Last updated: July 30, 2025

Introduction

The pharmaceutical landscape for rare and orphan diseases is undergoing transformative shifts driven by innovative therapies, regulatory incentives, and evolving market demands. ALSUMA, a clinical-stage therapeutic targeting specific neurological disorders—particularly amyotrophic lateral sclerosis (ALS)—epitomizes this evolving paradigm. Understanding its market dynamics and financial trajectory requires analysis of current clinical progress, regulatory pathways, competitive landscape, pricing strategies, and market access considerations.

Clinical and Regulatory Milestones Impacting ALSUMA

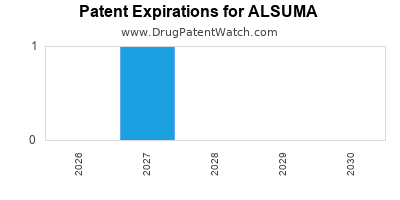

ALSUMA’s potential value stems from its innovative mechanism of action and promising preliminary clinical data. Currently in Phase II/III development, ALSUMA’s therapeutic focus addresses unmet medical needs in ALS management, a rapidly evolving field characterized by accelerated regulatory pathways under Orphan Drug and Fast Track designations by agencies such as the FDA and EMA. These incentives expedite approval timelines and extend market exclusivity, thereby influencing ALSUMA’s potential financial trajectory.

The regulatory environment significantly influences ALSUMA’s market access prospects. The FDA’s Orphan Drug designation confers a seven-year exclusivity period upon approval, incentivizing investment and elevating market anticipation. Parallel regulatory strategies in Europe and Asia further bolster global commercialization prospects, adding layers to the market dynamics (see [1]).

Market Size and Epidemiological Landscape

ALS (amyotrophic lateral sclerosis) affects approximately 2 per 100,000 individuals worldwide, translating to an estimated 160,000 patients globally. The disease's progressive nature, limited treatment options, and high-demand for neuroprotective therapies create sizable commercial opportunities.

The U.S. market alone is projected to reach $600 million to $1 billion annually by 2030, assuming successful commercialization, driven by increasing diagnosis rates, improved clinician awareness, and willingness for advanced therapies. European and Asian markets collectively add substantial revenue potential, with Asia’s emerging healthcare infrastructure and increasing disease awareness poised to expand ALS treatment adoption (see [2]).

Competitive Landscape and Market Penetration Challenges

The industry landscape features established treatments such as riluzole and edaravone, which offer modest survival benefits. Emerging pipeline drugs, including gene therapies and neuroprotective agents like ALSUMA, face competition from both small molecules and biologics.

Barriers to market penetration include high clinical trial costs, strict regulatory requirements, and the inherently complex nature of neurological disease trials. Pricing acceptance remains a challenge, particularly for high-cost therapies addressing small patient populations. Market access negotiations, reimbursement policies, and patient advocacy also shape ALSUMA’s financial outlook.

The competitive positioning hinges on demonstrating superior efficacy, safety, and cost-effectiveness. Strategic partnerships with healthcare providers and payers can facilitate faster adoption and reimbursement.

Pricing and Reimbursement Strategies

Pricing strategies for ALSUMA must balance recouping R&D investments with patient affordability and payer acceptance. Orphan drugs typically command premium prices—ranging from $100,000 to over $300,000 annually—subject to reimbursement negotiations.

Innovator companies increasingly adopt value-based pricing models, demonstrating clinical benefit to justify high prices. Payer engagement before launch can expedite reimbursement and coverage decisions, ensuring revenue flow post-approval.

Financial Trajectory and Investment Outlook

The financial trajectory for ALSUMA hinges on clinical trial outcomes, regulatory approvals, market entry speed, and commercialization execution. An optimistic scenario entails FDA breakthrough designation, accelerated approval, and subsequent rapid market penetration.

In such instances, revenues could scale to hundreds of millions within 3-5 years post-approval, assuming a conservative market share of 10-20%. Early-stage investor interest is high, driven by pipeline promises and regulatory support, but risks associated with clinical failure or delayed regulatory decisions temper valuations.

Conversely, clinical setbacks or adverse safety profiles could significantly impair financial prospects. The high costs associated with neurology drug development—estimated upwards of $2 billion per approved therapy—highlight the importance of strategic funding, partnerships, and efficient trial designs.

Emerging Trends and Future Outlook

Several key trends could influence ALSUMA’s long-term financial trajectory:

- Personalized Medicine: Genetic profiling may enable targeted therapy, increasing efficacy and market penetration.

- Combination Therapies: Synergistic approaches with existing drugs could amplify therapeutic benefits, expanding indications.

- Digital Health Integration: Remote monitoring and patient-reported outcomes could facilitate faster trials, reduce costs, and improve data quality.

- Global Market Expansion: Entering emerging markets with growing healthcare infrastructure can diversify revenue streams.

The evolving regulatory landscape, combined with the increasing prevalence of neurodegenerative diseases and technological innovation, positions ALSUMA favorably but necessitates vigilant competitive and financial management.

Key Takeaways

- Regulatory incentives, such as orphan drug designation, significantly enhance ALSUMA’s market attractiveness and financial prospects.

- The size of the ALS patient population offers substantial revenue potential, tempered by high treatment costs and reimbursement hurdles.

- Competitive landscape analysis is essential to position ALSUMA effectively amid existing therapies and pipeline advancements.

- Strategic pricing and reimbursement negotiations are critical components for realizing expected revenues.

- Clinical success and regulatory approval are pivotal milestones dictating ALSUMA’s return on investment and market penetration.

FAQs

1. What is the current clinical status of ALSUMA?

ALSUMA is in Phase II/III clinical trials targeting ALS and related neurodegenerative disorders, with promising preliminary efficacy data and regulatory designations that could expedite approval.

2. How do orphan drug designations impact ALSUMA’s market potential?

Orphan status provides market exclusivity, financial incentives, and regulatory support, which can substantially accelerate time to market and boost revenue prospects.

3. What challenges could delay ALSUMA’s financial growth?

Regulatory setbacks, clinical trial failures, safety concerns, high development costs, or unfavorable reimbursement negotiations could impair commercialization timelines and revenue potential.

4. How does market competition influence ALSUMA’s financial trajectory?

Existing treatments with modest benefits and emerging pipeline therapies create a competitive environment that pressures pricing, market share acquisition, and adoption speed.

5. What future trends could enhance ALSUMA’s profitability?

Advancements in personalized medicine, digital health integration, strategic alliances, and global market expansion are likely to positively influence ALSUMA’s long-term financial trajectory.

References

[1] U.S. Food and Drug Administration (FDA). Orphan Drug Designation Program. 2022.

[2] GlobalData. Neurodegenerative Disease Market Analysis. 2022.