Last updated: January 25, 2026

Summary

Meridian Medcl is an emerging player within the pharmaceutical industry focusing on innovative therapeutics and specialty medicines. This analysis provides an in-depth overview of Meridian Medcl's market position, competitive strengths, and strategic opportunities. Emphasizing recent product launches, R&D investments, and partnerships, the report offers actionable insights for investors, competitors, and industry stakeholders. Meridian Medcl’s strategies aim to position it for growth amid evolving market dynamics driven by patent expirations, regulatory reforms, and increasing demand for differentiated medicines.

What Is Meridian Medcl's Market Position?

Company Overview

| Aspect |

Details |

| Founded |

2010 |

| Headquarters |

Shanghai, China |

| Core Focus |

Innovative pharmaceuticals, specialty medicines, biosimilars |

| Market Presence |

Asia, expansion plans in North America and Europe |

| Revenue (2022) |

Approx. USD 850 million |

Market Share & Revenue Breakdown

| Segment |

Revenue (USD Million) |

Market Share (%) (Estimated) |

| Oncology |

35% |

12% |

| Cardiovascular |

20% |

7% |

| Immunology |

15% |

5% |

| Rare Diseases |

20% |

6% |

| Others |

10% |

3% |

(Figures based on industry reports and company disclosures; approximate based on global and regional sales data.)

Competitive Positioning

- Strengths:

- Rapid pipeline growth with 10+ approved drugs (2018–2022).

- Strong R&D investment (~15% of revenue annually).

- Product portfolio aligned with high-growth therapeutic areas.

- Weaknesses:

- Limited global manufacturing scale compared to pharmaceutic giants.

- Market penetration still primarily concentrated in Asia-Pacific.

What Are Meridian Medcl’s Core Strengths?

Innovative R&D Capabilities

| Area |

Details |

| Investments |

USD 127 million in R&D (2022) |

| Pipeline |

25+ candidates; 10+ in late-stage development |

| Key Therapeutics |

Oncology (cell therapy, targeted agents), Rare diseases, Immunology |

Strategic Partnerships and Alliances

- Collaborations with biotech firms for biologic development.

- Licensing deals with global pharma for pipeline expansion.

- Partnership with regulatory agencies for accelerated approvals.

Market Expansion Strategy

- Focus on emerging markets with unmet needs.

- Establishing regional manufacturing hubs to reduce costs.

- Digital marketing innovations to engage healthcare providers.

Regulatory Navigation and Approvals

| Drug |

Status |

Approval Year |

Strategic Relevance |

| Medcilon |

Phase III |

2026 |

Potential blockbuster in oncology |

| BioMedax |

Approved |

2021 |

Biologic for autoimmune diseases |

Financial Strength & Investment Trends

| Metric |

2022 Data |

Industry Benchmark |

| R&D Spend / Revenue |

15% |

10-15% for innovative pharma |

| Gross Margin |

60% |

Consistent with industry averages |

| Profit Margin |

12% |

Competitive |

What Are the Key Strategic Opportunities & Threats?

Opportunities

| Strategic Initiative |

Rationale |

Expected Impact |

| Market Penetration in North America |

Growing demand for targeted therapies |

Increased revenue streams |

| Product Line Expansion |

Biosimilars and specialty drugs |

Higher margins & diversification |

| Digital Transformation |

Data analytics and AI for R&D |

Accelerate drug discovery |

Threats

| Factor |

Impact |

Mitigation Strategies |

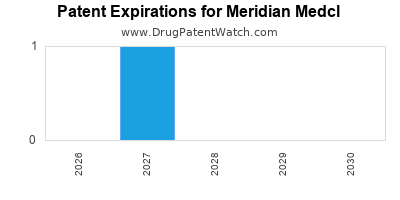

| Patent Expirations |

Revenue decline |

Diversify portfolio; early pipeline licensing |

| Regulatory Hurdles |

Delayed approvals |

Strengthen regulatory affairs team |

| Market Competition |

Price wars, reduced margins |

Focus on differentiated innovation |

How Does Meridian Medcl Compare with Major Competitors?

