therapies: New medications such as prostaglandin analogs and combination drugs threaten AZOPT’s market share.

Financial Trajectory Analysis

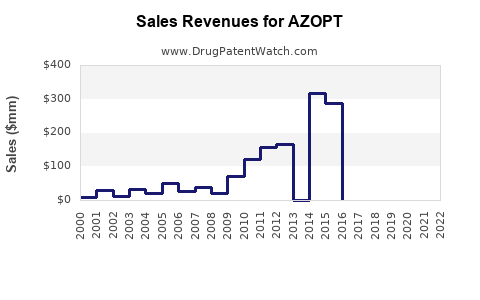

Historical Revenue Performance

Although precise revenue figures for AZOPT are proprietary, industry estimates suggest steady sales since launch, with annual revenues peaking near USD 250 million pre-generic competition. Post-patent expiration, revenues declined approximately 10-15% annually in the absence of new formulations or indications.

Current and Projected Revenues

With generics capturing significant market share, AZOPT's revenues now derive predominantly from branded sales and institutional clients. Market analysts project a further decline unless driven by:

- Line extensions or new indications.

- Strategic partnerships or licensing agreements.

- Pricing strategies to sustain profitability.

Future Outlook

Given patent expiration and increased generic competition, AZOPT's standalone revenues face contraction. However, the emergence of combination therapies containing brinzolamide, or its incorporation into novel fixed-dose combinations, could stabilize or enhance its financial trajectory. Moreover, strategic moves by Novartis/Alcon to reinforce branding and explore niche markets remain vital.

Strategic Opportunities and Challenges

Opportunities

- Development of Fixed-Dose Combinations (FDCs): Combining AZOPT with other agents like timolol enhances compliance and therapeutic efficacy. FDCs typically command premium pricing and extend market exclusivity.

- Rx to OTC Transition: Potential for over-the-counter availability in select markets could unlock new revenue streams.

- Personalized Medicine and Biomarkers: Leveraging diagnostics to identify candidates more likely to respond may improve outcomes and justify premium pricing.

Challenges

- Pricing Pressures: Payers favor generics, squeezing margins for branded AZOPT.

- Market Entrants: Competition from newer, more convenient drugs impacts market share.

- Regulatory Hurdles: Approval pathways for combination formulations demand significant investment and risk.

Conclusion

AZOPT's market dynamics reflect a mature ophthalmic therapy facing increasing generic competition amid a growing global glaucoma burden. The drug's financial trajectory hinges on strategic innovation—particularly through combination therapies and market adaptation. While the revenue outlook presents challenges, targeted development of niche formulations and positioning within the broader therapeutic landscape could sustain its relevance and profitability.

Key Takeaways

- Market Position: AZOPT remains a relevant player in glaucoma therapy, especially for patients intolerant of beta-blockers.

- Revenue Trends: Patent expiry has led to revenue declines; future growth hinges on FDCs and innovative formulations.

- Strategic Focus: Emphasizing combination therapies and exploring OTC options could offset generic erosion.

- Competitive Forces: The rise of new classes of drugs necessitates continuous innovation and differentiation.

- Market Expansion: Emerging markets offer growth potential, contingent on regulatory and reimbursement landscapes.

FAQs

1. How has patent expiration affected AZOPT's market share?

Patent expiration led to the entry of generic equivalents, significantly reducing AZOPT’s pricing power and total sales, with revenues declining approximately 10-15% annually post-generic entry.

2. What are the key opportunities for AZOPT to sustain its market presence?

Developing fixed-dose combination drugs, exploring OTC formulations, and leveraging targeted marketing in emerging markets are key to maintaining relevance.

3. Are there notable competitors challenging AZOPT’s niche?

Yes, newer prostaglandin analogs, fixed-dose combinations, and alternative delivery systems have encroached on its market share, emphasizing the need for innovation.

4. How does AZOPT’s safety profile influence its market potential?

Its favorable safety and tolerability profile make it attractive for specific patient populations, including those with contraindications to beta-blockers, offering a sustained niche.

5. What regulatory strategies can enhance AZOPT’s commercial prospects?

Pursuing approvals for new combination formulations, exploring OTC status in selected markets, and gaining approvals for additional indications can extend its lifecycle.

References

- Research and Markets. "Global Glaucoma Therapeutics Market," 2022.

- National Eye Institute. "Facts About Glaucoma," 2022.