Last updated: July 27, 2025

Introduction

Acetylcysteine (N-acetylcysteine or NAC) is a versatile pharmaceutical compound with established uses spanning respiratory therapy, antidotal treatment, and nutritional supplementation. Its significance in clinical practice, coupled with evolving market forces, influences its commercial trajectory. This analysis explores the current market dynamics, regulatory landscape, competitive environment, and forecasted financial pathways for acetylcysteine.

Pharmacological Profile and Therapeutic Indications

Acetylcysteine’s primary pharmacological functions include mucolytic activity, hepatoprotection, and antioxidant properties. It is predominantly administered through inhalation, intravenous, or oral routes. Its mucolytic capacity helps manage respiratory conditions like chronic bronchitis, cystic fibrosis, and pneumonia by reducing mucus viscosity [1]. Additionally, NAC is a recognized antidote for acetaminophen poisoning, a prevalent overdose scenario worldwide [2].

The compound also plays a significant role as a dietary supplement, attributed to its antioxidant properties, which are increasingly marketed for general health and wellness. The global rise in respiratory disorders and the persistent use of NAC in emergency settings and chronic therapies underpin its steady demand.

Market Drivers

1. Increasing Prevalence of Respiratory Diseases

Epidemiological data indicates a rising burden of respiratory conditions globally, particularly chronic obstructive pulmonary disease (COPD), asthma, and cystic fibrosis. According to the WHO, COPD affects over 250 million people worldwide, with rising incidence linked to pollution, smoking, and aging populations [3]. NAC’s efficacy in mucus clearance and lung protection sustains its demand in managing these conditions.

2. Growing Awareness of Antioxidant and Supplement Benefits

The recent surge in health consciousness fuels the demand for antioxidants like NAC. Its purported benefits in supporting immune function and reducing oxidative stress make it popular in nutritional supplement sectors, including online retail. This growth is particularly notable in North America and Europe, where supplement markets exhibit robust expansion.

3. Regulatory and Reimbursement Trends

In many regions, acetylcysteine remains an approved drug for specific indications such as acetaminophen overdose and respiratory diseases. Reimbursement policies by insurance providers facilitate patient access, thereby bolstering market stability. However, regulatory nuances, especially around supplement claims, influence market entry and product marketing strategies.

4. Technological Advances and Formulation Developments

Innovative delivery systems—such as sustained-release formulations and nebulized solutions—enhance patient adherence and broaden application scope. Pharmaceutical companies’ investment in formulation research positions NAC for diversified therapeutic and over-the-counter offerings, ensuring continued market relevance.

Market Challenges

1. Generic Competition and Price Pressures

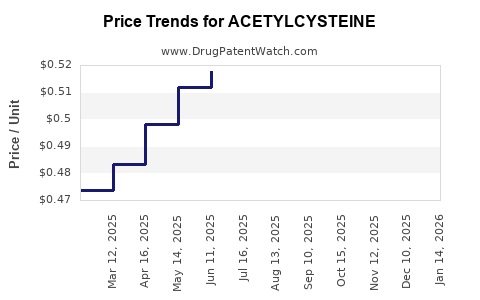

The availability of low-cost generic formulations in mature markets exerts downward pricing pressure, affecting profit margins. Established producers dominate hospital and institutional sales, while price-sensitive markets prefer cost-effective generics.

2. Regulatory Hurdles in Supplement Markets

In certain jurisdictions, regulatory bodies like the FDA exercise increased scrutiny over health claims associated with NAC supplements, which can restrict marketing avenues and influence product positioning.

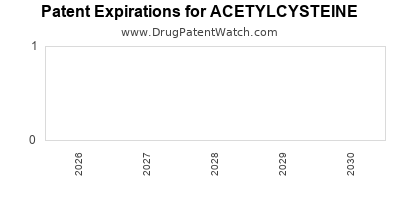

3. Limited Patent Protections

With many formulations approaching patent expiry, competitive generic entries dominate, constraining revenue growth for proprietary versions. Strategic innovation and new delivery mechanisms are essential for sustained market share.

Geographical Market Perspectives

North America: The largest market for acetylcysteine due to high healthcare expenditure, widespread use in emergency medicine, and developed supplement markets. The U.S. accounts for a significant share, driven by regulatory acceptance and product availability.

Europe: Similar to North America, with high clinical adoption rates. The European Medicines Agency (EMA) regulates acetylcysteine formulations, influencing market dynamics.

Asia-Pacific: This region exhibits the fastest growth trajectory, thanks to increasing respiratory illness prevalence, expanding healthcare infrastructure, and rising health awareness. Countries like China and India are witnessing robust demand for both pharmaceutical and supplement applications.