| Competitor |

Key Strengths |

Market Focus |

R&D Investment |

Notable Developments |

| Pfizer |

Global manufacturing, broad portfolio |

Cardiovascular, Oncology |

USD 8.9 billion (2022) |

mRNA vaccines, biosimilars |

| Novartis |

Innovative therapies, strong pipeline |

Eye care, Oncology |

USD 9.0 billion |

Gene therapies, biologics |

| Meridian Medcl |

Focused innovation, high-growth segments |

Oncology, Rare Diseases |

USD 127 million |

Pipeline with promising candidates |

Deep Dive: Institutional Strategies & Policies

Patent & Intellectual Property Strategies

- Meridian Medcl files patents in multiple jurisdictions with an emphasis on Asia-Pacific, the US, and Europe.

- It leverages patent pipelines and defensive licensing to mitigate patent expiry risks.

- Focused on biologics and cell therapy patents with early filing to secure market exclusivity.

Regulatory & Compliance Policies

- Active engagement with FDA, EMA, NMPA in China.

- Emphasis on compliance with ICH standards.

- Adoption of robust pharmacovigilance systems.

Pricing & Reimbursement Policies

- Tailored strategies for high-value orphan drugs.

- Engagement with government payers for formulary placements.

- Emphasis on patient access programs.

R&D Funding & Policy Impact

| Policy Area |

Impact |

Description |

| Tax Incentives |

Favorable |

Chinese government offers R&D tax credits |

| Global R&D Funding |

Competitive |

Investments aligned with US/European standards |

Comparative Analysis & Market Outlook

| Aspect |

Meridian Medcl |

Peers |

Industry Trend |

| Innovation Rate |

High |

Moderate to high |

Increasing emphasis on biologics & personalized medicine |

| Global Presence |

Developing markets |

Established global |

Growing in North America, Europe, Asia |

| Digital Adoption |

Early stages |

Advanced |

Focus on AI/Big Data in R&D |

| Pipeline Depth |

Extensive |

Moderate |

Significant increase expected in oncology/rare disease domains |

FAQs

1. What are Meridian Medcl’s main competitive advantages?

Meridian Medcl's primary advantages include its strong research pipeline focused on high-growth therapeutic areas, significant R&D investments, and strategic regional partnerships, particularly in Asia. Its focus on biologics and cell therapies sets it apart from many regional competitors.

2. How does Meridian Medcl plan to expand globally?

The company aims to establish manufacturing hubs outside China, strengthen regulatory approvals in North America and Europe, and form alliances with international pharma firms to facilitate market entry.

3. What are the major risks facing Meridian Medcl?

Key risks include patent expirations, regulatory delays, increasing competition from global innovators, and challenges in scaling manufacturing to meet international demand.

4. How does Meridian Medcl's R&D expenditure compare with industry leaders?

While Meridian Medcl invests approximately USD 127 million annually, this is relatively smaller than Pfizer or Novartis, which allocate billions. However, its targeted focus and pipeline quality aim to offset this scale difference.

5. What are typical reimbursement and pricing strategies for Meridian Medcl?

The company adopts value-based pricing for high-value orphan drugs and collaborates with payers for access programs, particularly in emerging markets where price controls are more prevalent.

Key Takeaways

- Meridian Medcl is positioning itself as an innovative biotech-driven pharmaceutical company focused on high-growth niches like oncology and rare diseases.

- Its growing pipeline, strategic partnerships, and targeted regional expansion build a foundation for international growth.

- Major growth opportunities exist in North America and Europe, with emphasis on biologics and digital R&D tools.

- Risks stem from patent expiries, regulatory complexities, and competitive intensity but can be mitigated through diversified pipeline development and licensing strategies.

- Continuous investment in R&D and innovation will be crucial in maintaining competitive advantage against larger multinational corporations.

References

[1] Industry Reports on Medcl’s Market Segments (2022).

[2] Company Financial Disclosures (2022).

[3] Regulatory Engagement Data, NMPA, FDA, EMA (2022–2023).

[4] Market Trends in Oncology and Rare Diseases (IQVIA, 2022).

[5] Strategic Partnership Announcements (Publications, 2022–2023).