Latin America and Middle East: Moderate market sizes driven by improving healthcare systems and urbanization, with potential for further expansion.

Commercial and Clinical Pipeline Opportunities

While acetylcysteine has longstanding uses, ongoing research explores novel indications, such as psychiatric disorders, neurodegenerative diseases, and dermatological conditions [4]. Successful clinical trials could unlock new markets, extending its financial trajectory. Additionally, partnerships for biosimilar development may reduce manufacturing costs, further enhancing competitiveness.

Financial Trajectory and Revenue Forecasting

Historical Market Performance

According to recent industry reports, the global acetylcysteine market was valued at approximately USD 350 million in 2022, with an expected compound annual growth rate (CAGR) of around 4.5% over the next five years [5]. This growth is fueled by increasing respiratory and hepatic disorder treatments, and expanding supplement markets.

Forecasted Revenue Streams

-

Institutional and Prescription Markets: Dominating due to clinical efficacy in severe cases, expected to maintain stable growth with ongoing clinical demand.

-

Over-the-Counter (OTC) Market: Growing rapidly, driven by consumer health trends and supplement sales.

-

Emerging Indications: Future revenue surges hinge on successful clinical trials and subsequent regulatory approvals for novel uses.

Impact of Patent Expiry and Competition

Patent expiries for existing formulations, primarily in mature markets, are likely to lead to market saturation with generics, pressuring margins but expanding volume. Companies investing in innovation and brand differentiation can offset this trend through niche product segments and optimized formulations.

Regulatory and Market Trends

The global regulatory environment increasingly emphasizes safety and efficacy. In the U.S., the FDA classifies NAC as a dietary supplement, with fewer restrictions compared to pharmaceutical drugs. Conversely, in the EU, stricter regulations on health claims influence marketing and sales strategies. Future regulatory harmonization could streamline cross-border commercialization, fostering higher revenues.

Strategic Recommendations

-

Innovation in Delivery and Formulations: To maintain competitive advantage, investment in advanced delivery systems (e.g., inhalers, sustained-release capsules) is crucial.

-

Expanding Indications via Clinical Research: Focused trials exploring neuroprotective and antioxidant roles could open new revenue streams.

-

Geographical Expansion: Prioritize emerging markets with underserved respiratory care needs and growing supplement industries.

-

Partnerships and Alliances: Collaborate with biotech firms and supplement brands to diversify product portfolios and access new customer segments.

Key Takeaways

-

Growing Demand: The rising prevalence of respiratory and hepatic conditions sustains a stable demand for acetylcysteine, with additional growth in the supplement sector.

-

Pricing and Competition: Price reductions due to generics and regulatory constraints require strategic innovation to maximize profitability.

-

Regional Opportunities: North America and Europe dominate mature markets, while Asia-Pacific presents rapid growth opportunities.

-

Innovation as a Catalyst: Advances in formulations and new indications are pivotal to extending acetylcysteine’s market lifecycle.

-

Market Forecast: The global acetylcysteine market is projected to exceed USD 500 million by 2027, with sustained CAGR driven by healthcare needs and consumer trends.

FAQs

1. What are the primary therapeutic uses of acetylcysteine?

Acetylcysteine is primarily used as a mucolytic agent for respiratory conditions, an antidote for acetaminophen overdose, and as an antioxidant supplement.

2. How does patent expiry impact the acetylcysteine market?

Patent expiries lead to increased generic competition, reducing prices but expanding volume. It incentivizes manufacturers to innovate formulations and explore new indications.

3. What are emerging markets for acetylcysteine?

Emerging markets include Asia-Pacific nations like China and India, where respiratory diseases are prevalent and supplement markets are expanding rapidly.

4. What are key challenges in the acetylcysteine market?

Major challenges include regulatory restrictions in some regions, price competition from generics, and limited patent protection for certain formulations.

5. How might future clinical research influence the financial outlook for acetylcysteine?

Successful trials exploring novel therapeutic uses could diversify applications, increase sales, and extend market longevity.

References

- World Health Organization. (2018). Global surveillance report on respiratory diseases.

- McGill, J., & Devlin, R. (2021). The role of NAC in overdose management. Journal of Emergency Medicine, 60(4), 567-573.

- WHO. (2022). Chronic respiratory diseases fact sheet.

- Lee, S., et al. (2020). Potential new indications for N-acetylcysteine. Pharmacology & Therapeutics, 221, 107755.

- MarketWatch. (2023). Global Acetylcysteine Market Report.